- Home

- Monetary Policy For A High-Pressure Econ...

The recovery from the recession of 2008-09 has been slow, but Federal Reserve policymakers believe it is nearing completion. According to the December Survey of Economic Projections from the Federal Open Market Committee (FOMC), the unemployment rate will fall from 5.8% in the fourth quarter of 2014 to about 5.2% or 5.3% in the fourth quarter of 2015, a level the Fed thinks is consistent with its mandate for “maximum employment.” In this scenario, as the labor market normalizes, core inflation as measured by the personal consumption expenditure (PCE) price index will rise smoothly to the Fed’s target of 2% in 2015 or 2016.

FOMC members want to accommodate this return to long-run equilibrium while avoiding an overheating of the economy that would push inflation above target. Based on FOMC statements, it appears likely that the Fed will pursue its goals by raising short-term interest rates above their current near-zero levels at some point around the middle of 2015.

This essay argues that a different path for monetary policy would be better for the economy. The Fed should seek to push the unemployment rate well below 5%, at least temporarily. A likely side effect would be a temporary rise in inflation above the Fed’s target, but that outcome is acceptable. To push unemployment down, the Fed should keep interest rates near zero for longer than is currently expected, certainly past the end of 2015.

This policy recommendation rests on three ideas. First, the Great Recession has done damage to the U.S. economy that, in the absence of strong monetary stimulus, is likely to persist indefinitely. This damage includes high levels of long-term unemployment, nonparticipation in the labor force, and involuntary part-time work, and low levels of output relative to the path the economy was following before 2008.

Second, this damage can be reversed to a substantial degree by expansionary monetary policy. Expansionary policy can create what Arthur Okun[1] called a “high-pressure economy,” one with stronger-than-average economic growth and low unemployment. A high-pressure economy would create jobs for people who otherwise might be chronically unemployed, and push output back toward its pre-recession trend.

Finally, though a high-pressure economy would probably push inflation above the Fed’s target level, this overshoot would be modest and temporary, and any adverse effects would be slight compared to the gains in employment and output.

Many economists have urged the Fed to keep interest rates low beyond mid-2015 and not worry that inflation might overshoot the Fed’s target. The typical rationale for this position, however, is different from mine. Economists such as Paul Krugman and Lawrence Summers stress the asymmetry of risks facing the Fed. There is uncertainty about how much stimulus the economy needs, and they argue that the cost of too little stimulus is greater than the cost of too much, because of risks involving deflation and the zero bound on interest rates. Prudence dictates that the Fed should err on the side of more expansionary policy.

My point is a complementary argument for expansionary policy. Suppose we ignore uncertainty and assume the Fed can confidently guide the economy on a smooth path to 2% inflation and 5.2% unemployment. Hitting those targets would still not be the optimal policy. The Fed should push unemployment lower and inflation above 2% on purpose, not merely accept a risk of this outcome.[2]

In what follows, I review the conventional wisdom about monetary policy, which says the ideal outcome for the economy is smooth convergence to the Fed’s inflation target. I then discuss reasons to question this view. These reasons include, first, the long-term benefits of a high-pressure economy, and, second, the anchoring of inflation expectations, which reduces the cost of overshooting the inflation target. These ideas are supported by recent research on the unemployment-inflation tradeoff in the United States.

Conventional Thinking

Before the financial crisis, there was a consensus about optimal monetary policy. In this consensus, the centerpiece of policy is an inflation target, typically 2% (this level was implicit in the United States until the Fed formalized it in 2012). The goal of policy is to keep inflation close to the target, with levels of output and unemployment consistent with that goal. If an economic slump pushes inflation below the target, the Fed should seek to push it back up, but policymakers should not stimulate the economy so much that inflation exceeds the target.

This consensus rested on several ideas about the economy. First, the economy has a long-run level of output—commonly called potential output—and a long-run level of unemployment—the natural rate—that are determined by factors such as productivity growth and turnover in the labor market. Monetary policy cannot influence these long-run levels. Expansionary policy can raise output above potential and push unemployment below the natural rate, but only temporarily. Alan Greenspan said the gains from unusually low unemployment are “ephemeral.”

