- Home

- Family Income Support

- LaDonna Pavetti Testifies Before The Hou...

LaDonna Pavetti Testifies Before the House Ways and Means Committee, Subcommittee on Human Resources

Thank you for the invitation to testify today. I am LaDonna Pavetti, Vice President for Family Income Support at the Center on Budget and Policy Priorities, a policy institute located here in Washington. I conducted some of the very first studies on the implementation of welfare reform and now spend most of my time working with state administrators and local and state non-profit organizations to improve the program.

My testimony today will cover three topics. First, I will provide five key facts that demonstrate how little TANF does to help families find work and escape poverty. Then, I will suggest policy changes to improve TANF’s ability to reach families in need and improve their employment prospects. I will conclude with evidence of the safety net’s important role in supporting and encouraging work.

Five Key Facts about TANF Programs

We have observed over the last 18 years how TANF performed in both good and bad times. The labor market was extraordinarily strong in TANF’s early years, while in more recent years it has been one of the worst on record. When assessing TANF’s accomplishments, it is important to consider how it has performed over the full period. Proponents use data from TANF’s early years (through 2000) to tout TANF as a resounding success, but that view ignores what has happened during the last 14 years.

To be sure, TANF’s early years were marked by unprecedented declines in the number of families receiving cash assistance — and unprecedented increases in the share of single mothers working, especially those with a high school education or less. But since then, TANF’s record has been dismal. TANF provides basic assistance to few families in need and responded only modestly to the significant increase in unemployment nationally during and after the Great Recession — and not at all in a number of states, including some of those hardest hit.

Taking into account the full 18 years of TANF’s history, here are five key facts that I would encourage the Committee to keep in mind in considering how to improve TANF programs to help more families find work and escape poverty:

- TANF provides cash assistance to very few needy families.

- TANF lifts far fewer children out of deep poverty (incomes below half of the poverty line) than its predecessor, Aid to Families with Dependent Children (AFDC), did.

- States spend little of their TANF funds to help improve recipients’ employability.

- Most of the early employment gains among never-married single mothers after TANF’s creation have been lost.

- The success of “work first” programs, which emphasize getting participants into the labor market quickly, is vastly overstated. Although employment increased, the vast majority of were not stably employed.

Below, I provide more detail on each of these key facts.

Fact #1: TANF Provides Cash Assistance to Very Few Needy Families

Over the last 18 years, the national TANF average monthly caseload has fallen by almost two-thirds — from 4.7 million families in 1996 to 1.7 million families in 2013 — even as poverty and deep poverty have worsened. The number of families with children in poverty hit a low of 5.2 million in 2000, but has since increased to more than 7 million. Similarly, the number of families with children in deep poverty hit a low of about 2 million in 2000, but is now above 3 million.

