- Home

- TANF’s Inadequate Response To Recession ...

TANF’s Inadequate Response to Recession Highlights Weakness of Block-Grant Structure

Proponents Wrong to See It as Model for Medicaid, SNAP, or Other Low-Income Programs

Summary

Leading conservatives in Congress – including House Budget Committee Chairman Paul Ryan – as well as some conservative activists and commentators [1] have recently cited welfare reform and the TANF block-grant structure as a model for reshaping the federal-state funding relationship in other programs for low-income families, such as Medicaid and the Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps). The TANF block grant, however, is not the shining success that they suggest.

The recent recession has exposed serious weaknesses in TANF’s ability to respond to significant changes in the economy, resulting largely from its block-grant structure. Under TANF, federal funding does not rise when caseloads increase in hard economic times – unlike TANF’s predecessor, Aid to Families with Dependent Children (AFDC), under which the federal government shared the costs of increased caseloads with the states. With AFDC, federal funding rose automatically during economic downturns as state caseloads expanded, enabling states to respond to rising hardship and poverty.

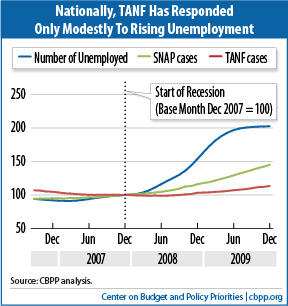

Under the TANF structure, many states’ TANF programs have responded inadequately — or not at all — to the large rise in unemployment during this very deep recession, leaving large numbers of families in severe hardship. In 16 states, TANF caseloads rose by less than 10 percent between December 2007 and December 2009; in six states, caseloads actually fell. This performance contrasts sharply with SNAP, where funding expands automatically to respond to the rising need for food assistance. In fact, the number of SNAP participants rose by 45 percent during the same period, as the number of unemployed people doubled and they and other households lost income.

Moreover, states whose TANF programs were more responsive to the greater need for assistance are now cutting their TANF cash assistance programs to reduce the amount of TANF expenditures used to support unemployed parents, despite a continuing poor job market. At least four states have cut their already-low monthly cash assistance benefits, which will push hundreds of thousands of families and children below — or further below — half of the poverty line. Several states have also shortened lifetime time limits on TANF benefits (which already were 60 months or less) and others have cut TANF-funded support for low-income working families.

Many of these cuts — including cuts in services and supports to help poor parents find jobs — run counter to states’ longstanding approaches to welfare reform. And cuts in benefits just when they are needed most, during a serious economic downturn, is what critics of the 1996 welfare reform act most feared.

Moreover, TANF’s annual block grant funding level has been frozen since its creation 15 years ago and has lost 28 percent of its value to inflation, with the decline growing larger with each passing year. Required minimum levels of state funding for TANF (under what is known as the “maintenance-of-effort, or MOE, requirement) have fallen in value by 28 percent, as well.

In TANF’s early years, a sharp drop in TANF caseloads — the product of a strong economy and state welfare reform policies — offset the fall in real funding and enabled states to shift some TANF and MOE funds to other areas, such as child care assistance. When poverty and unemployment rose substantially in the recent recession, however, states’ TANF block grant amounts remained frozen, and the limited federal TANF funds available to help states weather the recession were depleted quickly.

Today, overall federal TANF funding is actually lower — even in nominal dollars — than when TANF began, despite much higher unemployment and poverty and 15 years of inflation. Federal TANF funding initially had three components — the basic TANF block grant, TANF Supplemental Grants for 17 mostly-poor states that were disadvantaged by the basic TANF block grant funding formula, and a TANF Contingency Fund to provide additional funds to states in tough economic times. Now, neither the Supplemental Grants nor the Contingency Fund remains; the Contingency Fund ran out of money earlier this fiscal year, and Congress did not renew the Supplemental Grants before they ended on June 30. These losses of funds, despite a 9 percent unemployment rate, came on top of the 28 percent real reduction in basic block grant and state MOE funds. The loss of funding on multiple fronts is a key reason for the inadequate response to increased need and the harsh cutbacks that now mark TANF.

TANF Much Less Responsive Than SNAP to Recent Recession

A key question since the creation of the TANF block grant in 1996 has been what would happen under TANF’s fixed federal block-grant funding when the economy weakened substantially and the number of families in need grew markedly. The recent recession and continuing economic downturn provide the most significant evidence to date on this issue.