Second, a period of unsustainably high output and low unemployment raises the inflation rate above the Fed’s target. And once inflation rises, it is difficult and painful to get it back down. This view was strongly influenced by the experience of the 1970s, when overly expansionary policy contributed to a rise in inflation, which then seemed stuck at a high level. Inflation fell only when Paul Volcker’s tight monetary policy caused a deep recession in the early 1980s.

The costs of reversing a rise in inflation were rooted in the behavior of inflation expectations. Before 2000, expectations appeared to adapt to changes in the actual inflation rate. This produced a vicious circle: an increase in inflation led to an increase in expected inflation, and that expectation was self-fulfilling because it caused firms to raise prices more quickly and workers to demand larger wage increases. This dynamic was the reason that high inflation continued until it was broken by an economic slump.

If one accepts these traditional ideas, then the policy advocated in this essay is foolish. If a high-pressure economy pushes inflation above the Fed’s target, unemployment falls in the short run but the rise in inflation persists. At some point, the Fed must push unemployment above its natural rate to return inflation to the target. Ultimately, an overly aggressive push to reduce unemployment leads only to instability in the economy, with no long-run benefits.

This conventional thinking may be accurate for some economies in some time periods, but not for the United States today.

Anchored Expectations

The first way current reality departs from traditional thinking is in the behavior of inflation expectations. There is considerable evidence that since about 2000 expected inflation has been nearly constant at the Federal Reserve’s target. Expectations have not responded significantly to fluctuations of actual inflation around the target.

While this idea departs from the conventional wisdom of the past, it is hardly outside the mainstream today. Since the late 1990s, Federal Reserve officials have committed themselves to keeping inflation near 2% and have successfully reversed temporary deviations from their target. Fed officials and many others argue that this policy has changed the behavior of expectations. As Frederic Mishkin puts it, the Fed’s commitment to stable inflation “in both words and actions” has produced “a strong anchoring of long-run inflation expectations.”[3]

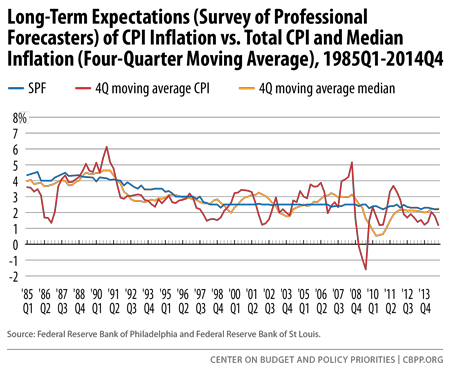

This idea receives striking support from the Survey of Professional Forecasters (SPF). For the period 1985 to the present, Figure 1 shows the mean forecast of inflation in the consumer price index over the next 10 years. The figure also shows four-quarter moving averages of actual inflation rates—both headline CPI inflation and weighted median inflation, which is a measure of the underlying or “core” inflation rate. From 1985 until the late 1990s, expected inflation as measured by 10-year SPF forecasts drifted downward, following the trend in actual inflation. Since then, by contrast, expected inflation has been almost constant, despite significant fluctuations in actual inflation.[4]

A detail: in Figure 1, the anchor for expected inflation is 2.5%, which at first blush differs from the Fed’s target of 2%. This discrepancy is explained by a difference in measurement. The Fed targets inflation as measured with the deflator for personal consumption expenditure, while the expected and actual inflation rates in the figure are based on the consumer price index. For subtle technical reasons, CPI inflation exceeds PCE inflation by about 0.5% on average.