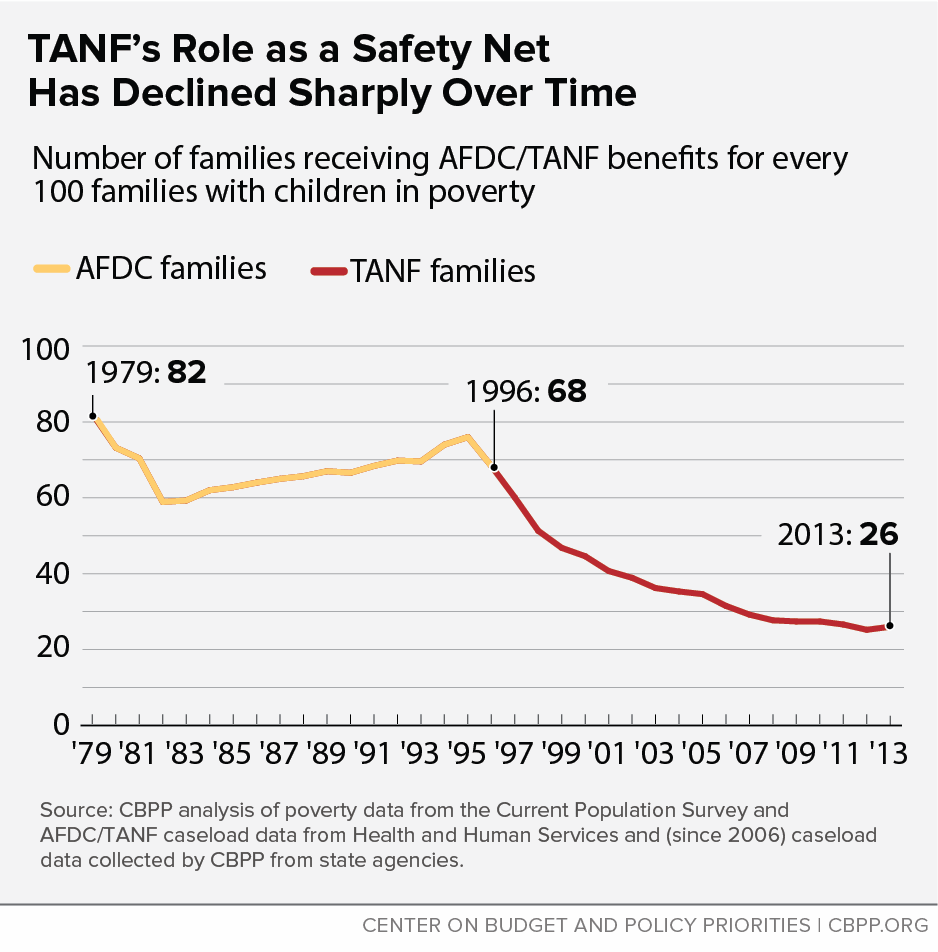

These opposing trends — TANF caseloads going down while poverty is going up — mean that TANF reaches a much smaller share of poor families than AFDC did. When TANF was enacted, nationally, 68 families received assistance for every 100 families in poverty; that number has since fallen to just 26 families receiving assistance for every 100 families in poverty. (See Figure 1.) And, in a number of states, TANF provides cash assistance to a much smaller share of poor families than the national data suggest. In ten states, fewer than 10 families receive cash assistance for every 100 families in poverty.

Fact #2: TANF Lifts Many Fewer Children out of Deep Poverty Than AFDC Did

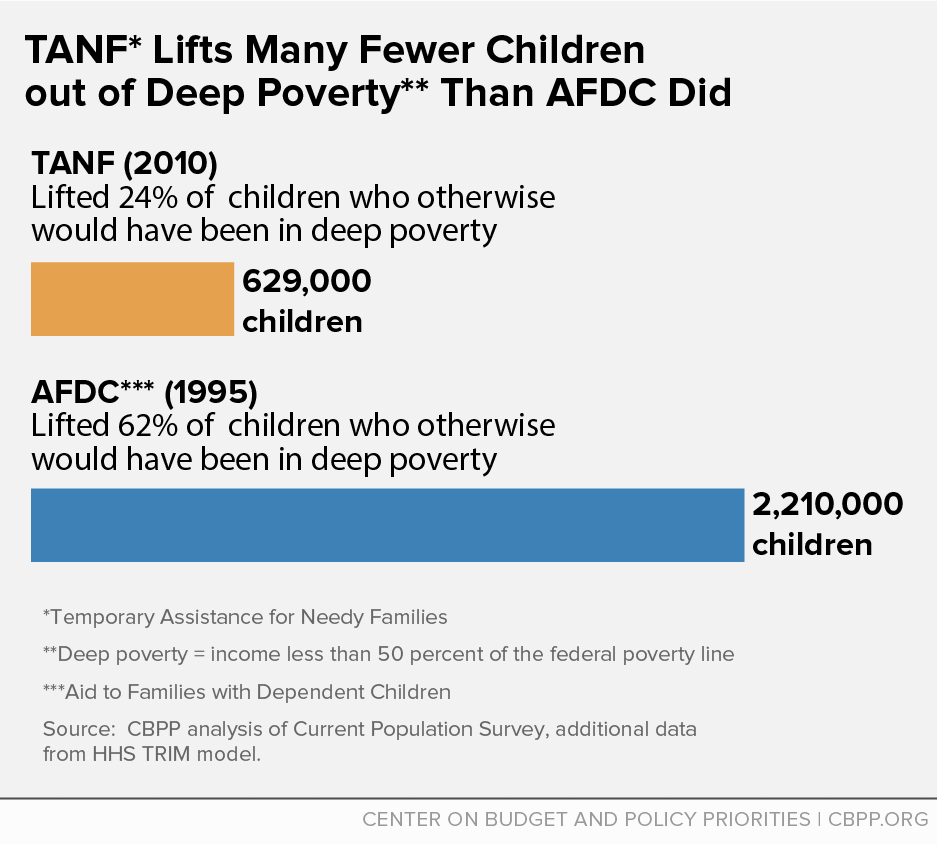

The share of children living in deep poverty has increased since welfare reform was implemented, and research suggests that the loss of TANF benefits contributed to that growth. TANF benefits are too low to lift many families out of poverty, but they can reduce the depth of poverty. Unfortunately, TANF has proven far less effective at lifting families out of deep poverty than AFDC, mostly because fewer families receive TANF than received AFDC. (The erosion in the value of TANF benefits also contributed.) While AFDC lifted more than 2 million children out of deep poverty in 1995, TANF lifted only 629,000 children out of deep poverty in 2010. (See Figure 2.)

