Ten Serious Flaws in the House and Senate Budget Plans

End Notes

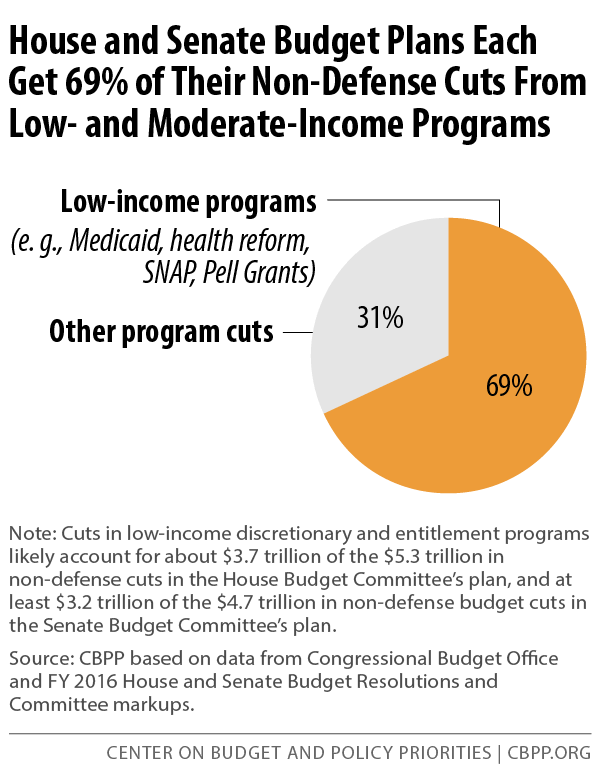

[1] Richard Kogan and Isaac Shapiro, “Congressional Budget Plans Get Two-Thirds of Cuts From Programs for People With Low or Moderate Incomes,” Center on Budget and Policy Priorities, March 23, 2015, https://www.cbpp.org/cms/index.cfm?fa=view&id=5289.

