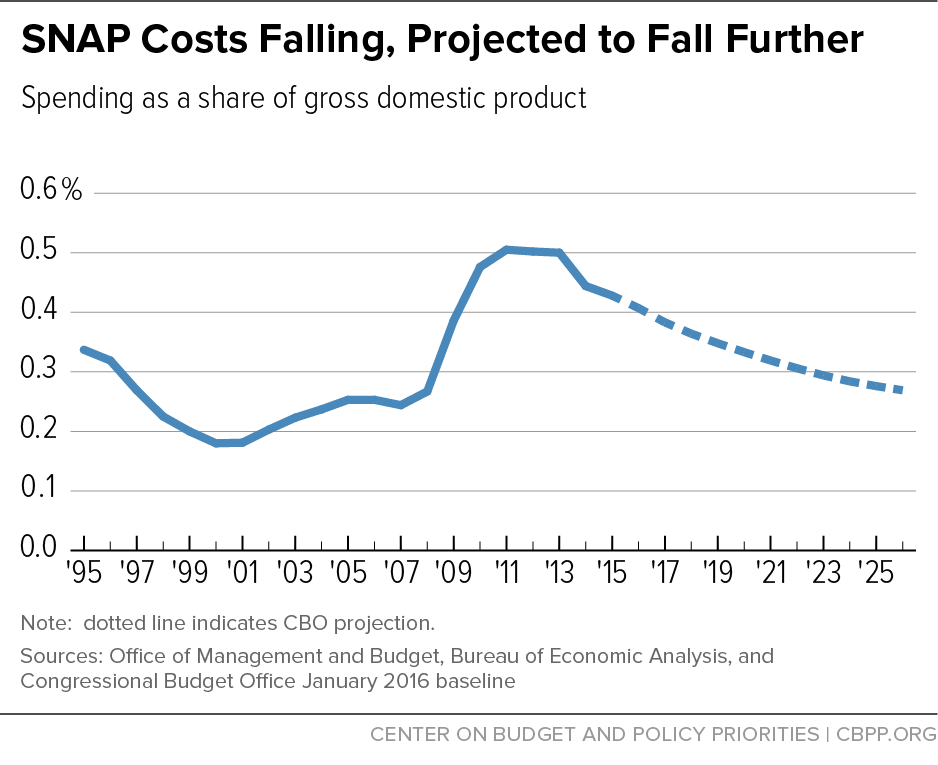

SNAP spending, which rose substantially as a share of the economy (gross domestic product or GDP) in the wake of the Great Recession, fell for the second consecutive year in 2015,[1] following the pattern that the Congressional Budget Office (CBO) and other experts expect.

- SNAP spending fell as a share of GDP in 2015. Spending on SNAP (formerly food stamps) as a share of GDP fell by 4 percent in 2015. In 2014 it fell by 11 percent, largely due to the expiration of the Recovery Act’s SNAP benefit increase on November 1, 2013. That expiration lowered average benefits by about 7 percent for the rest of 2014, Agriculture Department (USDA) data show.[2]

- CBO’s forecast indicates SNAP isn’t part of the long-term budget problem. As the economic recovery continues and fewer low-income people qualify for SNAP, CBO expects SNAP spending to fall further in future years, returning to its 1995 level as a share of GDP by 2020. (See Figure 1.) Thus, while CBO recently projected that the overall gap between federal spending and revenues will grow over the coming decade,[3] SNAP is not contributing to this problem; CBO forecasts that SNAP will decline as a share of the economy over the entire ten-year budget window.

