Costing well over $100 billion a year, tax incentives for retirement plans such as pensions, 401(k)s, and individual retirement accounts (IRAs) are one of the largest federal tax expenditures. Yet they appear to do little, relative to their high cost, to accomplish their goal of encouraging new saving.

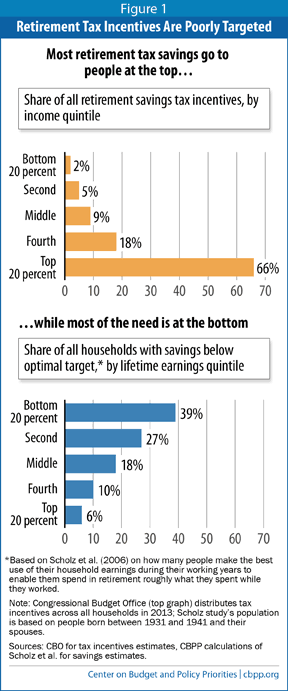

The main reason is that the bulk of their benefits go to higher-income households; in 2013, some 66 percent of the benefits of the retirement tax incentives went to the 20 percent of taxpayers with the highest incomes. These higher-income taxpayers are likely to save substantial amounts anyway for retirement and other purposes, and they are likely to respond to retirement tax incentives primarily by shifting existing assets into tax-preferred accounts rather than by undertaking additional saving.[1] Meanwhile, the bottom 20 percent of households receive just 2 percent of the benefits of retirement tax incentives, even though low-income people are the least likely to have savings and the most likely to need tax incentives to save for retirement (see Figure 1). To ensure sufficient savings during retirement, therefore, current tax incentives are poorly targeted and inefficient.

The primary retirement savings incentives allow people to contribute to retirement accounts, such as a traditional 401(k) or IRA plan, on a pre-tax basis. That is, taxpayers can defer all taxes on retirement contributions and earnings until they withdraw the money in retirement,[2] at which point it is taxed as ordinary income.

Part of the reason that this subsidy is substantial is that average tax rates tend to be lower in retirement, both because on average, retirees have less income than before retirement, and because Social Security income is taxed at lower rates than are wages and salaries. A person generally needs less income in retirement to maintain the same standard of living, in part because it’s no longer necessary to save for retirement or pay work-related expenses, and also because most people who are retired don’t incur substantial child-rearing costs. (The principal exception is in the health care area; a small percentage of retired people can face catastrophic health care costs as a result of the lack of a limit in Medicare on out-of-pocket costs and the costs that people can face for nursing home or other institutional care.)

With “Roth” IRAs and Roth 401(k)s, the tax treatment is reversed: contributions are taxed, but neither the growth of the assets in these accounts over time as they produce earnings, nor the withdrawals made in retirement, are subject to tax. Taxpayers choose the type of retirement vehicle that benefits them most over time. For example, they will likely choose a Roth-type account rather than a traditional account if their tax savings in retirement will exceed their upfront tax payments.

The total of all assets in defined contribution and IRA retirement plans is estimated to be over $10 trillion in 2013.[3]

The Congressional Budget Office (CBO) estimates[4] that tax breaks for retirement contributions and earnings will be the second-largest tax expenditure over the next decade, costing $137 billion in 2013 and $2 trillion over 2014-2023. These estimates are based on January 2013 figures from the Joint Committee on Taxation, which estimated the revenue loss from individual tax provisions as shown in Table 1.[5]

By CBO’s estimate, these incentives will cost the federal government more than all veterans’ programs combined — from veterans’ disability compensation and veterans’ pensions to veterans’ health care, which together will cost $1.7 trillion over the decade. They will also cost more than the costs of the Departments of Transportation and Education combined ($1.6 trillion over the decade).

The benefit from the deferral on retirement contributions is tied to a taxpayer’s marginal tax rate and thus rises as household income increases. For example, someone making $40,000 and in the 10 percent tax bracket receives an upfront tax subsidy of 10 cents per dollar of deductible retirement contributions, whereas someone who makes $450,000 and is in the 35 percent bracket receives an upfront subsidy of 35 cents on the dollar.