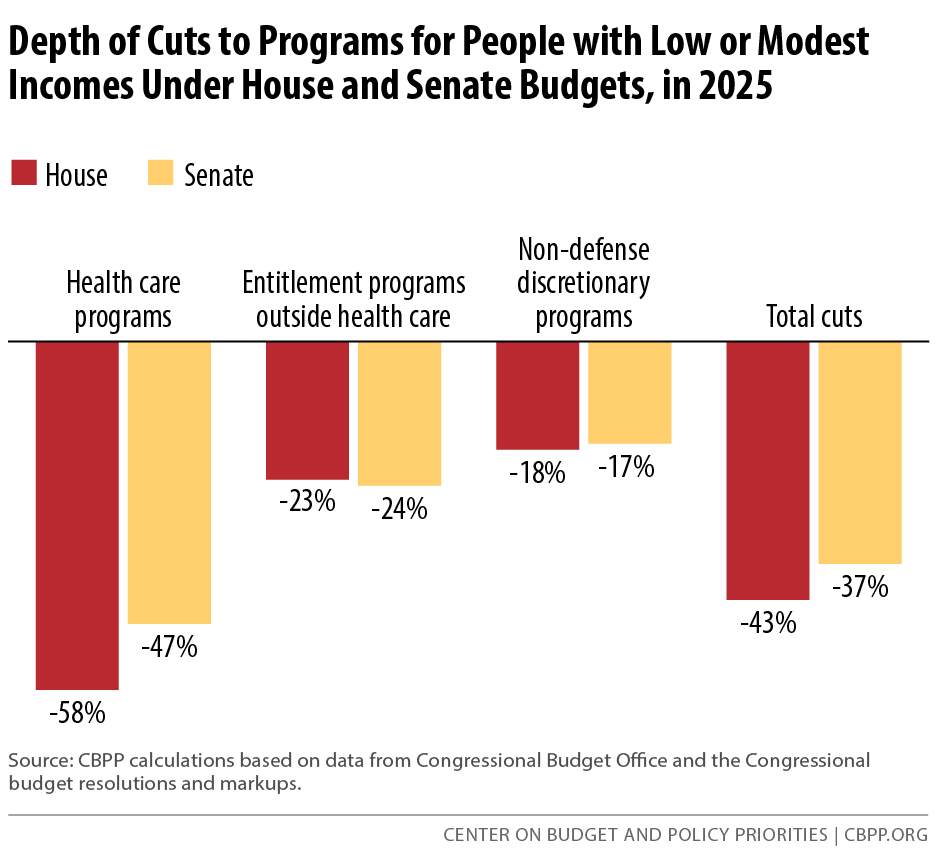

[2] Isaac Shapiro, “Congressional Budgets Would Ultimately Cut Programs for Low- or Moderate-Income People by About 40 Percent,” Off the Charts blog, March 24, 2015, http://www.offthechartsblog.org/congressional-budgets-would-ultimately-cut-programs-for-low-or-moderate-income-people-by-about-40-percent/.

[3] Bryann DaSilva, “Congressional Budget Plans Hurt Low-Income Working Families,” Off the Charts blog, March 19, 2015, http://www.offthechartsblog.org/congressional-budget-plans-hurt-low-income-working-families/.

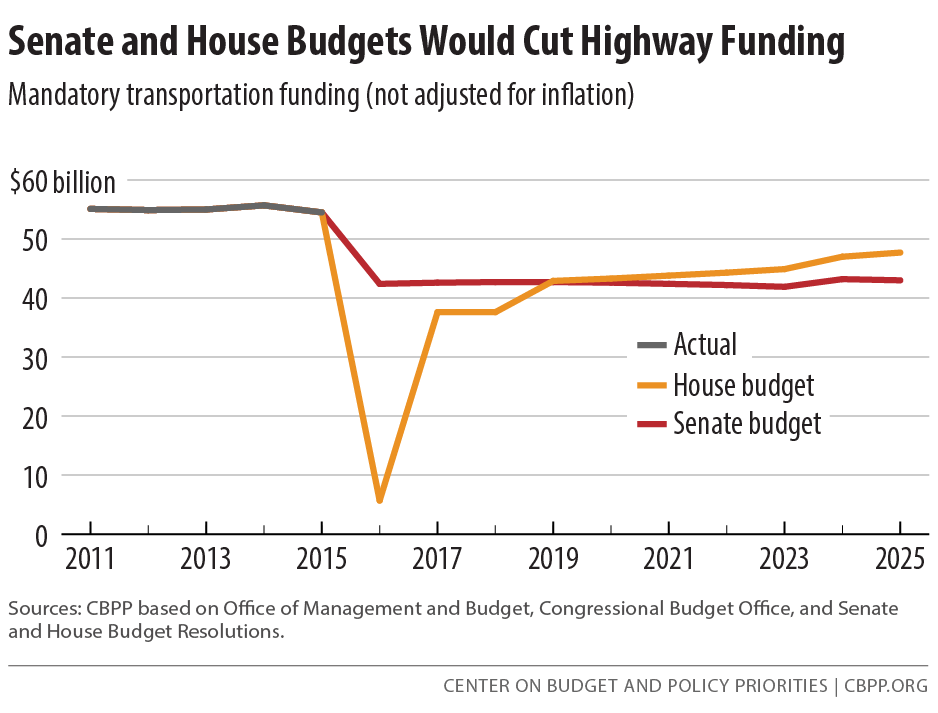

[4] David Reich, “House, Senate Budgets Have Big Cuts in Transportation Infrastructure,” Off the Charts blog, March 27, 2015, http://www.offthechartsblog.org/house-senate-budgets-have-big-cuts-in-transportation-infrastructure/.