Nationally, TANF has been only modestly responsive to the downturn. Using data collected directly from the states, [2] we estimate that between December 2007 and December 2009, TANF caseloads increased by 13 percent, while SNAP caseloads grew by nearly half and the number of unemployed persons doubled. (See Figure 1.) There was wide variation in states’ responsiveness. In 22 states, TANF caseloads responded little or not at all to the recession; 16 states had caseload increases of less than 10 percent, and six states had caseload declines. At the same time, caseloads increased by more than 20 percent in 15 states, and by 11 to 20 percent in 13 states.

A striking feature of this variation is that it is not closely related to the increase in the number of unemployed individuals or the level of unemployment in a state. For example, the five states with the largest increases in the number of unemployed persons between December 2007 and December 2009 experienced TANF caseload increases during this period that varied widely, from 13.1 percent to 27.7 percent.[3] And in the 15 states whose unemployment rates were higher than the national average in May 2011, [4] caseload changes between December 2007 and December 2009 ranged from a 29 percent decline in Rhode Island to a 39 percent increase in Oregon.

The SNAP program does not share TANF’s block-grant structure, and it responded much more effectively to the downturn. SNAP benefits are 100 percent federally funded (states share in covering SNAP’s administrative costs), and when the need for food assistance rises as it has during the recent recession, the federal government picks up the added cost. SNAP is a counter-cyclical program in which the federal government provides additional funding in tough economic times. SNAP enrollment increased by 5.6 million households, or 45 percent, between December 2007 and December 2009. The program helped keep 3.8 million families out of poverty in 2009.[5]

Fixed Federal Funding Has Led to TANF Benefit Cuts and Eligibility Restrictions

- At least four states — California, Washington, South Carolina, and New Mexico — and the District of Columbia have cut monthly cash assistance benefits for TANF families, reducing already low and inadequate benefits even further. In South Carolina, for example, TANF benefits now equal just $216 a month for a family of three — only 14 percent of the poverty line. These cuts will push hundreds of thousands of families and children deeper into severe poverty, which we define as having income below half of the poverty line.

- States have shortened or otherwise tightened their lifetime time limits on receipt of TANF benefits, cutting off aid entirely for thousands of very poor families and reducing benefits for thousands more. For example, Arizona, which shortened its time limit from 60 months to 36 months in 2010, further shortened the limit to 24 months this year. Washington State and Michigan tightened their time limit exceptions significantly. This change resulted in over 5,000 poor families — about 10 percent of the caseload — losing benefits entirely in Washington State. The Michigan change is expected to result in over 12,000 poor families — about 15 percent of the caseload — losing benefits.

- States are cutting TANF-funded support for low-income working families. Michigan is slashing its refundable Earned Income Tax Credit for such families (which it partially funds with TANF dollars) by two-thirds. This change will raise state income taxes for several hundred thousand low-income working families and tax more children and families into poverty. Several other states have weakened “make-work-pay” policies by cutting or eliminating modest TANF benefits that working-poor families can receive in those states to supplement their low wages.

Many of these cuts run counter to states’ longstanding approaches to welfare reform. For example, some states that had encouraged work by providing support to poor parents in low-wage jobs are abandoning those policies. Similarly, states are shortening their time limits and eliminating various time-limit extensions or exemptions and some states are applying these changes retroactively. (Retroactive application means that a state counts past months of TANF receipt against the time limit under the new policy change even though, under the old policy, the time clock did not apply when the family received those benefits in the past.) Some states are terminating or reducing benefits for some of the most vulnerable families, most of whom have very poor labor market prospects; many of these families and children will almost certainly end up with neither work nor cash assistance, or with cash assistance that is so limited that it leaves them in severe poverty.

Block-Grant Structure with Fixed Funding and Significant State Flexibility Led to TANF’s Failure to Respond Adequately During the Recession

Under the 1996 welfare law, which replaced AFDC with the TANF block grant, states essentially received fixed federal funding each year in exchange for greater flexibility in using that funding and designing their programs. States have more flexibility in how they spend their TANF and MOE funds and no longer have to follow detailed federal rules for determining initial and ongoing eligibility. States are, however, subject to penalties if they fail any of a number of federal grant conditions, including that they meet a rigidly prescribed “work participation rate” (the percentage of a state’s cash assistance recipients engaged in a set of narrowly-defined work activities for 20 to 30 hours per week). States also face restrictions on using federal funds to provide assistance to families for longer than 60 months, and they must meet a maintenance-of-effort (MOE) requirement that obligates them to expend an amount of state funds each year that is no less than a specified percentage of the amount they spent on AFDC and related programs in 1995.

