BEYOND THE NUMBERS

Bipartisan Child Tax Credit Expansion Would Benefit Millions of Workers in Low-Paid Occupations

The House-passed bipartisan Child Tax Credit expansion would benefit millions of children whose parents or other caregivers do important work for low pay. People who work as delivery drivers, home health aides, child care workers, cashiers, and in many other occupations often face unpredictable hours for low wages. The Senate should act now to pass this legislation and support millions of low-paid workers, whose families include about 16 million children who currently get a partial credit or none at all because their families’ incomes are too low.

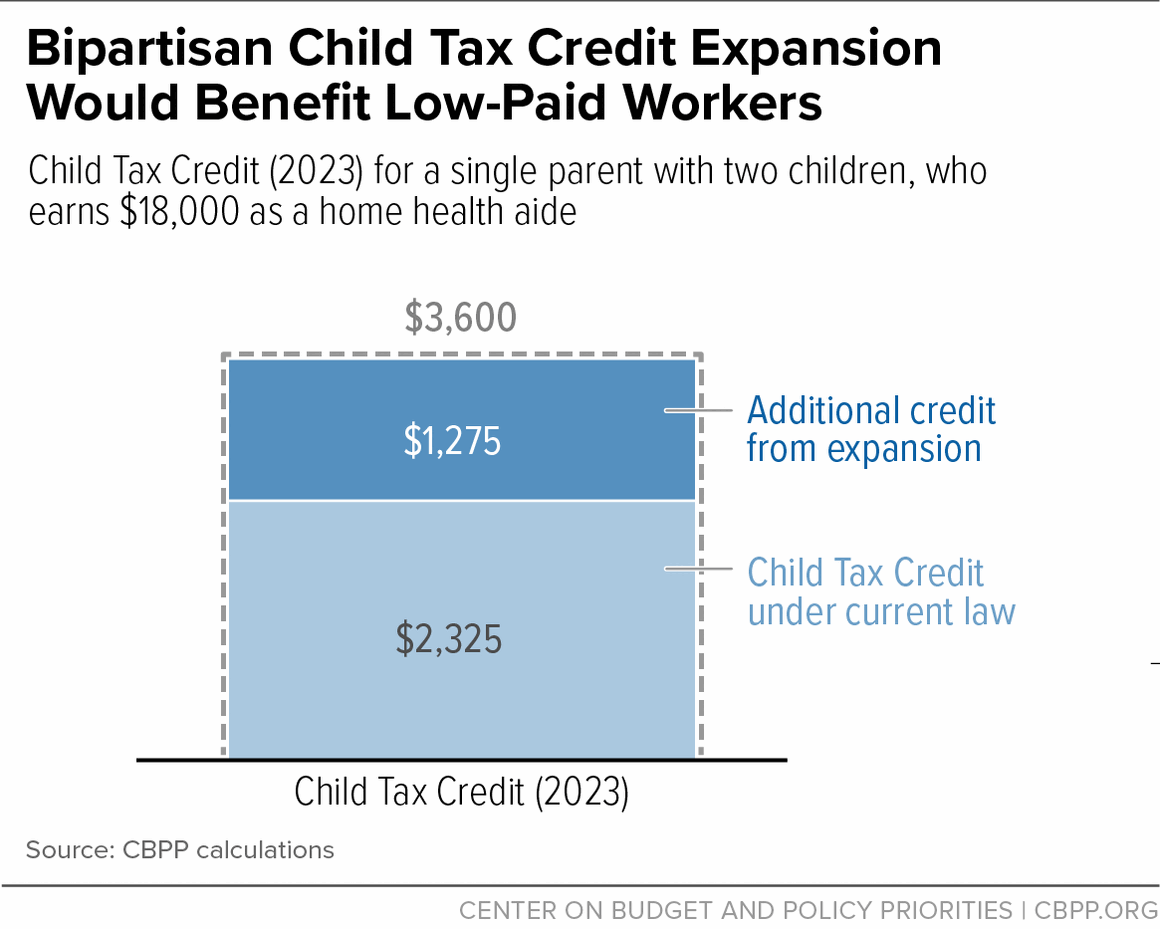

Consider a single parent with two children, who earns $18,000 as a home health aide. Under the proposed bipartisan expansion, this family would receive a Child Tax Credit of $1,800 per child in the first year, for a total of $3,600 — an increase of $1,275 over current law (see chart). That cash could help the family pay rent, buy groceries, and put gas in their car.

