- Home

- Income Security

- Increases In TANF Cash Benefit Levels Ar...

Increases in TANF Cash Benefit Levels Are Critical to Help Families Meet Rising Costs

Temporary Assistance for Needy Families (TANF), the primary cash assistance program for families with children when they face a crisis or have very low incomes, can play a key role in ensuring that these families have incomes to meet their basic needs. Research shows that providing cash assistance to families experiencing poverty can improve children’s health and academic achievement, which in turn can lead to better health and higher earnings in adulthood. Cash assistance to families struggling to make ends meet enables them to afford necessities such as rent, utilities, personal hygiene products, and school supplies. States, which have total flexibility to set benefit levels, have kept them too small to meet families’ basic needs and maintain their financial stability. Although several states increased cash benefits since July 2021 and some states have policies in place to automatically increase cash benefits, there is much more that can be done to improve TANF benefit levels.

Regular increases in cash benefits keep the value of TANF benefits from eroding over time due to inflation. These increases are especially important during hard economic times when families face higher prices and additional expenses. Driven by the economic consequences of the COVID-19 pandemic, inflation increased 9.1 percent for the 12 month-period ending in June 2022, the largest 12-month increase since the period ending in November 1981.[2]

States can mitigate the impacts of inflation by increasing benefit levels, establishing mechanisms to prevent cash benefits from eroding in the future, providing housing supplements and other additional payments, and ending punitive policies that reduce or take away cash assistance. A federally mandated minimum benefit and changes to TANF’s funding structure are also needed to ensure that all children and families receive adequate help, regardless of the state where they live. Families should not have to face tough choices such as paying rent or buying diapers and other necessities in challenging times.

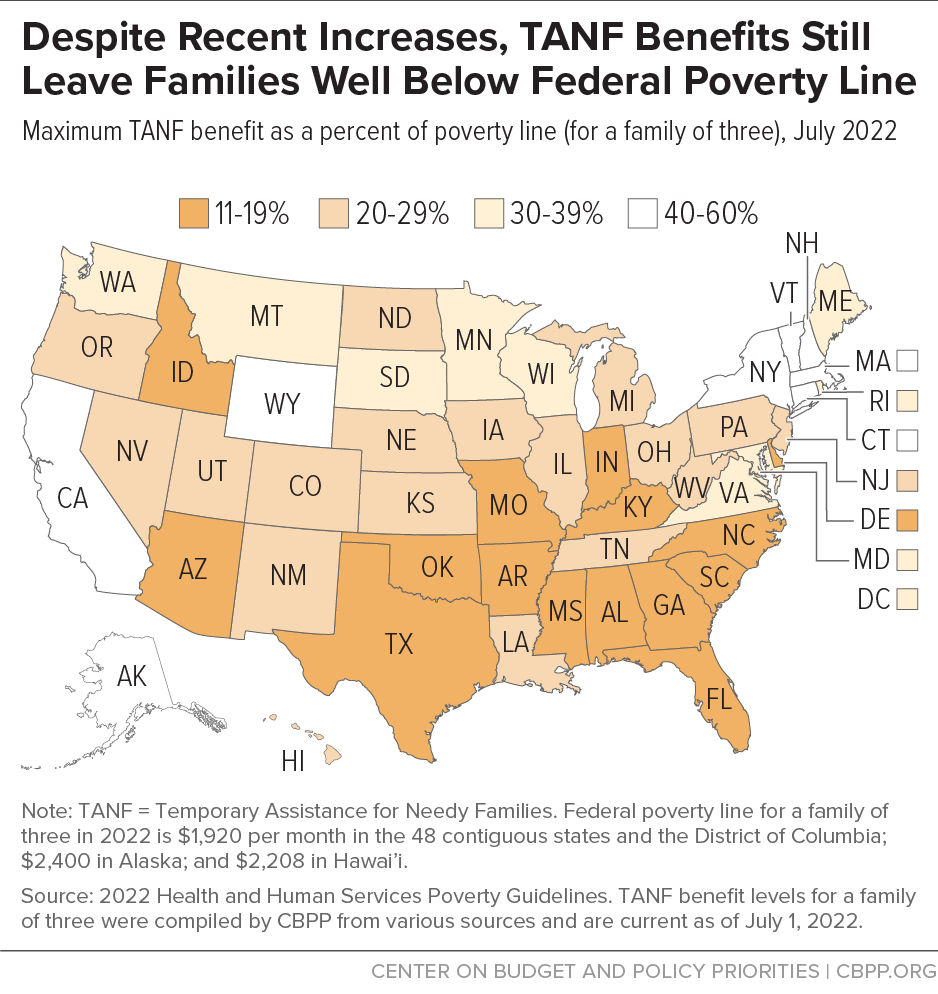

Fifteen states and the District of Columbia increased their cash benefits between July 2021 and July 2022, although TANF benefits in most states are still at their lowest value since the program was created in 1996. Despite recent increases, cash benefits are at or below 60 percent of the poverty line in every state and below 20 percent in 15, mostly Southern, states. (See Figure 1.) Inadequate and shrinking cash benefits affect all families facing a crisis or struggling to pay for the basics. But research shows that families with low incomes, especially Black and Latinx families, are more likely to experience the economic effects of inflation such as an increase in food, rent, and housing prices compared to white families.[3]

To reimagine TANF to better serve all families in need, we must consider how a history of racism affects the program today. The “Black Women Best” framework developed by Janelle Jones, chief economist at the SEIU and formerly chief economist at the U.S. Department of Labor, argues that “if Black women — who, since our nation’s founding, have been among the most excluded and exploited by the rules that structure our society — can one day thrive in the economy, then it must finally be working for everyone.”[4] Consistent with Jones’ framework, redesigning TANF so that it centers the needs of Black women and families and adequately helps families struggling to afford basic necessities would better serve families of all races and ethnicities. Such a redesigned TANF program would benefit not only the approximately 5 million Black children living in the states with the lowest TANF cash benefits, but also the approximately 7 million Latinx children and 13 million white children who live in these states.[5]

Fifteen States and D.C. Raised Benefit Levels Since July 2021

This report, an annual update of state TANF benefit levels, covers benefit changes that took effect in the 50 states and D.C. between July 1, 2021, and July 1, 2022. The benefit levels cited reflect the maximum monthly benefit for a family of one parent and two children with no other income as of July 1, 2022. However, families often do not receive the maximum TANF benefit; therefore, the cash benefits cited may exceed what many families receive. Benefit levels in seven states (California, Connecticut, Kansas, New York, Pennsylvania, Vermont, and Virginia) vary by geographic region. (For more details on the benefit levels reported, see the footnotes in Appendix Table 1.)

Benefit Increases Taking Effect Through July 1, 2022

Fifteen states and the District of Columbia increased benefit levels between July 2021 and July 2022. (See Table 1.) All but six of these increases represent recurring adjustments. Some of the increases represent historic changes and continue the positive trend of states increasing benefit levels in recent years. The benefit level (in nominal dollars) in the median state is now $492, a decrease from last year’s median state benefit level of $498. (See Appendix Table 1.)

| TABLE 1 | ||||

|---|---|---|---|---|

| States Raising TANF Cash Benefits between July 2021 and July 2022 | ||||

| Monthly maximum benefit for a single-parent family of three | ||||

| State a | July 2022 Benefit | Increase Since July 2021 | Percent Change | Recurring Adjustment? |

| California b | $925 | $47 | 5% | X |

| Colorado | $559 | $51 | 10% | |

| Connecticut c | $771 | $62 | 9% | |

| District of Columbiad | $665 | $7 | 1% | X |

| Illinois | $549 | $6 | 1% | X |

| Louisiana | $484 | $244 | 102% | |

| Maine | $628 | $8 | 1% | X |

| Minnesota | $641 | $9 | 1% | X |

| New Hampshire | $1,151 | $53 | 5% | X |

| Ohio | $542 | $30 | 6% | X |

| South Carolina | $323 | $18 | 6% | X |

| South Dakota | $668 | $38 | 6% | |

| Texas | $312 | $4 | 1% | X |

| Vermont | $811 | $112 | 16% | |

| Virginia | $587 | $28 | 5% | |

| Wyoming | $781 | $55 | 8% | X |

TANF = Temporary Assistance for Needy Families.

a Massachusetts had a cash benefit increase that did not become effective until October 2022. The cash benefit level is now $783.

b California increased its cash benefit levels to $1,119 effective October 2022.

c In 2022 Connecticut changed the way its benefit is calculated, which resulted in its benefit increase of $62. Connecticut now ties its benefits to 73 percent of its Standard of Need, which is based on 55 percent of the federal poverty level. This means that benefits are effectively indexed to 40 percent of the federal poverty level and will automatically increase going forward. Prior to 2022 Connecticut's benefit level was based on a payment standard from the AFDC program, which was adjusted annually based on the Social Security Administration’s COLA for Social Security and Supplemental Security Income benefits, contingent on funds being available.

d The District of Columbia included a provision in its fiscal year 2023 budget to implement an annual COLA at the beginning of its fiscal year, October 2022. Its benefit as of October 1, 2022, is $696 for a family of three.

