BEYOND THE NUMBERS

With Father’s Day approaching, 13 million fathers in working families are benefiting from two key tax credits for low-income workers — the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC). These credits lifted 1 million working dads out of poverty in 2013 (the most recent year for which we have data), using a Census Bureau poverty measure that counts tax credits and government benefits.

Our fact sheet gives state-by-state figures on how many fathers in working families benefit from the EITC and CTC.

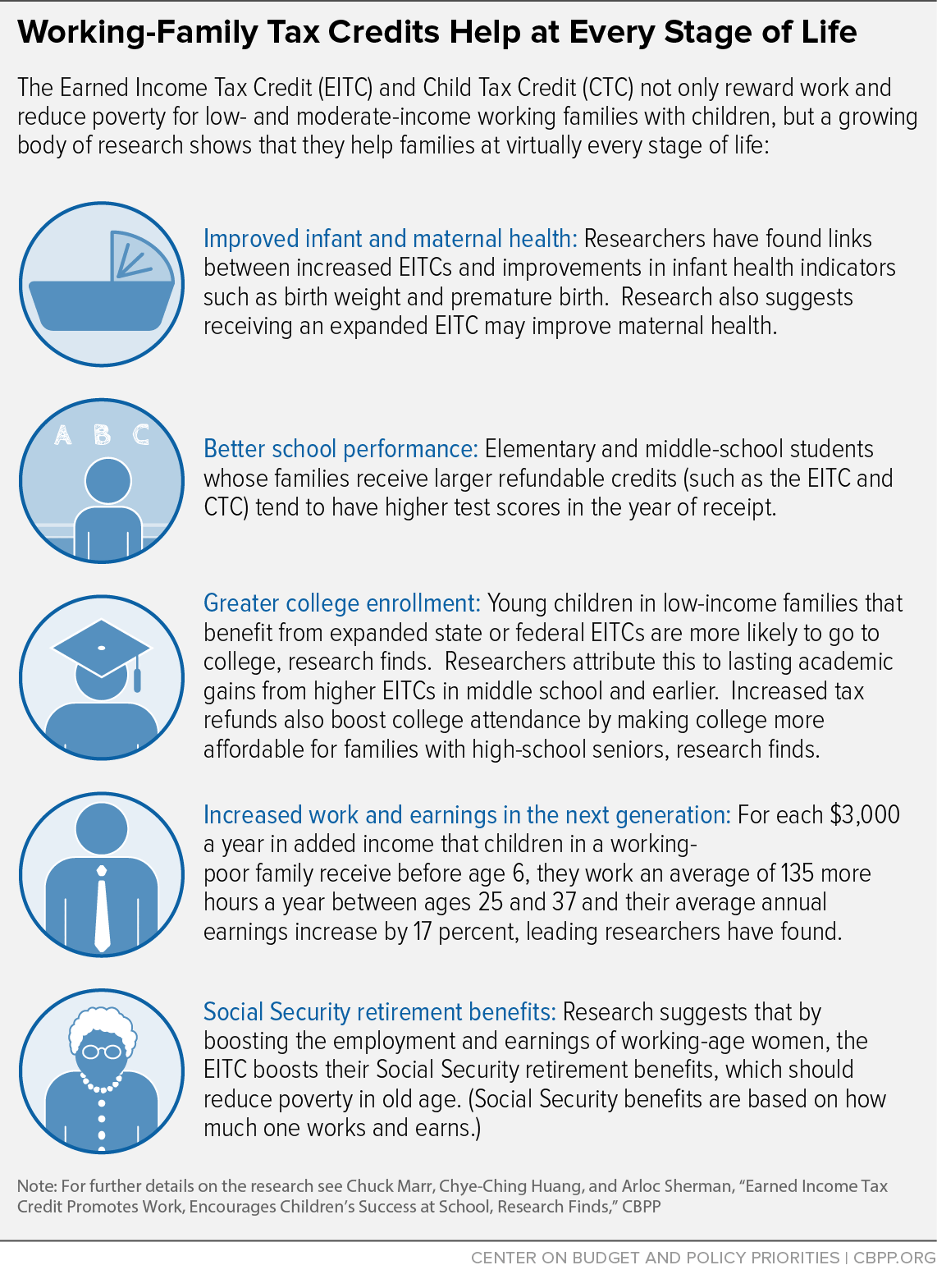

The EITC and CTC help working parents make ends meet. In addition, a growing body of research suggests that children in families receiving the credits have improved health, perform better in school, are likelier to attend college, and can be expected to work and earn more as adults (see graphic).

But unless Congress acts, key EITC and CTC provisions will expire at the end of 2017. The stakes for working dads are high: nearly 6.6 million working fathers would lose all or part of their EITC, CTC, or both, and more than 2 million working fathers would be pushed into or deeper into poverty. Many low-income working dads would lose their entire CTC. For example, a single father with two children working full time as a custodian for the minimum wage and earning $14,500 would lose his entire CTC of $1,725.

That’s why it’s critical for working fathers — and their families — that policymakers make the key EITC and CTC provisions permanent.

Further, states can help dads and kids by creating and strengthening state EITCs. State EITCs build on the federal tax credits by helping working parents, while making sure state tax codes treat low-wage fathers more fairly. Like the federal EITC, state EITCs make kids healthier and help them do better and go further in school.

For more, see our chart book on the EITC and CTC.