The anchoring of inflation expectations has been welcome news for policymakers. According to Janet Yellen:

Well-anchored inflation expectations have proven to be an immense asset in conducting monetary policy. They’ve helped keep inflation low and stable while monetary policy has been used to promote a healthy economy. After the onset of the financial crisis, these stable expectations also helped the United States avoid excessive disinflation or even deflation.[5]

Just as anchored expectations have helped prevent deflation, they can help contain inflation in a high-pressure economy. A period of unusually strong growth and low unemployment could push inflation above the Fed’s target temporarily. With anchored expectations, however, this experience would not cause a persistent rise in expected and actual inflation that is costly to reverse. Instead, inflation would return automatically to its target when output and unemployment return to equilibrium levels.

Of course the anchoring of expectations is not immutable. If future inflation deviates substantially and persistently from the Fed’s target, policymakers’ commitment to the target could lose credibility, and expected inflation could change. I will assume anchored expectations in most of this essay, but at the end I consider the risk of de-anchoring. On balance, this risk makes the case for expansionary policy even stronger than it is when we assume anchoring.

Long-Term Effects of Low- and High-Pressure Economies

Here I advance two propositions. First, the Great Recession has done long-term damage to the economy. The Fed says it is making progress toward its goal of “maximum employment,” but the experience since 2007 has diminished policymakers’ estimates of the employment and output levels consistent with that goal.

This idea deviates sharply from traditional macroeconomic theory, in which recessions affect output and employment only in the short run. Yet the Great Recession’s persistent effects—often called “hysteresis”—have been identified in much recent research, including influential work at the Fed.[6]

Second, the damage from the Great Recession can potentially be reversed, at least to a large degree. A high-pressure economy can push output and employment back toward the levels considered healthy and normal before 2008. This view is supported by historical experiences in the United States and elsewhere, and by evidence from labor economics.

Damage From the Great Recession

A number of studies examine the damage to the U.S. economy from the Great Recession. Typically, they estimate that output in 2015 will be 5 or 10 percent below the trend that output was following before 2008. Only a small part of this loss represents a temporary shortfall of output from current estimates of potential output. Instead, there has been a large loss of potential—a fall in the level of output the economy is capable of producing with normal resource utilization. In a recent study I found this loss to be 5.3% based on OECD estimates of U.S. potential output and 7.7% based on IMF estimates.[7]

This loss reflects several factors. One is a decline in the fraction of the population that is working. Another is a loss of physical capital resulting from low levels of investment during the recession. It also appears that total factor productivity—the productivity of given levels of labor and capital—has grown more slowly than usual, for reasons that are not well understood.[8]

I will focus here on damage to the labor market. It now appears that the recession has had only moderate long-term effects on the unemployment rate. The current consensus of the FOMC is that the natural rate of unemployment is around 5.2 to 5.5 percent, perhaps half a percentage point above its pre-recession level. This effect is modest compared to the short-run impact of the recession, which pushed the unemployment rate to 10 percent in 2009.

As many have pointed out, however, the unemployment rate understates the recent damage to the labor market. The recession has led an unexpectedly large number of workers to drop out of the labor force, reducing the measured unemployment rate without increasing employment. The employment-to-population ratio was 63.4% in December 2006, fell to 58.2% in November 2010, and has recovered only to 59.3% in January 2015. So, of the fall in the employment-population ratio during the downturn, only about one-fifth has been reversed.

Some analysts, including those at the Congressional Budget Office, argue that demographic factors, not the Great Recession, are the primary reason the employment-population ratio has fallen. In my view, researchers such as Erceg and Levin[9] have shown persuasively that demographics are not the main factor. A simple way to appreciate this point is to examine the employment-population ratio for prime-age workers, ages 25-54. This ratio fell from 80.3% to 74.8% during the recession, and has since recovered to 77.2%. It is less than half way back to its pre-recession peak.

Yet another sign of long-term damage is a persistent increase in the number of workers saying they are involuntarily working part time. Levin estimates that this aspect of labor market slack is equivalent to an additional 0.7 percentage points in the unemployment rate.[10]

A glass can be half empty or half full. The U.S. labor market has improved substantially since its low point in 2009-10. It also looks good compared to the depressed economies of Europe. Yet millions of jobs lost during the Great Recession are not coming back in the return to normalcy envisaged by the Fed.

