We have updated this paper to reflect the latest data. Please find the current version

here.

Some policymakers have cited the replacement of the Aid to Families with Dependent Children (AFDC) program with the Temporary Assistance for Needy Families (TANF) block grant under the 1996 welfare law as a model for how to dramatically restructure other federally funded programs for low-income families. House Budget Committee Chairman Paul Ryan has proposed converting Medicaid, SNAP (food stamps), and other unspecified low-income programs into block grants to states and significantly reducing their funding levels, citing TANF as the model.[2]

A close examination of how states have used their federal and state funds under TANF, however, provides a cautionary tale about the dangers of converting basic safety-net programs to block grants. With the TANF block grant in place, the cash assistance safety net for the nation’s poorest families with children has grown weaker, not stronger. Moreover, most states failed to respond adequately in providing assistance to very poor families during the recent recession when the need for such help increased markedly.

The TANF block grant fundamentally altered both the structure and the allowable uses of federal and state dollars previously spent on AFDC and related programs. Under TANF, the federal government gives states a fixed block grant totaling $16.5 billion each year and requires them to maintain a certain level of state spending (totaling $10 billion-11 billion a year), based on a state’s level of spending for AFDC and related programs prior to its conversion to TANF in 1996. (This state funding requirement is known as the “maintenance of effort” requirement, or MOE.)

States can use their federal TANF dollars and state MOE funds to support a broad range of activities related to promoting the four purposes of TANF specified in federal law: assisting needy families so children can be cared for in their own homes or the homes of relatives; reducing the dependency of needy parents by promoting job preparation, work and marriage; preventing out-of-wedlock pregnancies; and encouraging the formation and maintenance of two-parent families.

While states vary significantly in how they have used their TANF and MOE funds, several overall patterns have emerged. Beginning in TANF’s early years, shrinking cash assistance caseloads freed up federal and state funds that had previously gone to poor families in the form of benefits. States used the flexibility that the block grant gave them to redirect those funds. Some of the freed-up funds were channeled to child care and welfare-to-work programs to further welfare reform efforts, particularly in TANF’s early years. But over time, states redirected a substantial portion of their TANF and MOE finds to other purposes, with some funds being used to substitute for (or “supplant”) existing state spending and thereby help plug holes in state budgets or free up funds for purposes unrelated to low-income families or children. When the recent recession hit in late 2007, many states were unable — for fiscal or political reasons — to reclaim those dollars to address the substantial increases in need for cash assistance among the growing numbers of poor families; instead, facing budget shortfalls, many states cut already-low TANF benefit amounts further, shortened TANF time limits, or took other actions to shrink caseloads or keep them from rising much in the face of mounting need.

In 1995, for every 100 families with children living in poverty, 68 received cash assistance through AFDC to help meet basic needs; by 2010, for every 100 families that were poor, only 27 families received such assistance.[3] Moreover, for families still receiving cash assistance, median benefit levels have plummeted — falling 20 percent since TANF’s creation (after adjusting for inflation). Benefits for a family without other cash income now fall below 30 percent of the poverty line in the majority of states.[4] As a result of these two trends, TANF now lifts a far smaller fraction of deeply poor families and children out of severe poverty than AFDC did. A recent study finds that the number of U.S. families and children living below a standard the World Bank uses to measure serious poverty in third-world countries — living on less than $2 per person per day — has doubled since TANF’s creation.[5]

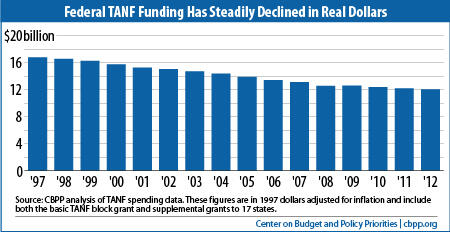

Contributing to these outcomes is the fact that the amount of funding the federal TANF block grant provides is lower now — not just in inflation-adjusted terms but even in nominal terms — than when TANF was created in 1996. (See box on p. 4.) The basic TANF block-grant dollar amount has been frozen since 1996, with no adjustment for inflation. And last year Congress terminated the supplemental block-grant funding that had been provided each year since 1996 to 17 mostly poor states that were disadvantaged by the block grant formula.

This report analyzes the changes in federal TANF and state MOE expenditures since 1997, with a focus on the past decade.[6] We examine key spending trends across all states. We also highlight the wide variations across states in how they spend their TANF/MOE funds.

The key findings of this analysis include the following:

- Spending on basic assistance accounts for a relatively small share of TANF and MOE expenditures. At TANF’s onset, 70 percent of the combined federal TANF and state MOE funds were used for basic assistance for poor families. By contrast, that figure fell to only about 29 percent of TANF and MOE funds in 2011. Nine states spent less than 15percent of their TANF/MOE funds on basic assistance in 2011.

- States initially shifted some resources from cash assistance to activities designed to promote or support work, but those investments leveled off nearly a decade ago. In the early years of TANF, states shifted some of their TANF and MOE funds to support child care or work activities. Spending in these areas has remained generally flat for the last decade, however, and has dropped somewhat in recent years. States now spend only about a quarter of their TANF and MOE dollars on child care and work activities.

- States are using a significant and growing share of TANF and MOE funds to support other state services, including child welfare; states also have diverted substantial funds formerly used to assist poor families to other purposes. In some cases, states’ use of TANF and MOE funds for other services has enabled states to expand useful existing services. In other cases, states have used TANF/MOE funds to replace existing state funds, thereby freeing those state funds for purposes unrelated to providing a safety net or work opportunities for low-income families.

These trends in state TANF/MOE spending over the last 15 years raise concerns about the extent to which states have used TANF or MOE funds for areas beyond the core welfare reform areas and have diverted funds from supporting needy families to filling state budget holes. Congress (and HHS to the extent it has authority) should consider setting tighter parameters for state spending of TANF and MOE dollars.

Policymakers should also look to the lessons learned through the story of spending under the TANF block grant. Block grants may initially entice states with offers of flexibility but ultimately leave them worse off over time, particularly when demographic or economic conditions change or if the block grant amounts are not adjusted for inflation and changes in the size of the low-income population. Block grants can mask deep cuts in federal funding, especially over time.

Moreover, block grants can lead to less accountability, lessened federal direction and oversight, and significant amounts of federal funds being spent in ways that Congress did not envision or intend. Ultimately, block grants can lead to substantial amounts of funding not being used for the purposes for which they were provided and serving instead to help fill state budget holes.

Readers interested in learning more about state TANF spending patterns can access companion state fact sheets to this report, which provide information on TANF expenditure trends in each of the 50 states and the District of Columbia, while Appendix I provides additional background on TANF and MOE funding and the rules regarding states’ use of TANF and MOE dollars.

TANF and MOE Spending Has Declined Significantly in Inflation-Adjusted Terms

For the most part, the spending data we discuss in this paper are not adjusted for inflation; to avoid confusion, we use the actual dollar amounts that states have reported they spent each year under TANF. Unless we note otherwise, the text and the figures use these nominal dollars. Readers thus should recognize that a trend that appears to be flat spending actually represents a decline in expenditures in real — or inflation-adjusted — dollars. Similarly, an apparent increase in nominal-dollar spending may not represent a true increase when considered in real dollars. And a decline in nominal-dollar spending since TANF’s creation in 1996 represents a much larger reduction in real-dollar spending. We have, however, adjusted for inflation in several instances through the report, including in the figure in this box, to illustrate what the inflation-adjusted trend looks like there is no adjustment for inflation built into either the federal TANF block grant allocations or state MOE requirements. Over time, both federal TANF funding and state MOE spending requirements thus have eroded substantially in real terms. The TANF block grant was funded at $16.5 billion in 1996 and has remained at that level ever since. After adjusting for inflation, states now receive 30 percent less in federal TANF funding than when Congress enacted the welfare law in 1996 (see figure below).