-

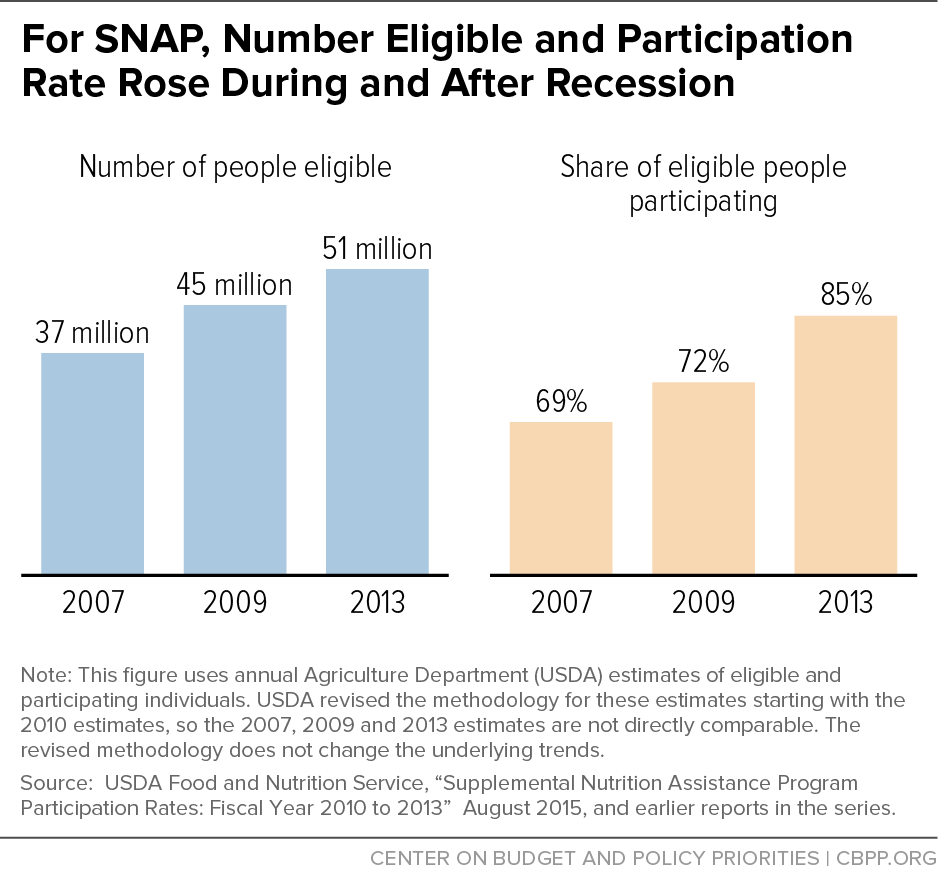

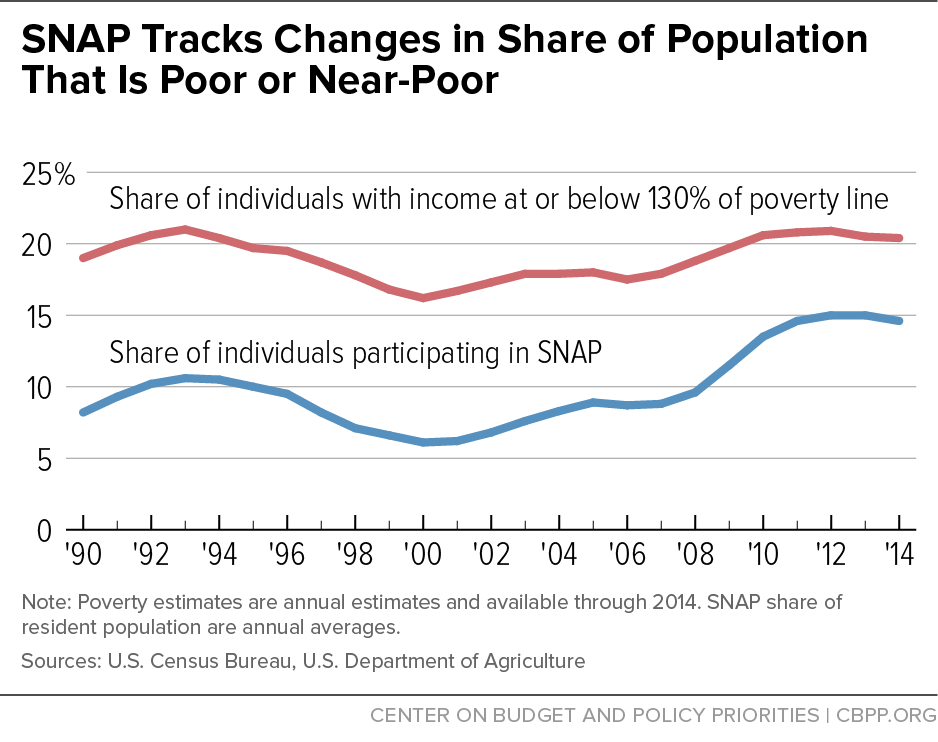

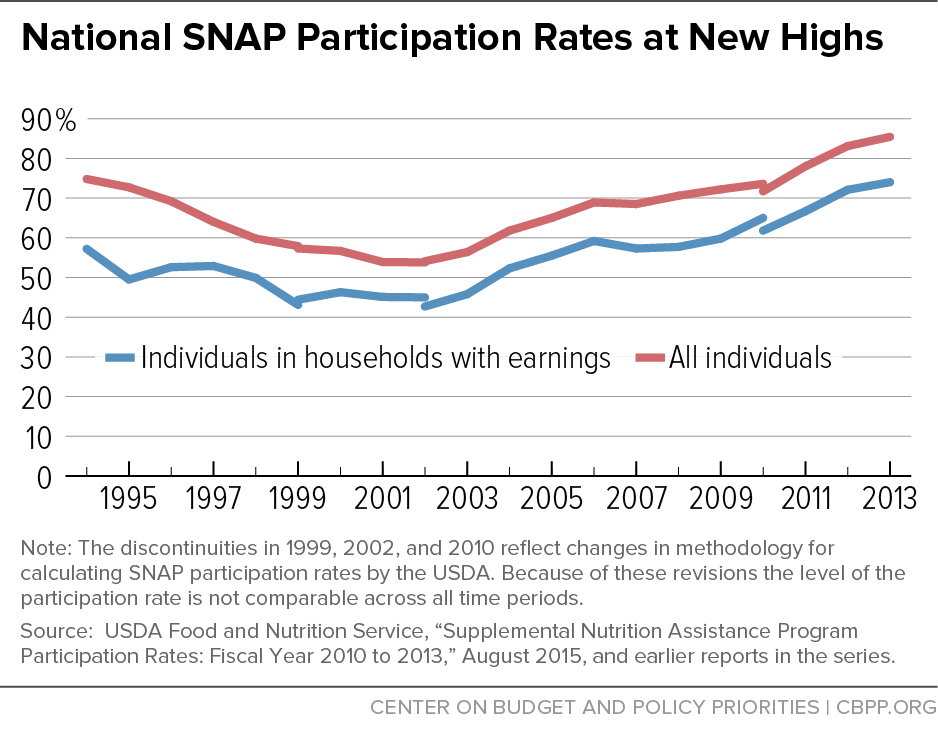

SNAP caseloads grew significantly between 2007 and 2011 as the recession and lagging recovery led more low-income households to qualify and apply for help. The number of people eligible for SNAP rose from 37 million in 2007 to 45 million in 2009 and 51 million in 2013, USDA data show. The participation rate among eligible individuals also rose, from 69 percent in 2007 to 85 percent in 2013 (the most recent year available). The rise in the participation rate likely reflects the severity of the downturn and state efforts to reach more eligible households — particularly working families and senior citizens — by simplifying SNAP policies and procedures, among other factors.

