A balanced budget amendment to the U.S. Constitution would be an unusual and economically dangerous way to address the nation’s long-term fiscal problems. It would threaten significant economic harm, as explained below. It also would raise a host of problems for the operation of Social Security and other vital federal programs. It’s striking that the House Republican leadership intends to schedule a vote on a balanced budget amendment just a few months after the President and Congress enacted a tax cut that will increase deficits by as much as $2 trillion over the next decade.[1]

The economic problems with such an amendment are the most serious. By requiring a balanced budget every year, no matter the state of the economy, such an amendment would raise serious risks of tipping weak economies into recession and making recessions longer and deeper, causing very large job losses. That’s because the amendment would force policymakers to cut federal programs, raise taxes, or both when the economy is weak or already in recession — the exact opposite of what good economic policy would advise.

When the economy slows, federal revenues decline or grow more slowly and the cost of unemployment insurance and other social programs increases, causing deficits to rise. Rather than allowing the “automatic stabilizers” of lower tax collections and higher unemployment and other benefits to cushion a weak economy, the amendment would force policymakers to cut programs, raise taxes, or both. That would launch a damaging spiral of bad economic and fiscal policy: a weaker economy would lead to higher deficits, which would force policymakers to cut programs or raise taxes more, which would further weaken the economy.

If a such an amendment had been ratified when Congress last voted on these proposals and had been enforced for fiscal year 2012, “the effect on the economy would be catastrophic,” Macroeconomic Advisers, one of the nation’s preeminent private economic forecasting firms, concluded at the time. It would have caused the unemployment rate to double from 9 percent in that year to 18 percent by throwing an additional 15 million people out of work, according to the firm. Not only that, “recessions would be deeper and longer” under a constitutional balanced budget amendment, and uncertainty would be cast over the economy that could retard economic growth even in normal economic times, the analysis concluded.[2]

The fact that states must balance their budgets every year — no matter how the economy is performing — makes it even more important that the federal government not also face this requirement and thus further impair a faltering economy. And while most constitutional balanced budget amendments introduced in Congress would allow Congress to waive the balanced budget requirement with a supermajority vote in both chambers, that hardly solves the problem. Recent experience shows the difficulty of securing a supermajority vote in both chambers for almost any major legislation. Moreover, data showing that the economy is in recession do not become available until the economy has already begun to weaken; it could well take many months before sufficient data are available to convince a congressional supermajority to waive the balanced budget requirement, if it were possible to do so at all. In the meantime, substantial economic damage — and large job losses — would have occurred.

Beyond the economy, a balanced budget amendment would raise other problems. That’s because of its requirement that federal expenditures in any year must be offset by revenues collected in that same year. Social Security could not draw down the balances it has accumulated in previous years to pay benefits in a later year but, instead, could be forced to cut benefits even if it had ample balances in its trust funds; currently, those balances approach $2.9 trillion. The same would be true for the military retirement and civil service retirement programs, whose balances sum to $1.7 trillion. Nor could the Federal Deposit Insurance Corporation or the Pension Benefit Guaranty Corporation respond quickly to bank or pension fund failures by using their assets to pay deposit or pension insurance, unless they could do so without causing the budget to slip out of balance.

Amendment proponents often argue that, because states and families must balance their budgets each year, the federal government also should do so. Yet this is a false analogy. While states must balance their operating budgets, they can — and do — borrow for capital projects such as roads, schools, or water treatment plants. Families often borrow, as well, such as when they take out mortgages to buy homes, dealer-financed loans to buy cars, or government loans to send children to college. The proposed constitutional amendment would bar the federal government from making worthy investments in the same way.

This paper outlines the risks of a constitutional balanced budget amendment. Moreover, some balanced budget proposals also would either prohibit any tax increases or restrict federal revenue collections to quite low levels, limit total federal expenditures to levels that would essentially impose a constitutional requirement for deep budget cuts affecting tens or hundreds of millions of Americans, or both; this analysis also addresses those issues (see Appendix). One of the two proposals introduced this Congress by Rep. Bob Goodlatte (R–VA), the chair of the House Judiciary Committee, includes both of these additional requirements.

