- Home

- The Child Tax Credit

Policy Basics: The Child Tax Credit

Enacted in 1997 and expanded multiple times with bipartisan support since 2001, the Child Tax Credit helps families manage the cost of raising children. Under current law the credit is worth up to $2,000 per eligible child (under age 17 at the end of the tax year). For 2021 only, the American Rescue Plan Act increased the maximum credit amount to $3,600 for children under age 6 and $3,000 for children aged 6-17, made the credit fully available to children and families with low incomes, included 17-year-olds for the first time, and issued half of the credit through advance monthly payments.

The Child Tax Credit lifted 4.3 million people ― including 2.3 million children ― above the poverty line in 2018. It remains an effective tool for reducing poverty nationwide.

Helping Families With Low Incomes

Prior to the Rescue Plan and under current law, the value of the Child Tax Credit for families with low incomes increases with a household’s earnings, up to $2,000 per child. A family who earns less than $2,500 receives no credit, however, and a single parent with two children who earns between $2,500 and roughly $30,000 receives only a partial credit.

In addition, only a portion of the credit is refundable. This means that, if the value of the credit exceeds the amount of federal income tax a family owes, the family may receive part or all of the difference in the form of a refund check. Thus, families can benefit from the credit even if their incomes are low enough that they owe little or no federal income tax in a given year. These families still pay payroll taxes, however, and they usually receive less than the full credit amount.

When filing taxes, families can receive a refund equal to 15 percent of their earnings above $2,500; this refund can be worth up to $1,500 per child in 2022. For example, a single mother with a 5-year-old and 8-year-old who earned $14,000 can receive $1,725 (15 percent of $11,500), or roughly $850 per child, as a refund under current law.

Families with dependents who do not qualify for the Child Tax Credit may be able to claim the $500 non-refundable Credit for Other Dependents (ODC), which was created under the 2017 Tax Cuts and Jobs Act. For example, dependents of any age who have a Social Security number or Individual Taxpayer Identification Number may qualify for the ODC. Families with Child Tax Credit-qualifying children as well as ODC-qualifying dependents are eligible to claim the appropriate credit for each dependent.

The Child Tax Credit Under the American Rescue Plan Act

Congress expanded the Child Tax Credit for one year (2021) in the American Rescue Plan Act enacted in March 2021. The maximum credit amount increased from $2,000 to $3,600 per child under age 6 and to $3,000 per child aged 6-17 (including 17-year-olds for the first time). The larger credit amount started phasing out for head of household tax filers at $112,500 and for married couples at $150,000. The underlying $2,000-per-child credit starts phasing out for head of household tax filers at $200,000 and for married couples at $400,000.

The Rescue Plan also made the full credit available (generally known as making it “fully refundable”) to children whose parents had low or no earnings in a given year, and therefore previously received a partial credit or no credit at all. Under the expansion of the Child Tax Credit, the Treasury Department was also authorized to issue half of a family’s credit through advance monthly payments from July to December 2021 and half when the family filed their 2021 taxes. More than 90 percent of families with lower incomes used their monthly payments to buy food, pay utility bills, make rent or mortgage payments, buy clothing, and cover education costs.

Full refundability is important for families with low incomes, who otherwise wouldn’t receive the tax benefits available to families with higher incomes, to help manage the costs of raising children. An estimated 19 million children receive less than the full credit, or no credit at all, because their families earned too little. This includes roughly 45 percent of Black children and up to 39 percent of Latino children, due to historical and ongoing structural racism and discrimination that results in racial disparities in income; roughly 1 in 3 children living in rural areas, in part because jobs in rural areas typically provide lower pay compared to jobs in metro areas; and roughly 17 percent of white children.

