Last week we analyzed a proposed constitutional amendment in Florida to limit state revenue (“Amendment 3”). Our new paper looks at a different measure on the November ballot (“Amendment 4”), which:

would lock a deeply flawed set of property tax changes into the state’s constitution, leading to tax increases for large numbers of Florida residents, a competitive disadvantage for new and emerging businesses, and significant cuts in local services — while producing little if any economic benefit.

Proponents claim that Amendment 4 would boost Florida’s economy and fix key flaws in the property tax system. In reality, as

our paper explains, the amendment would:

- Raise taxes on many established, year-round residents.

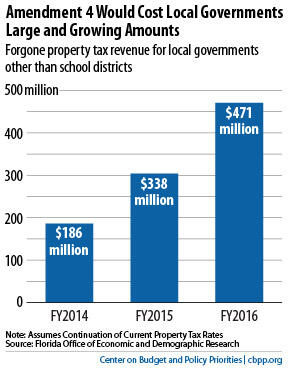

- Require local governments to make deep cuts in services.

- Harm Florida’s economy.

- Send millions of dollars in tax benefits out of state.

- Hurt new and expanding small businesses — important engines of job growth.

Amendment 4 appears on the ballot alongside another measure that poses a serious threat to local services. Amendment 3 would place a severe limit on state revenue growth, and in so doing would very likely squeeze state aid to local governments. Because local governments get a substantial share of their funding from the state, such cuts could punch a large hole in local budgets, precipitating significant local service cuts and tax increases. Paired with the revenue loss from Amendment 4, the impact would be even more dramatic.