Erosion of Federal and State TANF Funding

When it was created in 1996, the federal TANF block grant was funded at $16.5 billion per year. It has remained at that level ever since. Because it was never adjusted for inflation, federal block grant funding has lost significant value over time; states receive 28 percent less in real (inflation-adjusted) dollars than in 1997, a year when the unemployment rate averaged 4.9 percent. The amount of state funds that states must spend to meet their MOE obligation has also remained flat since 1996, so required MOE spending levels have shrunk by 28 percent in real terms, as well. And the MOE obligation requires states to devote to TANF purposes an amount equal to only 80 percent of the amount they spent on AFDC and related programs in 1995, without any adjustment for inflation since that year.

In addition, for the first time since TANF’s creation, Congress in 2011 sharply reduced (by 33 percent) funding for the TANF Supplemental Grants provided to 17 mostly poor states. Congress out these grants by funding them for only part of the year. The funding for these grants, which have been an integral part of TANF since its creation in 1996, ended on June 30, 2011.[7]

This erosion in TANF funds has had a pronounced impact on low-income families:

- TANF benefit levels now cover a smaller share of recipients’ basic needs. The majority of states have increased their TANF benefit levels in nominal terms since the advent of the block grant, but not by enough to keep pace with inflation. When adjusted for inflation, benefit levels — which already were well below the poverty line in every state — have declined by 20 percent or more in 30 states since 1996. In the median state, the entire monthly TANF benefit equals only half of the cost of the fair market rent for a two-bedroom apartment;[8] this is HUD’s basic measure of the rental cost of a modest apartment and is the rental standard used in federal low-income housing programs.

- Employment assistance counselors carry higher caseloads and consequently cannot provide as much help to people looking for work. In addition to providing cash benefits, one of the core services that TANF agencies offer is employment assistance. But because staff salaries have necessarily risen as prices have increased, while block grant funding has remained frozen, TANF staffs have been cut even as need has increased, and counselors who provide employment assistance now generally carry larger caseloads than they did prior to the recession. As a result, recipients get less help with finding employment at the very time they need more assistance because of the shortage of jobs.

- TANF-funded assistance provided to working families is weakening. The majority of parents who leave welfare for employment earn low wages. Most states provide some supportive services, especially child care and transportation assistance, to help offset some of the costs of working that these families face. But these work-related costs increase over time, whereas states’ TANF funding is frozen. As a result, the amount of TANF money spent on child care for TANF recipients and low-income working families has remained flat since fiscal year 2000, even though the cost of child care has increased considerably, rising twice as fast since 2000 as the median household income of families with children.[9] When costs rise and funding remains flat, either families receive less assistance to offset the costs of working or fewer families receive assistance. While some states may make up the difference with state funds, many do not have the resources to do so.

Shifting of TANF and MOE Funds to Other Areas of State Budget

Congress created TANF at a time when the economy was strong. Many parents, including those with lower levels of education, subsequently found jobs and left the TANF rolls. Stringent state policies also caused significant numbers of families who did not find employment to leave TANF. The overall result was a much larger decline in TANF caseloads than anyone had predicted. TANF caseloads fell by 54 percent by 2005, and by 61 percent before the recession hit in 2007. These declines, combined with broad state flexibility in the use of TANF and MOE funds, freed up substantial resources that states used to fund other services that fall within the four purposes of TANF. [10]

In TANF’s early years, states used some of these freed-up funds for services directly related to welfare reform such as increased child care assistance for low-income working families that do not receive TANF cash assistance. States also used TANF or MOE funds to help support initiatives such as refundable state Earned Income Tax Credits for low-income working families, early education initiatives, or certain child welfare services. In some of these cases, TANF or MOE funds supported an expansion of such services or covered the increased costs of maintaining services as prices and wages increased. In other cases, TANF funds supplanted state dollars that had previously supported these services, allowing the state to use the freed-up dollars for purposes unrelated to TANF.

