más allá de los números

What to Look for in Tomorrow’s Jobs Report

Federal Reserve Chair Janet Yellen and her policy-making colleagues have made clear that their decision about when to start raising interest rates will be “data driven.” Fed watchers will get lots of data in tomorrow’s jobs report, but don’t expect it to give them an epiphany about what the Fed will do when they next meet in September.

The great unknown in the jobs market isn’t whether things are getting better — they have been for some time — but, rather, how much room is left for improvement.

Employers have added 245,000 jobs a month over the past year and unemployment has fallen almost a full percentage point, from 6.2 percent in July 2014 to 5.3 percent last month (it was 5.0 percent when the recession started). Those are good headline numbers, but other indicators suggest that we have many more people who’d like to work but don’t have a job than we’d see in a truly robust labor market.

June’s drop in the unemployment rate was not all it seemed, since it was associated with a drop in the labor force participation rate (the share of the population either working or actively looking for a job) to its lowest level since the 1970s. Baby boomers are aging into their retirement years, so some of the low labor force participation simply reflects the graying of America — but not all. Thus, on unemployment, the most encouraging news in tomorrow’s report would be a rise in labor force participation accompanied by a steady or even falling unemployment rate.

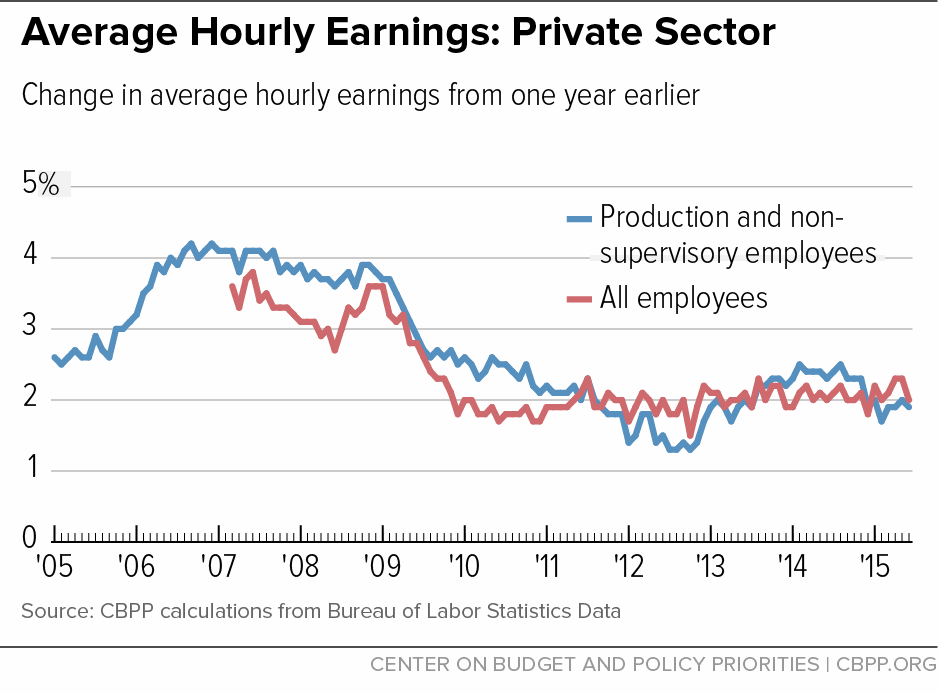

Sluggish wage growth is the best evidence that the labor market isn’t close to overheating. Average hourly earnings of employees on private payrolls have grown modestly throughout the recovery, averaging about 2 percent a year (see chart). Inflation has been modest as well but, over the course of the recovery, real (inflation-adjusted) wages have hardly grown, failing to keep pace with increases in workers’ productivity (output produced per hour of work). As a result, the share of national income going to profits has risen relative to that going to wages.

Both inflation and productivity have fluctuated more than nominal earnings but, on average, productivity has risen about 1 percent per year since the end of the recession while consumer price inflation has risen about 1.7 percent. Inflation has fallen recently as energy prices have dropped, boosting workers’ purchasing power. But if Fed policymakers are right that underlying inflation is moving toward their 2 percent target, we’ll need to see substantially faster growth in nominal wages, and a tighter labor market than we have now, to sustain real wage growth.

A single month’s jobs report can’t tell us anything definitive about underlying labor market trends. But if tomorrow’s jobs report shows (1) continued strong payroll job growth, (2) higher labor force participation and steady or falling unemployment, and (3) higher average hourly earnings growth, that constellation of indicators may reflect the “further improvement in the labor market” that the Fed says it’s awaiting to begin raising rates. But without all three — and a jobs report next month that shows the same thing — the situation will remain murky.