The nation faces challenging, though manageable, long-term fiscal problems,[3] but a balanced budget amendment to the U.S. Constitution is an unsound and dangerous way to address them. It would require a balanced budget every year regardless of the state of the economy, unless a supermajority of both houses overrode that requirement. This is an unwise stricture that many mainstream economists have long counseled against because it would require the largest budget cuts or tax increases precisely when the economy is weakest. It holds substantial risk of tipping faltering economies into recessions, making recessions longer and deeper, and precipitating very large additional job losses. When the economy weakens, revenue growth drops and revenues may even contract. And as unemployment rises, expenditures for programs such as unemployment insurance (UI) — and to a lesser but significant degree, SNAP (food stamps) and Medicaid — increase. These revenue declines and expenditure increases are temporary; they largely or entirely disappear as the economy recovers. But they are critical for helping struggling economies avoid falling into recessions and for moderating the depth and length of the recessions that do occur.

During economic downturns, consumers and businesses spend less, which in turn causes further job loss. But the increases in UI and other federal benefits that occur automatically help cushion the blow, by keeping purchases of goods and services from falling even more. Increased expenditures for UI, SNAP, and Medicaid benefits during a recession, when jobs are scarce, not only help the families that receive the benefits, but also help preserve the remaining jobs and incomes of those who produce or sell groceries, school supplies, health care, and other essentials.

Likewise, during recessions, tax revenues fall faster than wages and business profits, because lower wages and profits push people into lower tax brackets. This means that after-tax incomes decline by less than pre-tax incomes, mitigating the harm to purchasing power caused by the recession. And like the automatic benefit increases, this automatic feature of tax law not only helps those who have lost wages but also helps preserve the remaining jobs and incomes of people who produce or sell goods and services throughout the nation. That is why economists use the term “automatic stabilizers” to describe the automatic declines in revenues and automatic increases in UI and other benefits that help to stabilize the economy when it turns down.

A constitutional balanced budget amendment, however, essentially suspends the automatic stabilizers. It requires that federal programs be cut or taxes increased to offset the automatic stabilizers and prevent a deficit from occurring — pulling money out of the economy at exactly the wrong time, the opposite course from sound economic policy.

This is not to say that rising deficits are always good for the economy. To the contrary; when the economy booms, deficits should fall or even turn to surpluses, to prevent overheating and so lengthen an ongoing expansion. And the net of deficits and surpluses over time should, on average, be sufficiently low that the ratio of debt to Gross Domestic Product (GDP) does not grow to unmanageable heights. Broadly, however, sound fiscal policy is in substantial part about getting the timing of deficit increases and decreases right. That’s why a balanced budget requirement is dangerous — it prohibits getting the timing right because it requires balanced budgets in every year, regardless.

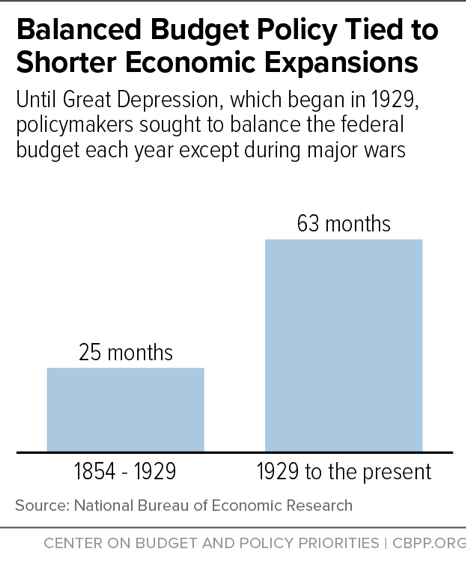

U.S. history reinforces the economic logic of avoiding such a stricture. Until the Great Depression, presidents and congresses tried, largely successfully, to balance the federal budget every year except during major wars, regardless of the state of the economy. Since Franklin Roosevelt’s inauguration in 1933, in contrast, deficits have been allowed to grow as the economy weakened and shrink as it recovered. The result has been fewer and shorter recessions. Specifically, from 1854 (the first year of data on recessions) through 1929, the nation suffered an average of 2.8 recessions per decade. But since then, that average dropped to 1.6 recessions per decade. Moreover, the average length of economic expansions grew from 25 months in the earlier period to 63 months in the later one (see Figure 1), with the eight longest expansions on record occurring in the modern era.[4]

Given shorter and less frequent recessions and longer expansions in the modern era, it isn’t surprising that economic growth over time has been faster than in the earlier period.[5] After accounting for inflation and the growth of the working-age population, the economy expanded at an average rate of 1.4 percent per year from 1848 through 1929 but at an average pace of 2.0 percent per year since the modern era began.[6]

