BEYOND THE NUMBERS

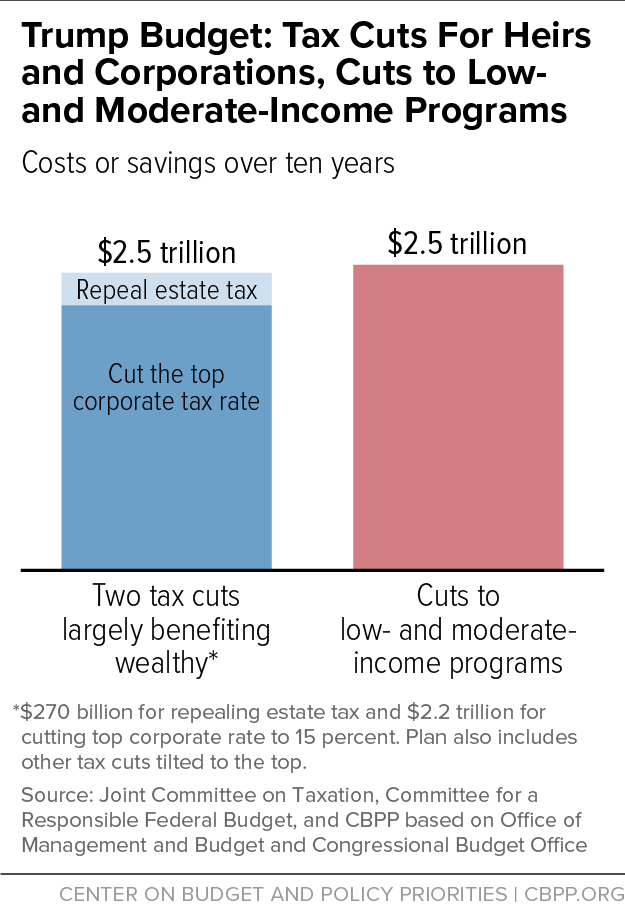

Trump Plan: $2.5 Trillion in Program Cuts for Low- and Moderate-Income People; $2.5 Trillion on Two Tax Cuts for Corporations and Wealthy Heirs

President Trump said he was not elected to serve special interests, but instead, “the forgotten men and women of our country, and that’s what I’m doing.” His budget paints a starkly different picture, however, because it would shift trillions of dollars from struggling families to the wealthy.

The Trump budget would cut $2.5 trillion over the next decade from programs that help struggling low-and moderate-income families afford the basics and improve their upward mobility. These are the largest cuts in a President’s budget in the modern era, even when adjusted for inflation or measured as a percent of the economy. My colleagues explain:

The proposed reductions to low- and moderate-income programs would increase the number of uninsured by substantially more than 23 million; significantly undermine the Supplemental Nutrition Assistance Program (SNAP, formerly food stamps), which now provides basic food aid to more than 40 million low-income Americans; and dramatically reduce job training and education aid, which are essential to helping people move out of poverty by securing decent jobs.

At the same time, the President proposes roughly $6 trillion in tax cuts (from his tax plan and from the House-passed bill, which he has endorsed, to repeal the Affordable Care Act) over the next decade. They’re so skewed to the top that the tiny fraction of households with annual incomes above $1 million would get more than $2 trillion in tax cuts. In other words, millionaires would gain trillions from the Trump plan.

As we’ve detailed, the Trump tax plan has little to offer low- and moderate-income families but many tax cuts that are heavily tilted to the wealthy and corporations — and no credible way to offset their cost. They include slashing the top corporate tax rate from 35 to 15 percent, which would mainly benefit wealthy investors, and repealing the estate tax, which would only benefit the heirs of the wealthiest 2 out of every 1,000 estates in the country. Those two tax cuts alone would cost $2.5 trillion — essentially the same as the cut in low-and moderate-income programs. (See chart.)

The President’s budget tries to obscure this massive income shift by not accounting for the vast majority of the tax cuts’ costs. But his priorities remain clear: tax-cut windfalls for the wealthy and corporations, and huge cuts in health, food, job training, and other basic aid, producing greater hardship for struggling families.