BEYOND THE NUMBERS

"Tax Freedom Day" Analysis Can Give a Misleading Impression of Tax Burdens

We explain the problems inherent in the Tax Foundation’s annual “Tax Freedom Day” analysis in a new paper. Here’s the opening:

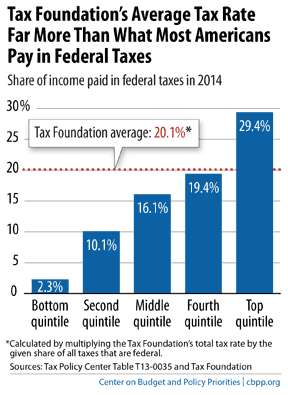

The Tax Foundation released its annual “Tax Freedom Day” report today that, once again, can leave a strikingly misleading impression of tax burdens — showing an average federal tax rate across the United States that’s likely higher than the tax rate that 80 percent of U.S. households actually pay (see chart).

Image

To project the day when “the nation as a whole has earned enough money to pay its total tax bill for [the] year,” the Tax Foundation calculates the average tax rate by measuring tax revenues as a share of the economy (similar to estimates of total revenues as a share of Gross Domestic Product, or GDP).

In a progressive tax system like that of the United States, only upper-income households on average pay federal tax at rates that are equal to or above federal revenues as a share of the economy. Estimates from the nonpartisan Urban-Brookings Tax Policy Center show that low- and middle-income households (about 80 percent of all households) will pay a smaller share of their income in federal taxes this year than the Tax Foundation’s average tax rate.

The Tax Foundation acknowledges this issue in a methodology paper accompanying its report, noting that its estimates reflect the “average tax burden for the economy as a whole, rather than for specific subgroups of taxpayers.” Consequently, those who report on Tax Freedom Day as if it represents the day until which the typical American must work to pay his or her taxes are misinterpreting these figures and inadvertently fostering misimpressions about the taxes that most Americans pay.

Click here to read the full report.