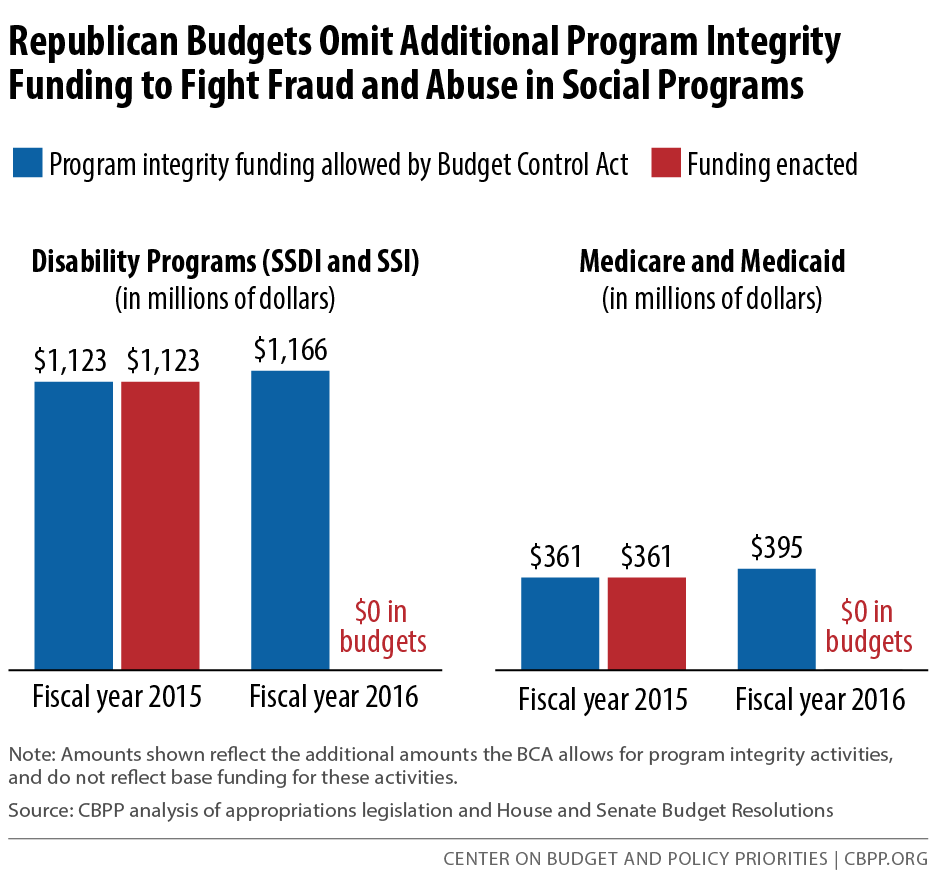

[5] Robert Greenstein, “Despite Anti-Fraud Rhetoric, Republican Budgets Omit Funding to Combat Fraud and Abuse,” Off the Charts blog, March 25, 2015, http://www.offthechartsblog.org/despite-anti-fraud-rhetoric-republican-budgets-omit-funding-to-combat-fraud-and-abuse/. The House budget expresses support for program integrity activities but states that they must be funded within the caps — meaning that fully funding them would require even deeper cuts in other NDD programs, which already must adhere to the austere sequestration levels in 2016. And after 2016, the House budget cuts NDD programs below the sequestration levels, leaving even less room for program integrity funding.

[6] U.S. Department of Justice and U.S. Department of Health and Human Services, Annual Report of the Departments of Health and Human Services and Justice: Health Care Fraud and Abuse Control Program FY 2014, March 19, 2015, http://oig.hhs.gov/publications/docs/hcfac/FY2014-hcfac.pdf.

[7] Robert Greenstein and Joel Friedman, “Balancing the Budget in Ten Years and No New Revenue Are Flawed Budget Goals,” Center on Budget and Policy Priorities, March 13, 2015, https://www.cbpp.org/cms/index.cfm?fa=view&id=5282.