Moreover, in 2012, Congress reduced overall federal TANF funding when it failed to fund the TANF Supplemental Grants, which Congress created as an integral part of TANF in 1996 and provided to 17 states every year from then until last year. (The Supplemental Grants were only partially funded for FY 2011 and were not funded at all for FY 2012.) The Supplemental Grants were intended to help address the disadvantage that various states (primarily the poorest ones and those with high population growth) faced as a result of the decision reflected in the 1996 welfare law to base each state’s TANF block grant funding amount on that state’s expenditure level under AFDC in the mid-1990s. The TANF allocation formula does not reflect changes since the mid-1990s in the size of a state’s population. It also locks states whose AFDC expenditures per poor child were very low in the mid-1990s into low investments on a permanent basis. The Supplemental Grants were designed to lessen the resulting inequities and problems. Now, however, nothing in TANF does.

The minimum amount that each state is required to expand to meet its MOE obligation has also remained flat since 1996, with no adjustment for inflation; it, too, has declined 30 percent in real terms. (This is in addition to the fact that the MOE requirement requires states to spend only 80 percent — or in some cases, 75 percent — of the nominal amount they were spending on AFDC and related programs in the mid-1990s,prior to TANF’s creation.)

States have a total of $27 billion-$28 billion in combined federal TANF and state MOE funds available to spend each year.[7] The total amount actually expended, however, varies for several reasons. States can carry over some of their unspent federal TANF dollars to a future year. They also can claim to have made MOE expenditures in excess of the minimum requirement, and they have incentives to do so. Much of the “excess” state MOE spending, however, reflects accounting maneuvers and does not constitute a true increase in state MOE expenditures, as explained below.

In the past few years, states have received some additional federal funds from the TANF Contingency Fund created as part of the 1996 welfare reform legislation and the TANF Emergency Fund, created by the 2009 Recovery Act (which has since expired). These funds were intended to make some additional funding available during periods such as recessions (although the Contingency Fund is beset with problems in how and when it allocates funds to states and has not performed this function well).

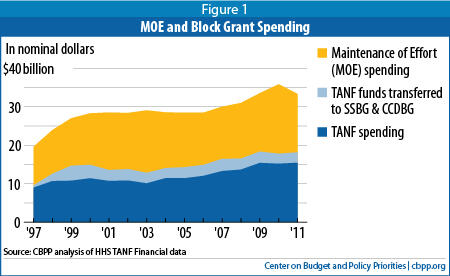

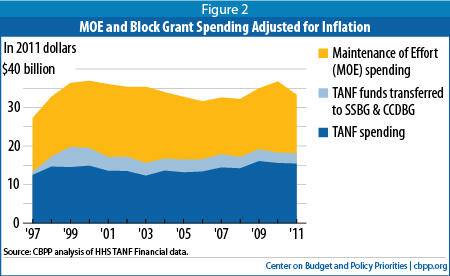

In general, total TANF and claimed MOE spending gradually edged up over the years in nominal dollars, rising for example, from $27 billion in 1999 to $31 billion in 2008 (see Figure 1). Total TANF and MOE spending reached a high of $35.8 billion in 2010, in substantial part due to an additional $5 billion in federal funds made available in fiscal years 2009 and 2010 through the Recovery Act’s TANF Emergency Fund. In 2011, total TANF and MOE spending declined by $2.5 billion, to $33.3 billion.

Looking at total TANF and MOE spending over time in inflation-adjusted dollars illustrates that, after initially ramping up when TANF was created and other than the temporary bump in recent years that has ended, spending has not increased in real dollars (see Figure 2). After adjusting for inflation, the $33.3 billion in expenditures in 2011 is about the same as the $27 billion expended in 1998 — a year when the national unemployment rate was a little more than half what it was in 2011.

In the first few years after Congress created TANF, caseloads plummeted — and many states spent

less than the annual block grant amount allotted to them and thereby accumulated significant TANF reserves.

[8] States then began to spend down these reserves, partly in response to fears that Congress would take back the unspent TANF reserves and partly because of mounting pressure to use these funds to help finance other parts of state budgets. As discussed below, states have increasingly come to view the TANF block grant as a source of federal funds that can free up state money for an array of other uses. In 2007, at the onset of the recession, state reserves (i.e., unspent TANF funds) totaled $4 billion across the nation, down from $7 billion at their peak in 2000.

[9]

Total expenditures that states claimed as MOE spending remained fairly consistent at $10 billion-$11 billion per year in TANF’s early years but rose to more than $15 billion by 2009, with a number of states reporting spending significantly more than their minimum MOE requirement. These increases generally did not, however, involve an increase in state resources for needy families; instead, they largely reflected the fact that states have become more aggressive in claiming and counting existing state or local governmental or third-party (i.e., non-governmental) spending as MOE.[10]

After the Deficit Reduction Act of 2005 made it harder for states to meet their TANF “work participation rate” requirements — and thereby threatened more states with the potential loss of some federal TANF funds — a number of states found it advantageous to claim additional expenditures they hadn’t previously reported as MOE. This was beneficial to states because they can use reported MOE spending in excess of their minimum MOE requirement to obtain “caseload reduction credits” that lower the work participation rate they must meet. Thus, the amount that states claim as MOE spending began to rise substantially after the TANF changes in the Deficit Reduction Act of 2005 took effect.

States have broad flexibility in how they spend federal and state TANF dollars for activities that meet any of TANF’s four purposes.a They are required to report quarterly and annually on how much they have spent and what they spent the funds on; the data cited here on how states have used their TANF funds come from these reports.b

Each state reports how much TANF or MOE spending occurred during the reporting period in question in each of 21 categories or subcategories of spending identified on ACF Form 196 (the form states must submit to HHS). We combine these 21 federal reporting subcategories into nine broader categories, and discuss five of the nine here in greater detail. (See Appendix II for details about how we regrouped the 21 subcategories.) The nine categories (those in bold are discussed in greater detail in this analysis) are:

- basic assistance;

- administration and systems;

- work-related activities and supports;

- child care (including transfers to the Child Care and Development Fund);

- refundable tax credits for low-income working families;

- nonrecurring short-term benefits, generally for emergency needs;

- pregnancy prevention and two-parent family formation and maintenance;

- transfers to the Social Services Block Grant; and

- spending categorized as “Authorized Under Prior Law” or “Other Nonassistance.”c

In addition to identifying what TANF or MOE spending was used for, a state also must identify the specific funding source for each expenditure subcategory. A state must identify if it used federal funds and, if so, whether the funds were from the regular TANF block grant or other TANF sources (e.g., the Contingency Fund or the TANF Emergency Fund). If state MOE funds were used, a state must identify if the funds were spent for a program that also received federal TANF funds or in a separate state program that did not receive TANF funds.d

Our analysis uses the term “federal TANF dollars” to include expenditures from the TANF block grant plus any additional federal funds received through the TANF Contingency Fund, the TANF Emergency Fund, or the TANF Supplemental Grants that 17 states received until this year. (See Appendix I for details on the various TANF-related federal funding streams.) Our analysis also combines each state’s MOE expenditure data (rather than separating out expenditures for separate state programs). Finally, for the most part, we combine TANF and MOE spending data rather than focusing on whether the funds used for a particular purpose were TANF funds or MOE funds.

aSee Appendix I for more background on TANF funding and state spending flexibility.

bThe primary source of TANF and MOE spending information is the reports that states file with HHS on a quarterly (and annual) basis on the form ACF-196. See, ACF 196 TANF Report Form and Instructions, http://www.acf.hhs.gov/programs/ofa/policy/pi-ofa/2009/200910/pi200910.htm

cSee box on p.17 for more detail on what activities fall in the AUPL and “Other Nonassistance” categories. Throughout this report, we use the term “Authorized Under Prior Law” or the shorthand AUPL for the spending category that the Department of Health and Human Services labels as Authorized Solely Under Prior Law. See Appendix II.

dThere are some differences in how TANF or MOE funds can be used. There also are some differences in certain TANF requirements regarding the use of funds; the application of these requirements depends on the source of the funding in question. See Appendix I.

