The Roadmap for America’s Future, which Rep. Paul Ryan (R-WI) — the ranking Republican on the House Budget Committee — released in late January, calls for radical policy changes that would result in a massive transfer of resources from the broad majority of Americans to the nation’s wealthiest individuals.[1]

The Roadmap would give the most affluent households a new round of very large, costly tax cuts by reducing income tax rates on high-income households; eliminating income taxes on capital gains, dividends, and interest; and abolishing the corporate income tax, the estate tax, and the alternative minimum tax. At the same time, the Ryan plan would raise taxes for most middle-income families, privatize a substantial portion of Social Security, eliminate the tax exclusion for employer-sponsored health insurance, end traditional Medicare and most of Medicaid, and terminate the Children’s Health Insurance Program. The plan would replace these health programs with a system of vouchers whose value would erode over time and thus would purchase health insurance that would cover fewer health care services as the years went by.

The tax cuts for those at the very top would be of historic proportions. A new analysis by the Urban Institute-Brookings Institution Tax Policy Center (TPC) finds:

- The Ryan plan would cut in half the taxes of the richest 1 percent of Americans — those with incomes exceeding $633,000 (in 2009 dollars) in 2014.

- The higher one goes up the income scale, the more massive the tax cuts would be. Households with incomes of more than $1 million would receive an average annual tax cut of $502,000.

- The richest one-tenth of 1 percent of Americans — those whose incomes exceed $2.9 million a year — would receive an average tax cut of $1.7 million a year. These tax cuts would be on top of those that high-income households would get from making the Bush tax cuts, which are due to expire at the end of 2010, permanent.

To offset some of the cost of these massive tax cuts, the Ryan plan would place a new consumption tax on most goods and services, a measure that would increase taxes on most low- and middle-income families. TPC finds that:

- About three-quarters of Americans — those with incomes between $20,000 and $200,000 — would face tax increases. For example, households with incomes between $50,000 and $75,000 would face an average tax increase of $900. (These estimated changes in taxes are relative to the taxes that would be paid under a continuation of current policy — i.e., what tax liabilities would be if the President and Congress make permanent the expiring 2001 and 2003 tax cuts and relief from the alternative minimum tax.)

- The plan would shift tax burdens so substantially from the wealthy to the middle class that people with incomes over $1 million would face much lower effective tax rates than middle-income families would. That is, they would pay much smaller percentages of their income in federal taxes.

Because of the Ryan plan’s enormous tax cuts for the affluent, even the very large benefit cuts that the plan would make in Medicare, Medicaid, and Social Security — and the plan’s middle-class tax increases — would not put the federal budget on a sustainable course for decades. The federal debt would soar to about 175 percent of the gross domestic product (GDP) by 2050. In contrast, most fiscal policy analysts recommend that the debt-to-GDP ratio be stabilized within the next ten years, and at a far lower level.

Assertions that the Ryan plan is fiscally responsible rest on a serious misunderstanding of a Congressional Budget Office (CBO) analysis of the plan. CBO only partially analyzed the Ryan plan. Contrary to some media reports, CBO has not prepared an actual cost estimate of it. [2] CBO generally does not produce estimates of the effects of proposed changes in tax policies; that is the responsibility of the Joint Committee on Taxation. In its analysis of the Ryan plan, CBO did not attempt to measure the revenue losses that Rep. Ryan’s proposals would generate.

Instead, as its report states, CBO simply used an assumption specified by Rep. Ryan’s staff that the overall level of revenues would remain unchanged from what the federal government would collect through 2030 under current policies, and would equal 19 percent of GDP in later years. CBO did not find that the Ryan plan actually would achieve these assumed revenue levels. (For commentary by Howard Gleckman of the Tax Policy Center on the widespread misunderstanding of the CBO analysis, see the box on page 5.)

The reality is different; TPC finds that the Ryan plan would result in very large revenue losses relative to current policies. TPC estimates that even with its middle-class tax increases, the plan would reduce federal revenues to 16 percent of GDP in 2014. Because the tax cuts for the wealthy would dwarf the tax increases for the middle class, the Ryan plan would allow the federal debt to continue growing for a number of decades to come, despite its steep cuts in Medicare, Medicaid, and Social Security.