With the shift of funds to these and other areas, spending on basic cash assistance for poor families declined in most years. In fiscal year 1997, when TANF began, states spent 70 percent of their federal and state TANF dollars on basic cash assistance for poor families with children. That share declined to 58 percent of TANF dollars in 1998, and to just 28 percent by 2009.[11]

And while the amount of TANF and MOE funds spent on work activities and child care grew quickly at the beginning of TANF, doubling between 1998 and 2000, it has since remained nearly flat or even declined. In 2009, these areas of activity accounted for about one-quarter of state and federal TANF expenditures.

The need for basic assistance has increased sharply during the recent economic downturn. But states generally have not moved back the TANF and MOE funds they shifted to other areas of their budgets. Facing fiscal constraints, states have been reducing funding for basic assistance, work activities, and/or child care, rather than bringing the TANF or MOE dollars back from other parts of the state budget so that they can maintain these forms of assistance or meet increased need.

Disincentives to Save for a Rainy Day

Federal TANF rules allow states to save some of their federal TANF dollars from one year to the next, which can make it possible for states to amass some funds for a “rainy day.” But when the recession hit, states’ TANF reserves were much too small to meet the large increase in need.

During the early years of welfare reform, states built up significant unspent TANF reserves as TANF caseloads declined. As those reserves mounted, however, so did threats that Congress would cut back on the amount of the annual TANF block grant, on the grounds that states had more funding than they needed. Such proposals began surfacing as early as 1999. This threat encouraged states to reinvest their savings in other programs that fall within TANF’s four broad purposes rather than leave substantial funds in reserve and risk having Congress cut the size of the TANF block grant. By the end of 2007, when the recession hit, unspent TANF funds totaled $4 billion across the nation, down from $7 billion at their peak in 2000. [12]

Inadequate Additional Federal Help for States in Hard Economic Times

The 1996 welfare reform law created a $2 billion TANF Contingency Fund that states could draw upon when unemployment was high and more families were in need. States made little use of the fund until the recent recession. A handful of states then began drawing on the Fund in 2008. Twenty-one states and the District of Columbia used these funds for one or more years in 2009-2011.

But the Contingency Fund ran out of money earlier this year. Moreover, while it was in operation, the Fund suffered from serious flaws that impeded its effectiveness in responding to an economic downturn.[13]

- Some states with very high unemployment rates were unable to qualify for contingency funds due to the fund’s complicated and often daunting requirements. To qualify, a state had to maintain an expenditure level of state TANF funds equal to 100 percent of the amount that the state spent in 1995 (instead of TANF’s usual 75 or 80 percent MOE requirement). In addition, some forms of state spending that count toward TANF’s MOE requirement do not count toward the Contingency Fund’s MOE requirement — most notably child care, which in some states accounts for a significant share of MOE spending under TANF. Furthermore, a state not only had to meet the 100 percent state expenditure standard but had to exceed it by an amount sufficient to match the contingency funds it received; otherwise, the state could be required to repay some of the contingency funds.[14] Many states, facing budget shortfalls as a result of steep, recession-driven declines in revenues, had difficulty increasing their MOE expenditures, making them ineligible for contingency funds.

- Moreover, the amount of contingency funding distributed to those states that did qualify for these funds proved highly inadequate. The original $2 billion in contingency funding was exhausted in December 2009, and an additional allocation of $330 million was exhausted during the first three months of fiscal year 2011. Moreover states that qualified for contingency funds in fiscal years 2010 and 2011 received only a fraction of the amount for which they were eligible. And currently, although need remains high, there is no Contingency Fund for states to draw upon.

- Finally, the federal rules governing how states may use money they draw from the Contingency Fund are defective. These rules do not require states to use the funds to increase services to help families work or meet basic needs in hard economic times. States are allowed to use these funds for any TANF purpose. So, while states could use the funds to respond to increased need, they also could use the funds simply to help meet existing, or even reduced, costs (as a result of cutbacks) for basic cash assistance or work-related activities; they could then withdraw an equivalent amount of funding from TANF to shift to other activities elsewhere in the state budget (as long as those activities fall within one of TANF’s broad purposes). As a result, contingency funds could supplant state funds previously used for such purposes. A state could receive contingency funds and still cut benefits or eligibility, and some states did.

