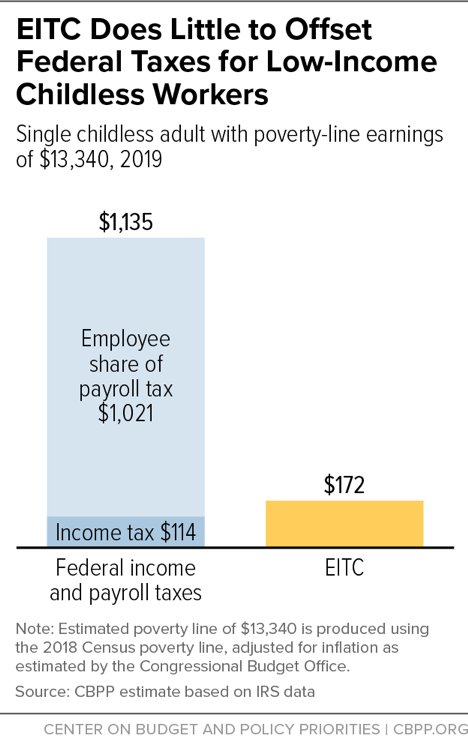

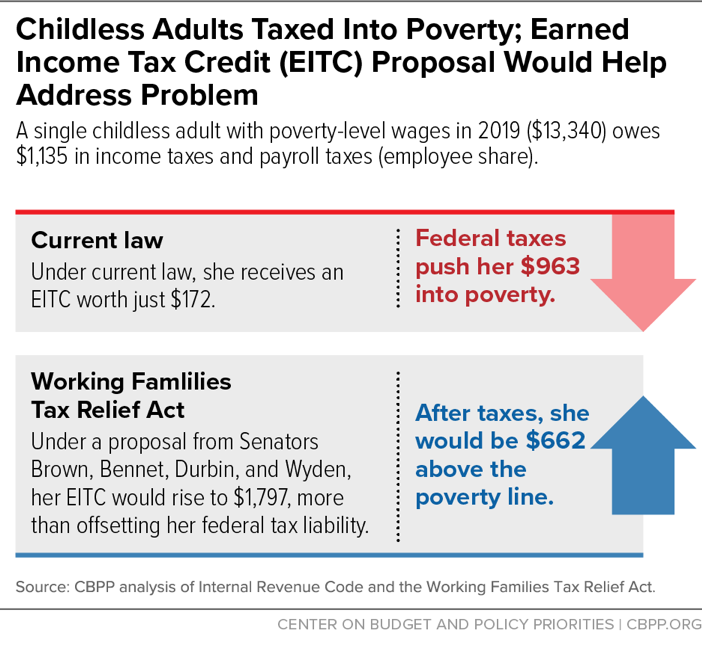

Childless Adults Are Lone Group Taxed Into Poverty

EITC Expansion Could Address Problem

End Notes

[1] “Childless adults” refers to workers, including non-custodial parents who are not raising minor children in their home and not claiming dependents for purposes of the EITC.

[2] For analysis of the proposal, see Chuck Marr et al., “Working Families Tax Relief Act Would Raise Incomes of 46 Million Households, Reduce Child Poverty,” Center on Budget and Policy Priorities, April 10, 2019, https://www.cbpp.org/research/federal-tax/working-families-tax-relief-act-would-raise-incomes-of-46-million-households.

[3] Some 60,000 workers aged 19-67 who aren’t full-time students would still be taxed into, or deeper into, poverty. Many of them are people who would remain ineligible for the EITC because they do not meet the EITC’s net investment test — filers with investment income of more than $3,500 are ineligible for the EITC.

Approximately 200,000 people under age 19 or over age 67 are taxed into, or deeper into, poverty, a number that wouldn’t be affected by the bill. Under the bill, people under 19 would remain ineligible to claim the childless workers’ EITC because children through age 18 can be claimed by their parents for the much larger EITC for families with children. Also, in creating the childless workers’ EITC in 1993, Congress made people age 65 and over (then Social Security’s “normal retirement age,” which now is rising to 67) ineligible for the childless workers’ EITC because such individuals often have Social Security income that isn’t counted as adjusted gross income (AGI), and hence they may be less needy than their AGI may imply. Roughly 550,000 full-time students between the ages of 19 and 24 also would not be affected; as noted, their parents can claim many of them for the larger EITC for families with children.

[4] CBPP analysis of the March 2018 Current Population Survey. The estimate includes all workers aged 19-67 who: 1) do not have a qualifying child for the EITC; 2) are not a tax dependent themselves; 3) are full-time students between the ages of 19 and 24; and 4) owe federal income tax plus the employee share of the payroll tax that push them below the poverty line, or they already are poor (based on their cash income before income and payroll taxes) and are pushed further into poverty by those taxes. It includes workers who are (or whose spouses are) aged 19-67. The calculation starts with the combined cash income of a worker and his or her spouse, which includes pre-tax market income as well as government cash benefits (including, for example, Social Security retirement and disability benefits and Supplemental Security Income), and then considers the effect of subtracting (or not subtracting) federal income taxes and the employee share of payroll taxes. (Note that these estimates do not include housing assistance and SNAP, formerly known as food stamps. Adding a per capita share of housing assistance and SNAP benefits for workers or spouses who receive these benefits does not materially affect the estimate.) Poverty status is determined at the level of the tax filing unit (the tax filer, their spouse, and any dependents, as identified in our tax model), and uses the 2017 Census official poverty threshold appropriate for the tax unit based on number and age of the tax unit members.

[5] Twenty-nine states and the District of Columbia have state EITCs.