Over the years, leading economists have warned of the adverse effects of a constitutional balanced budget amendment. For example, in congressional testimony in 1992, Robert Reischauer — one of the nation’s most respected experts on fiscal policy and then director of the Congressional Budget Office (CBO) — explained: “[I]f it worked [a constitutional balanced budget amendment] would undermine the stabilizing role of the federal government.” Reischauer noted that the automatic stabilizing that occurs when the economy is weak “temporarily lowers revenues and increases spending on unemployment insurance and welfare programs. This automatic stabilizing occurs quickly and is self-limiting — it goes away as the economy revives — but it temporarily increases the deficit. It is an important factor that dampens the amplitude of our economic cycles.” Under a constitutional amendment, he explained, these stabilizers would no longer operate automatically.[7]

Similarly, when Congress considered a constitutional balanced budget amendment in 1997, more than 1,000 economists, including 11 Nobel laureates, issued a joint statement that said, “We condemn the proposed ‘balanced-budget’ amendment to the federal Constitution. It is unsound and unnecessary… The proposed amendment mandates perverse actions in the face of recessions. In economic downturns, tax revenues fall and some outlays, such as unemployment benefits, rise. These so-called ‘built-in stabilizers’ limit declines of after-tax income and purchasing power. To keep the budget balanced every year would aggravate recessions.”[8]

At a Senate Budget Committee hearing in January 2011, CBO director Douglas Elmendorf sounded a similar warning when asked about a constitutional balanced budget amendment:

Amending the Constitution to require this sort of balance raises risks… The fact that taxes fall when the economy weakens and spending and benefit programs increase when the economy weakens, in an automatic way, under existing law, is an important stabilizing force for the aggregate economy. The fact that state governments need to work … against these effects in their own budgets — need to take action to raise taxes or cut spending in recessions — undoes the automatic stabilizers, essentially, at the state level. Taking those away at the federal level risks making the economy less stable, risks exacerbating the swings in business cycles.[9]

And as noted above, the economic forecasting firm Macroeconomic Advisers (MA) concluded in 2011 that if a constitutional balanced budget amendment had been ratified and in effect for fiscal year 2012, the effect on the economy would have been severe.[10] If the 2012 budget had been balanced through program cuts, MA found, those cuts would have totaled about $1.5 trillion in 2012 alone — and would have thrown about 15 million more people out of work, doubled the unemployment rate from 9 percent to approximately 18 percent, and caused the economy to shrink by about 17 percent instead of growing by an expected 2 percent. Such a budget cut would have been radical in every sense; for example, if Social Security had been protected, it could have entailed cutting all other programs by more than six of every ten dollars in 2012, including Medicare, veterans’ benefits, cancer research, national defense, and school lunches, to name just a few.

Even if a balanced budget amendment were implemented when the budget was already in balance, MA concluded, it would still put “new and powerful uncertainties in play. The economy’s ‘automatic stabilizers’ would be eviscerated [and] discretionary counter-cyclical fiscal policy would be unconstitutional…. Recessions would be deeper and longer.”

MA also warned that “The pall of uncertainty cast over the economy if it appeared a [balanced budget amendment] could be ratified and enforced in the middle of recession or when the deficit was still large would have a chilling effect on near-term economic growth.” MA concluded that a balanced budget amendment would have detrimental effects on economic growth in both good times and bad.

Finally, Jerome Powell, the newly appointed chair of the Federal Reserve, stated during recent testimony that he was “not a supporter of the balanced budget approach.”[11]

Economic logic, U.S. history, and experts concur that requiring a balanced budget would exacerbate recessions. This is the consensus view. Recently, the IGM Forum, operated by the University of Chicago’s Booth School of Business, surveyed 42 of the nation’s leading economists of all political persuasions, asking them to evaluate the opposite proposition: that a balanced budget requirement would help stabilize the economy. Did they agree that “amending the Constitution to require that the federal government end each fiscal year without a deficit would substantially reduce output variability in the United States”? (Emphasis added.) The forum reported that 99 percent disagreed with the proposition.[12] Of the surveyed economists, four have won the Nobel Prize.