Source: CBPP-compiled 2022 state benefit levels

Since July 2021, nine states took on specific legislative or administrative actions to increase their grant levels. For example:

- Louisiana more than doubled its benefit level from $240 to $484, its first increase since TANF’s creation.

- Vermont increased its benefit from $699 to $811 in most of the state, its largest increase since 2019.

- South Dakota increased its benefit level from $630 to $668, a $38 increase from 2021.

- Virginia increased its benefit level across most of its populous counties from $559 to $587, its sixth benefit increase since 2016.

Although cash benefits increased in 10 states because of a cost-of-living adjustment (COLA), the amount of the COLA varied substantially across the states, from as low as $4 in Texas to as high as $55 in Wyoming. Six states had less than a $20 increase due to a COLA, and two states had more than a $50 increase to their TANF benefit levels due to COLAs in their state. This reflects variation in cash benefit levels as well as different mechanisms for automatically increasing benefits (discussed later in the paper).

TANF Cash Benefits Continue to Lose Purchasing Power in Most States; Inflation Disproportionately Harms Households with Low Incomes, Families of Color

In 15 states, cash benefit levels do not even reach 20 percent of the poverty line ($386 per month for a family of three), compared to seven states in 1996.[6] Despite recent increases, TANF cash benefits would still leave a family of three at or below 60 percent of the poverty line in every state. (See Figure 1 and Appendix Table 2.) Nationally, TANF cash benefits have lost substantial purchasing power due to inflation and do far less to help families escape “deep poverty” (family incomes below half of the poverty line) than in 1996.

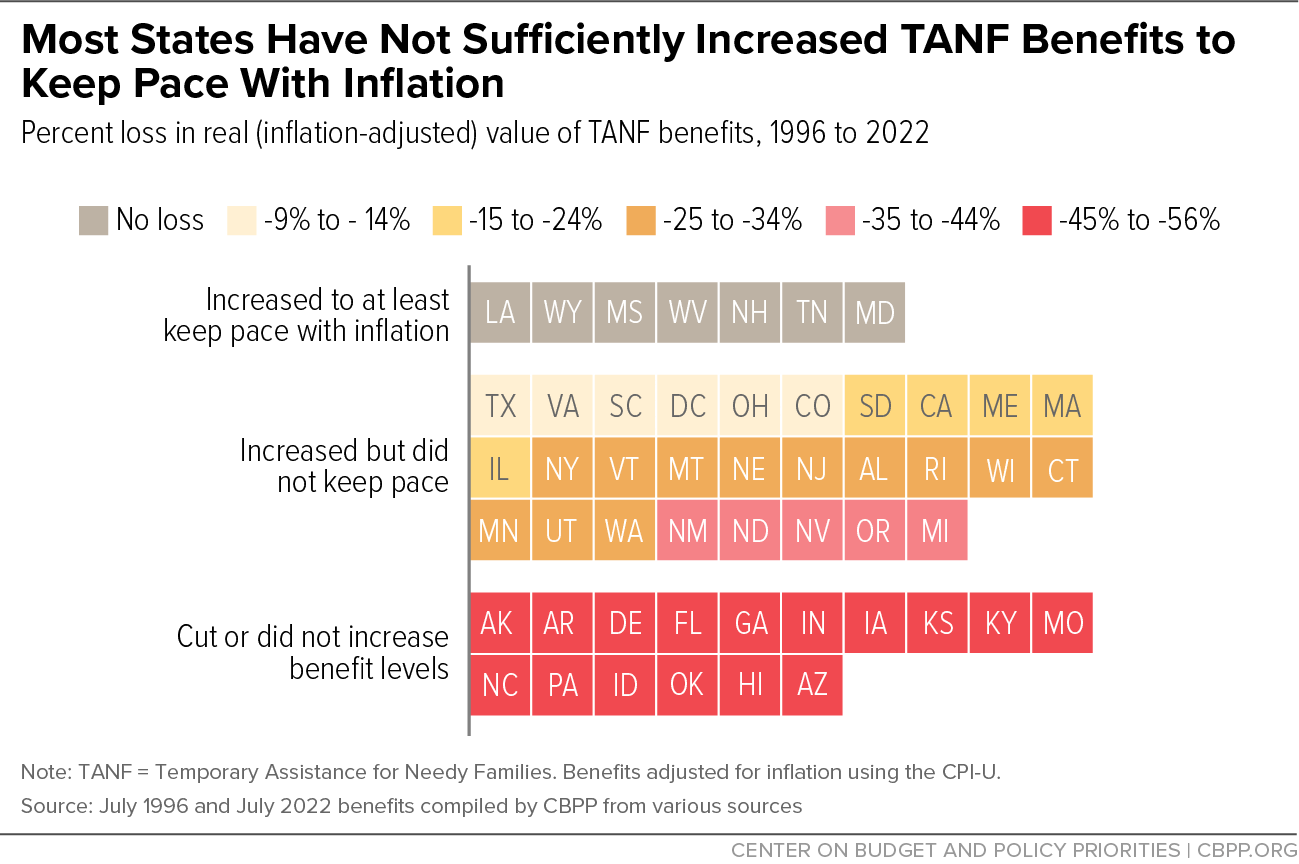

In 2022, cash benefits in just seven states had a real (inflation-adjusted) value that was the same as or higher than in 1996. At the other end, 12 states[7] had the same nominal cash benefit levels in 2022 as in 1996, meaning that benefits have fallen by 45 percent in inflation-adjusted terms. Four states— Arizona, Hawai’i, Idaho, and Oklahoma — cut cash benefits without later restoring them, so these benefits are below their 1996 levels even without adjusting for inflation. In the remaining 27 states and D.C., cash benefit increases were not sufficient to keep pace with inflation, leading to an average value loss of 28 percent. (See Figure 2 and Appendix Table 1.)

Although recent TANF cash benefit increases in some states will help families better meet their basic needs, benefits in every state provide inadequate resources, and benefits in most states are not adjusted to account for periods of high inflation — like the period families are currently enduring. Even when states adjust their TANF benefits for inflation, there is a lag; families in states that automatically adjust benefits for inflation will not see adjustments to account for the current high levels of inflation until next year.

Research shows that households with low incomes are hurt by inflation the most. Families with the lowest incomes spend a higher share of their income on necessities than more well-off families.[8] Therefore, when prices for these necessities rise and TANF benefits remain stagnant, families must get by with less. They must ration necessities, buy cheaper, lower-quality products, or simply go without. Notably, prices for groceries rose 12.2 percent for the 12 months ending in June 2022; this was the largest 12-month increase since April 1979.[9] Further, data from the Bureau of Labor Statistics indicate that essential food items like fresh meat and vegetables have become significantly more expensive, leading to families consuming less nutritious options like frozen or processed foods.[10] Given the inadequacy of TANF cash benefits, families are forced to make hard choices, such as whether to fill their car with gas to get to work, pay a phone or utility bill, or buy clothing and hygiene supplies for their children.