Furthermore, with the onset of the recession in December 2007, states had another reason to claim MOE expenditures above the minimum level that a state is required to spend: doing so helps a state qualify for money from the TANF Contingency Fund.[11]

In addition to claiming more longstanding state expenditures as MOE in recent years, some states have moved aggressively to claim existing expendituresby third parties, such as food banks or domestic violence shelters, as MOE. Some states have done this in order to institute budget cuts that withdraw substantial state funds that were used for TANF purposes, while still claiming to meet their MOE requirement so that they aren’t penalized for failing to do so. States employ this strategy to claim increased MOE spending even as they are withdrawing state funding and cutting benefits or services for low-income families. A state following this practice can appear to be holding TANF/MOE spending steady or increasing it, while cutting TANF services markedly.

One vivid example comes from Georgia, where third-party spending now represents nearly half of all MOE that the state claims, an increase of 20 percent between fiscal years 2010 and 2011. During the same period, the state has cut funding substantially for TANF-related benefits and services.[12]

In general, states must spend TANF and MOE funds on activities that further one of TANF’s four purposes:

- assisting needy families so children can be cared for in their own homes or the home of relatives;

- reducing the dependency of needy parents by promoting job preparation, work, and marriage;

- preventing out-of-wedlock pregnancies; and

- encouraging the formation and maintenance of two-parent families.

States may also spend funds on activities that they supported with Emergency Assistance funds prior to 1996 even if the activities do not fall under one of these four TANF purposes. Spending under this grandfathered authority is reported as “Authorized Under Prior Law” (AUPL).

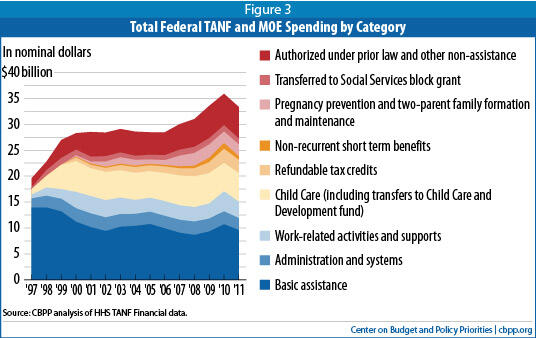

Over time, states have shifted much of their TANF and MOE spending from basic assistance to other activities (see Figure 3). This section examines some of those shifts, with particular emphasis on five key areas of spending: 1) basic assistance; 2) work activities and supports; 3) child care; 4) spending that is AUPL or “Other Nonassistance” spending; and 5) pregnancy prevention and support and maintenance of two-parent families. (See Appendix II for more information on what we included in these five spending categories; also see box on page 17 for more information on AUPL and “Other Nonassistance.”)

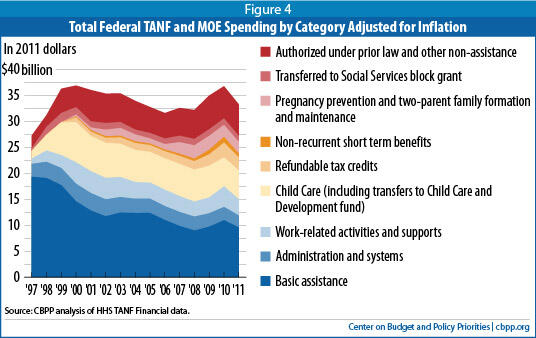

In fiscal years 1997 and 1998, states spent 70 percent and 58 percent, respectively, of their combined TANF and MOE dollars on basic assistance. By 2008 and 2009, that share had declined to just 28 percent. (It rose slightly to 30 percent for 2010, but was down to 29 percent for 2011.) The decline in spending on basic assistance is even more dramatic when shown in real (inflation-adjusted) dollars (see Figure 4). The sharespent on work activities and child care grew quickly at the beginning of TANF — doubling between 1998 and 2000 to about one-quarter of total TANF/MOE spending — but has remained nearly flat in nominal dollars since (with a slight decline since 2000 when viewed as inflation-adjusted dollars).

Meanwhile, other areas of spending have received substantial increases. By 2011, three areas of spending that accounted for just 7 percent of total TANF/MOE spending in 1998 had climbed to almost 33 percent: refundable tax credits, pregnancy prevention and the two-parent family formation, and the AUPL/“Other Nonassistance” category. In recent years, states have spent a larger share of TANF and MOE funds in these three categories combined than on basic assistance.

Spending trends in some individual states have been even more dramatic. For example, while states overall spent only 29 percent of their total TANF/MOE dollars on basic assistance in 2011, nine states spent 15 percent or less on it, with four of these states spending less than 10 percent. Similarly, in 2011, states overall spent 18 percent of TANF/MOE funds in the combined AUPL/“Other Nonassistance” category, but 12 states spent more than 35 percent in this category and seven of those states spent more than 45 percent. While many of these may be worthy expenditures, the more broadly TANF funds are spread, the fewer resources are available to provide basic assistance and to fund work services and supports that can help recipients find and maintain employment.

A big part of the story of TANF and MOE spending over the last 15 years has been the shift away from basic assistance to other areas of spending, which is reflected in the dramatic decline in the amount of basic assistance provided to very poor families. This shift has substantially reduced TANF’s ability to reduce severe poverty and to respond to increases in need in hard economic times.

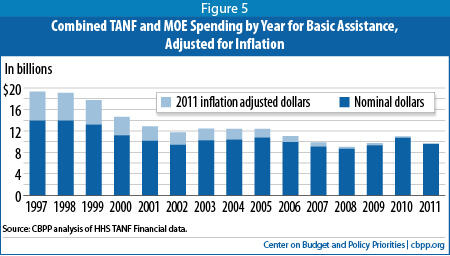

In each of TANF’s first two years, states spent nearly $14 billion in TANF/MOE funds on basic assistance. By 2008, spending on basic assistance dropped to $8.6 billion, before rising to $9.3 billion in 2009 and $10.7 billion in 2010, when all states had access to additional federal funds provided through the TANF Emergency Fund and some states also obtained funds through the Contingency Fund. The $9.6 billion spent on basic assistance in 2011 was lower than in 2010, but higher than in 2009. (See Figure 5.) Even with higher levels of spending in recent years, the change from 1997 to 2011 represents a 50 percent decrease in spending in inflation-adjusted dollars, despite the fact that the 9 percent national unemployment rate in 2011 was far above the 5 percent rate in 1997.

As noted earlier, the $14 billion spent in 1997 and again in 1998 represented 70 percent and 58 percent, respectively, of total TANF/MOE spending in each of those years. The $9.6 billion spent in 2011 represented 29 percent of national TANF/MOE expenditures that year.

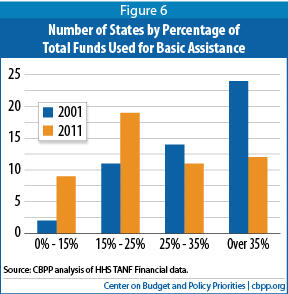

This trend toward spending a smaller amount, and a diminished share, of TANF and MOE dollars on basic assistance was even more pronounced in certain states. Between 2001 and 2011, the number of states spending less than 25 percent of their TANF/MOE funds on basic assistance more than doubled, from 13 to 28 states, while the number spending more than 25 percent of TANF/MOE funds on basic assistance plunged from 38 to 23 (see Figure 6).

Not surprisingly, the states that spend the smallest shares of their TANF/MOE funds on basic assistance are states where TANF provides a weak safety net for poor families and children. For the most part, these states have the nation’s lowest benefit levels and provide basic cash assistance to a smaller share of poor families than does the typical state. In the eight states that spend the smallest shares of their TANF/MOE funds on basic assistance, no more than 11 of every 100 families with children who lived in poverty in 2009 and 2010 received TANF cash assistance (the ratio was 27 out of 100 such families for the United States as a whole).