Proponents of a constitutional amendment often respond to these admonitions by noting that most of the recent such proposals would allow a vote of three-fifths (or two-thirds) of the House and the Senate to waive the balanced budget requirement. However, it is difficult to secure three-fifths votes for any major legislation, much less a two-thirds vote. Moreover, much data on the economy are collected and published with a lag of at least several months, and it could well take a number of months after the economy has begun to weaken before sufficient data are available to convince three-fifths of both houses of Congress that economic conditions warrant waiving the balanced budget requirement, if three-fifths were willing to waive the requirement at all. Furthermore, it is all too likely that even after the evidence for a downturn is clear, a minority in the House or Senate would hold a waiver vote hostage to demands for concessions on other, possibly unrelated, matters.

By the time a recession is recognized and the required votes are secured in both chambers, extensive economic damage could occur and hundreds of thousands — or millions — of additional jobs could be unnecessarily lost.

A parallel problem is that most versions of the proposed constitutional amendment would make it even harder to raise the debt limit by requiring a three-fifths vote for that in both the House and Senate. This is playing with fire. In recent years, Congress often has struggled to raise the debt limit even by simple majority vote. And since the turn of the century, a substantial number of debt limit increases enacted by Congress failed to receive a three-fifths vote in both houses. Imposing a supermajority requirement would heighten the risk of a federal government default, which would raise our interest costs and could damage the U.S. economy for years to come.

The fact that states must balance their operating budgets even in recessions — which causes the economy to contract further — makes it even more important that the federal government not be subject to the same stricture. As Norman Ornstein of the American Enterprise Institute has written:

Few ideas are more seductive on the surface and more destructive in reality than a balanced budget amendment. Here is why: Nearly all our states have balanced budget requirements. That means when the economy slows, states are forced to raise taxes or slash spending at just the wrong time, providing a fiscal drag when what is needed is countercyclical policy to stimulate the economy. In fact, the fiscal drag from the states in 2009-2010 was barely countered by the federal stimulus plan. That meant the federal stimulus provided was nowhere near what was needed but far better than doing nothing. Now imagine that scenario with a federal drag instead.[13]

In the same way, a constitutional balanced budget amendment would have precluded the 2009 Recovery Act — a significant portion of which constituted financial assistance to state governments for state Medicaid programs and state and local education — even though recent research shows that the Great Recession would have been far worse without it.[14]

The bottom line is that the automatic stabilizers need to continue to protect U.S. workers and businesses, but a balanced budget amendment would preclude them from doing so.

Nor is a recession the only concern. Consider the savings and loan crisis of the 1980s, or the financial meltdown in the fall of 2008. A constitutional balanced budget amendment would have hindered swift federal action to rescue the savings and loan industry and people who put their savings into those institutions, or to rapidly put the Troubled Assets Relief Program in place. In both cases, history indicates that federal action helped save the economy from what likely would have been far more dire problems.

Moreover, the federal government provides deposit insurance for accounts of up to $250,000 per depositor; this insurance — and the confidence it engenders among depositors — is critical to the sound functioning of our financial system so that we avoid panics involving a run on financial institutions, as occurred in the early 1930s. As explained below, a constitutional prohibition of any deficits (unless and until a supermajority of both houses of Congress voted to authorize them) could seriously weaken the guarantee that federal deposit insurance provides. That is a risk we should not take.

These are illustrations of why fiscal policy should not be written into the Constitution.

Consider also how a balanced budget requirement would affect Social Security. By design, the Social Security trust fund is building up reserves — in the form of Treasury securities backed by the full faith and credit of the United States — which will be drawn down to help pay benefits when the number of retired “baby boomers” peaks in the late 2020s and early 2030s. Currently, Social Security holds $2.9 trillion in Treasury securities. But under the balanced budget amendment, it would essentially be unconstitutional for Social Security to draw down these savings to pay promised benefits. Instead, benefits could have to be cut, because all federal expenditures would have to be covered by tax revenues collected during that same year. More precisely, Social Security would be allowed to use its accumulated Treasury securities to help pay benefits only if the rest of the federal budget ran an offsetting surplus (or if the House and Senate each mustered three-fifths or two-thirds votes to permit deficits).

Medicare Part A — the Hospital Insurance trust fund — has the same structure as Social Security. That trust fund currently holds about $200 billion in Treasury securities, but under a balanced budget amendment, it would be unconstitutional for Medicare to draw down those savings to pay hospitalization costs because all federal expenditures — which includes Medicare payments — would have to be covered by taxes collected in the same year.