Due to long-term systemic racism in areas such as employment, education, and housing, people of color are more likely to have low incomes and families of color are disproportionately harmed by the impacts of inflation.[11] A recent study found that Black, Latinx, and American Indian households are impacted the most, with 63 percent of American Indian adults, 55 percent of Black adults, and 48 percent of Latinx adults currently experiencing serious financial problems amid rising inflation. These rates are in comparison to 38 percent of white adults and 29 percent of Asian adults facing similar, serious financial problems.[12]

States can and should do more to help families meet their basic needs. The same study finding that Black, Latinx, and American Indian adults are disproportionately experiencing financial problems amid rising inflation also found that 50 percent of Black adults, 50 percent of Latinx adults, and 45 percent of American Indian adults say they have fallen behind in terms of achieving their life goals. This is in comparison to 40 percent of white adults and 33 percent of Asian adults.[13]

State TANF Benefit Decisions Have Disparate Impacts, Especially for Black Children

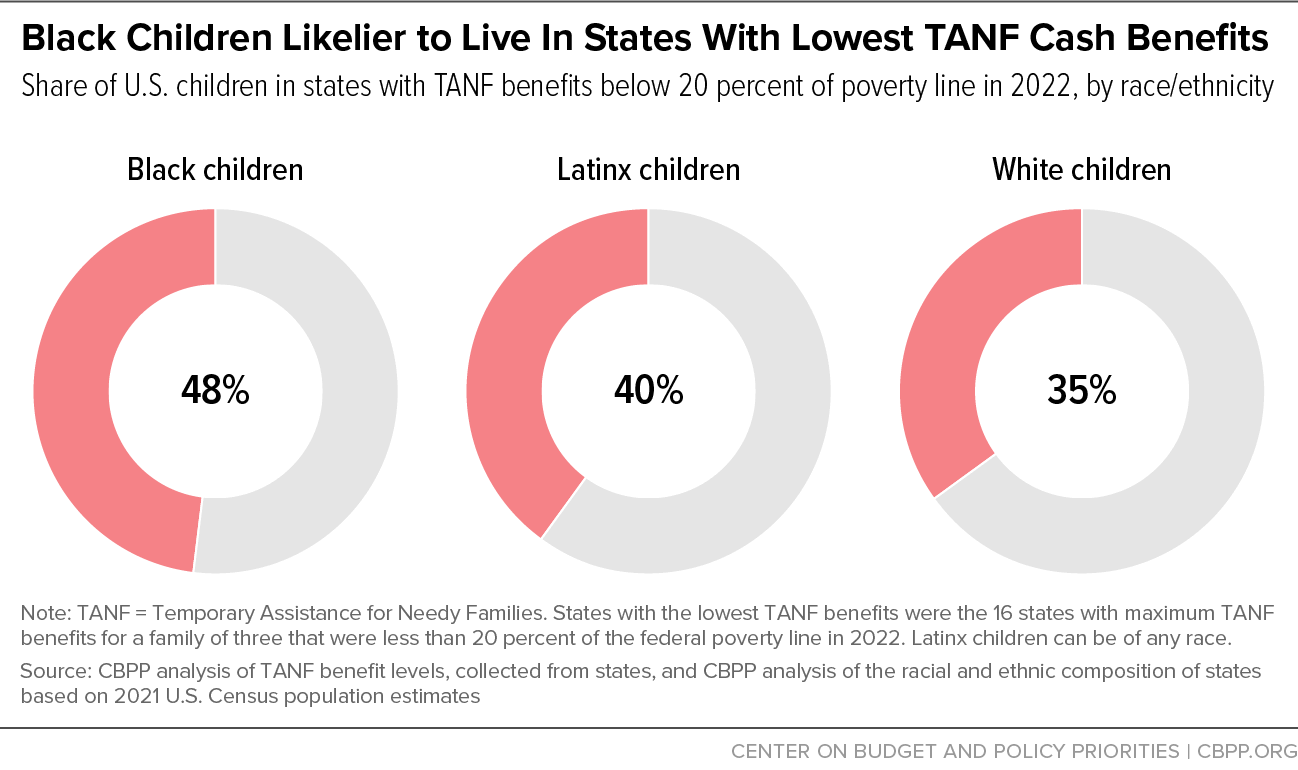

Low TANF cash benefits, which disproportionately affect the benefits available to Black children, are rooted in a long history of racist ideas and policies. TANF cash benefit levels tend to be lower in states where Black residents make up a greater share of the population, when controlling for other factors, recent research finds.[14] Forty-eight percent of all Black children in the U.S. live in states with benefit levels below 20 percent of the poverty line, compared to 40 percent of Latinx children and 35 percent of white children.[15] (See Figure 3.)

This is consistent with earlier literature that documented lower AFDC benefit levels among states with greater shares of Black residents or Black AFDC recipients.[16]

State decisions to impose family cap policies, which deny families a higher benefit if they have another child while on TANF, are also tied to race, research shows.[17] State decisions on whether to partially or fully lift the federal drug felony ban which denies families cash benefits appropriate for their family size by making parents with drug felony convictions ineligible for assistance ― are also likely to disproportionately impact Black families.[18]

TANF Cash Benefits Historically Used to Control Behavior and Access

Since the beginning of cash assistance programs in the country, states’ unfettered ability to set inadequate benefit levels set the course for racial disparities. As Congress debated the Social Security Act of 1935, which created AFDC (originally Aid to Dependent Children or ADC), initial proposals by federal policymakers to ensure adequate cash benefits were undermined by a then-powerful Southern congressional bloc, which insisted on state and local control over the program. Later attempts to establish a minimum federal benefit for AFDC were similarly rejected by Congress. In defeating these proposals and others that would have made cash assistance more adequate and accessible to Black women and their families, policymakers preserved racial discrimination and segregation in the economy by ensuring that AFDC did not compete with the low wages paid to Black workers, who often were segregated into agricultural and domestic roles.a

This trend of low cash benefits was predominant in, but not exclusive to, the South. One study found that between 1982 and 1996, a state’s Black population was a strong predictor of the state’s AFDC benefit levels, even when controlling for a state’s ideological leanings: conservative and liberal states with higher Black populations had lower average cash benefits than their peer states with lower Black populations.b

In addition to keeping benefit levels low, states with higher shares of Black residents are likelier to adopt punitive TANF policies that reduce or take away families’ cash benefits. These policies continue a history of legislative attempts to exert economic, reproductive, and behavioral control over Black women. For example, federal law requires states to reduce cash benefits (known as a “sanction”) for families who do not meet work or other requirements, but it is up to states to decide when they impose sanctions and how much cash benefits are reduced. Nearly all states use full-family sanctions that take away the entire benefit, and states with greater shares of Black residents tend to have harsher sanction policies.c

Policies that keep TANF cash benefits low and reduce or take away those cash benefits are based on racist ideas about Black women that paint them as lazy, negligent, and devious. But these ideas and the policies they intend to justify do not exclusively harm Black families: all families who do not meet onerous requirements, who have another baby while on TANF, or who have a member with a drug felony conviction are harmed by these policies.

a For more on the racist history of AFDC and TANF benefit levels, see Ife Floyd et al., “TANF Policies Reflect Racist Legacy of Cash Assistance,” CBPP, August 4, 2021, https://www.cbpp.org/research/family-income-support/tanf-policies-reflect-racist-legacy-of-cash-assistance.

b Ben Lennox Kail and Marc Dixon, “The Uneven Patterning of Welfare Benefits at the Twilight of AFDC: Accessing the Influence of Institutions, Race, and Citizen Preferences,” Sociological Quarterly, Vol. 52, 2011, pp. 376-399, https://www.jstor.org/stable/23027542.

c Ali Zane, “Maine Joins Growing List of States Repealing TANF Full-Family Sanctions,” CBPP, June 17, 2021, https://www.cbpp.org/blog/maine-joins-growing-list-of-states-repealing-tanf-full-family-sanctions.