Partly due to the inadequacy and ineffectiveness of the Contingency Fund, the 2009 Recovery Act established and funded a temporary TANF Emergency Fund, which provided states with additional funds to help provide ongoing basic assistance, short-term nonrecurring assistance, and/or subsidized jobs. This fund helped to stave off significant cuts in ongoing basic assistance in 2009 and 2010, but it expired on September 30, 2010. Every state except Wyoming drew funds from the TANF Emergency Fund, and all but five states received funds to help cover the costs of providing basic assistance to more families in need. Forty states also received funding to provide subsidized jobs to parents, many of whom likely would have been on TANF cash assistance rolls if they did not have those jobs.

Thanks in large part to the TANF Emergency Fund, only a few states reduced the amount of their basic TANF cash assistance grants during the two years that the Fund was in place (and only Arizona shortened its time limit).[15] The TANF Emergency Fund provided states with additional resources to respond to increased need. But it ended too soon.

Lacking further federal help from either the Contingency Fund or the Emergency Fund — and with the basic TANF block grant frozen — states this year began cutting benefits and implementing policies to shrink the number of poor families they serve. With a fixed federal block grant and significant state budget gaps, states faced tough choices about how to stretch their greatly eroded federal and state TANF funds while maintaining funding for other programs that they viewed as important — or that are protected by more powerful constituencies.

TANF’s Overall Record Belies Claims of Welfare Reform’s Success

The weaknesses in TANF that the recession has exposed cast serious doubt on the often-extravagant claims of welfare reform’s success. To be sure, in the early years of TANF implementation, the combination of welfare reform and a strong economy contributed to declining caseloads and increased employment among single mothers with low levels of education. But, a number of those improvements were short-lived, and they tell only part of the welfare reform story. The success of welfare reform should be judged by the lessons of the last 15 years as a whole — and in particular, on TANF’s performance during the recession, since a safety net is needed most when the economy is weak. TANF’s record here is not impressive:

- TANF now provides a safety net for very few families, even though the need for assistance is large. In 1995, AFDC assisted 75 families with children for every such 100 families in poverty. By 2009, TANF assisted just 28 families for every 100 in poverty.

- The employment gains of the early years of welfare reform, when the labor market was unusually strong, have not been sustained over time. The share of poorly educated single mothers with earnings rose sharply in the years immediately following welfare reform, from 49 percent in 1995 to 64 percent in 1999. However, as the economy started to weaken, much of the early gains were lost. The share of poorly educated single mothers with earnings stayed below 60 percent in every year after 2003 and reached a low of 54 percent in 2009.

- The poorest families have become poorer. In 1995, AFDC lifted 62 percent of children who would otherwise have been below half the poverty line out of severe poverty. By 2005, this figure for the TANF program was just 21 percent. The result has been a steady increase in the number of children living in severe poverty. The number of children living below half of the poverty line rose from 1.4 million in 1995 to 1.7 million in 2000 and 2.4 million in 2005, nearly a 75 percent increase. [16]

- Welfare reform has left a large and rising number of families with children disconnected from both work and the safety net. A recent policy brief from the Assistant Secretary for Planning and Evaluation found that about one in five low-income single mothers neither worked nor received government cash assistance from 2004 to 2008 — a big jump from one in eight in 1996-1997. [17]

Conclusion

The TANF block grant is often hailed as a model for reform for other safety net programs, such as Medicaid and SNAP. But shifting to a block grant with fixed federal funding has resulted in a substantially weakened safety net that has failed to respond effectively when the economy turned down and need increased. Over time, the share of TANF resources dedicated to providing basic assistance has declined dramatically, and that share failed to rebound when the recession hit. Nor have states, in shifting these funds, used most of the resources they once spent on cash assistance to help TANF recipients instead find and maintain employment. To the contrary, most of the shifted funds have gone for other purposes.

Finally, facing increased demand for assistance during a time of persistently high unemployment, states are now responding by cutting the amount of assistance they provide to very poor families with children or not providing assistance at all to some of the most vulnerable people. This is not a pattern that policymakers should want to replicate.

