The bipartisan tax deal includes a major anti-poverty accomplishment: permanent extension of key improvements in the low-income Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC) that were slated to expire after 2017.[1] The improvements strengthen the credits’ anti-poverty impact by about 20 percent. As a result, these working-family tax credits together keep more children out of poverty than any other policy tool.[2]

-

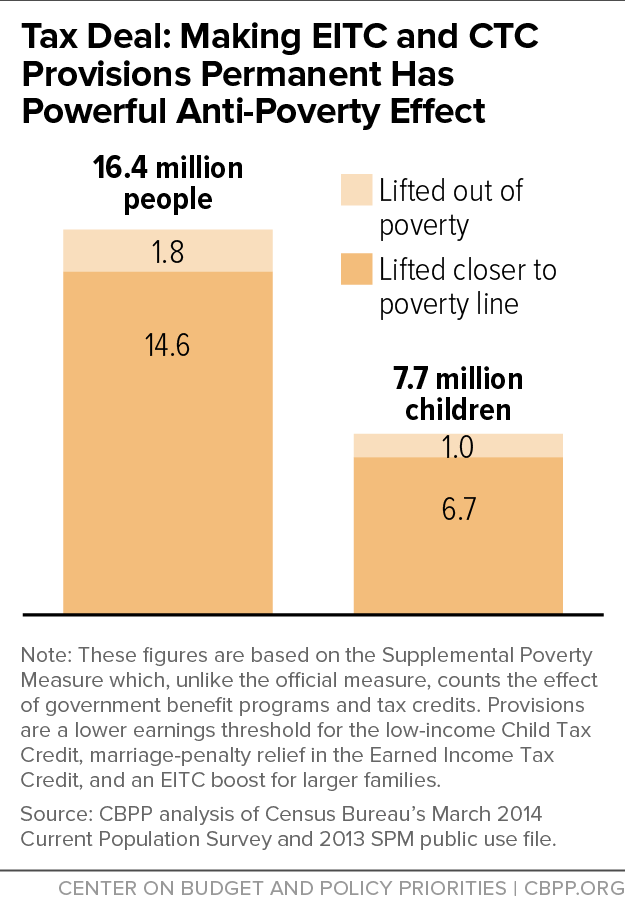

The improvements will continue to raise roughly 16 million people above or closer to the poverty line in 2018 and beyond, including up to 8 million children. (See Figure 1.)

-

Up to 50 million Americans will benefit from making the provisions permanent, including up to 25 million children.

The EITC and CTC encourage and reward work, and growing evidence suggests that income from these tax credits leads to better maternal and infant health, improved school performance, higher college enrollment, and increased work effort and earnings in adulthood.[3]

The package also makes permanent the American Opportunity Tax Credit (AOTC), which helps low- and middle-income families defray college costs. Like the CTC and EITC improvements, the AOTC is set to expire at the end of 2017. Permanently extending the AOTC further boosts the anti-poverty impact of the package’s tax provisions.[4]

Policymakers created the CTC in 1997 to help families meet the costs of raising children. The original credit generally was not refundable, meaning that it provided no help to working families with incomes too low to owe federal income tax, even though they often have the most difficulty covering child-related costs.

The 2001 Bush tax cuts doubled the maximum CTC from $500 to $1,000 per child and made the credit partially refundable, thereby enabling many working-poor families to qualify for the credit for the first time. Like the EITC, the CTC phases in with family earnings; the Bush tax cuts made a family eligible for a refundable CTC equal to 15 percent of the family’s earnings above $10,000, until the credit reached the full $1,000 per child. Because of the $10,000 threshold, millions of working-poor families were shut out of the credit entirely or received only a partial credit.

Recognizing the challenges that child-rearing costs create for working-poor families, policymakers took important steps — in 2008 under President Bush and in 2009 under President Obama — to lower the earnings threshold above which the CTC begins to phase in, which is now set at $3,000. The new bipartisan tax deal makes this $3,000 threshold permanent.

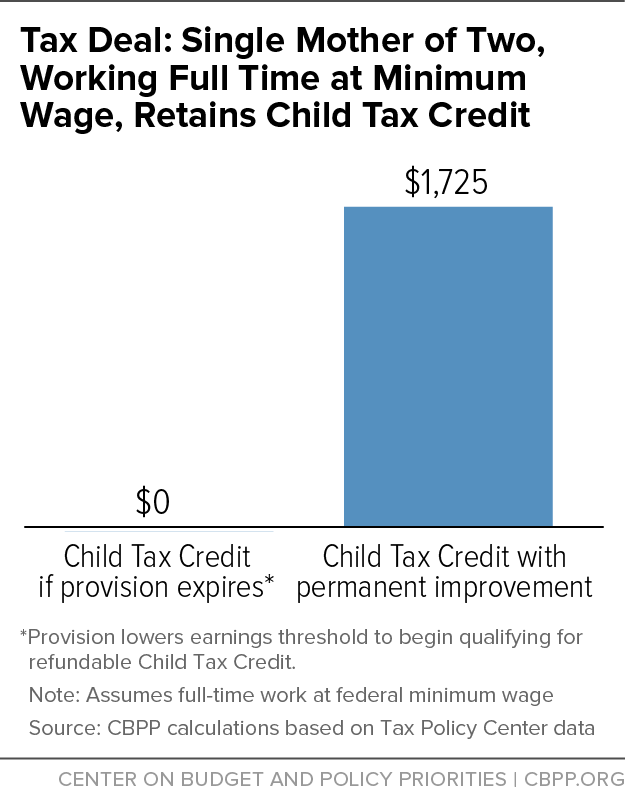

To understand what this means for low-income working families, consider a mother of two who works full time for the federal minimum wage at a local nursing home, earning $14,500. If this improvement expired at the end of 2017 as scheduled, she would lose her entire $1,725 Child Tax Credit. Under the new tax agreement, she will remain eligible for the CTC. (See Figure 2.)