The Ryan plan would eliminate traditional Medicare, most of Medicaid, and all of the Children’s Health Insurance Program (CHIP), converting these health programs largely to vouchers that low-income households, seniors, and people with disabilities could use to help buy insurance in the private health insurance market. Under Ryan’s plan, the value of the vouchers would fall further behind the rising cost of health care with each passing year, so they would purchase less health coverage over time. By 2080, Medicare would be cut 76 percent below its projected size under current policies, according to CBO. In other words, by 2080, the vouchers that would replace Medicare would receive one-quarter of the resources that Medicare would otherwise use.

The Ryan proposal would also replace the tax exclusion for employer-sponsored health insurance with a refundable tax credit for people to buy health coverage — the equivalent of a voucher. By eliminating the tax exclusion without providing incentives for employers to continue offering health coverage, the plan would likely cause a substantial decline in employer-based coverage.

The Ryan proposal thus would sharply reduce or eliminate all major forms of health insurance that spread risk by pooling healthy and less-healthy people together on a large scale. It would do so without taking significant action to create viable new pooling arrangements. Most Americans — including the poor and the elderly — would largely be left to purchase insurance on their own with a voucher or tax credit in an insurance market that would remain largely unreformed. In particular, insurance companies could continue to charge people much higher premiums based on age, gender, or health status.

The Ryan plan also largely lacks the kinds of provisions in the Senate- and House-passed health reform bills that are designed to slow health care cost growth by pushing health care providers to become more efficient and economical. Under the Ryan plan, the burden of reducing health care expenditures would fall primarily on beneficiaries, who would face steadily rising health care costs with a steadily diminishing amount of health insurance and might therefore forgo needed health care.

The Ryan plan proposes large cuts in Social Security benefits — roughly 16 percent for the average new retiree in 2050 and 28 percent in 2080 from price indexing alone — and initially diverts most of these savings to help fund private accounts rather than to restore Social Security solvency. Because the plan would divert large sums from Social Security to private accounts, it would leave the program facing insolvency in about 30 years, just as under current law. The plan would avoid insolvency by transferring $1.2 trillion from the rest of the budget to Social Security between 2037 and 2056, and those transfers would not be fully repaid until 2083.

The plan also seeks to entice higher-income seniors to divert a substantial share of their payroll tax contributions to private accounts. It would exempt from taxation all income drawn from these accounts in retirement, while retaining the feature of current law that counts as taxable income most of the Social Security benefits these affluent seniors could receive. In addition, the Ryan plan would require the federal government to guarantee the performance of the private accounts; if the stock market fell and value of the accounts declined sufficiently, the Treasury would have to make up the losses.

Overall, the plan’s cuts in Medicare, Medicaid, and Social Security (and other programs to a much lesser degree) would be so severe that CBO estimates they would shrink total federal expenditures (other than on interest payments) from roughly 19 percent of GDP in recent years to just 13.8 percent of GDP by 2080. Federal spending has not equaled such a low level of GDP since 1950, when Medicare and Medicaid did not yet exist, Social Security failed to cover many workers, and close to half of the elderly people in the United States lived below the poverty line.

The Ryan proposal would make sweeping changes to the federal tax system. It would:

- Lower the top marginal income tax rate to 25 percent from the 35 percent rate set by President George W. Bush’s tax cuts — and the 39.6 percent top rate that will take effect if the Bush tax cuts for high-income households are allowed to expire on schedule at the end of this year. The plan would set up an optional alternative tax system in which families could pay at a 25 percent rate for all income above $100,000 but would give up most existing itemized tax deductions and credits;

- Entirely exempt capital gains, dividends, and interest from taxation;

- Repeal federal estate and gift taxes;

- Repeal the alternative minimum tax (AMT);

- Repeal the corporate income tax and replace it with an 8.5-percent value-added tax, a form of sales tax on most goods and services; and

- Replace the tax exclusion for employer payments for health insurance with a refundable tax credit of $5,700 for families ($2,300 for individuals) that people could apply toward the purchase of insurance.

These changes would dramatically lower taxes for the wealthiest Americans, while increasing the tax burden for middle-income groups, according to the estimates the Tax Policy Center issued this week.[3] The numbers are breathtaking. Average tax cuts under the plan would equal:

- $1.7 million a year for the highest-income 0.1 percent of Americans (those with incomes over $2.9 million a year in 2009 dollars);

- $502,000 a year for people with incomes over $1 million; and

- $280,000 a year for people in the top 1 percent of the population (those with incomes over $633,000).

“Word is getting around that CBO has blessed a major budget reform plan proposed by Representative Paul Ryan (R-WI) as, in the words of National Review Online, ‘a roadmap to solvency.’ It isn’t true.