The military retirement and civil service retirement systems, which have their own trust funds, would be affected in the same way. Because all federal expenditures would have to be covered by taxes collected in the same year — and the use of accumulated savings thus would be unconstitutional — these trust funds would not be able to draw down their accumulated balances unless the rest of the budget ran offsetting surpluses. As a result, the $700 billion in Treasury securities held by the military retirement trust fund and the $900 billion in Treasury securities held by the civil service retirement trust fund would be unavailable to pay promised retirement pensions.

As noted, the potential effects on the banking system are another cause for concern. The Federal Deposit Insurance Corporation (FDIC) holds more than $90 billion of reserves, in the form of Treasury securities, to insure depositors’ savings. These reserves are called upon when banks fail. Similarly, the Pension Benefit Guarantee Corporation (PBGC) has $108 billion of reserves to draw upon if a corporation’s defined-benefit pension plan goes bankrupt.

The balanced budget amendment, however, could make it unconstitutional for the FDIC and the PBGC to use their assets to pay deposit or pension insurance, since doing so would generally constitute “deficit spending.” Such payments could be made only if the rest of the budget ran an offsetting surplus that year (or if Congress achieved the necessary three-fifths or two-thirds supermajorities to override the balanced budget requirement).

In general, a constitutional requirement that all expenditures during a given year be covered by tax revenues collected in the same year would undercut all U.S. government insurance and loan guarantees. Those range from the “full faith” backing by the U.S. government to pay interest on Treasury securities to deposit insurance, pension insurance, Federal Housing Administration loans, small business loans, flood insurance, and the nuclear power industry’s liability insurance under the Price-Anderson Act.

Henceforth, the U.S. government would only be able to fulfill its legal commitments if their cost did not cause a deficit, or if both houses of Congress voted by a three-fifths or two-thirds supermajority to waive the balanced budget requirement.

Yet the entire purpose of deposit insurance and other U.S. financial commitments is to guarantee financing in case of calamity. How reliable is the “guarantee” if the balanced budget requirement places it at risk or forces it to be withdrawn just when it is needed most?

If banks, thrift institutions, pension funds, small businesses, and mortgagers started to fail during a recession or a financial crisis, the large costs of paying federal insurance and guarantee claims probably could not be met within the confines of the balanced budget amendment. And if deposit insurance were no longer effective, panicked depositors could make runs on banks, causing a chain reaction that could turn a recession into a depression. That is what happened from 1929 to 1933. Indeed, federal deposit insurance was enacted in 1933 — after a four-year run by depositors on their banks — to halt that collapse.[15]

In sum, even if programs have built up substantial reserves to pay benefits and claims — such as in deposit insurance and Social Security — those reserves could fail to provide protection under a constitutional balanced budget requirement because the reserves would not count as revenues in the current fiscal year, while payments from the reserves would count as expenditures in the current fiscal year. In general, a balanced budget requirement in the U.S. Constitution would override any and all government guarantees and promises written into law: the guarantee to pay interest on the debt; or to pay insurance and guarantee claims for bank deposits, floods, loan defaults, and nuclear accidents; or to pay program benefits for Social Security, Medicare, Medicaid, unemployment benefits, veterans’ benefits, or military and civil service pensions; or to pay contractors who have delivered goods or services to the federal government. The availability of reserves and legal guarantees would be superseded by the constitutional bar against any deficit spending on an annual basis.

Analogies to States and Families Are Mistaken

Proponents of a constitutional amendment sometimes argue that states and families must balance their budgets every year, and the federal government should do so, too. But statements that the constitutional amendment would align federal budgeting practices with those of states and families are not accurate.

While states must balance their operating budgets, they can borrow to finance their capital budgets — to finance roads, schools, water treatment plants, and other projects. The same is generally true of local governments. And most state and local governments do borrow. Currently, state and local debt amounts to $3 trillion.

States also can build reserves during good times and draw on them in bad times without counting the drawdown as new expenditures that unbalance a budget. (Those state reserves are generally called “rainy day funds.”) Under the constitutional balanced budget amendment, by contrast, the federal government would be barred from using a similar practice, as it would be considered as moving the budget out of balance.