Families Cannot Afford Modest Rent with TANF Cash Benefits

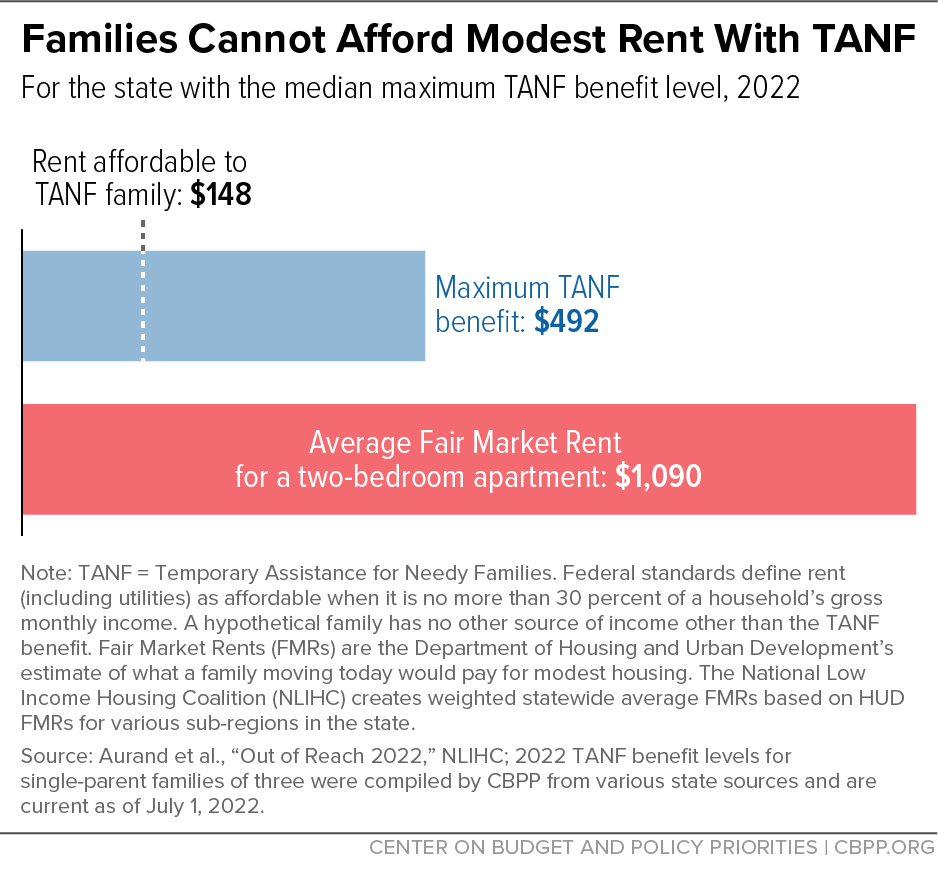

For families with children, housing is often the largest expense,[19] and overall annual housing expenditures accounted for the largest share of consumer expenditures in 2021. In 2022, a family of three receiving the maximum TANF benefit in the median state could only afford a rent far below the estimated cost of a modest two-bedroom apartment in that state, based on the Department of Housing and Urban Development’s (HUD) Fair Market Rents (FMRs).[20] (See Figure 4 and Appendix Table 3.)

Federal standards define rent (including utilities) as affordable when it takes up no more than 30 percent of a household’s income. For families whose only source of income is TANF, FMRs are well over 30 percent of the monthly maximum TANF benefit in every state. (See Appendix Table 3.) This is particularly concerning for Black and Latinx children, whose families have faced higher rates of housing insecurity and eviction filing, both before and during the pandemic.[21]

Only a small fraction of TANF families receive federal rental assistance through HUD.[22] A few states provide a housing supplement in addition to the base TANF cash benefit for families who do not receive HUD or other rental assistance. Six states provide such supplements, but in three states ― Massachusetts, North Dakota, and Vermont ― the supplements are very low, less than $50, and provide little assistance with families’ housing costs. Three other states ― Hawai’i, Maine, and Minnesota ― provide larger supplements that increase a family’s ability to pay for housing without rental assistance.[23] For example, Hawai’i now provides a housing supplement of up to $500 per month to households participating in the First-to-Work program after the legislature found that many participants could benefit from additional assistance to meet housing costs. Families in Hawai’i receiving the $500 housing supplement could afford a rent that is 35 percent of FMR, compared to 9 percent without the supplement.[24] Housing supplements help narrow the gap between what TANF families can afford and FMRs. When TANF families must spend more of their grant on their rent, they are left with less flexible income to spend on other needs.

States Should Combine TANF Benefit Increases with Recurring Adjustments to Help Families Cope With Rising Prices

Given the disproportionate effects of inflation on households with low incomes and families of color, states should not only increase TANF cash benefits but also make recurring adjustments to TANF benefit levels, such as through a statutory cost-of-living adjustment (COLA),[25] to keep pace with inflation and maintain families’ purchasing power.

Between July 2021 and July 2022, the District of Columbia and nine states — California, Illinois, Maine, Minnesota, New Hampshire, Ohio, South Carolina, Texas, and Wyoming — made such adjustments. Colorado also recently adopted a measure to prevent the future erosion of benefits, but no such adjustment took place by July 2022. Maryland, Nebraska, and Tennessee also have recurring adjustments, though they did not result in benefit increases between July 2021 and July 2022.

States take different approaches to adjusting their benefits to account for changes in living costs. One approach that states have taken is to index their TANF benefit levels directly to changes in living costs due to inflation. Maine and Ohio do this by mirroring the federal Social Security and Supplemental Security Income (SSI) COLA, which is based on changes in the federal Consumer Price Index (CPI). Wyoming indexes its TANF benefit level to changes in a state-specific cost-of-living index.

Other states have indexed their TANF benefits by tying them to a separate standard that is adjusted for inflation. For example, Illinois and New Hampshire tie their benefit levels to 30 and 60 percent of the federal poverty line, respectively, which is indexed to the CPI. Nebraska, South Carolina, and Tennessee tie benefit levels to their Standard of Need, which is updated annually in Tennessee, adjusted biannually in Nebraska based on changes in the CPI, and set to 50 percent of the federal poverty level in South Carolina.

While indexing benefits to a standard that adjusts to inflation can be an effective strategy, states can also choose a standard that is too low. For example, South Carolina and Texas make small adjustments to their benefit levels so that they remain around 17 percent of the poverty line, leaving families with far too few resources, even though benefits have nearly kept pace with inflation. When setting a COLA by tying benefits to a Standard of Need or to a share of the federal poverty guidelines, it is critical to make sure that the level set is not too low.

States can implement COLAs either through statute, which requires passing legislation, or administrative action. When possible, COLAs should be paired with one-time or gradual benefit increases of a larger scale in order to restore value lost to inflation, as a COLA only prevents future erosion to inflation. While benefit levels were too low to meet a family’s needs in most states in 1996, it may be a reasonable goal to set a target of restoring the value lost since TANF’s creation and implementing a COLA to prevent future loss, especially in the 15 states that have not increased or cut benefits since 1996.

Increasing TANF Benefits Is Critical for Families’ Economic Stability

States spend very little of their federal and state TANF funds on providing basic cash assistance to families. In fiscal year 2020, states spent just 22 percent of TANF funds on basic assistance, down from 71 percent in 1997, TANF’s first year. A majority of states also have some amount of unspent TANF funds in reserve, as federal law allows them to carry over unspent federal (but not state) funds. In 2020, 11 states had TANF reserves larger than their annual TANF block grant. States with large reserves can afford to increase benefits and implement a COLA. Even states without significant reserves can increase grants and implement COLAs by shifting TANF funds away from areas that do not help families with the lowest incomes meet their basic needs, such as college scholarships that reach middle-class families.

