BEYOND THE NUMBERS

House-Passed Bipartisan Tax Bill’s Child Tax Credit Expansion Would Especially Help Children Living in Rural Areas

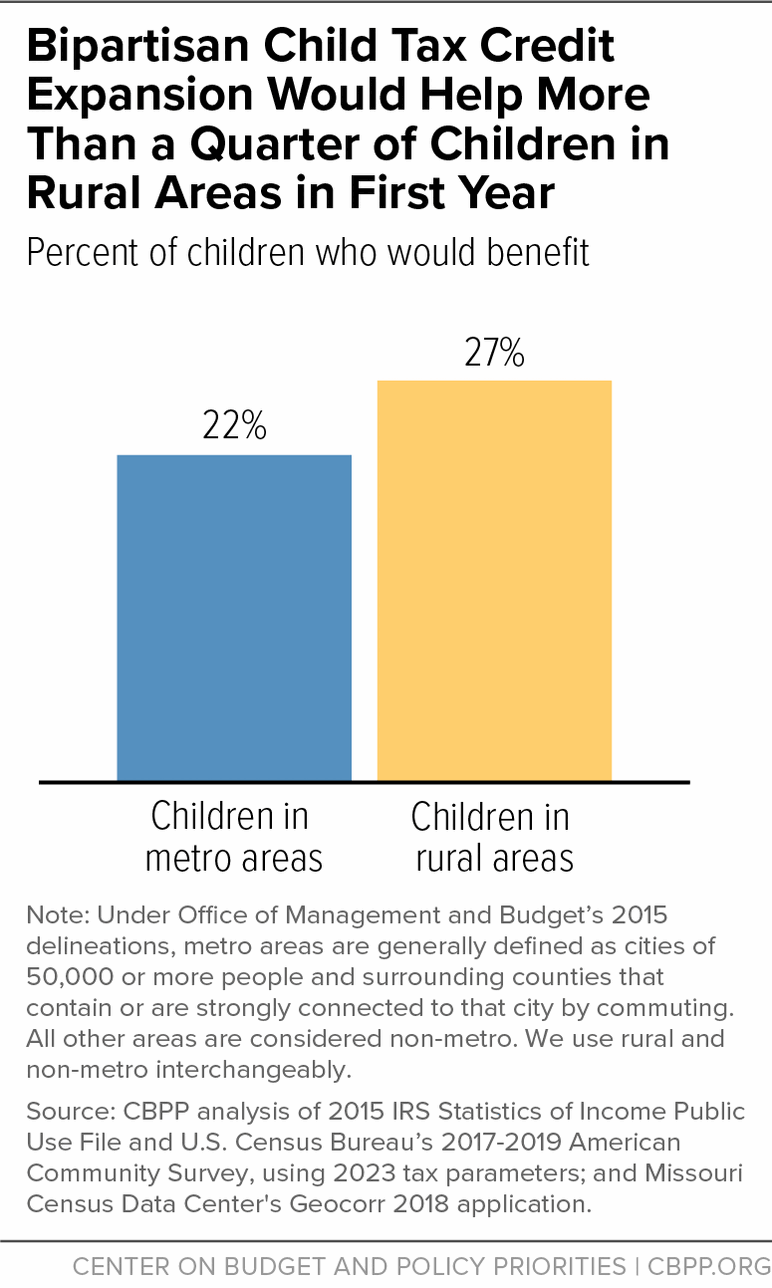

The Child Tax Credit expansion in the tax bill that passed by a strong bipartisan vote in the House last week would especially help children in rural areas. More than a quarter of all children under 17 living in rural (that is, non-metropolitan) areas would benefit in the first year, compared with just over one-fifth of children in metro areas. Nationwide, roughly 16 million children in families with low incomes — more than 80 percent of the 19 million children who currently get a partial credit or none at all because their families’ incomes are too low — would benefit from the bipartisan expansion. The Senate should pass this legislation as soon as possible to boost these families’ incomes.

The current design of the Child Tax Credit has several flaws that cause it to provide less help to the children who need it most. Critically, because of the way the credit phases in with earnings, approximately 19 million children in families with low incomes get a smaller credit than children in higher-income families, or none at all. This structure particularly disadvantages children who live in rural areas, largely because pay is typically lower in rural areas. (In 2022, rural pay was roughly 19 percent lower than in metro areas, based on median earnings for full-time, year-round workers with earnings.)

The bipartisan Child Tax Credit expansion focuses on helping children in low-income families now ineligible for the full credit by making major structural improvements, as we’ve detailed. These improvements mean that nationwide, an estimated 27 percent of children under 17 living in rural areas would benefit in the first year, compared with a still sizable 22 percent in metro areas (see graphic). The same pattern is true in most states. (See table.)

In six states, more than 100,000 children in rural communities would benefit from the expansion: Georgia, Kentucky, Mississippi, North Carolina, Ohio, and Texas; in an additional six states, more than 75,000 children in rural communities would benefit: Arkansas, Indiana, Michigan, Missouri, Oklahoma, and Tennessee. In fully a dozen states, at least 3 in 10 children in rural communities would benefit; and, in two of those states — Arizona and South Carolina — as many as 39 percent of children in rural areas would benefit.