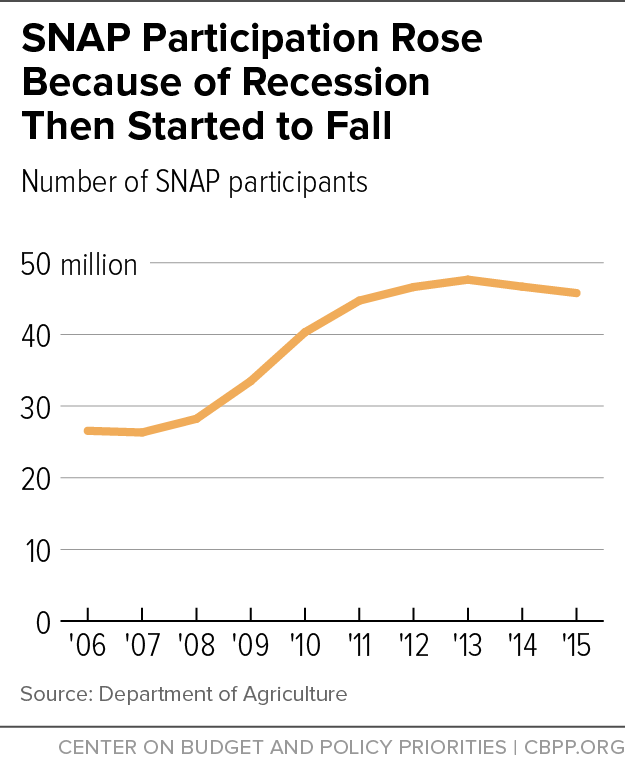

- SNAP caseloads began falling in 2014 and continued falling in 2015. SNAP caseload growth slowed substantially in 2012 and 2013, and caseloads fellby about 2 percent in 2014 and another 2 percent in 2015. For more than two years, fewer people have participated in SNAP each month than in the same month one year earlier. The number of people receiving SNAP has fallen by 2.6 million people since peaking in December 2012.[4] In 42 states, the number of SNAP participants was lower in December 2015 than in December 2012.[5]

- Food price increases in 2015 partly offset the drop in SNAP caseloads that year. In 2015, average SNAP benefits rose by about 1.5 percent because of food price inflation (which affects USDA’s “Thrifty Food Plan,” the basis for SNAP benefit levels), partly offsetting the drop in the number of SNAP recipients. Total SNAP benefit payments in 2015 were 0.5 percent lower than in 2014 and 8.3 percent lower than in 2013.[6]

- While SNAP caseloads are shrinking, they remain above pre-recession levels because poverty, food insecurity, and SNAP participation rates are also above pre-recession levels. The economic recovery has been slow to reach many Americans. Many households continue to struggle even years into the economic recovery.

- The return of a three-month time limit in many areas will contribute to further caseload and spending declines in 2016. More than 500,000 and as many as 1 million of the nation’s poorest people will be cut off SNAP over the course of 2016, due to the return in many areas of a three-month limit on benefits for unemployed adults aged 18-49 who aren’t disabled or raising minor children.[7]

SNAP’s growth starting in 2007 enabled it to help millions of families hit by the worst recession in decades, and recent caseload declines resulting from improving economic circumstances for low-income households are welcome. But other factors may also be pushing SNAP caseloads down, including the three-month time limit. States have made significant gains in recent years in lowering barriers to SNAP for eligible individuals, and a key question for the future is whether states can maintain that progress.

SNAP caseloads grew between 2007 and 2013 primarily because more households qualified due to the steep recession and sluggish initial recovery and a larger share of eligible households applied for help; Figure 2 shows the considerable increases in both areas. CBO has confirmed that “the primary reason for the increase in the number of participants was the deep recession . . . and subsequent slow recovery; there were no significant legislative expansions of eligibility.”[8]

The number of people eligible for SNAP rose from 37 million in 2007 (before the recession) to 45 million in 2009 and 51 million in 2013, USDA data show.[9] The participation rate among eligible individuals also rose, from 69 percent in 2007 to 85 percent in 2013 (the most recent year available).[10]

Several factors likely contributed to the increase in the participation rate. The widespread and prolonged effects of the recession, particularly the record long-term unemployment, may have made it more difficult for family members and communities to help people struggling to make ends meet. Households that already were poor became poorer during the recession and may have been in greater need of help. In addition, states continued efforts begun before the recession to reach more eligible households — particularly working families and senior citizens — by simplifying SNAP policies and procedures. Finally, research shows that take-up of SNAP among eligible households is higher when benefits are higher, so the Recovery Act’s temporary benefit increase may have raised participation rates.

The deep recession expanded SNAP caseloads in every state, and some of the states hit hardest by the recession saw the largest caseload increases. For example, Nevada, Florida, Idaho, and Utah — the states with the greatest growth in the number of unemployed workers between 2007 and 2011 — also had the greatest growth in the number of SNAP recipients during this period.