[13]

A central tenet of TANF is that cash assistance should provide temporary support while a family engages in required activities to help it connect to or prepare for work. Yet, analysis of state spending shows that most states spend little of their TANF funding on work-related activities.

For this analysis, we combined six different federal-reporting subcategories into a work-related activities category.[14] Nationally, most of the TANF and MOE spending in this category is reported in the broad “Other work activities” subcategory; a smaller share is spent on activities and services such as education and training or transportation to help low-income parents commute to a job or to a work program. Some states, however, spend a substantial share of their work-related activity spending in one of these smaller subcategories.[15]

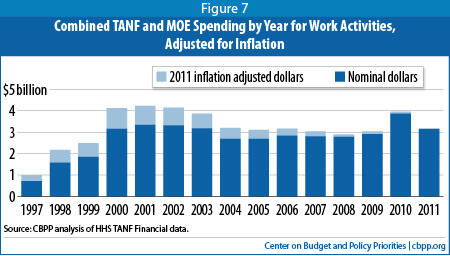

In TANF’s early years, investment in work-related activities more than doubled, from $724 million in 1997 to $1.9 billion in 1999 (see Figure 7). It then almost doubled again, reaching $3.3 billion annually in 2001 and 2002. It fell between 2003 and 2009, however, fluctuating between $2.7 billion (in 2004 and 2005) and $2.9 billion (in 2009). The change from 2000 to 2009 represents a 26 percent decrease in spending in real (inflation-adjusted) dollars.

For 2010, funding on work-related activities spiked to nearly $3.9 billion as a result of the additional $1 billion that states spent on subsidized employment programs that year under the TANF Emergency Fund.[16] When the Emergency Fund ended on September 30, 2010, most states discontinued or significantly scaled back their subsidized employment programs. Accordingly, the amount spent on work activities declined to $3.1 billion in 2011.

A look at the percentage of totalTANF/MOE spending that is devoted to these work-related activities reveals a similar pattern: a rapid rise in the early years from 3.7 percent of total TANF/MOE expenditures in 1997 to 11.7 percent in 2001 and 2002, a drop to below 10 percent for the 2004-2009 period, and a modest (but temporary) increase to 10.7 percent for 2010. At 9.4 percent, the share of TANF/MOE spending devoted to work activities in 2011 was back to where it was in the 2004-2009 period.

As with spending on basic assistance, there is significant variation across states. In 2011, 12 states spent less than 5 percent of their TANF and MOE funds in this category, while seven states spent more than 20 percent (and two of them spent 40 percent or more).

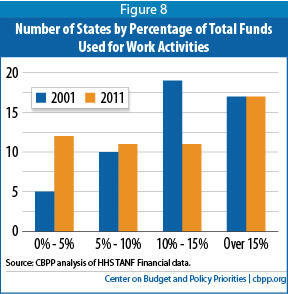

Between 2001 and 2011, the number of states spending less than 10 percent of TANF/MOE funding on work-related activities grew from 15 to 23 (see Figure 8).

On the whole, with the exception of 2010 when states received additional funding for subsidized jobs, states have not built upon or even maintained their initial increases in spending on work-related activities under TANF. Instead, they have withdrawn funding from these activities over most of the last decade. A handful of states have directed a sizable share of their work-related funds to transportation, an important support service, but TANF recipients need other work-related services as well. The rhetoric of welfare reform notwithstanding, states for the most part are not putting the funds freed up from reduced caseloads into helping TANF recipients prepare for or find work.

One of the initial bright spots under welfare reform was an increase in funding for child care. The increase in child care funding came from several different sources. First, the 1996 welfare law created a new Child Care Development Fund under the Child Care and Development Block Grant (CCDBG). [17] In addition, states could transfer a portion of their TANF block grant dollars to CCDBG. Finally, states could spend TANF or state MOE funds directly on child care (without having to transfer the funds to CCDBG) since spending on child care for needy families furthers one of the TANF block grant’s goals — connecting families to work. In this analysis, we look at trends in state use of TANF/MOE funds for child care, including TANF funds transferred to CCDBG (but not other federal funds, such as those directly appropriated to CCDBG).

States need not limit child care assistance financed by TANF and MOE funds to families that receive cash assistance; states can also use these funds for families that have left TANF for work, or other low-income working families. When families go to work and cash assistance caseloads decline, the need for child care funds increases.

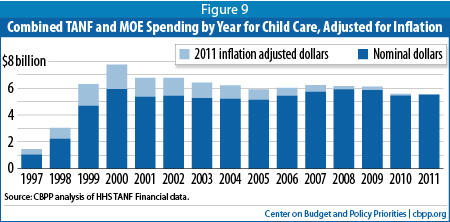

In TANF’s early years, TANF/MOE spending on child care increased dramatically, increasing more than five-fold from $1.1 billion in 1997 (TANF’s phase-in year) to $5.9 billion in 2000 (see Figure 9). It then fluctuated between $5 billion-$6 billion over the following decade (the 2011 figure was $5.5 billion).[18] The change from 2000 to 2011 represents a 29 percent decrease in real dollars.

The percentage of TANF/MOE funds used for child care follows a similar pattern: it jumped sharply in TANF’s early years, from 5.4 percent in 1997 to 21 percent in 2000, but stayed in the range of 18 percent to 19 percent for much of the past decade, before dropping from 19 percent in 2008 to 15 percent in 2010 and 17 percent in 2011.

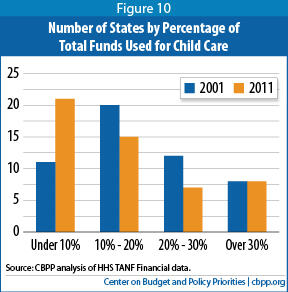

These national figures mask a spread across states. In 2011, eight states spent more than 30 percent of their TANF/MOE funds on child care; two of these states, Pennsylvania and Illinois, spent more than 40 percent. At the other end of the spectrum, 21 states spent less than 10 percent of TANF/MOE funds on child care in 2011, with ten spending less than 5 percent (see Figure 10).

Between 2008 and 2011, TANF/MOE spending on child care declined by $393 million or 7 percent. That figure reflects increases in some states and cutbacks in others. Nineteen states increased TANF/MOE spending on child care by a combined total of slightly more than $411 million between 2008 and 2011, while 32 states cut such spending by nearly $803 million.[19] Six states cut TANF/MOE spending on child care by 60 percent or more: Alabama, Arkansas, Colorado, Louisiana, Michigan, and Nevada. Two large states — California and Michigan — cut TANF/MOE spending for child care by a combined $471 million, more than the overall $393 million net decline in such spending across the nation.

Spending that is “Authorized Under Prior Law” (AUPL) or is labeled as “Other Nonassistance” encompasses expenditures for many different types of benefits and services. AUPL is spending that is allowed under TANF because, although not within the four TANF purposes, it is used for a service that was in the state’s AFDC Emergency Assistance plan at the time of the conversion of AFDC to TANF and thus was grandfathered as a permissible use of federal TANF funds. The majority of spending in AUPL is for child welfare services. In contrast, “Other Nonassistance” is a catch-all category of TANF/MOE spending that must fall within the four purposes of TANF but doesn’t specifically fit in another spending category for reporting purposes and does not fall within the definition of “assistance.” It covers a broader range of uses including, for example, child welfare and early education. (See Box on p. 17 for more detail.) We combine these two reporting categories for a general discussion of spending trends, with some separate detail about each of the two categories below.[20]

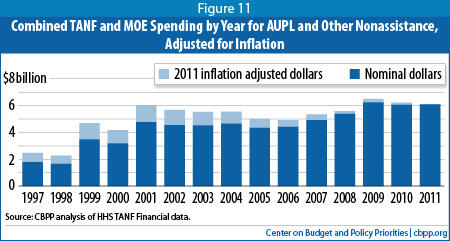

Spending on AUPL and “Other Nonassistance” has grown substantially under TANF — from $1.7 billion in 1997[21] to $3.5 billion in 1999 and $6 billion in 2011 (see Figure 11). Even when adjusted for inflation, the change from 1997 to 2011 represents a 152 percent increase. The percentage of TANF/MOE spending that goes for AUPL and “Other Nonassistance” has likewise increased, from 9 percent of TANF/MOE expenditures in 1997 to between 17 percent and 19 percent in recent years.