Families follow similar practices. While every prudent family balances its checkbook, that is not the same as balancing its budget, since balancing its budget means no borrowing. In reality, families borrow — they take out mortgages to buy a home or student loans to send a child to college; they buy cars through dealer financing, i.e., borrowing from automobile dealers. In short, families borrow to make various investments. (They also commonly use credit cards, another form of borrowing, i.e., deficit spending.) Currently, family indebtedness amounts to $15 trillion nationwide.[16] Families also save for the future and draw down those savings when appropriate, another reason their expenditures often exceed their income in a given year. For example, they draw down savings to make down payments on mortgages, to pay for college tuition, or to support themselves in retirement and, when times are tight, to cover expenses that exceed their current incomes.

To summarize, if required to operate under the same restrictions as the proposed balanced budget amendments, not only would a family be prohibited from taking out a mortgage to buy a house, it would be prohibited from using years of savings to accumulate enough cash to buy a house. It could buy a house only if all its expenses for the year — including the full purchase price of the house — were covered out of that year’s wages. Probably only 2 percent of American families could ever buy a house under those restrictions.

Yet the proposed constitutional amendment would bar the federal government from following the normal practices of families and of state and local governments. The total federal budget — including capital investments — would have to be balanced every year; no borrowing to finance infrastructure or other investments to boost future economic growth would be allowed. And if the federal government ran a surplus one year, or deposited some revenues into trust funds such as the Social Security trust fund, it could not draw those savings down the next year to help balance the budget or fulfill legal guarantees — saving for the future would be nearly pointless.

Supporters of the balanced budget amendment tend to sidestep questions about how the constitutional mandate would be enforced. But there are serious questions about this, and no clear answers. For example:

- Suppose the budget falls out of balance. What happens? Would the President have the unilateral power to impose balance? Suppose, for example, that congressional legislation designed to balance the budget is defeated at the end of the congressional session. Can the President unilaterally declare that it is law nonetheless? Can he instead make across-the-board cuts in all programs, including Social Security, Medicare, and defense, without congressional action? Can he select which programs to cut unilaterally? Can he impose across-the-board, or selected, increases in tax rates? How about across-the-board or selected reductions in tax expenditures?

- What about the Supreme Court? If the budget is not balanced, can the Court declare defeated deficit reduction legislation to be law? Can it override a presidential veto of such legislation? If it cannot enact a defeated or vetoed law, can it declare that a bill waiving the balanced budget requirement has been enacted if it received a majority vote but not a three-fifths or two-thirds vote? Alternatively, can it invalidate the most recently enacted appropriation bills? If that seems arbitrary and unworkable, can it order across-the-board cuts in all appropriations, or entitlement programs, or tax expenditures? Can it impose across-the-board surtaxes? Can it hold Congress or the President in contempt and possibly jail them if they ultimately do not act?

- If federal courts award claims or judgments against the United States, as they often do, but the costs would unbalance the budget and require an increase in the debt limit, what action would the courts take? Would the Supreme Court say that court-ordered payments are void?

To address the nation’s long-term budget problems, policymakers should seek to stabilize the debt as a percent of GDP in the coming decade and to reduce it or at least keep it stable after that — importantly, allowing for fluctuations as necessary over the business cycle.[17] This can be done without balancing the budget or running surpluses as long as the debt grows no faster than the economy on average over time.

For example, over the 33 years from 1946 through 1979, the nation ran balanced budgets or surpluses in only eight years; it ran deficits in the other 25. Yet over those 33 years, the debt fell from 106.1 percent of the economy (i.e., of GDP) to 24.9 percent, because the economy grew faster than the debt. Here, the analogy with families is accurate; if your income grows faster than your debts, you are in better financial shape and more creditworthy. As these figures show, avoiding all deficits and debt is unnecessary.

Finally, some worry that the growth of federal debt threatens to bankrupt the nation. We just noted that if your income grows faster than your debts, your financial position improves. Similarly, if your assets grow faster than your debts, your financial position improves. True, federal debt really is a government liability. But the federal government, state and local governments, households, and businesses possess real assets as well, such as bank deposits, stocks, bonds, and real estate. It would be concerning if the nation’s debts were growing faster than its assets, but the opposite is the case: the nation’s assets are growing faster than its debts and have been for almost all our history.