TANF Responded Unevenly to Increase in Need During Downturn (with state-by-state fact sheets)

Many States Cutting TANF Benefits Harshly Despite High Unemployment and Unprecedented Need

Policy Basics

Income Security

End Notes

[1] Representative Paul Ryan (R-WI), “Paul Ryan’s Check on Budget Hysteria: GOP Bolsters the Safety Net,” The Christian Science Monitor, May 18, 2011, http://budget.house.gov/News/DocumentSingle.aspx?DocumentID=241970 .

Others who have made similar claims include Senator Orrin Hatch (R-UT), Ranking Member, Senate Finance Committee; Representative Jim Jordan (R-OH); Katherine Bradley, Research Fellow, The Heritage Foundation; Peter Ferrara, General Counsel, American Civil Rights Union; and Phil Kerpen, Vice President, Americans for Prosperity.

[2] LaDonna Pavetti, Danilo Trisi, and Liz Schott, “TANF Responded Unevenly to Increase in Need During Downturn,” Center on Budget and Policy Priorities, January 25, 2011.

[3] The increase in the number of unemployed persons in these states between December 2007 and December 2009 was as follows: Wyoming 172%, Alabama 165%, Nevada 157%, Idaho 155%, and Florida 26%.

[4] The unemployment rate for March 2011 for each of these states was as follows: California 12.0%, Florida 11.1%, Georgia 10.0%, Kentucky 10.2%, Michigan 10.3%, Mississippi 10.2 %, Nevada 13.2%, Oregon 10.0% and Rhode Island 11.1%.

[5] Arloc Sherman, “Despite Deep Recession and High Unemployment, Government Efforts — Including the Recovery Act — Prevented Poverty from Rising in 2009, New Census Data Show,” Center on Budget and Policy Priorities, January 5, 2011.

[6] For fuller discussion of 2011 state TANF cuts, see Liz Schott and LaDonna Pavetti, “Many States Cutting TANF Benefits Harshly Despite High Unemployment and Unprecedented Need,” Center on Budget and Policy Priorities, May 19, 2011.

[7] LaDonna Pavetti, Liz Schott and Ife Finch, “Expiration of TANF Supplemental Grants A Further Sign of Weakening Federal Support for Welfare Reform,” Center on Budget and Policy Priorities, June 27, 2011.

[8] Liz Schott and Ife Finch, “TANF Benefits Are Low and Have Not Kept Pace with Inflation,” Center on Budget and Policy Priorities, October 14, 2010.

[9] National Association of Child Care Resource and Referral Agencies, Parents and The High Cost of Child Care: 2010 Update, NACCRRA, 2010.

[10] The four purposes set forth in the TANF law are: (1) provide assistance to needy families so that children may be cared for in their own homes or in the homes of relatives; (2) end the dependence of needy parents on government benefits by promoting job preparation, work, and marriage; (3) prevent and reduce the incidence of out-of-wedlock pregnancies and establish annual numerical goals for preventing and reducing the incidence of these pregnancies; and (4) encourage the formation and maintenance of two-parent families.

[11] This 28 percent national share of state and federal TANF spending masks tremendous variations among states. For example, ten states spent 15 percent or less of their TANF and MOE funds on basic assistance.

[12] Because states are not consistent in how they report unobligated and obligated funds, we combine those two categories to identify unspent funds. Unliquidated funds include funds that have been obligated but not yet spent, but may also include funds that have not been obligated.

[13] For a fuller discussion, see Liz Schott and LaDonna Pavetti, “Redesigning the TANF Contingency Fund to Make it More Effective,” Center on Budget and Policy Priorities, June 13, 2011.

[14] For a fuller discussion of the reconciliation process, see Liz Schott and LaDonna Pavetti, “Redesigning the TANF Contingency Fund to Make it More Effective,” Center on Budget and Policy Priorities, June 13, 2011, (Appendix I).

[15] Rhode Island shortened its time limit during this period, but that policy change was enacted before the impact of the recession.

[16] Arloc Sherman, “Safety Net Effective at Fighting Poverty But Has Weakened for the Very Poorest,” Center on Budget and Policy Priorities, July 6, 2009.

[17] U.S. Department of Health and Human Services, Office of the Assistant Secretary for Planning and Evaluation (ASPE), “Low-Income Single Mothers Disconnected From Work And Public Assistance,” ASPE Research Brief, March 2011, http://aspe.hhs.gov/hsp/11/SingleMothers/rb.pdf

More from the Authors