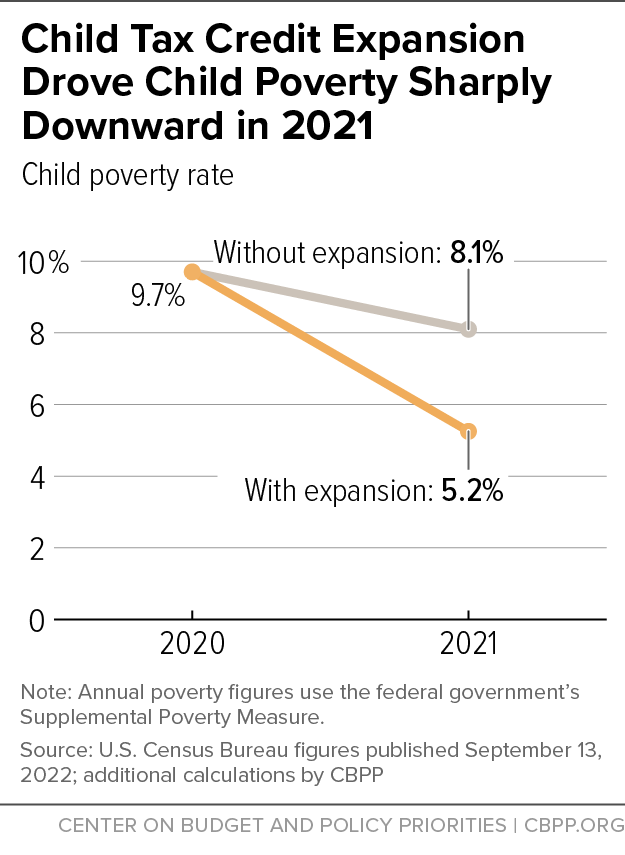

Combining full refundability, extended eligibility for 17-year-olds, and the larger credit amount, the expanded Child Tax Credit drove child poverty sharply downward in 2021, when it reached a record low of 5.2 percent, according to Census Bureau data. It kept roughly 2.1 million children above the poverty line ― including an estimated 752,000 Latino children, 649,000 white children, 524,000 Black children, 89,000 American Indian and Alaska Native children, and 56,000 Asian children ― and lessened differences in poverty rates between children of all races and ethnicities.

The Rescue Plan also permanently made the credit available to children living in the U.S. Territories ― in addition to the temporary expansion ― erasing long-standing discriminatory barriers that had prevented most families with children in the territories from accessing the credit. Previously, only families with three or more children in Puerto Rico were eligible for the Child Tax Credit, and funding sources for the credit in the other four territories — American Samoa, Guam, the U.S. Virgin Islands, and the Commonwealth of the Northern Mariana Islands — weren’t explicitly stated in statute. The Rescue Plan amended these critical gaps on a permanent basis.

In January 2022, the credit reverted to pre-Rescue Plan eligibility requirements and the $2,000-per-child maximum credit amount. If Congress fails to enact an expansion of the Child Tax Credit, those eligibility requirements will remain and millions of families will receive less than the full credit or nothing at all.

Reducing Poverty and Expanding Children’s Opportunities

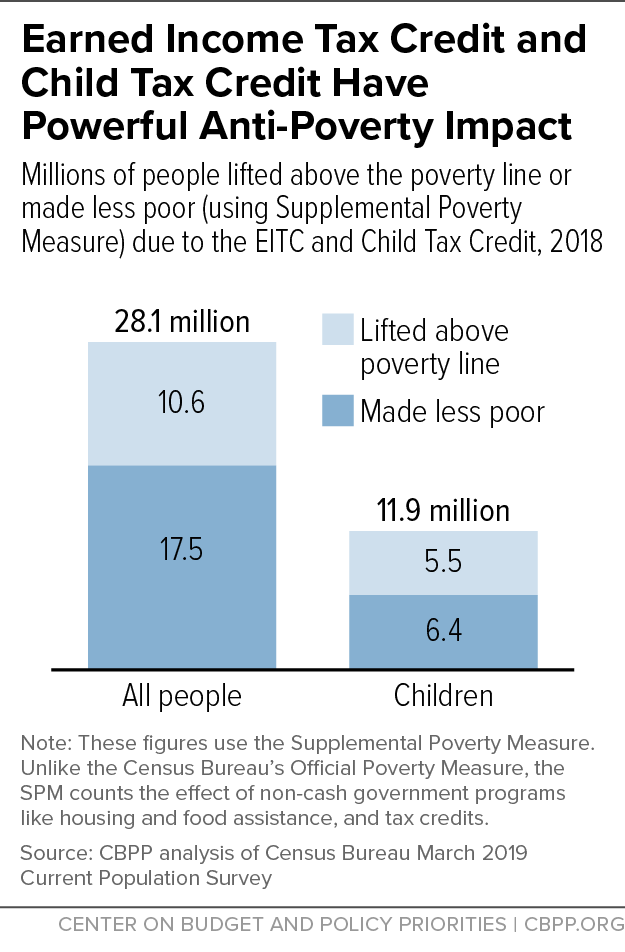

Despite the shortcomings of the Child Tax Credit prior to the Rescue Plan and under current law, which policymakers should address, the credit has been a powerful tool to help families lift themselves above the poverty line. For example, it lifted approximately 4.3 million people above the poverty line in 2018, including about 2.3 million children, and lessened poverty for another 12 million people, including 5.8 million children. The credit lifted even more families with children above the poverty line when combined with the Earned Income Tax Credit (EITC) for families with children. Many of the affected families with low incomes are ineligible for other tax-based assistance for children, such as the Child and Dependent Care Tax Credit, which is not refundable (except for 2021).

Boosting families’ incomes can expand opportunities for children, such as by improving school performance, research indicates. Increasing the incomes of families with young children who struggle to make ends meet not only tends to improve a child’s immediate well-being; it is also associated with better health, more schooling, more hours worked, and higher earnings in adulthood, research finds.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.