“…. All this confusion is due to a letter written on Jan. 27 from CBO director Doug Elmendorf to Ryan. In that 50-page document, CBO suggests the plan could eliminate the deficit in 50 years and, even more impressively, eliminate the debt by 2080.

“But, and this caveat is a whopper, CBO assumed this wonderful outcome would occur only if the revenue portion of Ryan’s plan generated 19 percent of GDP in taxes. And there is not the slightest evidence that would happen. …. Rather than estimate the true revenue effects of the Ryan plan, CBO simply assumed, as the lawmaker requested, that it would generate revenues of 19 percent of GDP (emphasis added).”

— Howard Gleckman, “Assume a Can Opener,” TaxVox, the Tax Policy Center Blog, February 4, 2010 .

These tax cuts would be on top of the 2001 and 2003 tax cuts. Compared to current tax law, under which the Bush tax cuts would expire at the end of 2010, the Ryan proposal would provide a tax cut averaging $2.1 million a year to the top 0.1 percent of households.

Yet the vast bulk of taxpayers — the nearly three-quarters of the population with incomes between $20,000 and $200,000 — would see their taxes go up. For example, those with incomes between $40,000 and $50,000 would see their taxes rise by an average of $788, or 10 percent. (Taxpayers with incomes below $20,000 would experience a very modest drop in taxes, averaging $164 a year.)[4]

The shift in tax burdens would be so pronounced that the very wealthy would face lower tax rates than the middle class. The Tax Policy Center reports that people with incomes over $1 million would pay an average of just 13 percent of their income in federal taxes, while households in every income group between $30,000 and $1 million would pay at higher rates than millionaires. For example, households with incomes between $30,000 and $40,000 would pay an average of about 14 percent of their income in taxes; households between $75,000 and $100,000 would pay 21 percent. (These percentages cover all federal taxes, not just the income tax.)

As a result of its costly new tax cuts for the wealthy, the Ryan plan would allow the federal debt to continue rising in relation to the size of the economy for at least

four decades. Even in CBO’s analysis of the Ryan plan, which assumed — as Ryan’s staff specified but the Tax Policy Center has found to be incorrect — that revenues would

not fall below their projected levels under current tax policies until after 2030, the federal debt would grow as a share of GDP until 2043, and the budget would not reach balance until 2063. Under the much more realistic revenue estimates that the Tax Policy Center has prepared, the budgetary outlook under the Ryan plan would be substantially worse.

Using TPC’s new revenue estimates, we estimate that the budget deficit under the Ryan plan would reach about 7 percent of GDP and the debt would grow to 90 percent of GDP by 2020. TPC estimates that revenues under the Ryan plan would average 16.3 percent of GDP over the period from 2011 through 2020.

In contrast, following the specifications provided by Rep. Ryan’s staff, the CBO analysis assumed that revenues over the same period would average 18.4 percent of GDP. That difference amounts to a loss of almost $4 trillion in revenues over the next decade. As a result of these lower revenues, federal interest costs would also be much higher than those shown in the CBO analysis.

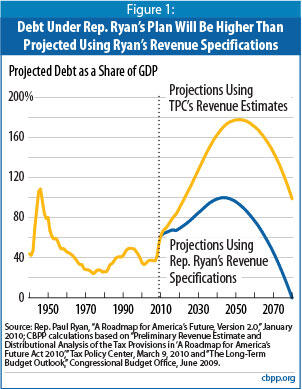

Extrapolating TPC’s revenue estimates beyond 2020 shows that the Ryan plan would fail to stem the rising tide of debt for years to come. [5] The debt would continue to grow in relation to the size of the economy for at least 40 more years — reaching over 175 percent of GDP by 2050. (See Figure 1.) Even by 2080, the debt would still equal about 100 percent of GDP. [6]

The Ryan plan would replace the current tax exclusion for employer-sponsored health insurance with a refundable tax credit or voucher of $2,300 for individuals and $5,700 for families. Low-income families with children (but not low-income individuals or couples) would be eligible for additional assistance — $5,000 for families with incomes up to 100 percent of the poverty line, declining to $2,000 for families with incomes between 180 and 200 percent of the poverty line.[7] The tax credit could be used to help buy any “qualified health insurance plan.” People eligible for Medicare would not qualify for the credit.