The Damage Is Reversible

Some believe that the damage from the Great Recession is a permanent feature of a new reality, one that we must accept in analyzing policy. This idea is implicit in the view of policymakers that the economy is approaching “maximum employment” in its current state. The idea is explicit in the Fed research of Reifschneider et al.[11] In analyzing policy, these authors assume a stark asymmetry: a recession can cause a permanent fall in employment, but there is no way a strong economy can have the opposite effect.

Yet common sense suggests that the damage from the Great Recession is reversible. If a recession leaves workers discouraged and detached from the labor force, a high-pressure economy with plentiful job opportunities could draw them back in. If low investment during a recession reduces the economy’s capital stock, a high-pressure economy could spur investment to rebuild it.

This idea is supported by historical evidence. In a 2009 study[12] I reviewed episodes in a number of countries in which strong economic expansions pushed down unemployment, and I found there was often a long-term decrease in the natural rate.

One example comes from the United Kingdom. In the mid-1980s, in the aftermath of Margaret Thatcher’s policies of austerity and disinflation, it appeared that U.K. unemployment was stuck above 10 percent. In the years that followed, however, the U.K. economy was stimulated by financial liberalization, an expansionary shift in fiscal policy, and a sharp fall in interest rates when the country left the European Monetary System in 1992. By the mid-1990s, estimates of the natural rate of unemployment in the United Kingdom were around 6%.

An important paper by Holzer[13] presents microeconomic evidence of the benefits from a high-pressure economy. Holzer examines the U.S. labor market in 1997-99, the height of the Clinton/Internet boom that pushed the unemployment rate below 4%. He compares this period to more normal conditions in 1992-94, when the economy was recovering from the recession of 1990-91 but the unemployment rate was still above 6%.

Holzer reports the results of surveys of employers about what types of workers they were willing to hire; he focused on groups that are often stigmatized, such as high school dropouts, welfare recipients, and people with little work experience. In the normal economy of 1992-94, a large fraction of employers said that such people lack the qualifications needed for the jobs the employers were offering. In the high-pressure period of 1997-99, more employers had become open-minded and willing to hire members of the stigmatized groups. A natural interpretation is that employers can afford to be choosy when there is a substantial pool of unemployed workers, but not when workers are scarce.

It seems likely (although more research is needed) that people hired during the late 1990s boom experienced long-term benefits. Unemployed people on welfare or without high school degrees are often considered to be “structurally” unemployed, doomed to joblessness unless they receive training or search more intensively for work. Yet the Holzer research suggests that a strong macroeconomy can help these people gain employment. Once they have jobs, leave welfare, and build up experience, they are presumably more employable for the long term.

Some Key Macroeconomic Relationships

So far we have reviewed some broad evidence of hysteresis—long-term costs of recessions and benefits of strong expansions. Here I look more closely at two macroeconomic relationships that underlie these phenomena. Both relate to the special role in the economy of short-term unemployment, defined as the percentage of the workforce unemployed for 26 weeks or fewer.

First, U.S. data suggest that it is short-term unemployment, rather than total unemployment or employment, that influences the level of inflation. As a result, there is a “natural rate” where short-term unemployment must settle to keep inflation stable at the Fed’s target. However, this outcome is consistent with higher or lower levels of long-term unemployment and nonparticipation in the labor force, which imply different levels of total employment.

Second, temporary deviations of short-term unemployment from its natural rate can have persistent effects on the labor market, helping to determine where total employment settles. Over 2007-14, a temporary rise in short-term unemployment left the economy with elevated levels of long-term unemployment and nonparticipation. A temporary period with short-term unemployment below its natural rate could reverse this process.