The growth over time has occurred almost entirely in “Other Nonassistance,” with total AUPL spending staying largely static.[22] Spending reported for “Other Nonassistance” rose from $3.2 billion in 2001 to $4.6 billion in 2009, while AUPL spending fluctuated between $1.6 billion and $1.7 billion over the same period. “Other Nonassistance” represented three-fourths, or $4.5 billion, of the spending in this combined category in 2011.

Growth in reported “Other Nonassistance” spending has been fueled almost entirely by MOE dollars; TANF spending here has remained at around $2 billion since 2001, while MOE spending claimed as “Other Nonassistance” has more than doubled since 2001 and stood at $2.5 billion in 2011. Much of that increase has occurred since 2006, particularly from 2009 through 2011.[23]

Although MOE spending reported in this category has increased, it does not necessarily represent an increase in underlying state spending or in benefits or services for low-income families. That’s because states can increase their reported MOE spending both by claiming existing state spending they hadn’t previously reported as MOE and by reporting existing third-party non-governmental spending they hadn’t previously counted as MOE. (See discussion on p. 6 and Appendix I). The increase in MOE spending in this category is likely to primarily reflect increases in the use by states of these types of accounting mechanisms.

AUPL represents spending for certain purposes that federal law formerly permitted states to support with AFDC funds and that states may now support with TANF funds, even if these purposes don’t fall within one of TANF’s four purposes. For example, broad though TANF’s purposes are, they don’t include some activities funded by state Emergency Assistance programs (under Title IV-A of the Social Security Act) that existed before TANF enactment. Such activities include certain juvenile justice, child welfare, and foster care activities for children who don’t live with parents or relatives. States may use federal TANF funds, but not MOE funds, for AUPL.

The “Other Nonassistance” category is intended to capture spending that TANF doesn’t consider “assistance” and that doesn’t fit into any other reporting category but is permitted because it meets one of the four purposes of TANF; examples include costs of general family preservation activities, parenting training, substance abuse treatment, and domestic violence services.a

The AUPL and “Other Nonassistance” categories are broad, and it can be difficult to determine precisely what services or benefits they cover. A study from Mathematica Policy Research concluded that most spending in this combined category is related to child welfare services.b

When Congress extended TANF for 2011, it required states to submit temporary spending reports covering March through June 2011 that provide more detail about these two categories.c HHS compiled the state-reported data in two reports to Congress.d The data show that more than 85 percent of expenditures reported as AUPL were for child welfare activities,e as was about a quarter of spending for “Other Nonassistance.” Some of the other spending in this category went for TANF program management and related expenses adult post-secondary education, and early childhood education. (It appears that some spending that various states report as “Other Nonassistance” could instead be classified under another TANF spending category. For example, much of the spending is supported by purpose 3, preventing non-marital pregnancy, but is reported here and not under the separate reporting category for purpose 3 and 4.)

a See HHS instructions on completion of financial data reporting form ACF 196 at http://www.acf.hhs.gov/programs/ofa/data/2011fin/categories.pdf

b Michelle Derr et al., “Understanding Two Categories of TANF Spending: ‘Other’ and ‘Authorized Under Prior Law,’” Mathematica Policy Research, September 2009, http://mathematica-mpr.com/publications/PDFs/family_support/TANF_spending.pdf. See ACF 196 (SUP), Detailed Expenditure Form and instructions for http://www.acf.hhs.gov/programs/ofa/policy/pi-ofa/2011/pi201104/pi201104.html.

c See ACF 196 (SUP), Detailed Expenditure Form and instructions for http://www.acf.hhs.gov/programs/ofa/policy/pi-ofa/2011/pi201104/pi201104.html.

d “Engagement in Additional Work Activities and Expenditures for Other Benefits and Services, March 2011: A Report to Congress,” HHS, http://www.acf.hhs.gov/programs/ofa/data-reports/cra/2011/march2011/cra_report-to-congress.html and “Engagement in Additional Work Activities and Expenditures for Other Benefits and Services, April-June, 2011: A Report to Congress,” HHS, http://www.acf.hhs.gov/programs/ofa/data-reports/cra/2011/june2011/cra-june2011.html.

eIbid.

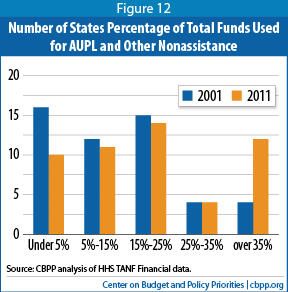

Although states collectively spent 18 percent of TANF/MOE funds on the combined AUPL/“Other Nonassistance” category in 2011, individual state spending on this category, like the others, varies widely (see Figure 12). Five states reported spending less than 2 percent of their TANF/MOE funds on AUPL/“Other Nonassistance,” while 13 states spent more than one-third of TANF/MOE funds in this category, and three states spent more than half.

Looking at the aggregate spending over the period from 1997 through 2011, 13 states spent more than one-quarter of their total TANF/MOE funds in this combined category. While spending in this category has grown in a number of states since 2006, some states have spent a substantial share of their TANF/MOE funds in this category for more than a decade. Colorado, Georgia, South Carolina, and Texas each reported spending more than a third of their total TANF/MOE dollars over the 1997-2010 period in this category.

Pregnancy Prevention and Support and Maintenance of Two-Parent Families

A broad range of activities can further TANF’s third and fourth purposes, preventing out-of-wedlock pregnancies and encouraging the formation and maintenance of two-parent families. Examples of permissible TANF or MOE spending under these purposes include:[24]

- Preventing out-of-wedlock pregnancies: abstinence programs; visiting nurse services; and programs and services for youth such as teen pregnancy prevention campaigns, counseling, and after-school programs that provide supervision when school is not is session. A state may also fund a media campaign for the general population on abstinence or prevention of out-of-wedlock childbearing.

- Encouraging two-parent families: parenting skills training; premarital and marriage counseling and mediation services; activities to promote parental access and visitation; job placement and training services for noncustodial parents; initiatives to promote responsible fatherhood and increase the capacity of fathers to provide emotional and financial support for their children; and crisis or intervention services.

States can use federal TANF dollars for these purposes to serve single or childless adults or youth and can serve persons withoutregard to income; the usual requirement to serve only needy, eligible families with children does not apply here. When a state uses MOE funds for these purposes, however, the needy, eligible family test still generally applies.[25] Even when the “needy” family test applies, some states have defined “needy” as being well above the poverty line for these particular TANF purposes — for example, families with incomes up to four times the poverty line, which is a little over $76,000 a year for a family of three.

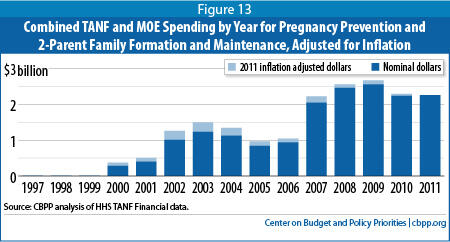

Initially, states did not separately track spending for these purposes under TANF; the first such data appear for 1999, and then only for one state. By 2000, however, more than two-thirds of states reported TANF and MOE spending for these purposes, totaling $284 million; by 2003, this amount had grown to more than $1 billion. Total spending dropped below the $1 billion mark in 2005 and 2006, then jumped sharply — in the wake of the Deficit Reduction Act — to more than $2 billion in 2007 and $2.6 billion by 2009 (before dropping slightly to $2.3 billion for 2011). Even when adjusted for inflation, the change from 2000 to 2011 represents more than a five-fold increase (see Figure 13).