Researchers Luke Shaefer and Kathryn Edin have found that the number of households with children with monthly cash incomes equivalent to less than $2 per person per day, a standard of poverty more associated with third-world countries, has more than doubled since 1996.[1] Counting the value of tax credits and non-cash benefits — housing assistance, tax credits, and SNAP (formerly food stamps) — lowers these numbers considerably, but the growth in extremely poor households with children remains troubling: a 50 percent increase, to 613,000 families in 2011. This measure of extreme poverty rose “particularly among those most impacted by the 1996 welfare reform,” Shaefer and Edin found.

Fact #3: States Spend Little of Their TANF Funds to Help Improve Recipients’ Employability

One of the key reasons for block granting TANF was to give states greater flexibility to help cash assistance recipients find and maintain work so they would no longer need assistance. The idea was that if states had more flexibility, they could use the funds previously used for cash grants to help recipients find jobs and to cover the costs of work supports like child care and transportation. While states modestly increased spending in these areas in TANF’s early years, however, they have not sustained the increases.

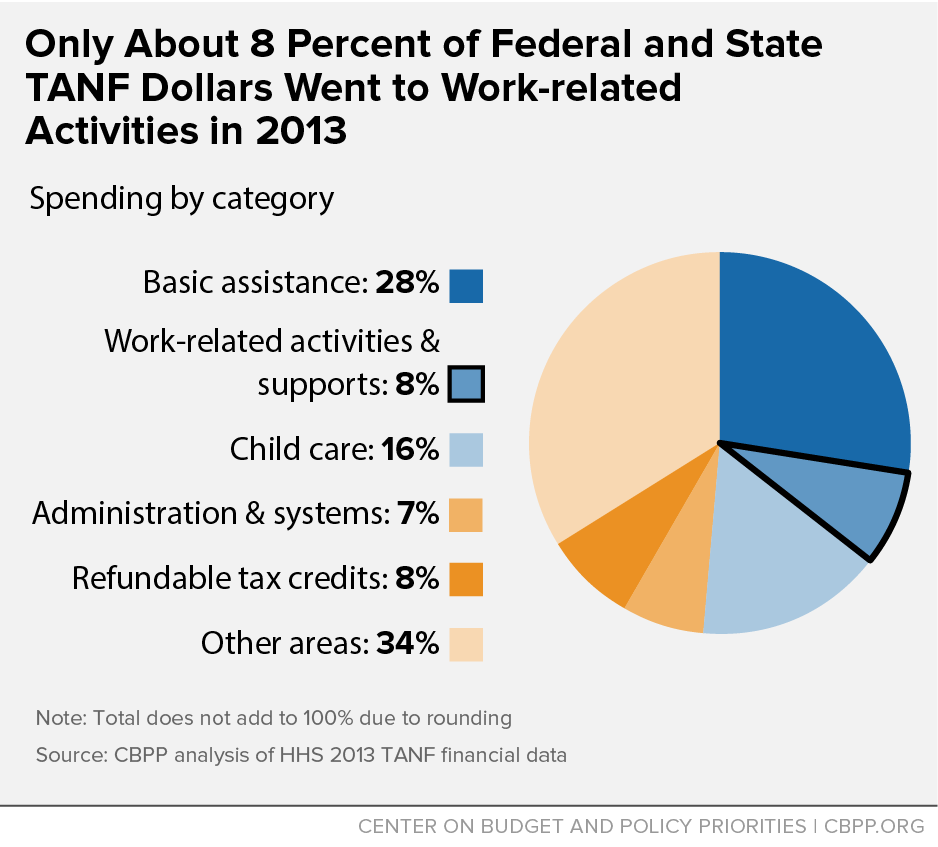

Overall, states spent only 8 percent of their state and federal TANF funds on work activities in 2013 (see Figure 3), with 14 states spending less than 5 percent. States spent 16 percent of these funds on child care, with 13 states spending less than 5 percent. States spent about a third of their TANF funds on other services such as child welfare, early education, afterschool programs, and pregnancy prevention programs. States are required to document how they spend their state and federal TANF funds, but there are no performance standards to measure whether those investments have resulted in improved outcomes for children or families.

