BEYOND THE NUMBERS

As state lawmakers consider policy issues that could profoundly affect economic opportunities in communities across the country, they have a fundamental choice: whether to provide the resources to invest in schools, transportation, health care, safe communities, and other building blocks of economic growth, or cut taxes and skimp on public investment.

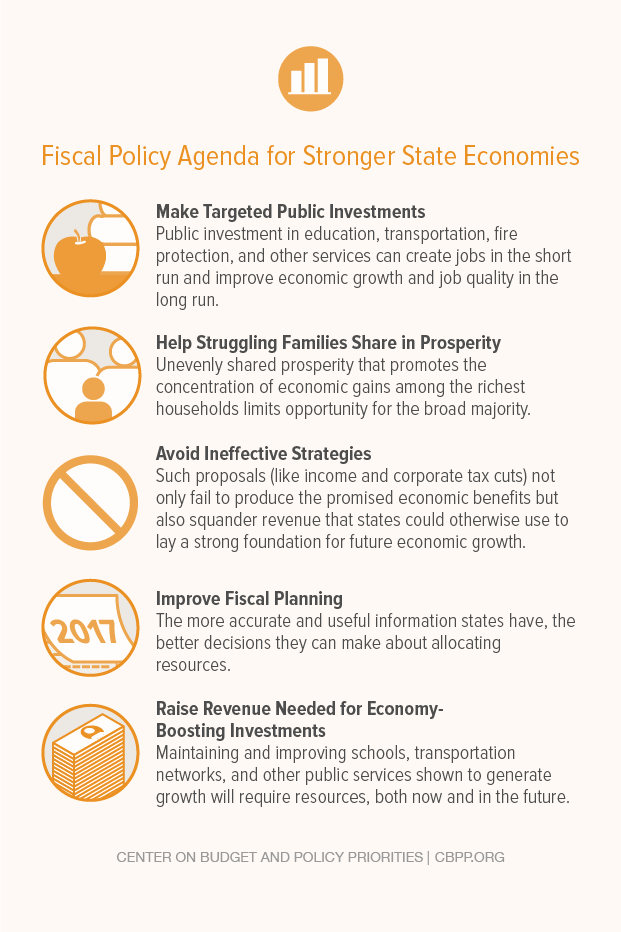

States have many tools to promote economic opportunity. Our new report provides a roadmap to fiscal policies that can help create jobs now and prime states for long-term, broadly shared prosperity. States should:

Make targeted public investments. Investing in education, transportation, and other services can create jobs in the short run and improve economic growth and job quality in the long run.

Help more families share in prosperity. Millions of families struggle to make ends meet because their jobs pay too little or offer inadequate, unpredictable, and inflexible schedules. States can help by creating or expanding state earned income tax credits for low-income working families and by making safety net programs more accessible to eligible families.

Avoid costly tax cuts and ineffective strategies like artificial spending limits. Such proposals not only fail to produce the promised economic benefits but also squander revenue that could otherwise lay a strong foundation for future economic growth.

Improve fiscal planning. More complete and accurate information can help states make better decisions about allocating resources. Improving cost estimates of tax and spending proposals and preparing multi-year budget forecasts are two ways that states can maintain key public investments over the long haul.

Raise revenue needed for economy-boosting investments. Maintaining and improving schools, transportation networks, and other public services that lay a strong foundation for growth will require resources, both now and in the future. States can strengthen their revenue systems by collecting taxes already due, closing corporate loopholes and wasteful tax incentives, and updating their sales taxes to reflect the growth of the service sector and of e-commerce.