Eliminating the tax exclusion would erode employer-sponsored coverage, and the Ryan plan takes few steps to stem that erosion. At present, workers owe no income or payroll taxes on compensation they receive in the form of employer-sponsored health insurance. If the tax exclusion were eliminated and workers could claim the new tax credit regardless of whether they obtained health coverage through their employer, many employers — particularly smaller ones — would likely conclude they no longer needed to provide coverage.

Furthermore, many younger, healthier workers whose employer continued to offer coverage would find they could buy cheaper coverage elsewhere, where they would not be pooled with less healthy individuals — and hence would leave their employer plan. That move, in turn, would drive up premiums for the older and less healthy workers who remained in employer plans, making employer plans still less viable.

As a result of the above changes, the Ryan proposal would lead millions of Americans to leave or lose employer-based coverage and seek coverage on their own, either in the individual health insurance market or the new state health insurance exchanges that the bill would set up. But the proposal — unlike the Senate- and House-passed comprehensive health reform bills — would do little to address the serious problems that plague private health insurance markets today.

The Ryan proposal would allow insurance companies to offer plans in both the exchanges and the individual insurance market whose premiums vary by age, gender, and health status. And while it would require plans in the exchanges to offer insurance to all applicants, this would be of little value because the proposal would not effectively limit the premiums that plans could charge people with pre-existing health conditions.

The proposal would require the exchanges to establish “mechanisms to protect enrollees from the imposition of excessive premiums.” But it provides no definition or standard for what constitutes an “excessive premium,” and its mechanisms to protect against excessive premiums would almost certainly prove to have a very limited effect.

For example, the proposal calls for an expansion of state high-risk pools as one option for limiting “excessive premiums,” but experience demonstrates that these pools do little to make coverage affordable. Thirty-four states have high-risk pools today, and the pools have proven to be a major disappointment. With over 33 million uninsured people in these states, the pools insure only about 200,000 people. [8]

The high-risk pools do not work well because they enroll only people in poor health who are otherwise unable to obtain coverage. Rather than keeping premiums affordable by pooling high-risk people with low-risk individuals, they essentially pool people in poor health with other people in poor health. As a result, coverage in a high-risk pool typically costs 125 percent to 200 percent of the rate for a comparable plan in the private insurance market.

In addition, to keep high-risk pools operating, many states have had to inject taxpayer subsidies into these pools in increasingly large amounts or, more typically, to restrain taxpayer costs by raising premiums or cost-sharing still higher, scaling back health benefits, imposing longer waiting periods for coverage of pre-existing conditions, or capping or freezing enrollment.

The design of the plan’s new state health insurance exchanges would also likely fail to restrain the growth of premiums. No one would be required to purchase insurance through the exchanges, and low-risk individuals could seek coverage outside them, in the individual market (which would remain subject to the existing, often ineffective patchwork of state regulation). As a result, low-risk individuals would probably tend to avoid the exchanges, and premiums in the exchanges would reflect a sicker-than-average mix of enrollees . Attempts to provide risk adjustment or reinsurance for plans within the exchange but not those outside it would further encourage this segmentation of the market by health risk.

Adding to these problems, the proposal would allow recipients to use their tax credits and vouchers to purchase “qualified health insurance” offered in any state. This provision would strongly encourage insurers to locate in states with lax regulations and to offer low-cost coverage aimed at cherry-picking healthy individuals. That arrangement, in turn, would almost certainly raise premiums even further for less-healthy people by encouraging healthier people to stay out of the exchanges. It would also undermine what limited consumer protections now exist in the individual market, as many states likely would feel forced to eviscerate those protections to keep insurers from moving to states with only minimal regulation. [9]

Still another concern is that the Ryan proposal’s tax credit and related subsidies would be inadequate to enable low-income people to purchase coverage even if they were in average health. For a family at the poverty line ($22,050 for a family of four in 2010), the tax credit and subsidy together would total $10,700 — well short of the $13,375 average cost of an employer-sponsored plan today.[10] For a family at twice the poverty line, the credit and subsidy would total $7,700, about $5,700 short of the average current cost of an employer plan. [11]

Furthermore, the tax credit and subsidies would increase each year by a smaller percentage than the increase in health care costs. [12] Over time, therefore, the voucher and subsidies would cover a steadily smaller fraction of the cost of individual health insurance.