Fact #4: Most of TANF’s Early Employment Gains Have Since Been Lost

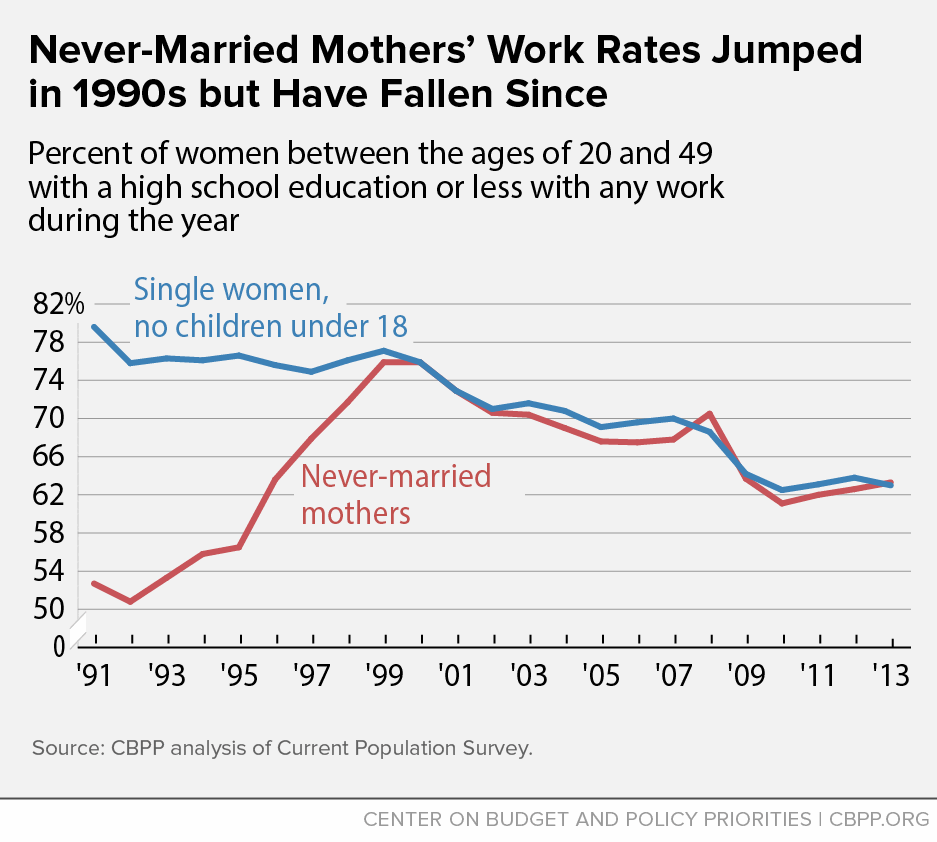

The employment situation for never-married mothers with a high school education or less — the group of mothers most affected by welfare reform — has changed dramatically over the last several decades. In the early 1990s, when states first made major changes to their cash welfare programs, only about half of these mothers worked — a much lower share than among single women without children who had similar levels of education. This large employment gap suggested that there was substantial room for these never-married mothers to increase their participation in the labor force.

By 2000, the employment gap between these two groups of women closed, and it has not reopened. But in the years since, the employment rate for both groups has fallen considerably. (See Figure 4.) The employment rate for never-married mothers is now about the same as when welfare reform was enacted 18 years ago. This suggests that limited employment among never-married mothers reflects the economy and low education levels, not the availability of public benefits or anything particular to never-married mothers.

The increase in labor force participation among never-married and other single mothers that occurred in the 1990s is often cited as a major accomplishment of welfare reform. Rigorous research suggests, however, that a strong labor market and the expansion of the Earned Income Tax Credit (EITC) played an even greater role. A highly regarded study by University of Chicago economist Jeffrey Grogger found that welfare reform accounted for just 13 percent of the total rise in employment among single mothers in the 1990s.[2] The EITC (which policymakers expanded in 1990 and 1993) and the economy accounted for 34 percent and 21 percent of the increase, respectively. Grogger also finds that welfare benefit levels accounted for an additional 7 percent of the increase, but this variable captures state-level variation in benefit levels that is unrelated to welfare reform.