The overwhelming majority of the spending in this combined category — 87 percent in 2011 — falls under purpose 3, preventing out-of-wedlock pregnancies. As states have identified and reported as MOE significant spending from other areas of state and government local government spending in recent years —such as pre-k or other early education, wrap-around activities for K-12, as well as support for higher education in the form of grants for low and middle-income students — this spending has often fallen under purpose 3.[26]

Trends in the share of total TANF and MOE spending used for purposes 3 and 4 follow a similar pattern. This spending grew from 1 percent of total TANF/MOE spending in 2000 to 4.2 percent in 2003, and 6.8 percent in 2011.

As with “Other Nonassistance,” the increases in spending in recent years for purposes 3 and 4 are largely due to increases in claimed MOE spending that occurred in large part as states initiated actions (following enactment of the Deficit Reduction Act in early 2006) to identify increasing amounts of existing state or third-party spending they could count in this category — and thus claim as increased or “excess” MOE spending. Total state MOE spending for purposes 3 and 4 was at least $1 billion a year higher in 2007 and subsequent years than prior to 2007. The amount of spending for purposes 3 and 4 attributable to MOE grew threefold after the DRA, increasing far more than the increase in TANF spending for these purposes. As noted above, the increased MOE spending reported under these purposes is mostly under purpose 3 and does not necessarily signify new or additional state spending and appears, for the most part, to reflect state accounting maneuvers.

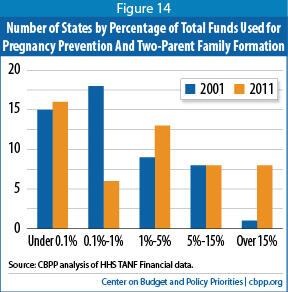

Here, too, tremendous variation in spending exists across states. Some states reported less than 1 percent of their TANF/MOE spending for 2011 in this category, while eight states reported more than 15 percent, and two such states — Arkansas and New Jersey — reported more than 30 percent (see Figure 14).

As noted above, our analysis combined TANF/MOE spending data into nine categories and examined five of them in detail. This section looks briefly at the four remaining categories, which together represent about $6.9 billion in TANF/MOE spending in 2011, or about 20 percent of the funds spent that year.

- Administration and systems: TANF/MOE spending in this category has been generally flat under TANF. Since 1999 (after initial implementation), total spending has fluctuated between $2.3 billion and $2.65 billion, or between 7 percent and 9 percent of total TANF/MOE spending each year. In 2011, the $2.3 billion spent here represented 7 percent of total TANF/MOE spending.

- Transfers to the Social Services Block Grant (SSBG): Thirty-nine states transferred $1.1 billion in TANF funds to this block grant in 2011. These transfers represented 3.4 percent of states’ total TANF and MOE spending that year. The share of TANF funds transferred to the SSBG in 2011 is similar to that transferred in 2001 and has fluctuated only slightly over the last decade.

- Refundable state tax credits: TANF/MOE spending on refundable state tax credits has increased significantly under the TANF block grant. The number of states using TANF or MOE funds for a refundable state tax credit, most commonly a state Earned Income Tax Credit (EITC), increased from 10 in 2001 to 21 in 2011. The total amount of such TANF and MOE spending increased four-fold over this period, from $672 million to $2.5 billion; as a share of TANF/MOE spending, it tripled, from 2.4 percent to 7.6 percent nationally. Some states spend considerably more; seven states spend more than 20 percent of their 2011 TANF/MOE funds in this category. While there has been gradual growth over the past decade, TANF/MOE spending on refundable state tax credits jumped by over $1 billion between 2008 and 2011. [27]

- Nonrecurrent short-term benefits: This category includes short-term aid that is often a one-time benefit and, in any event, does not cover more than four months worth of need. This could be emergency help with rent, utilities, or car repairs or an initial lump-sum “diversion payment” that a family may receive in lieu of receiving ongoing cash assistance. The amount of TANF and MOE funds spent in this category remains small but has grown gradually under TANF with bigger jumps in 2009 and 2010. In 2001, states spent $236 million in this category, less than 1 percent of total TANF/MOE spending. In 2010, states spent $1.1 billion — more than double what they spent in 2008, and 3 percent of total TANF/MOE spending. The bulk of this increase likely was due to the greater availability of monies for this category from the TANF Emergency Fund in 2009 and 2010. Spending in this category declined to $722 million in 2011, and to 2 percent of total TANF/MOE spending.

These trends in state TANF/MOE spending over the last 15 years raise concerns about the extent to which states have used TANF or MOE funds for areas beyond the core welfare reform areas and have diverted funds from supporting needy families to filling state budget holes, even as they provide cash assistance to a declining share of eligible families and fail to meet the needs of many poor — and especially deeply poor — families. Congress (and HHS to the extent it has authority) should consider setting tighter parameters for state spending of TANF and MOE dollars. Possible approaches to consider include the following:

- Increase state accountability. Require more detailed reporting about TANF and MOE spending. For example, require states to provide additional detail on their spending in the “Other Nonassistance” and AUPL categories, as Congress did on a temporary basis this year and which HHS has indicated that it intends to do on an ongoing basis.[28] In addition, states currently are required to provide more detail about MOE funds — such as amounts spent and numbers of families served for each type of expenditure — than they do for federal TANF funds. This detail should be required for federal dollars as well. Finally, states are not required to identify whether MOE expenditures are state funds, local government funds, or third-party funds; to the extent that third-party MOE is retained (see recommendation below to eliminate it), this detail should also be required.

- Narrow the permissible uses of TANF or MOE funds.

- Mandate a minimum share of funding for specified uses. Set a minimum share of a state’s TANF and MOE funds that it must spend in certain core welfare reform categories such as basic assistance and work-related services. A variant of this approach would trigger such requirements only if a state fails to meet certain performance measures; for example, a state that fails to meet its work participation rate requirement could be required to increase its investment in work-related activities for families receiving cash assistance by a set percentage or a threshold amount. A state that has a high rate of children in deep poverty or provides basic assistance to only a very small share of poor (or eligible) families could be required to increase its share of spending on such assistance.

- Prohibit spending that does not further one of the four goals of TANF; specifically, this means terminating or phasing out spending that has been allowed solely because it was Authorized Under Prior Law. This spending has been grandfathered in for the last 15 years, more than enough time for a transition or phase out. Instead, the total spent for AUPL has grown in many states, and this diversion of funds from the goals of TANF should be ended. Alternatively, states should not be able to spend more than a certain percentage (e.g., 5 percent) of TANF funds in this category, or at the very least, a state should not be able to spend more in AUPL (in nominal dollars) than it spent on the grandfathered activities in 1996.

- Define permissible expenditures more narrowly. Some states are spending a significant amount of their funding on activities that push the boundaries of TANF’s four purposes. These expenditures bear no relationship to its core functions of providing a safety net that helps very poor families stay together and helping families find and maintain work. Many of this spending is claimed either under “Other Nonassistance” or under Purpose 3. HHS should exercise its existing authority to prohibit or limit such spending, and to the extent additional authority (or parameters) are needed, Congress should set parameters and delegate the details to HHS.

Put another way, certain activities should not be permissible uses of TANF or MOE funds. For example, child welfare spending should be limited to spending that helps a child remain in his or her own home or the home of a relative. Funding for college scholarships for individuals who are not receiving or do not meet the eligibility criteria to receive TANF cash assistance is an example of an activity currently funded with TANF dollars that should not be permissible. In addition, Congress should narrow (or direct HHS to narrow) the types of activities that can be justified under Purpose 3 as states have pushed that boundary to encompass many types of spending including education spending at all levels (pre-K through college) as well as many other types of activities.