A Phillips Curve With Short-Term Unemployment

The idea that inflation depends on short-term unemployment is a theme in recent research. The rationale is that the long-term unemployed are “on the margins of the labor market.”[14] These workers are unlikely to find jobs because they are unattractive to employers and because they do not search intensively for work. As a result, only the short-term unemployed put downward pressure on wages and inflation.[15]

This idea helps explain inflation since the financial crisis. If one measures labor market slack with total unemployment, it is puzzling that the high unemployment levels since 2007 have not pushed inflation to lower levels than we have seen, even with anchored expectations. The puzzle is even greater if we account for falling labor force participation in measuring slack. It is easier to understand the stability of inflation if only short-term unemployment is relevant, because that variable rose less sharply than total unemployment after 2007, and has since returned to pre-recession levels.

Ball and Mazumder[16] argue that the path of short-term unemployment and the anchoring of expectations explain recent inflation behavior. In particular, we suggest a Phillips curve of the form:

πt = 2.5 + a(ūst-1 - us*) + ε

where πt is core CPI inflation in quarter t (which we measure with weighted median inflation); 2.5 is the constant level of expected CPI inflation; ūst-1 is the average level of short-term unemployment in the previous four quarters, from t-4 through t-1; and us* is the natural rate of short-term unemployment, which we assume is constant.

Ball and Mazumder estimate this equation for the period 2000-14. The estimated coefficient on short-term unemployment, a, is -1.0, and the estimated natural rate of short-term unemployment, us*, is 4.3%. The equation fits well: the adjusted R2, which measures the fraction of inflation movements that the equation explains, is 0.79. This fit is better than that of a more traditional Phillips curve that includes total unemployment.

Over the four quarters of 2014, us averaged 4.1%. This level is slightly below the estimate of 4.3% for us*, the natural rate of short-term unemployment. However, there is considerable uncertainty in the estimate of us*, so we do not know whether short-term unemployment in 2014 was somewhat above or somewhat below its natural rate. Over 2014, median CPI inflation averaged 2.1%, not very far from its 2.5% anchor. Overall, in 2014 the economy was not far from an equilibrium, with us at its natural rate and core inflation at the Fed’s target.

If we believe that the slack variable in the Phillips curve is near its natural rate, then conventional thinking says policymakers should not seek to push it lower, because inflation would rise. However, the Ball-Mazumder estimates suggest that the inflationary effect of a further decrease in short-term unemployment would be modest. Suppose, for example, that us falls from its current level of about 4% to 3%, and then stays at 3% for two years. The estimated coefficient in the Phillips curve, -1.0, implies that inflation would rise about 1 percentage point above the Fed’s target: core CPI inflation would rise to 3.5%, and core PCE inflation to 3%. Assuming inflation expectations remain anchored, if us returns to 4% after two years, inflation would then fall and settle near the target level.

As I discuss in an earlier paper,[17] there is little evidence that inflation rates up to 4% do material harm to the economy. Even if we assume that 2% PCE inflation is ideal, the costs of a few years of 3% rather than 2% would be trivial. By contrast, the fall in short-term unemployment behind the increase in inflation could have substantial and persistent benefits, as I discuss next.

Short-Term Unemployment, Long-Term Unemployment, and Nonparticipation

If short-term unemployment must settle at a natural rate, the long-term effects of booms and recessions on employment depend on how short-term unemployment interacts with long-term unemployment and labor force participation. These interactions are not well understood and deserve more research. For now, we can examine some apparent patterns in U.S. data.

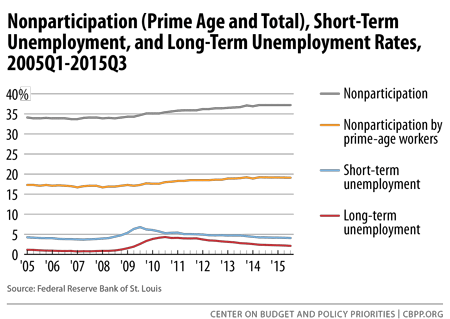

When the economy slows and unemployment rises, the share of unemployment that is long term also rises, and labor force participation falls. These patterns have long been recognized,[18] but for some reason they have been especially marked since the Great Recession. Figure 2 illustrates this point by plotting the paths of short-term unemployment, long-term unemployment, and nonparticipation since 2005. I also show nonparticipation by prime-age workers to filter out some of the effects of demographic factors.