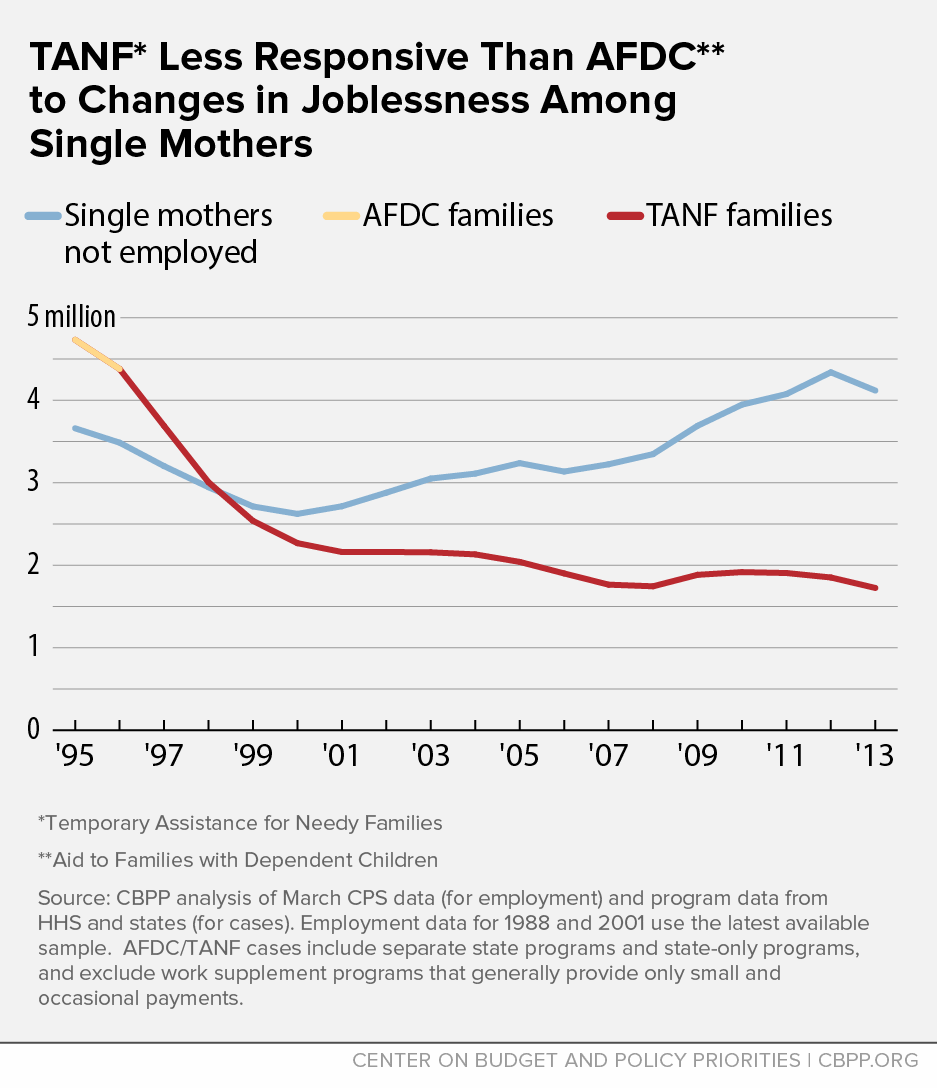

The growing gap between the number of single parents who are not working and the number of families receiving TANF also shows TANF’s limited reach to families in need. In 1995, the number of families receiving cash assistance in an average month exceeded the number of single mothers who were not employed over the course of the year. By 2013, the number of unemployed single mothers was more than 2.4 times the number of families receiving TANF in an average month. This gap was considerable even before the recession, but it grew substantially during the years of, and just after, the recession. (See Figure 5.)

Fact #5: The Success of “Work First” Programs Is Vastly Overstated

While there is evidence from several rigorous randomized control trials that “work first” programs significantly increased employment among welfare recipients, those studies are decades old, and what the programs did and did not accomplish is not well understood. In addition, today’s labor market is very different than the booming labor market of the 1990s.

Rigorous evaluations of work first programs in Portland, Oregon and two locations in California (Los Angeles and Riverside), conducted prior to welfare reform and in its early years, found that individuals randomly assigned to the programs were significantly more likely to be employed than those not assigned to participate.[3] However, the majority of the program participants were not stably employed, defined as having earnings in four consecutive quarters. For example, in the Portland program, just 38 percent of participants were stably employed; the comparable percentages for the Riverside and Los Angeles programs were 26 and 27 percent, respectively.