In addition, the legislation makes permanent two important EITC improvements also enacted in 2009.[5] One improvement reduces the EITC marriage penalty that many couples face. Currently, to reduce marriage penalties, the income level at which the EITC begins phasing out is set $5,000 higher for married couples than for single filers. It would be set only $3,000 higher if this provision expired after 2017, shrinking the EITC for many low-income married filers and increasing the marriage penalty for many families.

Second, the new legislation makes permanent a larger EITC for families with more than two children. One of the EITC’s positive design features has historically been that it adjusts for family size, since it is harder to feed and clothe a larger family than a smaller one on a given level of wages. Thus, the EITC has long had separate “tiers” for families with one child and families with two or more children. Recognizing the needs of families with more than two children, Congress in 2009 created an EITC tier for these families as well, which the new legislation makes permanent.

To understand the impact of these EITC provisions, consider a married couple with three children and earnings of $35,000. This family stood to lose $1,190 in EITC benefits in 2018: $731 from the decline in marriage-penalty relief and $459 from the loss of the EITC tier for larger families. The new legislation means this family will avert such a loss.

The CTC and EITC provisions in the tax extenders legislation increase the anti-poverty reach of the EITC and CTC by 20 percent.

- As noted, the improvements will raise roughly 16 million people above or closer to the poverty line in 2018 and beyond, including up to 8 million children.

- Up to 50 million Americans will benefit from making these provisions permanent, including up to 25 million children.

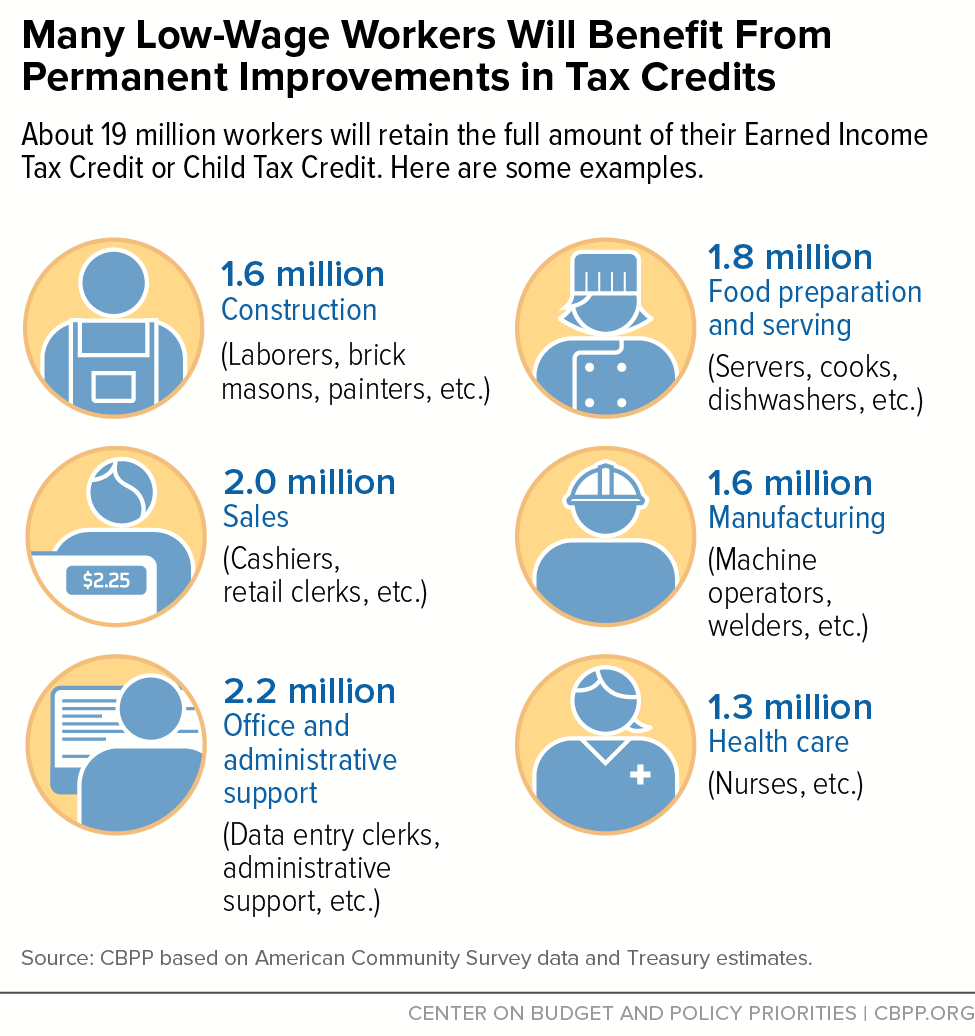

Workers in a broad cross-section of occupations will benefit from the permanent extensions, as Figure 3 shows. [6] In addition:

- About 1 million veteran and military families will retain the full amount of their current EITC, which was at risk under the improvements’ scheduled expiration.

- About 2.6 million rural families will benefit,[7] as well as about 6 million millennial workers (workers aged 18-34).[8]

- About 15 percent of the families that would have lost all or part of their tax credits include at least one member with a disability.