The high levels of long-term unemployment and nonparticipation shown in Figure 2 are sources of hysteresis. By definition, nonparticipants have stopped looking for work, and the long-term unemployed appear to reduce their search intensity.[19] A long period of nonemployment also damages a person’s prospects for finding a job even with vigorous searching. This point is illustrated by Ghayad’s study[20] of job applications, which finds that employers discriminate strongly against applicants who have not worked in the past six months. For these reasons, a recession that raises long-term unemployment and nonparticipation leaves lasting scars.

It is revealing to examine the timing of unemployment movements in Figure 2. The level of short-term unemployment peaked in the first quarter of 2009 and then started falling, as the most attractive job seekers found work. But long-term unemployment continued to rise, from 2.6% in 2009Q1 to 4.3% in 2010Q1. Long-term unemployment has fallen since then but is still well above its pre-recession level, even as short-term unemployment has recovered fully. The rate of nonparticipation started rising during the recession and simply kept rising, even for prime-age workers. Today, we are left with short-term unemployment near its natural rate, but with a legacy of long-term unemployment and nonparticipation that will persist if policy is not sufficiently expansionary.

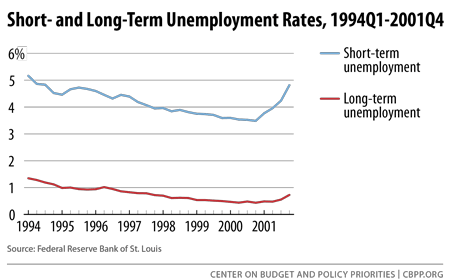

Does this process work in reverse? We can get some evidence from the high-pressure labor market of the late 1990s. (See Figure 3.) In the third quarter of 1994, the labor market seemed to be in equilibrium, with short-term unemployment of 4.8%, long-term unemployment of 1.2%, and total unemployment of 6.0%, which was a common estimate of the natural rate at the time. In 2000Q4, after the high-pressure period that followed, short-term unemployment was 3.5% and long-term unemployment was 0.4%, for a total of 3.9%. A fall in short-term unemployment of 1.3 percentage points reduced long-term unemployment by 0.8 percentage points. After that the economy weakened and short-term unemployment returned to 4.8% in 2001Q4, but long-term unemployment remained low at 0.7%.

Two factors limited the benefits of the late 1990s boom and give us reason to think a high-pressure economy could yield larger benefits today. First, the economy was not particularly depressed in the mid-1990s, at the start of the boom. With long-term unemployment starting at 1.2%, it could not fall very far. Today we have higher long-term unemployment, so more scope for improvement.

Second, the 1990s boom was interrupted by the abrupt end of the tech bubble and the 2001 recession. We can hope that the next high-pressure economy will be followed by a smoother return to long-run equilibrium.

The Risk of Unmooring Expectations

My argument so far has assumed that inflation expectations are anchored, so any overshoot of the Fed’s inflation target accompanying a high-pressure economy would be transitory. This assumption seems reasonable for the scenarios I consider, such as a 1 percentage point overshoot for two or three years. Since 2000, deviations from target of this magnitude have not caused expectations to become unmoored.

However, we cannot be certain that this situation will continue indefinitely. As discussed earlier, large enough deviations from the Fed’s inflation target would surely change expectations eventually. If the Fed tries to push inflation a point above its long-run target, perhaps policymakers will underestimate the strength of the economy, the overshoot will be larger and longer than intended, and expected inflation will rise.

That outcome would be unfortunate. If expected inflation follows actual inflation upward, we move back toward an accelerationist Phillips curve, and the rise in inflation would perpetuate itself. To return inflation to target, the Fed would have to tighten policy and push short-term unemployment back above its natural rate for a period of time. This low-pressure period could undo the benefits from the preceding high-pressure period.