Adding to SNAP costs, the 2009 Recovery Act temporarily boosted SNAP benefits to provide fast and effective economic stimulus and push against the rising tide of hardship for low-income Americans. Economists consider SNAP one of the most effective forms of economic stimulus. Moody’s Analytics estimates that in a weak economy, every dollar increase in SNAP benefits generates about $1.70 in economic activity. Similarly, CBO has found that SNAP has one of the largest “bangs-for-the buck” (i.e., increases in economic activity and employment per budgetary dollar spent) among a broad range of policies for stimulating economic growth and creating jobs in a weak economy.[11] The Recovery Act benefit boost raised SNAP spending (above what it otherwise would have been) by almost 20 percent in fiscal years 2010 and 2011 and between 8 and 11 percent in fiscal years 2009, 2012, and 2013, before ending early in fiscal year 2014.[12]

Two changes to many states’ SNAP eligibility rules also contributed somewhat to caseload growth during the recession. First, between 2009 and 2011, more states adopted the “broad-based categorical eligibility” option, which allows them to provide food assistance to households — primarily low-income working families and seniors — with gross incomes or assets modestly above federal SNAP limits but disposable incomes in most cases below the poverty line. Second, because of the recession, more areas of the country qualified for temporary waivers from the three-month time limit on SNAP benefits for unemployed childless adults. This waiver authority, which applies to areas with high unemployment, has existed under the same criteria since Congress established it (along with the time limit itself) in the 1996 welfare law.[13] (As discussed below, the number of areas eligible for waivers is shrinking as the economy recovers.)

Economists Peter Ganong and Jeffrey Liebman found that these two factors related to state eligibility rules explain less than a fifth of the increase in SNAP enrollment between 2007 and 2011. Increased adoption of broad-based categorical eligibility accounted for 8 percent of the increase, while the growth in temporary waivers accounted for another 10 percent.[14]