Finally, the Ryan proposal would not impose any minimum standards on insurance plans offered in the exchanges. The plans likely would have a widely varying and confusing set of benefits and cost-sharing rules that could lead many beneficiaries to enroll in plans that do not cover needed services or that impose onerous deductibles and co-payments. Plans also could impose both annual and lifetime limits on benefits (while such limits would have to be “reasonable,” the term is left vague), and benefits would not have to be comprehensive.[13] States would be barred from limiting the ability of any licensed insurer to offer any type of coverage in the exchange. [14]

The Ryan proposal would abolish Medicare in its current form for everyone currently below age 55. In other words, the traditional fee-for-service Medicare program would be eliminated for everyone becoming eligible after 2020.

People who become eligible for Medicare after 2020 would no longer have access to a defined set of benefits from any participating health care provider. Instead, they would receive a voucher worth $11,000 (on average) to be used to purchase private health insurance. Beneficiaries with incomes over $80,000 ($160,000 for a couple) would receive a voucher for half that amount or less. For those with incomes below 150 percent of the poverty line, Medicare also would contribute up to $6,600 to a Medical Savings Account. The proposal would also gradually increase the age of eligibility for Medicare from 65 years to 69 years and 6 months over the period from 2022 to 2086.[15]

Insurers would be allowed to charge sicker Medicare beneficiaries higher premiums. Medicare would endeavor to adjust each person’s voucher annually to reflect his or her health status (which is difficult to do fully and accurately), with those in poorer health receiving a larger voucher and those in better health getting a smaller voucher. Since premiums would not be regulated, however, the adjustments to the voucher could well be insufficient to cover the higher premiums that insurers would charge to sicker people.

Moreover, the Ryan plan imposes no requirement that private insurers actually offer health coverage to Medicare beneficiaries at an affordable price, or at all. Some beneficiaries, particularly the frail elderly, people with disabilities, and those with very modest incomes, could end up uninsured or heavily underinsured.

The Ryan plan also establishes no specific standards for Medicare benefits. Seniors and people with disabilities would receive only whatever benefits they were able to buy in the private market with their voucher.[16] The private insurance plans that would be available to Medicare beneficiaries likely would vary widely. They would present a potentially bewildering set of choices to many people who are very old or frail.

As with the tax credit that would replace the tax exclusion for employer-based coverage, the value of the Medicare voucher would not keep pace with increases in the cost of health care and would grow increasingly inadequate over time. Adding to this problem, privatizing Medicare would tend to raise health costs, since Medicare generally pays providers less than private insurance and incurs lower administrative costs than private insurance. As a consequence, many Medicare beneficiaries would likely find that their voucher enabled them to purchase much more limited coverage than Medicare now provides — with fewer covered services and significantly higher cost-sharing. This problem would grow more severe over time as the purchasing power of the voucher steadily eroded.

Overall, CBO estimates that the Ryan proposal would reduce projected Medicare expenditures by 37 percent by 2040, and 76 percent by 2080. (In other words, expenditures for the vouchers that would replace today’s Medicare would, in 2080, equal 24 percent of what Medicare expenditures are projected to be under current law.) Since the proposal does little to slow the growth of provider charges for health care services or insurance company charges for premiums, most of these reductions in Medicare spending would have to be borne by elderly and disabled beneficiaries themselves or their families. To the extent that they could not make up for the loss in Medicare coverage by paying substantially more out of pocket, beneficiaries would have to go without care or with inadequate care.

The Ryan proposal would eliminate most of Medicaid and all of the Children’s Health Insurance Program. Low-income families with children would receive a health insurance tax credit and some additional low-income assistance and be pushed into the private health insurance market to fend for themselves. Low-income seniors would lose both Medicaid and Medicare and receive the Medicare voucher and supplemental Medical Savings Account described above. They, too, would be pushed into the private health insurance market. Medicaid would continue to provide acute-care services for low-income people with disabilities. But the long-term care component of Medicaid would be converted to a block grant to states and funded at a level that would not keep pace with the costs of care. As a result, states would essentially be compelled to make steadily larger cuts in their long-term care services as time went by.

Low-income families with children would be particularly hard hit. The new tax credit and the low-income assistance would be too small to allow most such families to purchase comprehensive health insurance. Many Medicaid beneficiaries are in poorer health than people in private insurance and are more likely to have special health care needs. They could end up uninsured if they were unable to obtain coverage in the private market, while those who found coverage would face more limited benefits and higher out-of-pocket costs than under Medicaid.