The context in which TANF employment programs operate today suggests the need to move beyond work first. Unemployment is high and the employment prospects for less-educated individuals are more limited than in the 1990s. By 2020, 65 percent of all jobs will require postsecondary education and training beyond high school, with 35 percent requiring a bachelor’s degree and 30 percent requiring some college or an associate’s degree, a study by the Georgetown Center on Education and the Workforce estimates. At the current rate, the United States will have 5 million fewer workers with these education levels than the economy will need, according to the study.[4]

Research shows that additional education or training can yield substantial earnings gains – which means that participants with more education or training will need less government assistance to meet their basic needs. Some recent studies find that one additional year of schooling can leads to earnings gains averaging 10 to 15 percent per year.[5] Shorter-term post-secondary training, e.g., certificate programs that require less than two years of training, also has been shown to have valuable returns. Recently, professional certification or license holders earned more than those without these credentials at each level of education below a bachelor’s degree.[6] Post-secondary training programs that result in credentials related to technology, licensure, and in-demand occupations have shown particularly positive outcomes.[7]

In addition, several recent randomized control trials suggest that alternative approaches may produce substantially better outcomes than the early work first programs. For example, Building Nebraska Families, a home visiting program that focused on working with participants to set goals and build life skills (such as time and financial management skills), produced substantially larger impacts on stable employment than the most successful work first programs. The program boosted stable employment (defined as remaining employed for 12 consecutive months) by almost 17 percentage points, to 46 percent.[8] Recent rigorous evaluations suggest that training programs also can produce significant earnings increases, although there is sometimes a short lag before program participants reap the benefits of training.

For example, a randomized control trial of a 15-week computer repair training program showed a 32 percent ($4,700) increase in earnings in the second year of the study. A comparable study of a program that worked with employers to train individuals for construction, health care, and (to a lesser extent) manufacturing jobs led to a 27 percent ($6,300) increase in earnings in the second year.[9] A recent study of a year-long program for young adults that included classroom training and a paid internship increased earnings in the second year by 30 percent ($3,500).[10]

Recognizing the changing labor market and the payoffs from additional education and training, last year Congress passed the Workforce Innovation and Opportunity Act (WIOA) on a bipartisan basis to retool the nation’s workforce system. The legislation shifted the focus of the workforce system to building a skilled labor force and addressing barriers that keep people from finding or maintain employment. TANF’s work programs should also be retooled with those same goals in mind.

Creating TANF Work Programs that Improve Employment Outcomes and Promote Opportunity

The complexity and rigidity of TANF’s work requirements has caused states to design their TANF work programs in ways that compromise, rather than promote, the goal of connecting parents to work. Since the work participation rate is the primary measure by which states’ TANF programs are judged, states have designed their programs to maximize their success in meeting the work rate, often at the expense of actually helping the individuals with the largest employment barriers overcome those barriers and find jobs. Yet these are the individuals who have the most to gain from more extensive employment assistance.

Moreover, monitoring TANF recipients’ work participation is burdensome and costly for states. States are required to track and document every hour of every recipient’s participation. This means that states devote significant staff time to tracking hours rather than providing direct service to individuals that could improve their prospects for securing employment or make them more job-ready.

State TANF programs are built around an expectation of work, and many states argue that they could operate more effective work programs if they had more flexibility. Congress has several options to make TANF work programs more effective. The goal should be to bring TANF’s focus to work, not just work rates (or, as one state put it, to move “from participation that counts to engagement that matters”). Those options include:

- Require greater investments in work activities. One way to strengthen TANF work programs is to require states to spend a specified share of their TANF resources on activities designed to prepare recipients for work. In addition, states that do not meet applicable performance measures should be required to invest additional funds in work-related activities. The current penalty structure withdraws federal funds from state TANF programs, further shrinking state resources to meet families’ employment needs. Rather than pay a fiscal penalty, a state that fails to meet performance measures should be required to increase the share of its state and federal TANF spending that goes to work-related activities for families receiving assistance.

- Establish a demonstration project that encourages states to experiment with new approaches to increasing employment among TANF recipients. Some states are eager to redesign their TANF employment programs to make them more effective but are concerned about the potential impact on the TANF work participation rate. Building on the bipartisan demonstration project Congress created to encourage states to experiment with alternative approaches to improve the work outcomes of SNAP recipients, Congress could establish a demonstration project to encourage a new round of innovation in TANF work programs. To encourage increased investments in work, in order to participate they could be required to spend an increased share of their TANF funds on activities that are designed to prepare recipients for work. Participating states also would have to agree to participate in a rigorous evaluation and measure employment outcomes for all recipients. The purpose of the demonstration project would be to encourage states to adopt evidence-based practices and to produce new evidence of what works best and for whom.

- Redesign the TANF Contingency Fund to focus on subsidized employment and training. The Contingency Fund was created to provide states with additional resources during hard economic times. The recent recession exposed flaws in the design of the fund, which is unnecessarily complicated and poorly targeted to achieve its purpose. The fund could be redesigned to provide additional resources to states that want to improve their work programs. In keeping with its original purpose to help states during hard economic times, we suggest redesigning the fund to encourage states to operate subsidized employment programs for recipients who have been unable to find jobs. A portion of the fund could also be set aside to train TANF recipients for high-demand occupations or to support the development of two-generation approaches aiming to improve outcomes for parents and children simultaneously.

