BEYOND THE NUMBERS

House Speaker Paul Ryan is repeating a myth that we and others have debunked before: that Medicare is running out of money. “Medicare goes bankrupt in about 10 years,” he said on CBS’ “60 Minutes,” adding that “for the X-Generation on down, it won’t be there for us on its current path.” That’s just not true.

Medicare’s Hospital Insurance (HI) trust fund will remain solvent — that is, able to pay 100 percent of the costs of the hospital insurance coverage it provides — through 2028, the program’s trustees wrote in their latest report. Even after 2028, when the HI trust fund is projected for depletion, incoming payroll taxes and other revenue will still cover 87 percent of Medicare hospital insurance costs.

Policymakers will need to close this shortfall by raising revenues, slowing the growth in costs, or most likely both, as they’ve done many times before. But Medicare’s hospital insurance program will not run out of all financial resources and cease to operate after 2028, as “bankruptcy” suggests.

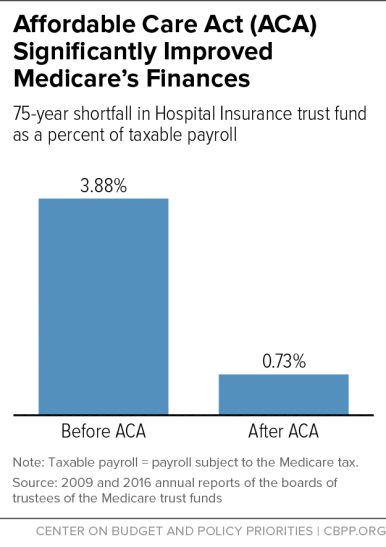

Contrary to Ryan’s widely discredited claim last month that the Affordable Care Act weakened Medicare’s finances, health reform (along with other factors) has significantly improved Medicare’s financial outlook, boosting revenues and making the program more efficient. The trustees now project that the HI trust fund will remain solvent 11 years longer than before health reform was enacted. And the HI program’s projected 75-year shortfall of 0.73 percent of taxable payroll is much less than the 3.88 percent of payroll that the trustees estimated before health reform. (See chart.)

This means that policymakers could close the projected funding gap by raising the Medicare payroll tax — now 1.45 percent each for employers and employees — to about 1.8 percent, or by enacting an equivalent mix of program cuts and tax increases.

The 2028 date doesn’t apply to Medicare coverage for physician and outpatient costs or to the Medicare prescription drug benefit, neither of which faces insolvency. They’re financed through the program’s Supplementary Medical Insurance (SMI) trust fund, which consists of two separate accounts — one for Medicare Part B, which pays for physician and other outpatient health services, and one for Part D, which pays for outpatient prescription drugs. Premiums for Part B and Part D are set each year at levels that cover about 25 percent of costs; general revenues pay the remaining 75 percent. Therefore, SMI can’t run short of funds.