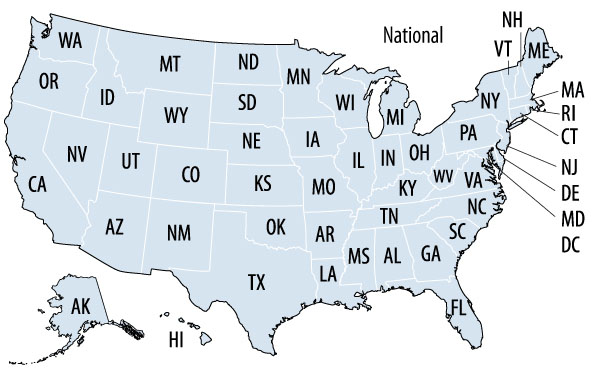

State Fact Sheets: The Earned Income and Child Tax Credits

End Notes

Total number of workers not raising children benefiting from President’s EITC proposal from Treasury Department, http://1.usa.gov/1qMc1ej. Number for the Brown-Neal proposal from CBPP estimates based on Treasury estimates and the Census Bureau’s March 2015 Current Population Survey (CPS). Figures for young people, veteran and military service members, rural workers, and workers in selected occupations from CBPP estimates using a combination of Treasury estimates, March 2015 CPS, 2012-2014 American Community Survey (ACS), and 2013 IRS zip-code-level data compiled by the Brookings Metropolitan Policy Program. Numbers helped by the Ryan plan may be slightly smaller than listed for some groups because the Ryan proposal does not extend eligibility to workers age 65 and 66, as the Obama plan does. Figures on number of recipients and dollars from IRS. National antipoverty impact of EITC/CTC from CBPP analysis of March 2015 CPS and Supplemental Poverty Measure (SPM) public use files for 2014; state estimates from “Fighting Poverty at Tax Time through the EITC,” http://brook.gs/1392sJG.