Table 1

Revenue Losses From Various Retirement Tax Breaks |

| | 2013, in billions |

| Defined-contribution plans (e.g., 401(k)) | $57 |

| Defined-benefit plans | $33 |

| Traditional IRAs | $11 |

| Keogh plans | $11 |

| Roth IRAs | $4 |

| Saver’s Credit | $1 |

| Source: Joint Committee on Taxation |

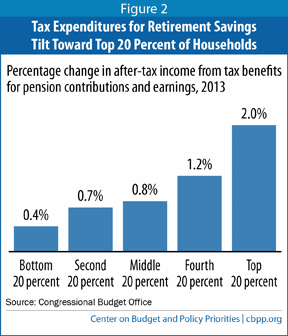

As a result, the benefits from retirement savings tax expenditures “tilt heavily toward the top,” as a recent CBO report explains.

[6] - The top 20 percent of households receive nearly twice as much in retirement tax subsidies as the bottom 80 percent combined.

- As a share of income, the subsidies are worth on average 2½ times as much for the people in the top fifth of households as for the people in the middle fifth, and five times as much as for the people in the bottom fifth (see Figure 2).

The tax code limits the amounts that taxpayers (and employers on behalf of their workers) can contribute to tax-preferred savings accounts each year. These contribution limits have become considerably more generous as a result of the Bush tax cuts,[7] which raised the limits and allowed additional “catch-up” contributions for people aged 50 and above. In 2013, a worker can put $17,500 into a 401(k) tax-free ($23,000 if the worker is 50 or older).[8] But the employer can make its own contributions, and the combined employee and employer limit is $51,000 ($56,500 if the worker is 50 or older). The annual contribution limit to IRA accounts is $5,500 ($6,500 for people aged 50 or older). (See Table 2.) Deposits to defined-benefit pension accounts (as opposed to defined-contribution plans, such as 401(k)s) are also tax free.

Table 2

Contribution Limits for Retirement Accounts Have Risen |

| Year | Contribution limit | Additional contribution amount allowed for people 50 and over |

| 401(k), employee contribution | 401(k), employer + employee combined | IRA | 401(k) | IRA |

| 2000 | $10,500 | $30,000 | $2,000 | $0 | $0 |

| 2005 | $14,000 | $42,000 | $4,000 | $4,000 | $500 |

| 2013 | $17,500 | $51,000 | $5,500 | $5,500 | $1,000 |

| Source: IRS |

These increases in the contribution limits overwhelmingly benefit people high on the income scale, for three reasons. First, most other Americans who contribute to retirement accounts contribute much smaller amounts and don’t approach the limits. The Urban-Brookings Tax Policy Center has noted that the increase in the contribution limits enacted over the past decade “benefit few workers because most contribute well below the old maximum.”

[9] Second, the higher an individual’s tax bracket, the greater the tax subsidy that he or she receives for contributions.

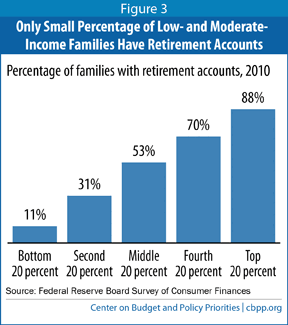

The third reason that the benefit of the higher contribution limits is so skewed to the top is that only about half of families even have retirement accounts,[10] and higher-income families are far more likely to have such accounts than families lower on the income scale, as Figure 3 shows. Low- and modest-income workers tend to have less access to work-based retirement plans,[11] either because their employer does not offer a plan or because they may work part time and don’t qualify for their employer’s plan. In addition, those low- and modest-income workers who do have access to work-based plans tend to participate less often,[12] in part because they often live paycheck to paycheck and feel they can’t afford to make retirement contributions out of their modest earnings, and in part because the tax subsidies they receive for retirement contributions are small.

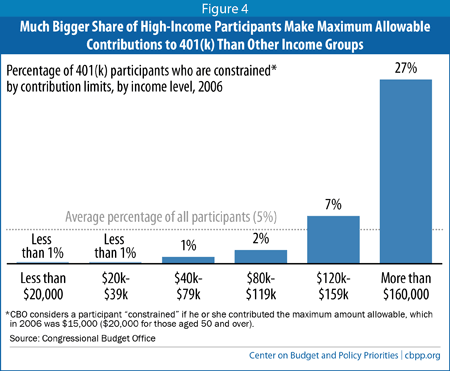

Among workers who participate in retirement plans, only a small percent are constrained by contribution limits. Only 5 percent of participants contribute the maximum amount to a 401(k),

[13] and those are primarily the participants with higher incomes, as Figure 4 shows.