Caseloads Are Falling and Are Projected to Fall Further

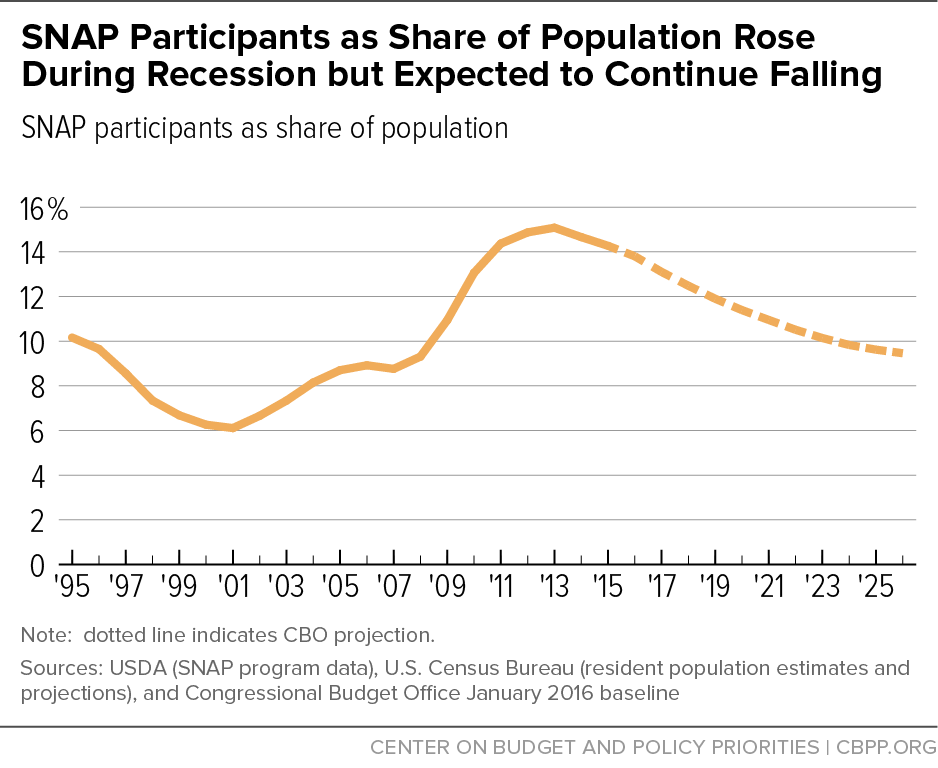

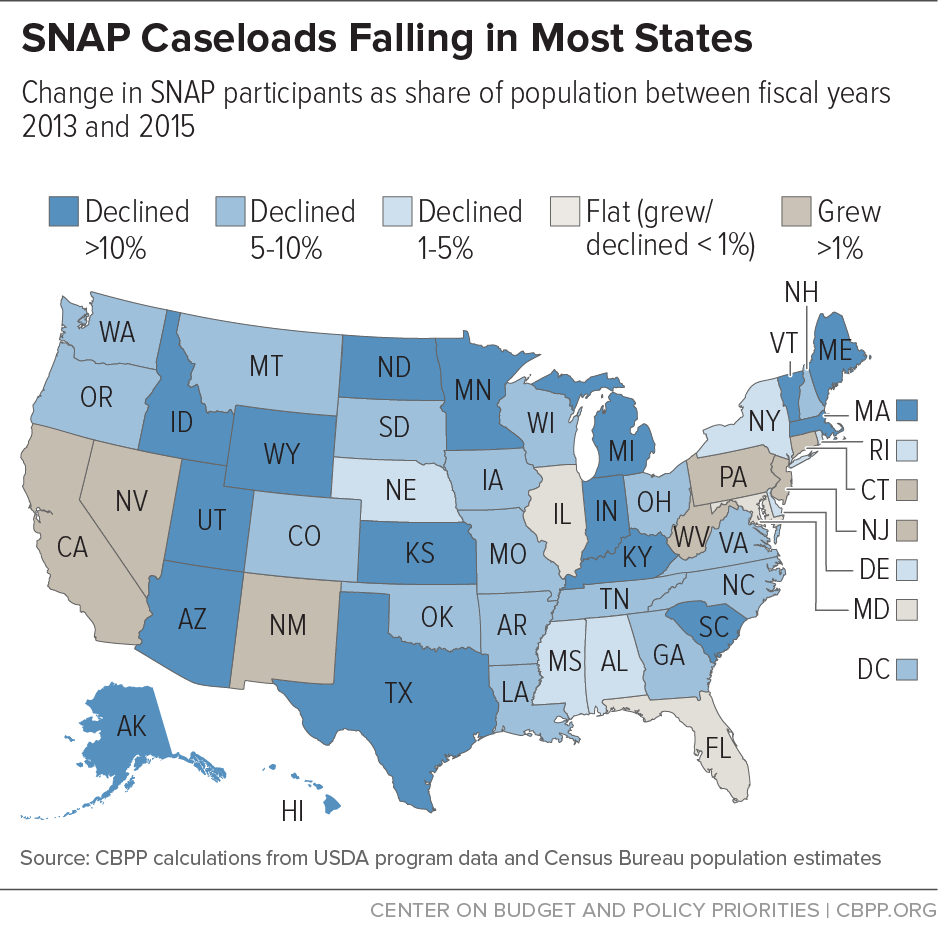

Annual SNAP caseload growth slowed to 4 percent in 2012 and 2 percent in 2013. In 2014 and 2015 SNAP caseloads declined in most states; as a result, the national SNAP caseload fell by 2 percent both years. (See Figure 3.)

Nationally, for more than two years fewer people have participated in SNAP each month than in the same month of the prior year; about 2.6 million fewer people participated in SNAP in December 2015 than in December 2012, when participation peaked.

CBO expects that as the economy improves, the number of participants will fall by about 2 to 4 percent each year over the next decade: from 45.8 million in fiscal year 2015 to 44.7 million in 2016, 42.8 million in 2017, and 33.1 million by 2026.[15] By 2026, CBO forecasts that the share of the population receiving SNAP will return close to 2007 levels, at about 9 percent. (See Figure 4.)[16]

Every state saw substantial SNAP caseload increases during the recession and slow recovery, as national caseloads were rising (that is, 2007 through 2012). The picture has not been as uniform across the states in the years since caseloads peaked. In more than 40 states, the average number of SNAP participants was lower in fiscal year 2015 than in fiscal year 2013, but caseloads have been essentially flat in some states and have risen in a few others, though caseload growth apparently ended in most of them by the end of 2015. (See Figure 5 and Appendix.)

Nationally, the number of SNAP participants fell by 4 percent between 2013 and 2015. Because the population grew slightly over this period, the share of the population participating in SNAP fell by more than 5 percent over this period.

- Most states have seen substantial caseload declines since 2013. In 34 states, the share of the population participating in SNAP has fallen by at least 5 percent. These states account for about 55 percent of the SNAP caseload. In most of these states, caseloads have fallen steadily since peaking in 2012 or 2013.

- In several large states, SNAP caseloads have fallen by less than 5 percent, have been essentially flat, or have grown somewhat. In New York, the share of the population participating in SNAP fell by just under 5 percent between 2013 and 2015, and in Florida and Illinois it was essentially flat. The share in Pennsylvania and California grew by 2 percent and 4 percent, respectively. Because these states as a whole account for a third of SNAP participants, they have a disproportionate impact on national SNAP caseloads. SNAP caseload growth seems to have ended in almost every state by December 2015.

The data needed to rigorously assess the causes of recent caseload trends won’t be available for several years, but the economic recovery is likely playing a major role.[17] SNAP caseloads have historically tracked economic conditions, rising when the economy weakens and then falling — with a several-year lag — when it recovers. The lag reflects the fact that people with lower education and skills aren’t the first to benefit from an improving economy. As CBO has observed:

Even as the unemployment rate began to decline from its 1992, 2003, and 2010 peaks, decreases in [SNAP] participation typically lagged improvement in the economy by several years. For example, the number of SNAP participants rose steadily from about 20 million in the fall of 1989 to more than 27 million in April 1994 — nearly two years after the unemployment rate began to fall and a full three years after the official end of the recession in March 1991.[18] [emphasis added]

Emerging research on the Great Recession finds that economic factors explain between about half and 90 percent of the increase in SNAP caseloads between 2007 and 2011.[19] One study, which tested different measurements of the economy and SNAP caseloads at the state and local level, found that the economy explained 70 to 90 percent of the increase in caseloads; it also found substantial lags — of up to two years — between changes in the economy and changes in SNAP participation. The authors concluded:

These simulations indicate a substantial role for the economy in determining the size of the SNAP caseload and suggest that the high levels of SNAP receipt seen during and after the Great Recession will unwind as the labor market improves. However, . . . fully unwinding the consequences of the Great Recession for SNAP receipt should be expected to trail the improvement of the economy by several years.[20]

The recent declines in SNAP caseloads suggest that this pattern is holding for the current recovery.