Because Medicaid beneficiaries have such low incomes, the Medicaid program generally does not charge premiums and limits cost-sharing to very small amounts. Those are features that private insurance does not replicate. Medicaid also provides certain benefits that vulnerable low-income populations — particularly children and people with special health care problems — often need but that private insurance typically does not provide.

For example, under the Ryan plan, poor children would lose an important Medicaid benefit (called early and periodic screening, diagnostic, and treatment services, or EPSDT) that assures that they receive regular, comprehensive health screenings and are fully covered for all medically necessary treatments for any medical conditions that are identified. Private insurance typically lacks such comprehensive coverage for children. This benefit is essential for poor children, because their parents often cannot afford treatments and health services that their children need if insurance does not cover them. Loss of this benefit could have significant adverse consequences for large numbers of low-income children who are in poor health.

Low-income seniors — who tend to be in significantly poorer health and have greater health needs — would lose both Medicaid benefits and protections and their guaranteed Medicare benefits. For those with large health care needs, the Medical Savings Account contribution would likely prove insufficient to cover the cost-sharing amounts that their private health insurance plan required.

The plan’s conversion of federal Medicaid funding for long-term care to a block grant also would have far-reaching consequences. Instead of receiving a fixed percentage of the costs that they incur in providing long-term care to Medicaid beneficiaries as states do today, states would receive a fixed dollar amount each year from the federal government for long-term care services. The amount of the block grant would increase by only 4 percent a year, even though the number of elderly people in need of long-term care is expected to grow markedly as the population ages and health care costs rise.[17] Over time, this proposal would shift substantial financial burdens to states and pose serious risks to beneficiaries. Because the block grant would fall far behind the need for long-term care as the years went by, the proposal almost certainly would lead states to curtail eligibility and reduce access to long-term-care services in the decades ahead for frail seniors and people with serious disabilities.[18] The proposal also ends the entitlement status for Medicaid long-term care; states would be free to impose waiting lists or otherwise close enrollment to impoverished people who are in need of nursing-home or other institutional care.

Rep. Ryan describes his plan as strengthening Social Security and making it permanently solvent. An examination of his proposal shows, however, that it would institute large cuts in traditional Social Security benefits, use most of the resulting savings initially to help fund private accounts, and compensate the Social Security trust fund with large general-fund transfers.

- The proposal would make substantial cuts in scheduled Social Security benefits by instituting “progressive price indexing” and increasing the full retirement age beyond the increases scheduled under current law. Unlike the balanced Social Security changes that the Greenspan Commission fashioned in 1983, which contained a mix of benefit reductions and tax increases, the Ryan plan neither lifts the Social Security payroll tax cap nor raises the payroll tax rate.

- It also would divert substantial sums from the Social Security trust funds into private accounts and then maintain Social Security solvency by transferring funds to Social Security from the rest of the budget.

- The Ryan plan increases Social Security payroll tax revenue by eliminating the tax exclusion for employer-provided health insurance. Employer-provided health benefits would be taxed the same as wages, so that such benefits would be subject to the Social Security payroll tax for people with earnings below the Social Security payroll tax cap, now $106,800 a year. Higher-income people with employer-based coverage wouldnot pay any more in Social Security payroll taxes (because they would already be at the payroll tax cap, which the Ryan plan does not raise). [19]

The Ryan plan would cut traditional guaranteed Social Security retirement benefits substantially compared to the benefits now scheduled to be paid. Much of the reduction would stem from the adoption of what is called “progressive price indexing,” which would reduce the benefits of future retirees except for the bottom 30 percent of wage earners. For the average new retiree, defined benefits would be reduced by about 16 percent in 2050 and about 28 percent in 2080. Reductions would be greater for retirees with higher earnings. Over time, progressive price indexing would transform Social Security into a program that provides a modest retirement benefit that is relatively flat — that is, largely unrelated to prior earnings. [20]

The Ryan plan would also increase the full retirement age, currently scheduled to reach age 67 for people born in 1960 or later. Ryan would accelerate this schedule by one year and would index the retirement age to life expectancy thereafter. As a result of indexing, the full retirement age would increase by one month approximately every two years. For example, the full retirement age would be about 68 for people born in 1983. Although frequently not understood, increasing the full retirement age results in a cut in benefits at any given age — it is an across-the-board cut that applies to everyone, regardless of the age at which they retire.[21]

These proposed benefit reductions and tax increases would more than eliminate Social Security’s funding shortfall over the next 75 years. The proposal uses up much of these savings initially, however, by allowing workers to divert a significant portion of their Social Security payroll tax contributions into private accounts, thereby draining the trust fund of resources it needs to pay Social Security benefits. (Traditional Social Security retirement benefits would be further reduced based on the extent of a worker’s participation in the private-account option, as discussed below.)