- Integrate TANF work programs into the broader workforce system. In many states, TANF work programs operate entirely separately from the broader workforce system. When Congress replaced the Workforce Investment Act (WIA) with WIOA, it created a framework to promote greater coordination and collaboration among several agencies that provide similar services. To encourage greater coordination among the WIOA and TANF systems, Congress could: (1) deem participation in a WIOA-funded project as meeting an individual’s TANF work requirement and (2) allow TANF agencies that become full partners in the One Stop Career Centers to measure their performance using the WIOA performance measures instead of the TANF work participation rate. Meeting the TANF work participation rate imposes an extra burden (and hence extra costs) on workforce programs, discouraging agency collaboration and making workforce programs reluctant to serve TANF recipients.

- Focus states’ incentives on improving actual employment placements. Under the current work rate and caseload reduction credit, a state gets no more recognition for preparing and placing a recipient in employment than it does for simply excluding a family from its caseload and giving it no employment help at all. States should receive credit for successful employment outcomes, not for failing to serve needy families and children. Possible steps include: (1) eliminating the caseload reduction credit or limiting how many percentage points of credit a state can use to reduce its work rate; (2) providing an employment credit in lieu of the caseload reduction credit; or (3) allowing a state to count persons who have left TANF for employment toward the work rate for a period of time.

- Simplify the work requirements and reduce paperwork burdens. Part of the tremendous amount of staff time that states spend tracking what activities can count toward the work rate and how many weeks or months of participation individuals have already used — as well as verifying every hour of participation in each activity — could better be spent focused on improving actual employment outcomes. Simplification efforts could include: (1) streamlining countable activities by easing complex limits on when certain activities can count, including limits on job search/job readiness and the distinction between core and non-core activities; and (2) allowing participation in more education activities to count based on documentation of enrollment and satisfactory progress.

- Redesign the work measures to support engagement of all recipients in activities that will prepare them for work, including job readiness and education and training activities. A work measure that recognizes state efforts to address the full range of work-preparation needs of the TANF caseload would give states credit for a broader array of activities and for various levels of engagement. Within the context of the current work requirements, changes that would further this goal include: (1) allowing a wider range of activities, including those addressing serious barriers to employment, to count (separate from the job search/job readiness category, which has severe restrictions); (2) lifting certain limits on when particular activities, like vocational education or job search, can count; (3) easing restrictions that make participation in education programs difficult; and (4) allowing partial credit for recipients who are engaged in activities for less than the required 20 or 30 hours per week.

The Importance of Maintaining a System of Work Supports

TANF is part of the larger safety net that plays a critical role in supporting families when they go to work. Those supports need to remain available to working families to help them make ends meet. Extensive research finds that the EITC is particularly effective at increasing work effort among single mothers.[11] It is widely considered one of the most effective policies for increasing the work and earnings of female-headed families and has been a key factor behind the large increases in work among single mothers since the early 1990s. Moreover, one study shows that raising low-income families’ incomes produces significant benefits for the next generation — receipt of an additional $3,000 when children are young results in an addition 135 hours per work per year when they become adults.[12]

Major improvements in the EITC and Child Tax Credit were enacted in 2009 and extended at the end of 2010 and 2012 but are scheduled to expire after 2017. These improvements lift 16 million people, including nearly 8 million children, out of poverty or closer to the poverty line each year, CBPP analysis of Census data shows.[13] Thus, if they expire after 2017, some 16 million people will be pushed into or deeper into poverty — and we will lose the benefits that accrue to the next generation.

A recent landmark study of the impact of food stamp benefits on children provides further evidence of long-term impacts of income support and similar assistance. The researchers, led by economist Hilary Hoynes of the University of California at Berkeley, used the gradual roll-out of the Food Stamp Program in the early 1970s to compare poor children who had access to food stamps in the early 1970s with comparable poor children from counties that hadn’t yet instituted the program. They examined records of these children for the subsequent decades and found that access to food stamps in early childhood (and the prenatal year) was associated with an 18 percentage-point increase in high school completion rates, lower rates of metabolic syndrome (obesity, high blood pressure, heart disease, and diabetes) in adulthood, and among girls, increases in “self-sufficiency” (using an index of education, earnings, income, and decreases in welfare receipt in adulthood).[14]

These studies demonstrate that the federal government has a critical role in increasing opportunity for the poor. In contrast, our experience with TANF shows that we cannot rely solely upon states to take on this responsibility. When states’ cash assistance caseloads fell substantially in the late 1990s, states could have used some of the freed-up funds to increase recipients’ employability. Instead, they made other choices, including using TANF funds to fill budget holes and to substitute for state funds they had previously used to provide assistance to poor families. If they wanted to increase opportunity now, they could do so by using more of their TANF funds to help TANF recipients and other low-income parents gain the education and skills they need to qualify for jobs that will help them escape poverty.