The expansion would help children of all races and ethnicities living in rural areas across the country. Rural communities are diverse — roughly 30 percent of children under age 17 in rural areas are Black, Latino, Asian, American Indian, Alaska Native, Native Hawaiian or other Pacific Islander, or more than one race — and the children in those communities who would benefit from the expansion reflect this diversity. For example, about 19 percent of children living in rural areas who would benefit are Latino, 14 percent are Black, and 6 percent are American Indian or Alaska Native (AIAN). About 56 percent are white.

For each of these groups, higher shares of children would benefit in rural areas than in metro areas. For example, nearly half (46 percent) of Black children living in rural areas would benefit, compared with 35 percent of Black children living in metro areas. Some 39 percent of Latino children in rural areas would benefit (compared with 35 percent in metro areas), as would 37 percent of AIAN children in rural areas (compared with 28 percent in metro areas). More than 1 in 5 white children in rural areas (21 percent) would also benefit, compared with 12 percent of white children in metro areas.

The expansion would give families with low incomes nationwide, and particularly those living in rural communities, meaningful help. Consider a married couple with three children, in which one parent earns $32,000 as a farmworker and the other parent stays home to take care of their two younger children while their older child is in school. Under the expansion, the family would receive about $1,940 per child, for a total of $5,830 — an increase of $975 compared to current law. The expansion would also help a single mother with a toddler and a child in elementary school, who earns $24,000 as a cashier at a gas station, by providing $1,960 per child (for a total of $3,920) — $400 more than they would receive under current law.

The Senate should take advantage of the current opportunity to provide this crucial support to children in these and other families with low incomes and pass the bipartisan tax bill.

| More Than a Quarter of Children Living in Rural Areas Would Benefit From House-Passed Bipartisan Child Tax Credit Expansion in the First Year Estimated children under 17 who would benefit, by state and rural or metro residence | |||

|---|---|---|---|

| Children living in rural areas who would benefit | Of children living in rural areas, percent who would benefit | Of children living in metro areas, percent who would benefit | |

| U.S. Total | 2,563,000 | 27% | 22% |

| Alabama | 72,000 | 30% | 27% |

| Alaska | 14,000 | 23% | 16% |

| Arizona | 31,000 | 39% | 27% |

| Arkansas | 81,000 | 33% | 26% |

| California | 38,000 | 25% | 24% |

| Colorado | 29,000 | 21% | 15% |

| Connecticut | 5,000 | 16% | 17% |

| Delaware | N/A | N/A | 21% |

| District of Columbia | N/A | N/A | 19% |

| Florida | 46,000 | 33% | 25% |

| Georgia | 128,000 | 33% | 26% |

| Hawai’i | 13,000 | 23% | 15% |

| Idaho | 34,000 | 25% | 19% |

| Illinois | 67,000 | 23% | 22% |

| Indiana | 77,000 | 24% | 21% |

| Iowa | 54,000 | 20% | 18% |

| Kentucky | 104,000 | 27% | 23% |

| Louisiana | 63,000 | 37% | 29% |

| Maine | 20,000 | 22% | 13% |

| Michigan | 85,000 | 25% | 23% |

| Minnesota | 51,000 | 19% | 15% |

| Mississippi | 116,000 | 33% | 29% |

| Missouri | 99,000 | 30% | 20% |

| Nebraska | 31,000 | 20% | 17% |

| Nevada | 12,000 | 23% | 25% |

| New Hampshire | 13,000 | 16% | 10% |

| New Jersey | N/A | N/A | 18% |

| New Mexico | 51,000 | 33% | 30% |

| New York | 66,000 | 27% | 23% |

| North Carolina | 139,000 | 31% | 24% |

| Ohio | 129,000 | 26% | 23% |

| Oklahoma | 81,000 | 28% | 24% |

| Oregon | 34,000 | 26% | 19% |

| Pennsylvania | 63,000 | 24% | 20% |

| Rhode Island | N/A | N/A | 18% |

| South Carolina | 59,000 | 39% | 25% |

| South Dakota | 26,000 | 25% | 15% |

| Tennessee | 86,000 | 28% | 27% |

| Texas | 228,000 | 33% | 27% |

| Vermont | 10,000 | 15% | 14% |

| Washington | 37,000 | 25% | 17% |

| West Virginia | 36,000 | 27% | 24% |

| Wisconsin | 59,000 | 20% | 18% |

| Wyoming | 14,000 | 15% | 15% |

Note: State figures exclude Kansas, Maryland, Massachusetts, Montana, North Dakota, Utah, and Virginia due to lack of reliable data on metropolitan/non-metropolitan (metro/non-metro) residence. U.S. Total includes all states. N/A: Not applicable because entire state is metro. Under the Office of Management and Budget’s 2015 delineations, metro areas are generally defined as cities of 50,000 or more people and surrounding counties that contain or are strongly connected to that city by commuting. All other areas are considered non-metro. We use rural and non-metro interchangeably.

Source: CBPP analysis of 2015 IRS Statistics of Income Public Use File (PUF) and U.S. Census Bureau’s 2017-2019 American Community Survey (ACS), using 2023 tax parameters; Missouri Census Data Center's Geocorr 2018 application. We start with a PUF-based estimate of children who would benefit and allocate it to states and metro/non-metro areas using the ACS (column 2); to estimate state-level metro/non-metro population (for calculating columns 3 and 4), we use an average of the 2017-2019 ACS population. For each of 2,351 local geographic areas identified in the Census files, we use data from the Missouri Census Data Center's Geocorr 2018 application on whether the area is metropolitan, non-metropolitan, or mixed, and, if mixed, what share of the population is non-metro under the Office of Management and Budget’s 2015 area definitions.