- Limit what a state can count as MOE by eliminating MOE from non-governmental third parties. In recent years, some states have claimed significant amounts of MOE spending from private third parties, in some cases substituting this for state spending and in other cases inflating MOE claims to help states meet work participation rates. This practice should be stopped.

- Define an income limit for “needy families” to ensure that states target TANF and MOE funds toward people with low incomes. Some states have used TANF or MOE funds for services for families at 300 or 400 percent of the poverty line (or even higher). The scarce dollars should be better targeted, and Congress should identify — or direct to HHS to do so — an income limit such as 200 or 250 percent of the poverty line. (Congress might want to specifically and narrowly allow spending up to 85 percent of State Median Income Level for child care in order to coordinate with CCDF limits.)

The story of spending under the TANF block grant for the last 15 years offers broader lessons about the risks of converting core programs for low-income families in which states are guaranteed federal funding for a specified share of their costs from entitlements to block grants. Block grants may initially entice states with offers of flexibility but ultimately leave them worse off over time, particularly when demographic or economic conditions change or if the block grant amounts are not adjusted for inflation and changes in the size of the low-income population. Block grants can mask deep cuts in federal funding, especially over time.

Moreover, block grants can lead to less accountability, lessened federal direction and oversight, and significant amounts of federal funds being spent in ways that Congress did not envision or intend. Ultimately, block grants can lead to substantial amounts of funding not being used for the purposes for which they were provided and serving instead to help fill state budget holes. All of these have occurred under the TANF block grant. The lessons of the last 15 years should provide a cautionary tale for proposals to restructure the funding of other means-tested programs along similar lines.

Key lessons that emerge from the TANF experience include:

- A block grant structure is incompatible with providing a safety net for poor families. Safety-net needs rise and fall with the economy. More job opportunities are available during good economic times than bad ones. Under a block grant that provides a fixed level of funding that does not rise and fall with need, states bear all the financial burden of increased need when the economy slows or the state’s low-income population grows for other reasons. And because states must balance their budgets even during recessions, they generally have been unable or unwilling to provide much added help when need increases — often choosing instead to reduce the assistance to needy families at the very time that poverty and hardship are swelling.

The mechanisms intended to help address these issues under TANF — such as the Contingency Fund for states with poor economies or Supplemental Grants for poor states and states experiencing substantial population growth — have been inadequately funded, and in some cases no longer exist. Moreover, if, like TANF, a block grant’s funding level is not adjusted for inflation, states risk having the purchasing power of the federal funding they receive erode substantially over time. And even inflation-adjusted block grants cannot address increased needs that arise where, due to economic or other circumstances, the size of a state’s poor population rises.

- Maintaining a strong safety net for the most disadvantaged families and children has not been a priority for most states. An argument often used to support block grants is that states are better at making decisions about how to help families in need. Yet under TANF, many states shifted substantial amounts intended to help poor families to other uses. These states have used their TANF block grant funds in ways that often have left many of the most disadvantaged families without much of a safety net — and without the employment resources that might help them gain a foothold in the labor market. In every state, TANF plays a markedly smaller role in providing cash assistance to very poor families to help them meet basic needs than AFDC did. Moreover, states have used only a modest share of their TANF resources to help individuals find employment, and few states have invested the necessary resources to help poor parents with the most serious employment barriers find and maintain work.

- There is substantially less accountability for federal funds under a block grant structure than under other shared federal-state funding arrangements. The TANF block grant provided states with substantial flexibility and limited reporting requirements. The tremendous flexibility states have had to use TANF funds for other than core welfare reform purposes has meant that Congress has sent a significant amount of funding to states with little accountability or even knowledge about how much of the money is being used. Under TANF, much of the spending has been used to supplant existing state spending, fill state budget holes, and/or fund new spending outside of welfare reform. Moreover, the difficulty inherent in changing block grant allocations across the states has meant that over time, Congress is providing money that increasingly is not being distributed in a manner that best furthers TANF’s original purposes. States are required to report how they spend their federal TANF block grant dollars and how they are meeting their state MOE requirement, but they must provide detailed data only on those program recipients who receive cash assistance, which constitutes a relatively small part of TANF/MOE spending.

- Even with a maintenance-of-effort requirement in place, states used the flexibility of the block grant to supplant state funds. The TANF MOE requirement was intended to ensure that states would continue to contribute state funds to programs for poor families, and it included a “new spending” test intended to limit supplantation by states. In fact, however, significant supplantation has occurred with both federal TANF and state MOE funds. At the outset, states withdrew state funds because their MOE requirement was set below 100 percent of what they had been spending in the years prior to welfare reform. In addition, as states realized how much flexibility they had, they began using federal TANF funds (which have no mechanism to guard against supplantation) to cover the costs of various services previously paid for with state funds.

It was relatively easy for states to use federal TANF funds to supplant state funds, because the purposes for which states could use TANF dollars — and for which they could count state expenditures towards their MOE requirement — were broader than under the prior state AFDC programs on which the TANF block grant allocations and required MOE spending levels are based.

Allowing states to count third-party expenditures toward their MOE requirement has exacerbated this problem, enabling some states to withdraw substantial amounts of state funds from programs for low-income individuals. And, over time, increases in costs due to inflation and other factors have further eroded whatever limited protection against supplantation the MOE “new spending test” might have provided.

While block grants can have a superficial appeal, they are not a necessary or appropriate mechanism for providing basic needs-based assistance to low-income families and individuals on a large scale. Much of what welfare reform sought to promote did not require block grants; states could have been given greater flexibility (and been subjected to certain requirements and standards) to greatly strengthen their work programs, impose sanctions for non-compliance with work requirements and establish time limits — without block granting the funds.

In TANF, the block granting was, in part, a device intended to allow states to shift funds from welfare benefits to work activities and supports such as child care, and some of that shift did occur in TANF’s early years. But TANF and MOE funding for work activities and child care has mostly stagnated over the last decade, as states continued to divert funding from basic assistance not primarily to invest the freed-up funds in child care or work activities but to use the funds elsewhere in state budgets. In recent years, as need has increased due to the weak economy, states generally have failed to shift back to basic assistance and work supports the federal and state TANF funds that they had directed to other areas of their budgets. Instead, facing fiscal constraints, many states have cut funding for basic assistance and often for work activities and child care assistance, as well, despite the increased need for help.

In programs such as Medicaid and SNAP, there is even less of a theoretical justification for block grants, as they each are intended to serve a narrowly defined purpose so no transfer of money is needed. If Congress chooses to do so, it can provide states with greater flexibility in various programs without the large risks and the financing and accountability problems associated with converting means-tested assistance programs to block grants. Moreover, existing waiver authority generally provides a much better, more targeted tool than block grants for providing states additional flexibility to test new approaches that can be spread to other states if they prove beneficial.

Each state receives a fixed annual amount of federal TANF funding, technically known as the State Family Assistance Grant but generally referred to as the TANF block grant. The total amount of federal block grant funds available to all states each year is $16.5 billion.[29] The TANF block grant allocations are set for each state in accordance with the 1996 welfare law, based on the amount of federal funding that the state had been receiving in AFDC and related programs before 1996. Each state’s annual block grant allocation amount remains unchanged since the creation of TANF over 15 years ago. Because states can carry over unspent TANF funds to use in future years, the amount of federal TANF funds that a state spends in a given year may vary.

A state can transfer up to 30 percent of its block grant funds per year to the Child Care and Development Block Grant (CCDBG) and up to 10 percent to the Social Services Block Grant (SSBG), as long as the total amount transferred doesn’t exceed 30 percent. Transferred funds are subject to the rules of the program to which they are transferred, not to TANF rules. Funds transferred to SSBG must be spent on programs and services for children or families with incomes below 200 percent of the poverty line.