Finally, in light of the growing body of research on the importance of income — and the devastating impact of poverty — on children’s early development, safety net programs other than TANF need to continue playing an extremely important role in reducing poverty and deep poverty. The evidence from TANF suggests that applying TANF-like changes (such as block granting) to other safety net programs would likely push more families into deep poverty and make some deeply poor families even poorer.

TANF reform is long overdue. We should fix its problems, not repeat its failures.

Policy Basics

Income Security

End Notes

[1] H. Luke Shaefer and Kathryn Edin, “Extreme Poverty in the United States, 1996 to 2011,” National Poverty Center Poverty Brief #28, February 2012, http://www.npc.umich.edu/publications/policy_briefs/brief28/policybrief28.pdf.

[2] Jeffrey Grogger, “The Effects of Time Limits, the EITC, and Other Policy Changes on Welfare Use, Work, and Income among Female-Head Families,” Review of Economics and Statistics, May 2003.

[3] Stephen Freedman et al., “The Los Angeles Jobs-First GAIN Evaluation: Final Report on a Work First Program in a Major Urban Center,” MDRC, June 2000, http://www.mdrc.org/sites/default/files/full_568.pdf; Gayle Hamilton et al., “How Effective Are Different Welfare-to-Work Approaches? Five-Year Adult and Child Impacts for Eleven Programs,” MDRC and Child Trends, December 2001, http://www.mdrc.org/sites/default/files/full_391.pdf.

[4] Anthony P. Carnevale, Nicole Smith, and Jeff Strohl, Recovery: Job Growth and Education Requirements through 2020, Georgetown Center on Education and the Workforce, 2013.

[5] C. Goldin and L. F. Katz, The Race between Education and Technology, The Belknap Press. Cambridge, MA, 2008.

[6] S. Ewert and R. Kominski, “Measuring Alternative Educational Credentials: 2012,” U.S. Census Bureau, 2014.

[7] H. J. Holzer and R. I. Lerman, “The Future of Middle-Skill Jobs,” Brookings Institution, 2009, http://www.brookings.edu/~/media/research/files/papers/2009/2/middle%20skill%20jobs%20holzer/02_middle_skill_jobs_holzer.pdf; L. S., Jacobson, R. J. LaLonde, Sullivan, “Estimating the Returns to Community College Schooling for Displaced Workers. Journal of Econometrics, 125(1-2), 2005, http://repec.iza.org/dp1017.pdf; C. Jepsen, K. Troske, and Paul Coomes, “The Labor-Market Returns to Community College Degrees, Diplomas, and Certificates,” University of Kentucky Center for Poverty Research Discussion Paper Number 2009-08, 2009, http://www.ukcpr.org/Publications/DP2009-08.pdf.

[8] Alicia Meckstroth et al., “Teaching Self-Sufficiency Through Home Visitation and Life Skills Education,” Trends in Family Programs and Policy, Issue Brief #3. Princeton, NJ: Mathematica Policy Research, 2009.

[9] Carol Clymer et al., “Tuning In to Local Labor Markets: Findings From the Sectoral Employment Impact Study,” Public/Private Ventures, 2010.

[10] Anne Roder and Mark Elliott, “A Promising Start: Year Up’s Initial Impacts on Low-Income Young Adults’ Careers,” Economic Mobility Corporation, 2011.

[11] Chris M. Herbst, “The labor supply effects of child care costs and wages in the presence of subsidies and the earned income tax credit,” 2009, www.chrisherbst.net/files/Download/C._Herbst_Labor_Supply_Effects.pdf.

[12] Greg Duncan and Katherine Magnuson, “The Long Reach of Early Childhood Poverty,” Pathways, 2011, https://web.stanford.edu/group/scspi/_media/pdf/pathways/winter_2011/PathwaysWinter11_ Duncan.pdf.

[13] The improvements lifted 1.8 million people above the poverty line in 2013 and made another 14.8 million poor people less poor by lifting their average family income by close to $1,000, based on the Supplemental Poverty Measure.

[14] Hilary W. Hoynes, Diane Whitmore Schanzenbach, and Douglas Almond, “Long Run Impacts of Childhood Access to the Safety Net,” NBER Working Paper 18535, 2012, www.nber.org/papers/w18535.

More from the Authors