The tax framework that President Trump and congressional Republican leaders announced in September proposes to repeal the estate tax — a tax on property (cash, real estate, stock, or other assets) transferred from deceased persons to their heirs. The federal estate tax is due only on the portion of an estate’s value that exceeds roughly $5.5 million per person ($11 million per couple). As a result, only the wealthiest 0.2 percent of estates pay the tax, and typically at fairly moderate rates. Repeal would give these estates windfall tax cuts averaging more than $3 million apiece, benefitting wealthy heirs. But it would do virtually nothing for small farms and businesses, despite the claims of repeal supporters. Repeal would also cost $239 billion over ten years and worsen wealth inequality.[1]

The estate tax is a tax on very large inheritances received by a small group of wealthy heirs. As New York University School of Law professor Lily L. Batchelder explains, “it would be more accurate to call wealth transfer taxes [such as the estate tax] ‘silver spoon’ taxes, not ‘death’ taxes as their opponents prefer.” In 2017:

- Only the heirs of the wealthiest 2 out of every 1,000 estates will face any estate tax.

- This is because the first $5.49 million of wealth transfers per person ($10.98 million per couple) are exempt and passed on tax-free — more than what middle-income Americans, who pay taxes on their weekly paychecks, typically earn in a lifetime.

- Taxable estates pay less than 17 percent of their value in tax, on average — well below the top marginal rate of 40 percent — due to the high exemption amount as well as deductions and loopholes.

- Repeal would provide the top 0.2 percent of estates with tax-cut windfalls averaging more than $3 million apiece. About 330 estates worth more than $50 million would get tax cuts averaging more than $20 million apiece.

Few Small Farms and Businesses Would Benefit From Repeal

Contrary to repeal proponents’ rhetoric, the estate tax affects very few small farms and businesses and is not a heavy burden for them:

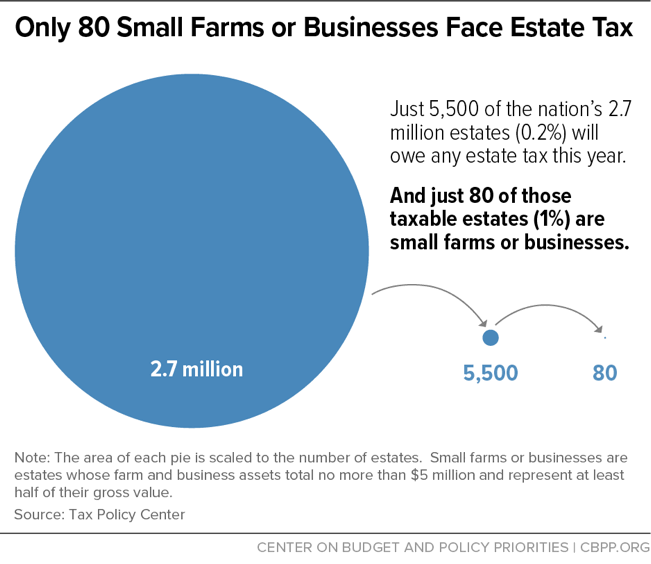

- Only 80 small farm or business estates nationwide will face the tax in 2017 (see chart).

- These few estates will owe less than 6 percent of their value in tax, on average.

- Most of them will have sufficient liquid assets to pay the tax without having to touch the farm or business.

- Special provisions aimed at small farms and businesses allow them to spread payments over 15 years at low interest rates.

- As the New York Times reported in 2001, when the estate tax applied to far more estates than it does today: “Even one of the leading advocates for repeal of estate taxes, the American Farm Bureau Federation, said it could not cite a single example of a farm lost because of estate taxes.”

A large body of research finds that the estate tax doesn’t significantly affect the decisions of wealthy people who bequeath huge amounts over how much to work and save. Thus, it likely has little or no effect on overall private saving. But the estate tax has a positive impact on overall national (private plus public) saving because of the revenues it raises.

Research also finds that the estate tax encourages heirs receiving massive inheritances to work and save by reducing the inheritance they can live off. Treasury Department analyst David Joulfaian estimates that “an inheritance of $1 million, other things equal, reduces labor force participation by about 11 percent.” Repeal would reduce work incentives for heirs.

- A large portion of taxable estates — including more than half of those worth over $100 million — consists of gains in the value of assets (such as stock or real estate) that have not been taxed before.

- Capital gains tax on the appreciation of assets is due only when the owner “realizes” the gain, usually by selling the asset. But if a person holds an asset that grows in value until his or her death, that “unrealized” capital gain is forgiven and doesn’t face any capital gains tax — known as the “trust fund loophole.”

- Heirs pay no income taxes on their inheritances, so the only tax that unrealized gains face now is the estate tax. Repeal would mean that much of the wealth that heirs inherit from large estates would never be taxed.

Repeal Would Increase Deficits and Inequality

- Because it affects only those who are most able to pay, the estate tax is the most progressive part of the tax code.

- Repeal would cost $269 billion over ten years, widening deficits and adding to pressure to cut federal programs — which, in turn, could impose sacrifices on less-fortunate Americans to pay for tax cuts for wealthy heirs.

- Inheritances account for about 40 percent of all household wealth and are extremely concentrated at the top. This contributes to inequality and hinders upward mobility from one generation to the next. Repealing the estate tax would eliminate the nation’s most effective tax policy tool to mitigate the negative effects of large inheritances.