Greenstein: House Budget Would Mean More Poverty, Inequality, and Hardship

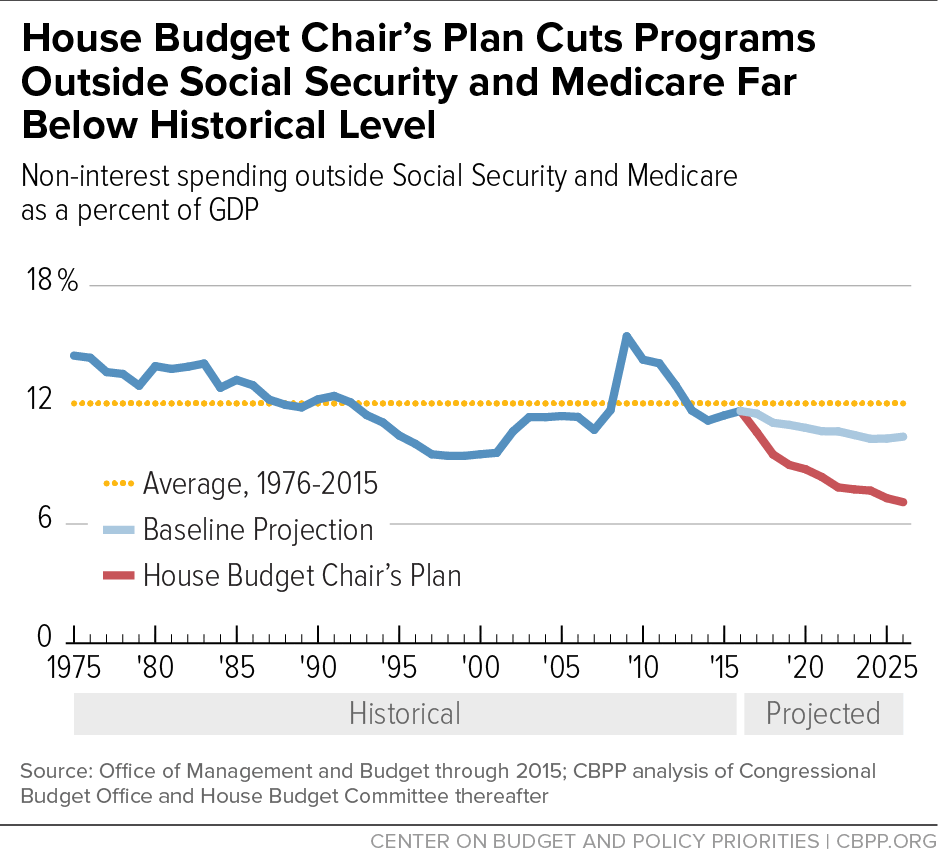

In an apparent attempt to appeal to archconservative members, the House Republican budget is a highly ideological document that proposes extreme policies in several areas. It would decimate large swaths of the federal government, shrinking spending outside Social Security, Medicare, and interest payments to 7 percent of GDP by 2026 — less than three-fifths of its average of the past 40 years (see chart) and only a little more than half its average level under President Reagan. It features particularly severe cuts in programs to help poor families and others of limited means.

- A strong ideological streak: The budget’s ideological nature shows in numerous places. It would repeal health reform (i.e., the Affordable Care Act, or ACA), undo much of the Dodd-Frank law (including its Consumer Financial Protection Bureau), and frustrate efforts to address climate change. On the latter, it attacks EPA rules to reduce global warming, cuts the EPA budget, eliminates Amtrak operating funding (which would likely mean more driving), and cuts mass transit funds — all while providing more tax incentives for oil and gas exploration.

- Poor Americans hit exceptionally hard: Despite House Speaker Paul Ryan’s statements in recent months that House Republicans want to focus on and reduce poverty, the budget calls for what would be the most severe budget cuts in modern history in assistance for Americans of limited means. (For more, see “Will the House Budget Reflect Speaker Ryan’s Statements to Spend the Same Amount in Fighting Poverty?”) These programs would be cut a stunning $3.5 trillion over ten years, eliminating, by 2026, roughly 40 percent of federal resources for low-income assistance. Although low-income programs account for 28 percent of federal domestic-program spending (i.e., spending on everything except defense and interest payments on the debt), they would bear about 60 percent of the cuts in the House budget.

- Adding millions to the ranks of the uninsured: The budget would make tens of millions more Americans uninsured by repealing the ACA (without putting anything in its place) and cutting Medicaid more than another $1 trillion over ten years on top of that. The ACA has reduced the number of uninsured people by about 20 million; the budget would reverse those gains, and its deep additional Medicaid cuts would intensify the damage. (For more, see “Medicaid Block Grant Would Add Millions to Uninsured and Underinsured.”)

-

Eviscerating non-defense discretionary programs: Also hit hard would be non-defense discretionary programs, which include everything outside defense, entitlement programs, and interest payments. The budget would cut non-defense discretionary programs and services by roughly $1 trillion over ten years below the levels under the harsh sequestration budget cuts. Yet under sequestration, spending for this part of the budget is already slated to shrink to the lowest level on record by 2018, as a percent of GDP, with data back to 1962.

The document that House Budget Committee Chairman Tom Price released today defending the budget highlights the importance of education and job training and of the problems posed by student debt. The budget’s strikingly low levels for non-defense discretionary programs, however, would make substantial cuts in education, job training, Pell Grants, and other such programs virtually inevitable. In fact, the budget figures that Chairman Price released today for “Function 500” of the federal budget — the part of the budget that includes virtually all education and job training spending — show 10-year cuts totaling about $250 billion.

Not surprisingly, the budget charts a different course on defense and taxes. It boosts the former. On the latter, it eliminates the Alternative Minimum Tax — intended to ensure that high-income people pay at least some minimum level of taxes — calls for lowering income tax rates, and proposes a corporate tax system under which all profits that U.S. corporations show on their books as coming from abroad, including offshore tax havens, are largely or entirely exempt from U.S. taxes. It speaks of closing some tax breaks but doesn’t identify any specific tax breaks to curb.

Little if any of this budget will become law this year. But the budget outlines a path down which many House members would take the country. If the policies in this budget were to become law in the years ahead, our nation would almost certainly become more mean-spirited and divided, with more poverty, inequality, and severe hardship and less opportunity. This budget is the latest evidence of the decline of responsible policymaking in our political system.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.