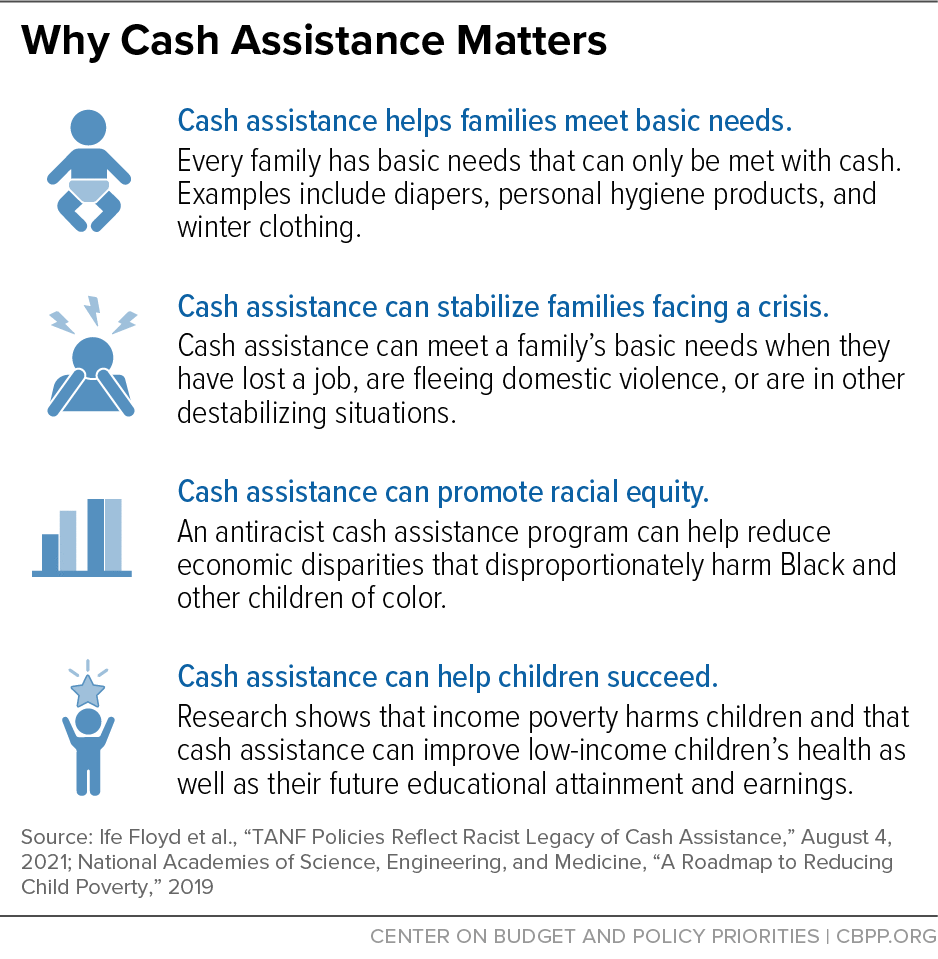

TANF provides a vital support to families with the lowest incomes: cash assistance. Other anti-poverty programs, such as the Supplemental Nutrition Assistance Program and refundable tax credits, have grown significantly and had a tremendous impact on reducing hardship, especially in Black and Latinx communities. Yet families with little or no cash income still need monthly cash assistance to be more economically secure. They have needs that may vary month to month and that only cash can cover. Cash assistance is also crucial for stabilizing families during crises and, if reimagined using a Black Women Best framework, can promote racial equity and child well-being. (See Figure 5.) Providing adequate, unconditional cash assistance also affirms the dignity of parents and caregivers and presumes they know how to best care for their children.

State and federal policymakers should do more to improve the adequacy of TANF cash benefits to help families meet their basic needs and thrive. Taking steps to raise benefit levels and enact COLAs is especially critical during periods of rising costs that disproportionately harm families of color and make it harder for families with low incomes to afford even necessities. Steps states can take now include:

- Reinvest TANF dollars to provide higher benefit levels for participating families. In fiscal year 2020, states spent just 22 percent of their TANF funds on providing basic cash assistance to families, down from 71 percent in 1997.[26] States with greater shares of Black residents tend to spend smaller shares of their TANF funds on basic assistance.[27] At a minimum, states should raise their benefit levels to restore value lost to inflation since 1996.

- Establish mechanisms to prevent benefits from eroding in the future. Adjusting TANF benefits yearly in step with inflation, such as through a statutory COLA, would maintain families’ purchasing power and help them meet basic needs. Because COLAs only prevent future erosion to inflation, they should be paired with one-time or gradual benefit increases of a larger scale to restore value lost to inflation.

- Provide additional monthly or short-term payments to families. States can provide monthly housing supplements — similar to those in Maine and Minnesota — for families who do not receive rental assistance or other supplements, such as California’s $30 per month diaper benefit[28] and Washington State’s recently implemented diaper benefit for families with children under age 3.[29] Many states used their allocation of the Pandemic Emergency Assistance Fund to provide additional short-term payments to TANF participants. For example, Alaska issued each TANF participant a nonrecurrent short-term benefit of $1,472, and Maine used its funds to send $100 per child direct payments to TANF-eligible families.

- End policies that reduce or take away families’ benefits. Maximum TANF benefit levels are too low, and families often get less than that amount because of punitive policies that reduce or take away benefits. States should eliminate full-family sanctions, which take away a family’s entire benefit. States that have not done so already should also fully lift the drug felony ban and eliminate family caps, which deny critical benefits to families because of racist assumptions about people with low incomes. In 2022, Colorado fully lifted the TANF drug felony ban; Connecticut and Oregon eliminated full-family sanctions; Rhode Island extended its time limit from 48 to 60 months; and Vermont significantly altered its work requirements.

As a fixed block grant that has lost more than 40 percent of its value over time, TANF cannot bear the full burden of helping families meet their basic needs. Other policy changes, such as directing child support payments to children for whom they are intended rather than intercepting them to repay the government for current or past TANF support, offer another important step toward ensuring that families have the resources they need to thrive.

While states have the flexibility to ensure that families have enough to afford necessities, they also have a long history of providing inadequate assistance — especially states with higher shares of Black residents. To ensure that no family falls below a certain income level, Congress needs to establish a federal minimum benefit. Congress also needs to make significant changes to TANF’s funding structure to retarget its resources to provide cash assistance, address funding inequities, and prevent the erosion of benefits over time.

Appendix

| APPENDIX TABLE 1 | ||||||||

|---|---|---|---|---|---|---|---|---|

| Monthly Maximum TANF Benefit Levels* | ||||||||

| (Single-parent family of three) | ||||||||

| State | July 1996 | July 2000 | July 2005 | July 2010 | July 2020 | July 2021 | July 2022 | 1996-2022 Change, Adjusted for Inflation |