For example, as of December 31, 2017, Federal Reserve data show that households had $15 trillion of financial liabilities (debts) but also had $114 trillion of assets, for a net wealth of $99 trillion. This wealth vastly overshadows the net financial liabilities of the federal, state, and local governments. The United States as a whole is far from anything that could be called bankruptcy: counting the liabilities of a) households, b) businesses, and c) federal, state, and local governments, but also counting their assets such as the value of businesses and real estate, the nation’s net wealth is $92 trillion.[18] Fundamentally, this net wealth is a source of national income and constitutes a base from which federal taxes can be drawn. This fact helps keep the government creditworthy.

Moreover, the nation’s net wealth continues to grow. The Federal Reserve’s data extend back to 1945. Even after accounting for 72 years of inflation, the nation’s average net wealth per person increased in 51 of those years and is currently four times as large as in 1945.[19]

Future generations will inherit the debts of the federal, state, and local governments. But they will also inherit assets worth far more.

Establishing a balanced budget amendment in the Constitution would be exceedingly unwise. It would likely exact a heavy toll on the economy and on American workers and businesses in the years ahead and likely make recessions more frequent and more severe. It would involve far more fiscal restraint than is necessary for prudent budgeting.

In addition, it would undercut the basic design of Social Security, deposit insurance, and all other government guarantees. And it is notably more restrictive than the behavior of prudent states and families.

Finally, it raises troubling questions about enforcement, including the risk that the courts or the President might be empowered to make major, unilateral budget decisions, undermining the checks and balances that have been a hallmark of our nation since its founding. In short, this is not a course the nation should follow.

This analysis focuses on House Joint Resolution 2 (H.J.Res. 2), introduced by Rep. Bob Goodlatte (R–VA) in January 2017. However, Rep. Goodlatte has also introduced House Joint Resolution 1 (H.J.Res. 1), which differs by also including a constitutional spending limit and a constitutional ban on revenue increases. The spending limit would be “one-fifth of economic output of the United States” (presumably 20 percent of gross domestic product) and be waivable only by a two-thirds vote of each house. The tax ban would apply to any “bill to increase revenues” and be waivable only by a three-fifths vote of each house. Yet federal expenditures exceeded 20 percent of GDP, on average, during the fiscal years budgeted for by the administrations of Presidents Ford, Carter, Reagan, George H.W. Bush, Obama, and Trump.[20]

Also of note, banning tax increases means that taxes can be cut whenever the budget is in surplus but can’t be raised even when the budget falls into deficit. This aspect of H.J.Res. 1 calls into doubt its main purpose. Consider that in December 2017 Congress enacted a large tax cut, disproportionately for the benefit of corporations and wealthy investors, by a very close and entirely partisan vote — and now, a few months later, H.J.Res. 1 would amend the Constitution to prevent any reversal of those tax cuts.

This aspect of H.J.Res. 1 could also lead to a constant ratcheting down of revenues, even though it will be advisable to raise revenues in the years ahead to help cover the increasing costs of an aging population.[21] Consider, for example, a proposal to restore 75-year solvency to the Social Security trust fund in part by raising the Social Security payroll tax cap. Such a proposal would also reduce overall federal deficits. But such a bill would be unconstitutional under H.J.Res. 1 simply because it raised revenues. Instead, Social Security benefits would have to be cut substantially (with no revenue increases) to make the trust fund whole; over 75 years, benefits would have to be cut by an average of 17 percent, according to the program’s trustees.

More broadly, the bar on revenue increases combined with the requirement of annual budget balance would mean that federal programs would bear all the burden: national defense, Social Security, Medicare and Medicaid, education, highways, veterans, agriculture, law enforcement, biomedical research, and much more.

And the required cuts would be very deep. If a balanced budget were required in 2019, when revenue is projected to be down at 16.5 percent of GDP (given the recent tax cuts), total spending would be constitutionally limited to 16.5 percent of GDP as well. This would require program cuts averaging more than 25 percent in 2019: if applied across the board, more than one-quarter of the Army, Navy, and Air Force; more than one-quarter of Social Security benefits; more than one-quarter of cancer research; and so on. Protecting any area would force the cuts to be even deeper in remaining areas. While this is an extreme case, the required program cuts would be extraordinarily deep under any set of circumstances. In 2025, for example, the deficit is not projected to be quite as large as in 2019, and Congress would have had eight years to phase in budget cuts and thereby generate some additional interest savings, slightly reducing the magnitude of the required cuts in 2025. But program cuts in 2025 averaging more than 20 percent across all programs would still be needed.