[14] (The percentage of IRA participants making the maximum contribution to an IRA is higher, but only 7 percent of all workers participate in such plans.

[15] )

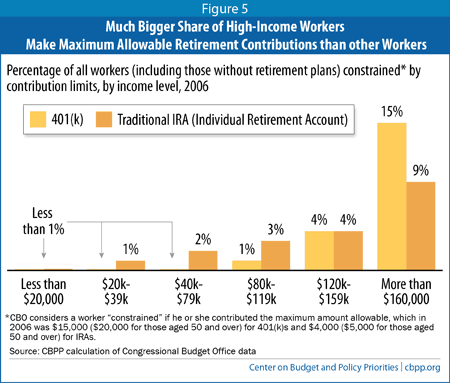

The impact of the current, high contribution limits remains heavily skewed by income when one looks at workers overall, as Figure 5 indicates, just as when one looks at workers who participate in such plans.

Moreover, those investors who are constrained by the contribution limits face no restrictions on the total amount of money that can accrue within retirement accounts on a tax-deferred basis (as the example of Governor Romney[16] illustrated). Indeed, some investment strategies can result in extremely affluent individuals receiving high returns on large sums placed in such accounts that far exceed the returns that more conventional types of investments generate. For example, some private equity firms have allowed employees to use tax-deferred retirement accounts to acquire interests in investment partnerships at a significantly lower valuation than the fair market value.[17] When the investments are successful, the value of the interests can explode; the Wall Street Journal reported last year on one private equity co-investor who reportedly saw a 583-fold increase in the value of an IRA investment.[18] These strategies can result in IRAs worth tens of millions of dollars.[19] Such cases represent loopholes around the already generous contribution caps and can result in runaway tax shelters.

For workers who participate in a retirement plan at work, there are income limits on the deductions for contributions made to a traditional IRA. These limits phase out the tax deduction between $59,000 and $69,000 in income for single filers, and between $95,000 and $115,000 in income for couples.[20] The amount that can be contributed to a Roth IRA also phases out with income — between $112,000 and $127,000 in income for single filers and between $178,000 and $188,000 in income for couples.[21]

Individuals with incomes above these income limits, however, can shift large sums (even their entire account balances) from 401(k)s and other accounts that don’t have income limits to a traditional or Roth account. They can also shift funds from a traditional IRA to a Roth IRA. In the case of a Roth conversion, taxes are owed on the amounts shifted into a Roth IRA, but all subsequent earnings on the account — and all withdrawals after five years — are entirely tax free. Such conversions can provide individuals with income far above the income limits with an opportunity to reduce their taxes through the Roth structure, particularly by shifting investments with the potential for a high rate of return from accounts in which future earnings will be subject to tax into accounts where all future earnings are tax free.

Another benefit that Roth IRAs provide to high-income households is that they do not require any distributions based on age, unlike other tax deferred plans such as 401(k)s and traditional IRAs, which require people to start taking distributions from the accounts no later than age 70½.

As a result, converting large balances from 401(k) accounts to Roth accounts can enable wealthy individuals to pass on more wealth to their heirs.[22]

Although high-income households receive the greatest tax incentives, low-income households face the greatest need for additional retirement saving. Studies find that lower-income households are, on average, much less prepared for retirement than higher-income households (see box).

There is no consensus on the best way to measure and estimate the adequacy of household retirement-savings,a but studies using a variety of methods consistently find that lower-income households are much less prepared for retirement than higher-income households and that a highly disproportionate share of the households with inadequate retirement savings are found in the lower part of the income distribution:

- Karl Scholz of the University of Wisconsin and colleaguesb have estimated whether people are saving “optimally” for retirement — that is, making the best use of their earnings during their working years to enable them to smooth out their consumption spending over their lifetimes. This study finds that the households at the bottom of the lifetime earnings distribution are those most likely to have savings below their optimal targets, and that (as Figure 1 of this paper illustrates), the majority of those with suboptimal savings are found in lower income groups. Eric Engen and colleagues have also used a “lifecycle” approach and found a similar pattern.c

- The Employee Benefit Research Instituted (EBRI) measures whether a household’s savings are sufficient to allow a benchmark level of consumption spending in retirement, based on the household’s prior consumption and the expected cost of long-term care. This method shows a greater total percentage of households with inadequate retirement savings than the Scholz analysis does — and an even starker divergence between low- and high-income households.