More than 400,000 cashiers and their families would benefit in the first year of the bipartisan expansion. Among the many other people who would benefit: the families of some 340,000 maids and housekeeping cleaners, 340,000 personal care and home health aides, 280,000 janitors and building cleaners, 250,000 nursing assistants, and 240,000 waiters and waitresses (see table). Hundreds of thousands of retail salespeople, child care workers, teaching assistants, food preparation workers, truck and delivery drivers, and others in low-paid occupations would receive a larger credit as well.

Many low-paid workers — often in service occupations — have volatile work hours and little or no paid leave. If they get sick, welcome a new child, or face health or caregiving needs, their earnings can drop significantly, either because they have to take unpaid leave or because they lose their job altogether. As a result, many could benefit from a provision in the bipartisan expansion that would allow a family whose earnings temporarily dropped to use the prior year’s earnings to calculate their Child Tax Credit. This provision is called a “lookback” and would help protect people from a drop in their credit if their earnings fell.

Some opponents of the expansion have questioned how the proposed expansion, including the lookback, might affect parents’ employment. Congress’s official tax scorekeeper, the nonpartisan Joint Committee on Taxation, determined that “the proposed expansion of the child tax credit on net increases labor supply,” though that increase is likely to be “too small to be significant.” In other words, the expanded credit would deliver gains to workers in low-paid jobs, without discouraging employment.

About 16 million children in low-income families would benefit in the first year of the bipartisan Child Tax Credit expansion. When the expansion is fully in effect in 2025, it would lift some half a million or more children above the poverty line and provide financial support to about 5 million more children in families with incomes below the poverty line. The Senate should take this opportunity to pass the House bipartisan bill as-is to support people working for low pay and their families.

| Bipartisan Child Tax Credit Expansion Would Benefit Millions of Workers and Their Families Selected occupations of parents or other caregivers who would benefit from the expansion in the first year | |

|---|---|

| Occupation | Parents or caregivers in occupation who would benefit |

| Cashiers | 411,000 |

| Maids and housekeeping cleaners | 343,000 |

| Cooks | 340,000 |

| Personal care and home health aides | 339,000 |

| Janitors and building cleaners | 282,000 |

| Construction laborers | 267,000 |

| Nursing assistants | 252,000 |

| Waiters and waitresses | 239,000 |

| Truck and delivery drivers | 233,000 |

| Laborers and hand freight, stock, and material movers | 215,000 |

| Customer service representatives | 212,000 |

| Landscaping and groundskeeping workers | 199,000 |

| Retail salespersons | 194,000 |

| First-line supervisors of retail sales workers | 172,000 |

| Other agricultural workers | 165,000 |

| Carpenters | 146,000 |

| Stockers and order fillers | 141,000 |

| Childcare workers | 140,000 |

| Teaching assistants | 126,000 |

| Food preparation workers | 118,000 |

| Miscellaneous production workers, including equipment operators and tenders | 116,000 |

| Secretaries and administrative assistants, except legal, medical, and executive | 101,000 |

| Receptionists and information clerks | 100,000 |

Notes: Parents or caregivers who would benefit are tax filers and/or their spouses who are at least age 18, worked at least one week in the year, and reported an occupation. "Personal Care and Home Health Aides" combines nearly 238,000 personal care aides (such as escorts for the elderly or those with disabilities) with nearly 102,000 home health aides (such as an in-home hospice attendant). Table shows all occupations with at least 100,000 workers estimated to benefit from the expansion. Estimates reflect a pre-pandemic economy and tax year 2023 tax rules.

Source: CBPP analysis of 2015 IRS Statistics of Income Public Use File, allocated by occupation based on CBPP analysis of the American Community Survey (ACS) for 2017-2019