Some critics have suggested that the fact that the unemployment rate has returned to pre-recession levels but SNAP enrollment has not indicates a problem with the program. However, the labor market for low-income households is weaker than the overall unemployment rate might suggest, as several other indicators show:[21]

-

Poverty and food insecurity, or the share of families lacking consistent access to adequate food, rose significantly during the recession and stayed well above pre-recession levels in 2014.[22] Both are better indicators of SNAP participation than the unemployment rate, and their only modest improvement since the end of the recession suggests that the drop in the unemployment rate masks continued hardship for many. (See Figure 6.)

- The share of the population age 16 and over with a job (known as the employment-population ratio) plummeted during the Great Recession and isn’t yet back to where it would be in a fully healthy labor market. After falling from 63.0 percent to 58.4 percent from 2007 to 2011, it rose only to 59.3 percent in 2015.[23] Unlike the unemployment rate, this measure includes people who would like to work but have dropped out or stayed out of the labor force because they think they have little prospect of finding a job.

- Long-term unemployment hit record highs in the recent recession and remains unusually high; in January 2016, roughly a quarter (26.9 percent) of the nation’s 7.8 million unemployed workers had been looking for work for 27 weeks or longer. By contrast, the long-term unemployed never constituted more than 26 percent of all unemployed workers in any prior recession back to World War II, and the figure has certainly never been so high this far into an economic recovery. Workers who have been unemployed for more than six months are only half as likely as those unemployed for shorter periods to have found employment by one month later; they also are more likely to have exhausted assets and other support and to seek help from SNAP.

- The number of unemployed not receiving unemployment insurance (UI) benefits — the group of the unemployed most likely to qualify for SNAP because they have neither wages nor UI benefits — continued to grow through 2014, and was higher in 2014 (6.9 million) than at the bottom of the recession (5.0 million in 2010). By 2015 the number dropped to 6.0 million, still 1.5 million higher than in 2007. As a result of these trends, the share of unemployed workers receiving UI fell to 27 percent by December 2014, the lowest figure on record in data back to 1971.[24] It didn’t increase significantly in 2015.

- The share of workers who are working part time because they can’t find a full-time job neared historic highs during the recession and remains elevated.

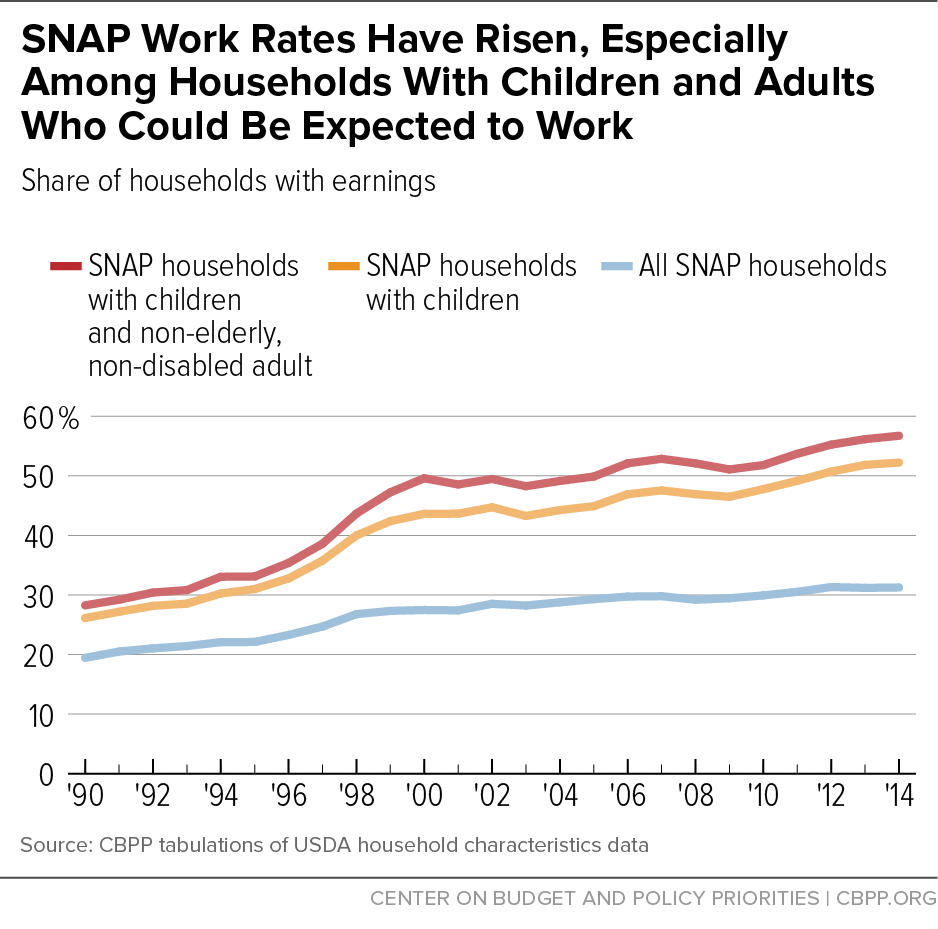

Two other factors may help explain why SNAP caseloads haven’t fallen more in recent years. First, low-wage workers often are eligible for SNAP, and a large share of SNAP recipients who can work do work. A parent with two children who works 35 hours a week at $10 an hour will qualify for about $300 a month in SNAP benefits. The share of SNAP households that have earnings while participating in SNAP has risen in recent decades and continued growing during and after the recession. (See Figure 7.) More than half of families with children that receive SNAP have earnings while receiving SNAP benefits. Thus, while unemployment statistics are helpful in understanding the economy’s impact on SNAP caseloads, many employed low-wage workers receive help from the program. When people leave the ranks of the unemployed for a low-wage job as the economy slowly recovers, they often remain eligible for SNAP.