| Alabama | $164 | $164 | $215 | $215 | $215 | $215 | $215 | -28% |

| Alaska | 923 | 923 | 923 | 923 | 923 | 923 | 923 | -45% |

| Arizona | 347 | 347 | 347 | 278 | 278 | 278 | 278 | -56% |

| Arkansas | 204 | 204 | 204 | 204 | 204 | 204 | 204 | -45% |

| Californiaa | 596 | 626 | 723 | 694 | 878 | 878 | 925 | -15% |

| Colorado | 356 | 356 | 356 | 462 | 508 | 508 | 559 | -14% |

| Connecticutb | 636 | 636 | 636 | 674 | 698 | 709 | 771 | -33% |

| Delaware | 338 | 338 | 338 | 416 | 338 | 338 | 338 | -45% |

| District of Columbia | 415 | 379 | 379 | 428 | 658 | 658 | 665 | -12% |

| Florida | 303 | 303 | 303 | 303 | 303 | 303 | 303 | -45% |

| Georgia | 280 | 280 | 280 | 280 | 280 | 280 | 280 | -45% |

| Hawai’ic | 712 | 570 | 570 | 610 | 610 | 610 | 610 | -53% |

| Idaho | 317 | 293 | 309 | 309 | 309 | 309 | 309 | -47% |

| Illinois | 377 | 377 | 396 | 432 | 533 | 543 | 549 | -20% |

| Indiana | 288 | 288 | 288 | 288 | 288 | 288 | 288 | -45% |

| Iowa | 426 | 426 | 426 | 426 | 426 | 426 | 426 | -45% |

| Kansas d | 429 | 429 | 429 | 429 | 429 | 429 | 429 | -45% |

| Kentucky | 262 | 262 | 262 | 262 | 262 | 262 | 262 | -45% |

| Louisiana e | 190 | 190 | 240 | 240 | 240 | 240 | 484 | 40% |

| Maine f | 418 | 461 | 485 | 485 | 610 | 620 | 628 | -18% |

| Maryland | 373 | 417 | 482 | 574 | 727 | 727 | 727 | 7% |

| Massachusetts g | 525 | 525 | 578 | 578 | 593 | 712 | 712 | -26% |

| Michigan | 459 | 459 | 459 | 492 | 492 | 492 | 492 | -41% |

| Minnesota | 532 | 532 | 532 | 532 | 632 | 632 | 641 | -34% |

| Mississippi | 120 | 170 | 170 | 170 | 170 | 260 | 260 | 19% |

| Missouri | 292 | 292 | 292 | 292 | 292 | 292 | 292 | -45% |

| Montana | 438 | 469 | 405 | 504 | 588 | 588 | 588 | -26% |

| Nebraska h | 364 | 364 | 364 | 364 | 468 | 485 | 485 | -27% |

| Nevada | 348 | 348 | 348 | 383 | 386 | 386 | 386 | -39% |

| New Hampshire i | 550 | 575 | 625 | 675 | 1086 | 1098 | 1151 | 15% |

| New Jersey | 424 | 424 | 424 | 424 | 559 | 559 | 559 | -28% |

| New Mexico | 389 | 439 | 389 | 447 | 447 | 447 | 447 | -37% |

| New York j | 577 | 577 | 691 | 753 | 789 | 789 | 789 | -25% |

| North Carolina | 272 | 272 | 272 | 272 | 272 | 272 | 272 | -45% |

| North Dakota k | 431 | 457 | 477 | 477 | 486 | 486 | 486 | -38% |

| Ohio l | 341 | 373 | 373 | 434 | 505 | 512 | 542 | -13% |

| Oklahoma | 307 | 292 | 292 | 292 | 292 | 292 | 292 | -48% |

| Oregon | 460 | 460 | 460 | 485 | 506 | 506 | 506 | -40% |

| Pennsylvania m | 403 | 403 | 403 | 403 | 403 | 403 | 403 | -45% |

| Rhode Island | 554 | 554 | 554 | 554 | 554 | 721 | 721 | -29% |

| South Carolina n | 200 | 204 | 205 | 270 | 299 | 305 | 323 | -11% |

| South Dakota | 430 | 430 | 501 | 555 | 615 | 630 | 668 | -15% |

| Tennesseeo | 185 | 185 | 185 | 185 | 277 | 387 | 387 | 15% |

| Texasp | 188 | 201 | 223 | 260 | 303 | 308 | 312 | -9% |

| Utah | 416 | 451 | 474 | 498 | 498 | 498 | 498 | -34% |

| Vermont q | 597 | 622 | 640 | 640 | 699 | 699 | 811 | -25% |

| Virginia r | 354 | 354 | 389 | 389 | 508 | 559 | 587 | -9% |

| Washington | 546 | 546 | 546 | 562 | 569 | 654 | 654 | -34% |

| West Virginia | 253 | 328 | 340 | 340 | 340 | 542 | 542 | 18% |

| Wisconsin s | 517 | 673 | 673 | 673 | 653 | 653 | 653 | -31% |

| Wyoming t | 360 | 340 | 340 | 561 | 712 | 726 | 781 | 19% |

| Median state u | 377 | 379 | 389 | 429 | 492 | 498 | 492 | -41.2% |

*Benefit levels are listed in nominal dollars.

Note: TANF = Temporary Assistance for Needy Families.

a California has different benefit levels based on geographic location (Region 1 or Region 2) and whether families are exempted from work requirements. The benefit levels reported here are for families in Region 1 (which includes the most populous counties) who are non-exempt. In October 2022, this benefit level will increase to $1,129.

b Connecticut has different benefit levels based on geographic location (Regions A, B, and C). The benefit listed here is for Region A, which covers the state’s highest-cost area. The state has a COLA based on the Social Security and SSI COLA. In 2021, this COLA was funded for the first time in several years. In Connecticut, the benefit level is set at 73 percent of its Standard of Need. Connecticut passed legislation to tie its Standard of Need to 55 percent of the federal poverty level.

c Hawai’i has a smaller benefit for families who must participate in work activities, and a higher benefit for families who are exempt. Benefits for a family of three are $610 and $763, respectively.

d Kansas has different benefit levels based on geographic location. The benefit levels reported here apply to most of the state.

e Louisiana has a different benefit structure for its TANF program for children who are not living with their parent, called the Kinship Care Subsidy Program. The benefit is $222 to $450 per child.

f Maine indexed its benefit levels to the Social Security and SSI COLA. Families whose housing costs exceed 50 percent of their countable income are eligible for a housing supplement of up to $300 per month.

g Massachusetts had a cash benefit increase that did not become effective until October 2022. The cash benefit level is now $783 with a -18 percent change between 1996 to 2022, adjusted for inflation. This amount is reflected in all other tables.

h Nebraska’s benefit level is tied to 55 percent of the state’s Standard of Need, which is adjusted biannually using the CPI-U.

i New Hampshire’s TANF benefit levels are tied to 60 percent of the federal poverty line and are adjusted each year.

j New York has different benefit levels based on geographic location. The benefit listed here is for New York City. New York State’s benefit has several components, including a statewide monthly basic allowance (for recurring needs), a statewide home energy allowance, a statewide supplemental home energy allowance, and a county-specific rental allowance, which varies from $259 to $447. The rental allowance in New York City is $400.

k North Dakota’s benefit of $486 includes a flat $50 per month housing supplement for families who are solely responsible for their shelter costs. The base benefit ($436 in 2021) is not shown so that the benefit level CBPP reports aligns with the reporting methodology of the Urban Institute Welfare Rules Database, where 1996-2005 North Dakota benefit level data are sourced.

l Ohio raises its TANF benefit levels each January based on the Social Security and SSI COLA.

m Pennsylvania has different benefit levels based on geographic location (Groups 1-5). The benefit levels listed here are for Group 2, which includes Philadelphia County, the county with the most TANF participants. In previous years, the benefit levels that CBPP reported for Pennsylvania were for Group 1 ($421). Current benefit levels for all groups have been effective since January 1, 1990, according to the state TANF manual.

n South Carolina’s benefit level is set at 33.7 percent of its Standard of Need (50 percent of the federal poverty level), which in turn equals about 17 percent of the federal poverty level.

o In 2021, Tennessee enacted legislation stating that the benefit level cannot go below 25 percent of the state’s Standard of Need, which is updated every year.

p Texas increases its benefit level in step with 17 percent of the federal poverty level.

q Vermont has different benefit levels based on geographic location. The benefit levels listed here are for families living outside of Chittenden County. It also provides a housing supplement of up to $45 per month for families whose housing costs exceed $400 (for those outside Chittenden County). CBPP collected the information for benefit levels for 2010-2022; benefit levels for prior years are from the Urban Institute Welfare Rules Database. In August 2022, the benefit level outside Chittenden County increased to $811.

r Virginia has different benefit levels based on geographic location (Groups II and III). The benefit levels listed here are for Group III, which includes the most populous counties. In 2022, Virginia passed budget legislation that would increase benefit levels by 5 percent.

s In Wisconsin, benefits have remained at $673 since 2011 for some categories of Wisconsin Works (W-2) participants (caretakers of newborns and pregnant women with at-risk pregnancies and no other children in their care). The benefit level for W-2 Transition placement is $608 per month.

t Wyoming adjusts its benefit levels based on changes in the state’s cost-of-living index for the previous year, as determined by the Division of Economic Analysis.

u The median state is not the same state every year; it has shifted as states have changed their benefit levels.

Source: TANF benefit levels for a single-parent family of three were compiled by CBPP from various sources and are current as of July 1, 2022. Inflation-adjusted, percent change uses the CPI-U.