As a result, a large hole would remain in Social Security’s finances, despite the steep Social Security benefit cuts and the increase in payroll tax collections. To cover the cost of private accounts while also making Social Security solvent despite the diversion of trillions of dollars from the Social Security trust funds to private accounts, the Ryan plan would rely on transfers from the rest of the budget. According to the Social Security actuaries, the Ryan plan requires transfers totaling $1.2 trillion between 2037 and 2056. Those transfers would not be fully repaid until 2083. [22]

Under the Ryan plan, individuals who divert a portion of their payroll tax contributions to private accounts would be guaranteed that they would receive back in retirement at least as much as they contributed, plus an adjustment for inflation. In essence, they would be given a federal guarantee against stock-market losses.

This guarantee could require a major federal bailout of private accounts during periods when the stock market performs poorly . The cost of this guarantee, unlike that of traditional Social Security, could escalate rapidly and add suddenly and unpredictably to the federal deficit. Providing a federal guarantee for stock-market investments also could encourage more risky investment decisions by individuals, as well as misguided attempts by policymakers to shore up weak or falling stock prices in response to pressures from constituents who are relying on these accounts to support them in old age.[23]

Reducing traditional Social Security retirement benefits for private-account participants and guaranteeing private-account contributions will encourage workers with above-average expected earnings to desert Social Security and opt for private accounts. Workers who choose to divert some of their payroll tax contributions to a private account will have their traditional Social Security retirement benefit reduced based on the ratio of their actual private-account contributions to the maximum possible contributions that could be made over a full working lifetime. People who enter the workforce in 2042 or later, when the private accounts are fully phased in, and who choose to contribute the maximum possible amount to their private account, would thus have their traditional Social Security retirement benefit reduced to zero. Under the Ryan proposal, high earners who remained in traditional Social Security would ultimately find their benefit reduced to about half of the currently scheduled amount. People who expect to have above-average earnings over their working lifetime could therefore expect to receive higher retirement benefits by opting for a private account than by remaining in traditional Social Security.

Moreover, the Ryan plan would provide an additional incentive for upper-income beneficiaries to divert their Social Security contributions into private accounts. Most of their traditional Social Security benefits would continue to be counted as part of their taxable income, as they are today. But benefits generated from their personal accounts would be entirely exempt from the income tax.

The result would be a system in which Social Security is very unattractive to affluent people. The Congressional Budget Office projects that 95 percent of college graduates (but only 5 percent of those who never attended college) would ultimately choose to establish a private account. [24] Progressive price indexing and increasing the full retirement age would sharply reduce their traditional Social Security benefits, and most of whatever Social Security benefit they continued to receive would be subject to the federal income tax. In contrast, by diverting a substantial share of their payroll tax contributions to private accounts, they could seek to achieve high stock-market returns and be guaranteed against loss if their investments went bad — and all of the income they withdrew from their accounts in retirement would be tax free. These changes would risk undermining the broad-based support that Social Security now enjoys. [25]

Although Congressman Ryan reserved his most detailed policy prescriptions for Medicare, Medicaid, and Social Security, his Roadmap would be incomplete if it omitted other spending. Therefore, his staff asked CBO to assume that — from 2010 through 2019 — nondefense discretionary spending would be frozen at 2009 levels in nominal terms. The roadmap would also rescind all unobligated discretionary funds provided by the American Recovery and Reinvestment Act of 2009 and reduce the amount of assets that could be purchased under the Troubled Asset Relief Program. Starting in 2020, spending in all areas of the budget except for Social Security, Medicare, Medicaid, and net interest would grow by the rate of inflation plus 0.7 percentage points — allowing such spending to remain roughly constant in real dollars, per person.

Taken as a whole, the Ryan plan would shrink federal expenditures back to the levels of the middle of the last century. Primarily because of the deep cuts in Social Security, Medicare, and Medicaid, CBO estimates that federal spending (other than on interest) under the Ryan plan would fall from about 19 percent of GDP in most recent years to 13.8 percent of GDP in 2080. Federal spending has not been that low since about 1950, when Medicare and Medicaid (and other important federal programs) did not yet exist, Social Security did not cover many workers (including many with very low incomes), and the poverty rate for the elderly was close to 50 percent.