In addition to the basic block grant, some states can or could receive additional TANF federal funds from:

- Contingency Fund: Congress created this $2 billion fund in the 1996 TANF law to provide additional help to states in hard economic times. States made little use of it until the latest recession, but they began to draw on it in 2008, and nearly half of the states have done so since then. After the original $2 billion provided in 1996 was depleted early in fiscal year 2010, Congress added limited funds for 2011 and 2012.[30] Since 2010, qualifying states have received only part of the amount for which they qualified each year.

- Supplemental Grants: Congress created these in tandem with the TANF block grant to help two groups of states disadvantaged by the block grant formula’s reliance on states’ AFDC spending levels in the mid 1990’s: states with high population growth and states that had provided very low cash assistance benefits under AFDC. Seventeen states received a Supplemental Grant amount each year from TANF’s inception through 2011; Congress reduced these grants by about one-third in 2011 and failed to fund them at all for fiscal year 2012. (The spending data analyzed here goes through 2011, the last year in which the states received Supplemental Grants.)[31]

- Emergency Fund: Congress created a $5 billion TANF Emergency Fund as part of the 2009 Recovery Act to reimburse states for 80 percent of their increased TANF or MOE spending in 2009 or 2010 on basic assistance, short-term nonrecurring benefits, and subsidized employment. Every state but Wyoming received support from the fund before it expired on September 30, 2010, with the $5 billion almost fully spent.

- High-Performance Bonus: Through 2004, states could receive additional federal TANF funds for strong performance in meeting the objectives of TANF. During the period the fund was in existence, $200 million in funding was available each year.

The high-performance bonuses and the Emergency Fund have expired, while the Supplemental Grants have ceased being funded. Because they are considered TANF spending, we included them in our analysis for the years in which states spent those resources.

State Maintenance-of-Effort Funding

Each year, a state is required to meet a maintenance-of-effort (MOE) obligation under the TANF block grant or face a fiscal penalty. (The statute refers to this spending as “qualified state expenditures” but common usage is “state MOE.”) Each state’s MOE amount is based on its historical spending, defined as its 1994 contribution to AFDC and related work programs. To meet its MOE obligation, a state must report spending an amount equal to at least 80 percent of this historical spending level; this minimum share falls to 75 percent for any year in which a state meets its TANF work participation rate (WPR) requirement.

The fact that the TANF statute defined the MOE requirement as only 75 percent or 80 percent of a state’s past expenditure levels (rather than the full 100 percent) itself allowed states to withdraw some portion of the funds that they previously spent on AFDC and related programs.[32]

Expenditures that qualify as MOE include state and local government spending or other “third-party” spending that benefits members of needy families and meets one of the four purposes of TANF.[33] Examples of third-party expenditures that states can claim as MOE include spending by food banks or domestic violence shelters on TANF-eligible families. Third-party MOE also can include in-kind expenditures such as volunteer hours or employer-provided supervision and training for people in subsidized jobs.

States can count expenditures for a broad range of activities as MOE. So to ensure that states maintain a meaningful financial commitment to TANF, the 1996 welfare law imposed a “new spending” test on MOE: spending that a state counts toward MOE that occurs outside of its prior AFDC and related expenditures must represent an increasedlevel of spending compared to what the state spent on that item in 1995.[34] Some states have created programs that did not exist in the state in 1995, such as a refundable Earned Income Tax Credit (EITC), and counted the spending for these programs as MOE, or have increased spending in pre-existing programs over 1995 levels. (HHS has ruled that third-party non-governmental spending that a state claims as MOE is not subject to the “new spending” test.[35] )

MOE expenditures must occur during the year for which the state claims them; states cannot carry these funds over to a future year. MOE expenditures can come from any area of the state budget and are not limited to spending by the TANF agency. MOE spending, however, must be an actual expenditure, not simply forgone revenue; thus, a state can count the refundable portion of a state EITC as MOE but not the portion that simply reduces the amount of income tax owed to the state.

In general, states must spend TANF and MOE funds on activities that further one of TANF’s four purposes: assisting needy families so that children can be cared for in their own homes; reducing the dependency of needy parents by promoting job preparation, work and marriage; preventing out-of-wedlock pregnancies; and encouraging the formation and maintenance of two-parent families.

Within this framework, TANF rules give states and their partners nearly total discretion about program design, as long as the activities benefit “needy” families (exceptions to this “needy family” requirement are discussed below). States can set their own definitions of “need” and can use different eligibility limits for different types of benefits or services. For example, a state might set a very low eligibility level for TANF cash assistance but also use TANF or MOE funds to provide refundable state EITC or child care subsidies to families up to a higher income level such as 200 percent of the poverty line.

When a state uses TANF or MOE funds to provide “assistance” to families, certain consequences — such as time limits, federal work participation rates, data reporting, and child support assignments — follow, though these consequences may depend upon exactly how funding is configured.[36] Federal TANF rules define “assistance” as ongoing benefits that meet basic needs.

While there is substantial overlap, there also are some differences in the permissible uses of federal TANF and state MOE funds. Key differences that are relevant for the spending trends analyzed in this report are:[37]

- Transfers: States may transfer TANF funds, but not MOE funds, to CCDBG or SSBG.

- Spending authorized under prior law: States may use TANF funds to help support certain Emergency Assistance programs under Title IV-A of the Social Security Act that federal law previously allowed states to support with AFDC funds, even if this spending does not meet one of the four purposes of TANF. This grandfathering provision does not apply to MOE funds.

- Spending under purposes 3 and 4 of TANF: States may use TANF funds for activities meeting the third and fourth purposes of TANF — preventing out-of-wedlock pregnancies and encouraging the formation and maintenance of two-parent families — without regard to whether the recipients are needy or are in eligible families, as long as the spending is not considered “assistance.”[38] Thus, TANF spending under these purposes can go for childless adults, or for broad populations, without regard to income. In contrast, state MOE funds spent under purposes 3 and 4 can only be used for eligible, needy families, except for the Healthy Marriage or Responsible Fatherhood activities set forth in the TANF law.[39]

- Circumstances when MOE can be used more broadly than TANF: If states keep MOE funds separate from TANF funds, they can use them without regard to some restrictions that apply to TANF funds, such as the federal 60-month time limit, certain restrictions on recent legal immigrants, and certain disqualifications (e.g., of fleeing felons). States can also use MOE funds but not TANF funds for medical services.

Since states generally draw on both TANF and MOE funds formany areas of spending, the funding is somewhat fungible, allowing states to shift funding as necessary to comply with any restrictions.

| CBPP Category |

Federal Reporting Categories |

| Basic Assistance |

Basic Assistance |

| Administration and Systems |

Administration |

| Systems |

| Work-related Activities and Supports |

Work Subsidies |

| Education and Training |

| Other Work Activities/Expenses |

Transportation and Other Supportive Services – Assistance

Transportation – Nonassistance (includes subcategories) |

| Individual Development Accounts |

| Child Care |

Child Care - Assistance

Child Care - Nonassistance |

| Transferred to Child Care and Development Fund |

| Refundable Tax Credits |

Refundable Earned Income Tax Credit |

| Other Refundable Tax Credits |

| Nonrecurrent Short-Term Benefits |

Nonrecurrent Short-Term Benefits |

Pregnancy Prevention and

Two-Parent Family Formation and Maintenance |

Prevention of Out-of-Wedlock Pregnancies |

| Two-Parent Family Formation and Maintenance |

| Transferred to Social Services Block Grant |

Transferred to Social Services Block Grant |

| Authorized Under Prior Law and Other Nonassistance* |

Authorized Solely Under Prior Law — Assistance

Authorized Solely Under Prior Law — Nonassistance |

| Other Nonassistance |

| * Prior to fiscal year 2000, “Authorized Under Prior Law” was not a reporting category. |