| APPENDIX TABLE 2 | |||

|---|---|---|---|

| TANF Benefit Levels as Percentage of Federal Poverty Level | |||

| State | 1996 | 2022 | Rank (2022) |

| Alabama | 15.2% | 11.2% | 50 |

| Alaska | 68.3% | 40.3% | 7 |

| Arizona | 32.1% | 14.5% | 46 |

| Arkansas | 18.9% | 10.6% | 51 |

| California | 55.1% | 48.2% | 2 |

| Colorado | 32.9% | 29.1% | 19 |

| Connecticut | 58.8% | 40.2% | 8 |

| Delaware | 31.2% | 17.6% | 37 |

| District of Columbia | 38.4% | 34.7% | 12 |

| Florida | 28.0% | 15.8% | 41 |

| Georgia | 25.9% | 14.6% | 45 |

| Hawai’i | 57.2% | 25.4% | 27 |

| Idaho | 29.3% | 16.1% | 40 |

| Illinois | 34.9% | 28.6% | 21 |

| Indiana | 26.6% | 15.0% | 44 |

| Iowa | 39.4% | 22.2% | 32 |

| Kansas | 39.7% | 22.4% | 32 |

| Kentucky | 24.2% | 13.7% | 48 |

| Louisiana | 17.6% | 25.2% | 30 |

| Maine | 38.6% | 32.7% | 16 |

| Maryland | 34.5% | 37.9% | 9 |

| Massachusetts | 52.2% | 40.8% | 5 |

| Michigan | 42.4% | 25.6% | 26 |

| Minnesota | 49.2% | 33.4% | 15 |

| Mississippi | 11.1% | 13.5% | 49 |

| Missouri | 27.0% | 15.2% | 42 |

| Montana | 40.5% | 30.6% | 17 |

| Nebraska | 33.7% | 25.3% | 29 |

| Nevada | 32.2% | 20.1% | 36 |

| New Hampshire | 50.8% | 60.0% | 1 |

| New Jersey | 39.2% | 29.1% | 19 |

| New Mexico | 36.0% | 23.3% | 31 |

| New York | 53.3% | 41.1% | 4 |

| North Carolina | 25.1% | 14.2% | 47 |

| North Dakota | 39.8% | 25.3% | 28 |

| Ohio | 31.5% | 28.2% | 22 |

| Oklahoma | 28.4% | 15.2% | 42 |

| Oregon | 42.5% | 26.4% | 24 |

| Pennsylvania | 38.9% | 21.0% | 34 |

| Rhode Island | 51.2% | 37.6% | 10 |

| South Carolina | 18.5% | 16.8% | 38 |

| South Dakota | 39.8% | 34.8% | 11 |

| Tennessee | 17.1% | 20.2% | 35 |

| Texas | 17.4% | 16.3% | 39 |

| Utah | 38.5% | 25.9% | 25 |

| Vermont | 58.5% | 42.3% | 3 |

| Virginia | 32.7% | 30.6% | 18 |

| Washington | 50.5% | 34.1% | 13 |

| West Virginia | 23.4% | 28.2% | 22 |

| Wisconsin | 47.8% | 34.0% | 14 |

| Wyoming | 33.3% | 40.7% | 6 |

| Median state | 34.9% | 25.6% | -- |

Note: TANF = Temporary Assistance for Needy Families.

Source: Calculated from figures in Appendix Table 1 and Health and Human Services poverty guidelines for a single-parent family of three for 1996 (https://aspe.hhs.gov/1996-hhs-poverty-guidelines) and 2022 (https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines)

| APPENDIX TABLE 3 | ||||||

|---|---|---|---|---|---|---|

| Rent Affordable to Family With Maximum TANF Benefit Compared to Fair Market Rent for Two-Bedroom Apartment | ||||||

| State | Rent Affordable to TANF Family* | Fair Market Rent (FMR)** | Rent Affordable to TANF Family as Share of FMR | Housing Supplement? | ||

| Alabama | $65 | $822 | 8% | |||

| Alaska | $277 | $1,264 | 22% | |||

| Arizona | $83 | $1,219 | 7% | |||

| Arkansas | $61 | $774 | 8% | |||

| California (Los Angeles Co.) | $278 | $2,044 | 14% | |||

| Colorado | $168 | $1,505 | 11% | |||

| Connecticut (City of Stamford) | $231 | $2230 | 10% | |||

| Delaware | $101 | $1,183 | 9% | |||

| District of Columbia | $200 | $1,765 | 11% | |||

| Florida | $91 | $1,372 | 7% | |||

| Georgia | $84 | $1,090 | 8% | |||

| Hawai’i1 | $683 | $2113 | 32% | X | ||

| Idaho | $93 | $981 | 9% | |||

| Illinois | $165 | $1,186 | 14% | |||

| Indiana | $86 | $882 | 10% | |||

| Iowa | $128 | $860 | 15% | |||

| Kansas | $129 | $879 | 15% | |||

| Kentucky | $79 | $841 | 9% | |||

| Louisiana | $145 | $920 | 16% | |||

| Maine2 | $488 | $1,180 | 41% | X | ||

| Maryland | $218 | $1,505 | 14% | |||

| Massachusetts3 | $275 | $1,975 | 14% | X | ||

| Michigan | $148 | $993 | 15% | |||

| Minnesota4 | $302 | $1,165 | 26% | X | ||

| Mississippi | $78 | $815 | 10% | |||

| Missouri | $88 | $881 | 10% | |||

| Montana | $176 | $918 | 19% | |||

| Nebraska | $146 | $883 | 16% | |||

| Nevada | $116 | $1,232 | 9% | |||

| New Hampshire | $345 | $1,367 | 25% | |||

| New Jersey | $168 | $1,628 | 10% | |||

| New Mexico | $134 | $913 | 15% | |||

| New York (New York City) | $237 | $2340 | 10% | |||

| North Carolina | $82 | $997 | 8% | |||

| North Dakota5 | $196 | $864 | 23% | X | ||

| Ohio | $163 | $887 | 18% | |||

| Oklahoma | $88 | $863 | 10% | |||

| Oregon | $152 | $1,438 | 11% | |||

| Pennsylvania (Philadelphia Co.) | $121 | $1,298 | 11% | |||

| Rhode Island | $216 | $1,264 | 17% | |||

| South Carolina | $97 | $1004 | 10% | |||

| South Dakota | $200 | $838 | 24% | |||

| Tennessee | $116 | $952 | 12% | |||

| Texas | $94 | $1,172 | 8% | |||

| Utah | $149 | $1,153 | 13% | |||

| Vermont6 | $288 | $981 | 29% | X | ||

| Virginia (Fairfax Co.) | $176 | $1,785 | 10% | |||

| Washington | $196 | $1,629 | 12% | |||

| West Virginia | $163 | $800 | 20% | |||

| Wisconsin | $196 | $965 | 20% | |||

| Wyoming | $234 | $888 | 26% | |||

| Median state | $152 | $1,090 | 12% | |||

Note: TANF = Temporary Assistance for Needy Families; Fair Market Rent = U.S. Department of Housing and Urban Development’s estimate of rent and utility costs for modest housing unit in local area; HMFA = HUD Metropolitan FMR Area. All dollar figures are monthly amounts.

*Figures shown represent 30 percent of the maximum TANF benefit unless the state has a housing supplement, in which case 100 percent of the maximum available housing supplement plus 30 percent of the base grant is considered affordable rent. Federal standards define rent (including utilities) as affordable when it takes up no more than 30 percent of a household’s income and hypothetical families are assumed to have TANF as their sole source of income. Though housing supplements are given to families as cash, it is reasonable to assume that families spend it on rent.

**Unless otherwise noted, the FMR presented is a weighted statewide average FMR based on HUD FMRs for various sub-regions in the state. In states where maximum benefit levels listed in Appendix Table 1 do not apply to the majority of the state, the FMR for the most populous county or city (in Connecticut and New York) in the region whose benefit is reported in Appendix Table 1 is used.

These figures do not represent the housing burden on actual TANF families, which depends on the amount of TANF cash assistance, their housing costs, and the amount of any other income or assistance.

1 Hawai’i provides a housing supplement of up to $500 per month. Without this supplement, the affordable rent for a family with the maximum TANF benefit ($610) would cover 9 percent of FMR.

2 Maine provides a housing supplement of up to $300 per month. Without this supplement, the affordable rent for a family with the maximum TANF benefit ($620) would cover 17 percent of FMR.

3 Massachusetts provides a flat $40-per-month housing supplement. Without this supplement, the affordable rent for a family with the maximum TANF benefit ($712) would cover 11 percent of FMR.

4 Minnesota provides a flat $110-per-month housing supplement. Without this supplement, the affordable rent for a family with the maximum TANF benefit ($532) would cover 17 percent of FMR.

5 North Dakota provides a flat $50-per-month housing supplement. Without this supplement, the affordable rent for a family with the base grant ($436; not shown in Appendix Table 1) would cover 15 percent of FMR.

6 Vermont provides a housing supplement of up to $45 per month. Without this supplement, the affordable rent for a family with the base grant ($699) would cover 23 percent of FMR. Calculations are for families living outside of Chittenden County.

Source: FMR data from Aurand et al., op. cit. TANF benefit levels for single-parent families of three were compiled by CBPP from various state sources and are current as of July 1, 2022.

