BEYOND THE NUMBERS

Speaking at a Committee for a Responsible Federal Budget event yesterday on public attitudes toward fixing Social Security, I discussed a new Voice of the People survey showing that strong majorities of both parties favor addressing the program’s long-term shortfall mostly by raising revenues. For example, a majority support a plan to eliminate the shortfall using 85 percent revenues and 15 percent benefit cuts. Our recent paper explores three approaches to raising revenue, any of which would strengthen Social Security over the long term:

- Raise or eliminate Social Security’s cap on taxable wages.

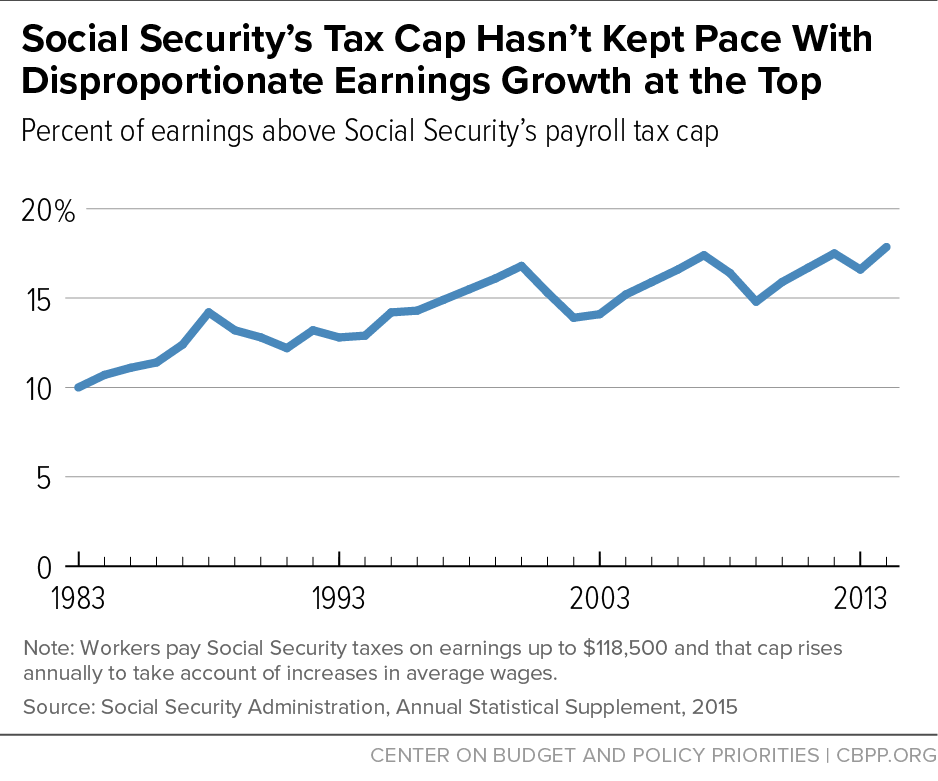

Currently, employees pay a 6.2 percent payroll tax on wages up to $118,500 of annual earnings; employers also pay 6.2 percent for each employee. When policymakers last adjusted the taxable wage cap in 1977, they set it to cover 90 percent of all wages and indexed it to rise annually with the average wage. But wages above the cap have grown much faster than the average wage, so the cap now covers only about 82 percent of all wages; the other 18 percent of wages aren’t taxed (see chart).

Raising the tax cap would lessen the erosion of Social Security’s payroll tax base, and it was the most popular option in the survey, supported by 88 percent of respondents. Only high earners would face a tax increase, and their benefits could rise as well under this option. Eliminating the cap would close even more of the shortfall, and most respondents support it.

- Raise the Social Security tax rate.

Raising the rate from today’s 12.4 percent (for workers and employers combined) would affect all covered workers and wouldn’t change benefits. Even a modest increase amounting to a few dollars a week for a typical worker could substantially improve Social Security’s long-term solvency, and most respondents are willing to pay it.

- Expand the Social Security tax base by applying the tax to fringe benefits.

A growing share of workers’ compensation comes not through wages but through fringe benefits that are exempt from Social Security taxes, such as employer-sponsored health insurance premiums. If Social Security counted these benefits as compensation (an option the Voice of the People survey didn’t include), affected workers would pay more in taxes but also get more in benefits under this option.