Contrary to claims that the Ryan plan is fiscally responsible — which reflect a misunderstanding of CBO’s analysis of the proposal — the plan would leave the federal budget in dire straits for decades as a result of its massive tax cuts for wealthy households and its diversion of Social Security payroll taxes to private accounts. The plan attempts to reduce deficits and debt many decades into the future by making deep cuts in Social Security’s defined benefits and by eliminating guaranteed Medicare benefits and substantially cutting back on medical assistance for low-income families and seniors. Yet even with these sweeping changes, the plan fails to achieve its fiscal goal, since federal debt under the proposal would rise over the next four decades to unsustainable levels far in excess of 100 percent of GDP. The proposal also would seriously erode employer-sponsored health insurance coverage for working Americans and their families without instituting the accompanying reforms in health insurance needed to create a viable substitute. All in all, the Ryan Roadmap charts a radical course that, if they understood it, few Americans likely would want to follow.

The Tax Policy Center recently released an analysis of the revenues that Rep. Paul Ryan’s plan would generate through 2020. [27] Revenues over the next ten years would be almost $4 trillion lower than Ryan assumed, according to the TPC estimates. That is, although Congressman Ryan asked CBO to assume that his proposal would raise the same revenues as the current tax system over the next ten years, TPC concludes that is not the case. Based on the TPC estimates through 2020, we project that Rep. Ryan’s overhaul of the tax code would lead to lower revenues than he assumed for many decades after 2020 as well.

We project revenues under Ryan’s plan through 2083 by extrapolating the TPC’s ten-year estimates using CBO’s long-term projections. [28] Specifically, we start with TPC’s estimate of revenues in 2020 under the Ryan plan, and assume those revenues will grow at the same rate as revenues under CBO’s Alternative Fiscal Scenario starting in 2021. [29],[30]

To estimate the resulting budget totals, we extrapolated the TPC revenues as just described; adopted the projections for non-interest spending from CBO’s analysis of the Ryan plan; and recalculated interest, deficits, and debt accordingly. (See Appendix Table 1 for results.)

These estimates assume that revenues climb gradually, as a share of GDP, after 2020 as they do in CBO’s Alternative Fiscal Scenario. If revenues were to grow more slowly under the Ryan plan than under CBO’s scenario, deficits and debt would be higher than we project. Furthermore, we project that revenues would exceed 19 percent of GDP beginning in 2067. When asking CBO to analyze his proposal, Rep. Ryan stipulated that revenues should equal 19 percent of GDP in the long run (a figure that he assumed would be reached in 2030). If Rep. Ryan indeed proposes to cap revenues at 19 percent of GDP, deficits and debt would decline more slowly than we project, and debt as a share of GDP would be about 10 percentage points higher in 2083 than we project.

| Appendix Table 1:

The Ryan Plan Generates Lower Revenues in the Near Term And for Most of Next Seven Decades Than Ryan Specified |

| Year | Projections Based on Rep. Ryan’s Revenue Specifications

As a Share of GDP | Projections Based on TPC Revenue Estimates Extended

As a Share of GDP |

| Revenues | Deficit (-) / Surplus (+) | Debt | Revenues | Deficit (-) / Surplus (+) | Debt |

| 2010 | 16.4% | -7.0% | 61% | 16.4% | -7.0% | 61% |

| 2020 | 18.5% | -3.8% | 69% | 16.6% | -6.9% | 90% |

| 2030 | 19.0% | -4.8% | 85% | 17.0% | -8.5% | 127% |

| 2040 | 19.0% | -4.5% | 99% | 17.3% | -8.8% | 162% |

| 2050 | 19.0% | -2.6% | 96% | 17.9% | -7.0% | 177% |

| 2060 | 19.0% | -0.6% | 77% | 18.5% | -5.0% | 171% |

| 2070 | 19.0% | +1.9% | 45% | 19.2% | -2.2% | 145% |

| 2080 | 19.0% | +5.0% | 0% | 19.8% | +1.9% | 99% |

| Source: Paul Ryan, “A Roadmap for America’s Future, Version 2.0,” January 2010; CBPP calculations based on “Preliminary Revenue Estimate and Distributional Analysis of the Tax Provisions in ‘A Roadmap for America’s Future Act 2010,’” Tax Policy Center, March 9, 2010; and Congressional Budget Office, The Long-Term Budget Outlook, June 2009. |