Increases in TANF Cash Benefit Levels Are Critical to Help Families Meet Rising Costs

TANF Can Be a Critical Tool to Address Family Housing Instability and Homelessness

Policy Basics

Income Security

End Notes

[1] Da’Shon Carr was an intern with CBPP from June 2022 through December 2022.

[2] U.S. Bureau of Labor Statistics, “Consumer Price Index News Release,” July 13, 2022, https://www.bls.gov/news.release/archives/cpi_07132022.htm.

[3] Munseob Lee, “Do Black Households Face Higher and More Volatile Inflation?” Federal Reserve Bank of Richmond, July 2022, https://www.richmondfed.org/publications/research/economic_brief/2022/eb_22-25; Emily Moss et al., “The Black-white Wealth Gap Left Black Households More Vulnerable,” Brookings Institution, December 8, 2020, https://www.brookings.edu/blog/up-front/2020/12/08/the-black-white-wealth-gap-left-black-households-more-vulnerable/.

[4] Kendra Bozarth, Grace Western, and Janelle Jones, “Black Women Best: The Framework We Need for An Equitable Economy,” Roosevelt Institute and Groundwork Collaborative, September 2020, https://rooseveltinstitute.org/wp-content/uploads/2020/09/RI_Black-Women-Best_IssueBrief-202009.pdf.

[5] CBPP analysis of 2021 U.S. Census population estimates, op. cit.

[6] Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Idaho, Indiana, Kentucky, Mississippi, Missouri, North Carolina, Oklahoma, South Carolina, and Texas.

[7] Alaska, Arkansas, Delaware, Florida, Georgia, Indiana, Iowa, Kansas, Kentucky, Missouri, North Carolina, and Pennsylvania. Delaware briefly increased benefit levels in 2010 before reverting to the same benefit level (in nominal dollars) it has had since 1996.

[8] The White House, “The Cost of Living in America: Helping Families Move Ahead,” August 11, 2021, https://www.whitehouse.gov/cea/written-materials/2021/08/11/the-cost-of-living-in-america-helping-families-move-ahead/.

[9] Joseph Llobrera, “SNAP Benefit Adjustments Will Help Low-Income Households Cope With Food Inflation,” CBPP, August 12, 2022, https://www.cbpp.org/blog/snap-benefit-adjustments-will-help-low-income-households-cope-with-food-inflation.

[10] Bureau of Labor Statistics, U.S. Department of Labor, “Consumer Price Index - 2022,” November 2022, https://www.bls.gov/news.release/pdf/cpi.pdf.

[11] Mark D. Shroder and Michelle P. Matuga, Housing Discrimination Today, Office of Policy Development and Research, Cityscape, Vol. 17, No. 3, 2015; Margery Austin Turner et al., “Housing Discrimination Against Racial and Ethnic Minorities,” Urban Institute, June 11, 2013; Patrick M. Kline, Evan K. Rose, and Christopher R. Walters, “Systemic Discrimination Among Large U.S. Employers,” National Bureau of Economic Research, Working Paper 29053, revised May 2022, https://www.nber.org/papers/w29053.

[12] National Public Radio, Robert Wood Johnson Foundation, and Harvard T.H. Chan School of Public Health, “Personal Experiences of U.S. Racial/Ethnic Minorities In Today’s Difficult Times,” August 2022, https://legacy.npr.org/assets/pdf/2022/08/NPR-RWJF-Harvard-Poll.pdf.

[13] National Public Radio, Robert Wood Johnson Foundation, and Harvard T.H. Chan School of Public Health, op. cit.

[14] Heather Hahn et al., “Why Does Cash Welfare Depend on Where You Live?” Urban Institute, June 5, 2017, https://www.urban.org/research/publication/why-does-cash-welfare-depend-where-you-live.

[15] CBPP analysis of 2021 U.S. Census population estimates collected from Kids Count Data Center, “Child Population by Race and Ethnicity in the United States,” Annie E. Casey Foundation, October 2022, https://datacenter.kidscount.org/data/tables/103-child-population-by-race-and-ethnicity?loc=1&loct=2#detailed/2/2-52/false/2048/68,69,67,12,70,66,71,72/423.

[16] For more on the racist history of AFDC and TANF benefit levels, see Ife Floyd et al., “TANF Policies Reflect Racist Legacy of Cash Assistance,” CBPP, August 4, 2021, https://www.cbpp.org/research/family-income-support/tanf-policies-reflect-racist-legacy-of-cash-assistance.

[17] Joe Soss et al., “Setting the Terms of Relief: Explaining State Policy Choices in the Devolution Revolution,” American Journal of Political Science, Vol. 45, No. 2, April 2001, http://urban.hunter.cuny.edu/~schram/ssvosettingthetermsofrelief.pdf.

[18] Ali Zane, “Remaining States Should Lift Racist TANF Drug Felony Bans; Congress Should Lift It Nationwide,” CBPP, June 30, 2021, https://www.cbpp.org/blog/remaining-states-should-lift-racist-tanf-drug-felony-bans-congress-should-lift-it-nationwide.

[19] Table 6 in U.S. Bureau of Labor Statistics, “Consumer Expenditures Report 2019,” December 2020, https://www.bls.gov/opub/reports/consumer-expenditures/2019/pdf/home.pdf/.

[20] HUD’s FMRs are gross rent estimates that include the shelter rent plus the cost of all utilities except phone and internet. For more on FMRs, see Andrew Aurand et al., “Out of Reach 2022,” National Low Income Housing Coalition (NLIHC), 2022, https://nlihc.org/oor.

[21] Arloc Sherman, “Widespread Economic Insecurity Pre-Pandemic Shows Need for Strong Recovery Package,” op. cit.; CBPP, op. cit.; Emily Lemmerman et al., “Preliminary Analysis: Who Is Being Filed Against During the Pandemic?” The Eviction Lab, December 21, 2020, https://evictionlab.org/pandemic-filing-demographics/.

[22] CBPP analysis of HUD administrative data and TANF caseload data collected from states.

[23] For more on TANF housing supplements, see Ali Zane, Cindy Reyes, and LaDonna Pavetti, “TANF Can Be a Critical Tool to Address Family Housing Instability and Homelessness,” CBPP, July 19, 2022, https://www.cbpp.org/research/family-income-support/tanf-can-be-a-critical-tool-to-address-family-housing-instability.

[24] Ibid.

[25] “Cost-of-living adjustment” can also be used to describe one-time benefit increases that are not set to repeat in subsequent years. Used here, the term describes only recurring adjustments to TANF benefit indexes to some measure of living costs.

[26] Office of Family Assistance, Administration for Children and Families, U.S. Department of Health and Human Services, “TANF and MOE Spending and Transfers by Activity, FY 2020: United States,” updated September 22, 2021, https://www.acf.hhs.gov/sites/default/files/documents/ofa/fy2020_tanf_moe_national_data_pie_chart.pdf; Diana Azevedo-McCaffrey and Ali Zane, “To Promote Equity, States Should Invest More TANF Dollars in Basic Assistance,” CBPP, updated January 12, 2022, https://www.cbpp.org/research/family-income-support/to-lessen-hardship-states-should-invest-more-tanf-dollars-in-basic.

[27] Zachary Parolin, “Temporary Assistance for Needy Families and the Black-White Child Poverty Gap in the United States,” Socio-Economic Review, May 14, 2019, https://doi.org/10.1093/ser/mwz025.

[28] CBPP and National Diaper Bank Network, “End Diaper Need and Period Poverty: Families Need Cash Assistance to Meet Basic Needs,” September 27, 2021, https://www.cbpp.org/research/family-income-support/end-diaper-need-and-period-poverty-families-need-cash-assistance-to.

[29] Washington State Legislature, Providing a Monthly Diaper Subsidy for Parents or Other Caregivers Receiving Temporary Assistance for Needy Families, State Bill, 5838 - 2021-22, https://app.leg.wa.gov/billsummary?BillNumber=5838&Initiative=false&Year=2021.

More from the Authors

Areas of Expertise

Recent Work:

Areas of Expertise

Recent Work:

Da’Shon Carr was an intern with CBPP from June 2022 through December 2022.