- The Center for Retirement Research at Boston Collegee compares households’ projected incomes with an assumed target amount needed to maintain their pre-retirement standard of living in retirement. This approach, which finds the highest total share of households with inadequate retirement savings among the three analytical approaches noted here, also shows that lower-income households are the least prepared.f

a Congressional Budget Office, “Baby Boomers’ Retirement Prospects: An Overview,” November, 2003, http://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/48xx/doc4863/11-26-babyboomers.pdf.

b Karl Scholz, Ananth Seshadri, and Surachai Khitatrakun, “Are Americans Saving ‘Optimally’ for Retirement?” Journal of Political Economy, 2006, vol. 114, no. 4, http://www.ssc.wisc.edu/~scholz/Research/Optimality.pdf.

c Eric M. Engen, William G. Gale, and Cori E. Uccello, “Lifetime Earnings, Social Security Benefits, and the Adequacy of Retirement Wealth Accumulation,” Social Security Bulletin, Vol. 66 No. 1, http://www.ssa.gov/policy/docs/ssb/v66n1/v66n1p38.pdf.

d Jack VanDerhei, “Retirement Income Adequacy for Boomers and Gen Xers: Evidence from the 2012 EBRI Retirement Security Projection Model,” Employee Benefit Research Institute, EBRI Notes Vol. 33, May, 2012, http://www.ebri.org/pdf/notespdf/EBRI_Notes_05_May-12.RSPM-ER.Cvg1.pdf.

e Alicia H. Munnell, Anthony Webb, and Francesca Golub-Sass, “The National Retirement Risk Index: An Update,” Center for Retirement Research, October, 2012, http://crr.bc.edu/briefs/the-national-retirement-risk-index-an-update.

f EBRI attributes much of the difference between its results and those of the Center for Retirement Research to EBRI’s incorporation of recent trends in retirement savings vehicles such as automatic enrollment and escalating contributions.

Beyond the stark inequity in subsidies and in the need for more substantial retirement savings, the retirement tax subsidies also are economically inefficient, because they largely subsidize behavior that would happen anyway.[23]

These subsidies increase personal saving only to the extent that they lead people to increase their retirement contributions by consuming less or working more, not by simply shifting existing assets from other savings or investment vehicles into tax-preferred accounts. The subsidies thus are “upside down”: they provide the largest subsidies to the people who are least likely to increase their savings in response and most likely to respond to the tax incentives by shifting savings from non-tax-preferred investment vehicles to tax-preferred accounts. As a Brookings Institution analysis explains, “[h]igh-income individuals are precisely the ones who can respond to such tax incentives by reshuffling their existing assets into these accounts to take advantage of the tax breaks, rather than by increasing their overall level of saving.”[24]

Low-income households, on the other hand, generally have little existing savings to shift. Accordingly, they are the group among whom nearly all retirement contributions induced by tax incentives represent new savings. But perversely, they are the people whom the current retirement tax incentives benefit the least, if at all.

As the Congressional Research Service (CRS) finds, “[p]roposals that increase retirement saving among low- and moderate-income workers could be effective in increasing new saving because these workers typically have little or no nonretirement saving to [shift to tax-preferred accounts].”[25] Several studies of pilot programs have shown that additional savings tax incentives directed at low-income people are modestly effective at increasing their savings, but only when the subsidy levels for these people are higher than current law provides.[26]

Because the bulk of current retirement tax benefits go to high-income taxpayers who are more likely to shift assets than to save more, the current system does a poor job of increasing private saving and is highly inefficient. When it comes to boosting national saving (a broader measure that consists of saving by households, businesses, and the government — and that reflects private saving minus government deficits or plus government surpluses), the current system fares even worse. The large costs of the retirement tax subsidies add to the federal deficit, so the current system may actually reduce net national saving. As CRS has concluded, “[c]onventional economic theory and empirical analysis do not offer unambiguous evidence that these tax incentives have increased personal or national saving.”[27] This is a devastating judgment, given the high cost of these subsidies.

Current tax incentives for retirement saving are expensive, inequitable, and economically inefficient, giving the largest subsidies to the people who least need help in saving adequately for retirement and are most able to shift assets to capture the subsidies. These subsidies are ripe for reform that can help accomplish two important goals — raising revenue for deficit reduction and tax-reform goals, and improving retirement saving incentives for low- and moderate-income households, the groups with the most people who need to boost their retirement assets. [28]