At first blush, this risk might seem to weaken the case for highly accommodative monetary policy. However, once we admit the possibility that expectations will become unmoored, the case for accommodative policy actually becomes stronger. The reason is that de-anchoring could occur in either direction, and the consequences of a fall in expected inflation could be far more dire than those of an increase.

A fall in expected inflation could lead to disaster because of the zero bound on nominal interest rates. With current rates near this lower bound, a fall in expected inflation would raise real interest rates. That could trigger a vicious circle in which high real rates slow the economy and raise unemployment, causing a further decrease in inflation, and so on.

My point here is a variation on the idea of “asymmetric risks” advanced by Krugman, Summers, and Chicago Fed President Charles Evans, among others. To guard against a deflationary spiral, the Fed should err on the side of too much stimulus rather than too little. It would be imprudent, therefore, to raise interest rates during 2015.

As Janet Yellen has pointed out, anchored expectations may have saved the economy from deflation over the last six years, when unemployment was high and actual inflation was below the Fed’s target. If policymakers let inflation stay below target for much longer, they are pressing their luck. If the FOMC overestimates the strength of the economy and tightens too soon, the period of low inflation will continue. As inflation stays below target for longer and longer, the risk rises that expectations will respond.

Indeed, the Survey of Professional Forecasters contains hints that a change in expectations may already have begun. Long-term inflation expectations averaged 2.40 over 2011, but only 2.24 over 2014 and 2.20 in the fourth quarter of 2014. This small decrease could be transitory noise, and perhaps the risk of a substantial change in expectations is modest. However, given the potentially disastrous effects, any hint of this phenomenon is worrisome. We do not want to learn from experience how long inflation can remain below target before causing a deflationary spiral.

Conclusion

What would happen if a strong labor market pushed inflation above the Fed’s target? According to the conventional wisdom of central banking, transitory gains to employment would be offset by the costs of pushing inflation back down. But current reality is different. With anchored expectations and hysteresis, a high-pressure economy can have small and temporary effects on inflation, and persistent benefits for employment.

The employment benefits persist because a high-pressure economy creates jobs for workers who appear detached from the labor market—people who might be labeled as structurally unemployed. As Summers puts it, “the best social policy is a high-pressure economy in which firms are chasing workers rather than workers chasing jobs.”[21]

These ideas should guide monetary policy. The Fed should do everything it can to promote a high-pressure economy, not increase interest rates and choke off growth as soon as inflation threatens to rise.

The Federal Reserve currently anticipates that its policies will push unemployment slightly below its natural rate. According to the December 2014 Summary of Economic Projections, FOMC members believe the “longer run” unemployment rate is 5.2 to 5.5 percent, but actual unemployment will be 5.0 to 5.2 percent in 2016. At her December news conference, asked to comment on these forecasts, Yellen said:

[A] short period of a very slight undershoot of unemployment below the natural rate will facilitate a faster return of inflation to our objective. It is, I should say, a very small undershoot....

Yellen then pointed out that labor market indicators such as participation and part-time work indicate greater slack than the unemployment rate. She continued:

[I]t may be that with a very small undershoot of this longer-run normal level of the unemployment rate, as measured by the standard unemployment rate, we’ll be seeing some further progress on those other measures of slack. But it’s important to point out that the committee is not anticipating an overshoot of its 2 percent inflation objective.

A very small undershoot of longer-run unemployment will probably have very small benefits for the labor market. A larger undershoot would have larger benefits. The Fed is wary of a larger undershoot because it does not want inflation to rise to 2.5 or 3 percent, even temporarily. If policymakers would accept a modest overshoot of their inflation target, they could do more to reverse the damage from the Great Recession.

I am grateful to Alexander Broholm for excellent research assistance.