Second, as discussed above, SNAP is reaching a larger share of eligible people, especially working families. Participation among eligible individuals in low-income working families rose from 43 percent to 74 percent between 2002 and 2013. (See Figure 8.) If participation rates have continued improving in the past few years, this could have partly offset the caseload decline resulting from a modestly stronger economy lifting some people above SNAP eligibility. For example, California, New Jersey, Nevada — three states where caseloads haven’t yet declined — historically had among the lowest SNAP participation rates. Participation rates may be rising in these states, pushing caseloads up.

At the same time, factors other than an improving economy may be pushing SNAP caseloads down, including:

- Return of the three-month time limit. Several states with large caseload declines, including Kansas, Maine, Minnesota, Utah, and Vermont, reinstated the three-month time limit for unemployed childless adults. These states had waived the time limit because of high unemployment but either became ineligible for waivers as unemployment fell or opted not to request a waiver for fiscal year 2014 or 2015. Their subsequent caseload declines foreshadow the impact in other states of ending the waivers, as discussed below.

- Administrative barriers. Some states with especially large caseload declines experienced delays in processing SNAP applications and other administrative problems over the last year or more. Media reports have described problems with SNAP administration in Georgia, Maine, Massachusetts, Missouri, Nebraska, and North Carolina, for example.[25] To the extent that applicants or participants have trouble obtaining SNAP benefits, this may suppress participation in some places and may explain subsequent increases in participation once these problems have been resolved.

- End of Recovery Act benefit increase. The November 2013 across-the-board benefit cut may have caused some eligible households to leave SNAP or not apply. As mentioned above, take-up of SNAP among eligible households is higher when benefits are higher. When benefits are lower, some eligible households conclude that applying and maintaining eligibility aren’t worth the small benefits they expect to receive.

Spending and Caseloads Will Continue Falling, Forecasts Indicate

CBO and others expect SNAP spending to continue to decline as the economy recovers and the number of SNAP participants falls. CBO expects SNAP spending to fall every year as a share of GDP, returning to its 1995 level by 2020.

Once the economy has fully recovered, SNAP costs are expected to rise only in response to growth in the size of the low-income population and increases in food prices. Unlike health care programs and Social Security, SNAP faces no demographic or programmatic pressures that will cause its costs to grow faster than the overall economy. Thus, SNAP will not contribute to the nation’s long-term fiscal problems.

To the extent that recent and future SNAP caseload declines reflect improving economic circumstances among low-income households, they are welcome. However, an austere provision in current law affecting some of the nation’s poorest individuals will also push down SNAP caseloads and costs. Over the course of 2016, at least 500,000 and up to 1 million people will be cut off SNAP due to the return in many areas of a three-month limit on SNAP benefits for unemployed adults aged 18-49 who aren’t disabled or raising minor children.

In the past few years, this three-month limit hasn’t been in effect in most states because the law allows states to suspend it in areas with high and sustained unemployment. Many states qualified for and received statewide waivers of the time limit due to the Great Recession and its aftermath. But as unemployment rates fall, most states will only be eligible to waiver high-unemployment areas within the state, such as counties. Over 40 states are implementing the time limit in 2016, 23 of them for the first time since before the recession.

Individuals subject to the time limit can receive only three months of SNAP benefits out of every three years unless they are working or in a work training program for 20 hours a week. States are not required to provide slots in training programs to ensure that recipients subject to the time limit have an opportunity to meet the requirement, and most don’t. As a result, even people who are working under 20 hours a week or are looking for a job or willing to participate in a work program can lose benefits after three months.

Food assistance for this group averages approximately $150 to $170 per person per month. Its loss will likely cause serious hardship among many, since the average income of those potentially affected is less than 20 percent of the poverty line while they’re receiving SNAP. Many of these individuals don’t qualify for other sources of assistance, and research shows that many face barriers to work.[26]

Another key issue is whether states will be able to maintain their progress in reaching eligible households. As noted, SNAP caseloads grew during the recession both because more people qualified for help (due to the weak economy) and because a larger share of eligible people applied for and received benefits. To the extent that administrative barriers are a factor in recent SNAP caseload declines, state and federal policymakers should address the problems. States have made significant gains in lowering barriers to SNAP for eligible individuals and should assess whether some eligible individuals continue to face barriers to applying for and receiving SNAP.

| TABLE 1 |

|---|

| |

SNAP Participants, FY 2013 (000s) |

SNAP Participants, FY 2015 (000s) |

Percentage Change in Number of Participants, 2013-2015 |

Participants as Share of Population, FY 2013 |

Participants as Share of Population, FY 2015 |

Percentage Change in Participants as Share of Population, 2013-2015 |

|---|

| Alabama |

915 |

889 |

-2.8% |

19.0% |

18.3% |

-3.4% |

|---|

| Alaska |

91 |

81 |

-11.2% |

12.4% |

11.0% |

-11.5% |

| Arizona |

1,111 |

999 |

-10.1% |

16.8% |

14.7% |

-12.5% |

| Arkansas |

505 |

469 |

-7.1% |

17.1% |

15.8% |

-7.7% |

| California |

4,159 |

4,418 |

6.2% |

10.9% |

11.3% |

4.3% |

| Colorado |

508 |

495 |

-2.5% |

9.7% |

9.1% |

-5.7% |

| Connecticut |

425 |

442 |

4.0% |

11.8% |

12.3% |

4.1% |

| Delaware |

153 |

150 |

-2.1% |

16.6% |

15.9% |

-4.1% |

| Dist. of Col. |

145 |

142 |

-2.1% |

22.5% |

21.2% |

-5.5% |

| Florida |

3,556 |

3,656 |

2.8% |

18.2% |

18.1% |

-0.4% |

| Georgia |

1,948 |

1,801 |

-7.6% |

19.5% |

17.7% |

-9.5% |

| Hawaii |

189 |

189 |

-0.2% |

13.5% |

13.2% |

-1.9% |

| Idaho |

227 |

197 |

-13.3% |

14.1% |

11.9% |

-15.4% |

| Illinois |

2,040 |

2,042 |

0.1% |

15.8% |

15.9% |

0.2% |

| Indiana |

926 |

832 |

-10.2% |

14.1% |

12.6% |

-10.9% |

| Iowa |

420 |

391 |

-6.9% |

13.6% |

12.5% |

-7.9% |

| Kansas |

317 |

274 |

-13.6% |

11.0% |

9.4% |

-14.1% |

| Kentucky |

872 |

769 |

-11.9% |

19.9% |

17.4% |

-12.4% |

| Louisiana |

940 |

860 |

-8.5% |

20.3% |

18.4% |

-9.4% |

| Maine |

249 |

203 |

-18.7% |

18.7% |

15.2% |

-18.7% |

| Maryland |

771 |

781 |

1.3% |

13.0% |

13.0% |

0.1% |

| Massachusetts |

888 |

786 |

-11.5% |

13.3% |

11.6% |

-12.6% |

| Michigan |

1,776 |

1,571 |

-11.5% |

17.9% |

15.8% |

-11.7% |

| Minnesota |

553 |

496 |

-10.3% |

10.2% |

9.1% |

-11.4% |

| Mississippi |

669 |

636 |

-4.8% |

22.4% |

21.3% |

-4.9% |

| Missouri |

930 |

845 |

-9.2% |

15.4% |

13.9% |

-9.8% |

| Montana |

129 |

119 |

-7.4% |

12.7% |

11.6% |

-9.0% |

| Nebraska |

180 |

174 |

-3.1% |

9.6% |

9.2% |

-4.5% |

| Nevada |

361 |

420 |

16.5% |

13.0% |

14.6% |

12.7% |

| New Hampshire |

117 |

106 |

-9.4% |

8.9% |

8.0% |

-9.9% |

| New Jersey |

876 |

906 |

3.4% |

9.8% |

10.1% |

2.8% |

| New Mexico |

440 |

453 |

2.9% |

21.1% |

21.7% |

2.9% |

| New York |

3,170 |

3,039 |

-4.1% |

16.1% |

15.4% |

-4.7% |

| North Carolina |

1,704 |

1,646 |

-3.4% |

17.4% |

16.4% |

-5.2% |

| North Dakota |

57 |

53 |

-6.0% |

7.9% |

7.1% |

-10.3% |

| Ohio |

1,825 |

1,676 |

-8.1% |

15.8% |

14.4% |

-8.5% |

| Oklahoma |

622 |

598 |

-3.8% |

16.2% |

15.3% |

-5.3% |

| Oregon |

818 |

780 |

-4.6% |

20.9% |

19.4% |

-6.8% |

| Pennsylvania |

1,785 |

1,827 |

2.3% |

14.0% |

14.3% |

2.2% |

| Rhode Island |

180 |

175 |

-2.7% |

17.1% |

16.6% |

-3.0% |

| South Carolina |

876 |

805 |

-8.1% |

18.4% |

16.5% |

-10.4% |

| South Dakota |

104 |

99 |

-5.3% |

12.4% |

11.5% |

-6.9% |

| Tennessee |

1,342 |

1,229 |

-8.4% |

20.7% |

18.7% |

-9.8% |

| Texas |

4,042 |

3,725 |

-7.8% |

15.3% |

13.6% |

-11.0% |

| Utah |

252 |

226 |

-10.3% |

8.7% |

7.6% |

-13.1% |

| Vermont |

101 |

85 |

-15.5% |

16.0% |

13.6% |

-15.4% |

| Virginia |

941 |

860 |

-8.6% |

11.4% |

10.3% |

-9.9% |

| Washington |

1,113 |

1,071 |

-3.8% |

16.0% |

15.0% |

-6.3% |

| West Virginia |

351 |

368 |

4.9% |

18.9% |

19.9% |

5.4% |

| Wisconsin |

857 |

806 |

-6.0% |

14.9% |

14.0% |

-6.5% |

| Wyoming |

38 |

33 |

-14.3% |

6.5% |

5.6% |

-14.9% |

| Guam |

46 |

47 |

3.5% |

28.3% |

29.2% |

2.9% |

| Virgin Islands |

27 |

27 |

0.1% |

26.2% |

26.5% |

1.2% |

| United States |

47,636 |

45,767 |

-3.9% |

15.1% |

14.2% |

-5.4% |