End Notes

[1] Arthur Okun, “Upward Mobility in a High-Pressure Economy,” Brookings Papers on Economic Activity, Spring 1973.

[2] In another work (“The Case for Four Percent Inflation,” Central Bank Review, Central Bank of Turkey, May 2013), I argue that the Fed’s long-run inflation target should be 4% rather than 2%. In this essay, I wish to sidestep this issue, so I make the conventional assumption that inflation must return to 2% in the long run. Even then, it is optimal for inflation to overshoot 2% temporarily.

[3] Frederic Mishkin, “Inflation Dynamics,” International Finance 10 (3), 2007.

[4] Core inflation is often measured with the CPI excluding food and energy, but the weighted median does a better job of filtering out transitory movements in inflation. See Laurence Ball and Sandeep Mazumder, “A Phillips Curve With Anchored Expectations and Short-Term Unemployment,” National Bureau of Economic Research Working Paper #20715, November 2014.

[5] Janet Yellen, “Panel Discussion on Monetary Policy,” at Rethinking Macro Policy II conference, International Monetary Fund, April 2013.

[6] Dave Reifschneider, William L. Wascher, and David Wilcox, “Aggregate Supply in the United States: Recent Developments and Implications for Monetary Policy,” presentation at International Monetary Fund Annual Research Conference, November 2013.

[7] Laurence Ball, “Long-Term Damage From the Great Recession in OECD Countries,” European Journal of Economics and Economic Policies: Intervention, no. 2, 2014. OECD is the Organization for Economic Cooperation and Development, IMF the International Monetary Fund.

[8] See Ball, “Long-Term Damage From the Great Recession in OECD Countries,” and Robert E. Hall, “Quantifying the Lasting Harm to the U.S. Economy From the Financial Crisis,” NBER Macroeconomics Annual, 2014, for more on these developments.

[9] Christopher Erceg and Andrew Levin, “Labor Force Participation and Monetary Policy in the Wake of the Great Recession,” International Monetary Fund Working Paper #13/245, 2013.

[10] Andrew Levin, unpublished data, 2015.

[11] Reifschneider, Wascher, and Wilcox, “Aggregate Supply in the United States.”

[12] Laurence Ball, “Hysteresis in Unemployment: Old and New Evidence,” in Jeff Fuhrer et al., Understanding Inflation and the Implications for Monetary Policy: A Phillips Curve Retrospective, Federal Reserve Bank of Boston, 2009.

[13] Harry Holzer, “Employers in the Boom,” Review of Economics and Statistics 88(1), 2006.

[14] Alan B. Krueger, Judd Cramer, and David Cho, “Are the Long-Term Unemployed on the Margins of the Labor Market?” Brookings Papers on Economic Activity, Spring 2014.

[15] See also James Stock, “Comment on Ball and Mazumder,” Brookings Papers on Economic Activity, Spring 2011, and Robert J. Gordon, “The Phillips Curve Is Alive and Well,” National Bureau of Economic Research Working Paper #19390, 2013. For an opposing view, see Michael T. Kiley, “An Evaluation of the Inflationary Pressure Associated With Short- and Long-Term Unemployment,” FEDS Working Paper 2014-28, Board of Governors of the Federal Reserve System.

[16] Ball and Mazumder, “A Phillips Curve With Anchored Expectations and Short-Term Unemployment.”

[17] Ball, “The Case for Four Percent Inflation.”

[18] See, e.g., Arthur Okun, “Potential GNP: Its Measurement and Significance,” Cowles Foundation Paper 190, 1962.

[19] Alan B. Krueger and Andreas Mueller, “Job Search, Emotional Well-Being, and Job Finding in a Period of Mass Unemployment,” Brookings Papers on Economic Activity, Spring 2011.

[20] Rand Ghayad, “The Jobless Trap” (unpublished), Northeastern University, 2014.

[21] Lawrence Summers, remarks at launch for “Report on the Commission for Inclusive Prosperity,” Center for American Progress, Washington, DC, January 15, 2015.