BEYOND THE NUMBERS

The Obama Administration predicts that the economy will grow faster over the next ten years than the Congressional Budget Office (CBO) does. As a result, the President’s budget has smaller projected budget deficits than CBO will unveil when it analyzes the President’s budget proposals in the coming weeks, using its own economic and technical assumptions.

While some administrations were known to heavily manipulate their economic forecasts to produce more desirable budget outcomes (see Scenario, Rosy), that doesn’t appear to be the case here. The Administration and CBO projections are not that far apart, and it’s hard to say one is better than the other. As CBO says, “economic forecasts are always subject to considerable uncertainty” and “the current outlook is especially uncertain.” (Small differences in economic assumptions can translate into noticeable differences in projected budget deficits. CBO estimates, for example, that a 0.1 percent per year higher growth rate over the 2011-2021 period would reduce the 2012-2021 budget deficit by $310 billion.)

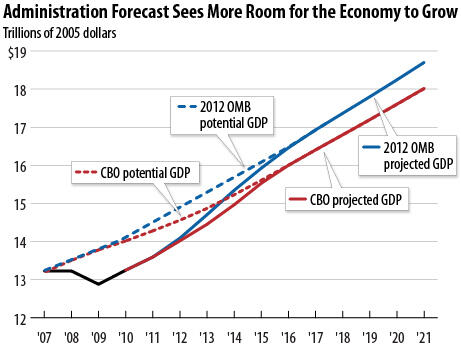

As these charts show, the economy faces a long climb back to full employment in the wake of the worst recession since the 1930s. Getting there requires closing the large gap between what the economy is producing to satisfy current demand (actual GDP) and what it is capable of producing if we make full use of our labor and capital resources (potential GDP).

The key difference between the Administration and CBO forecasts is that Administration economists are somewhat more optimistic about the economy’s longer-run capacity for growth than their CBO counterparts, and that translates into different forecasts for short-term growth as well. CBO believes that the after-effects of the financial crisis will pose more of a barrier to growth in coming years than the Administration does.

In the chart below, the red lines show actual and potential GDP under CBO’s forecast; the blue lines show actual GDP and our inference of potential GDP under the President’s 2012 budget forecast. Both CBO and the Administration predict that the gap between actual and potential GDP will be closed around 2017. But the Administration assumes this will occur at a higher level of GDP than CBO does, which means that the Administration’s estimate of GDP growth between now and 2017 is somewhat faster than CBO’s. Specifically, the Administration forecasts average annual growth of 3.6 percent from 2010 to 2017, compared with 3.1 percent for CBO.

Between 2017 and 2021, the Administration forecasts slightly higher growth in potential (and hence actual) GDP than CBO does (2.5 percent versus 2.4 percent) but also a slightly higher unemployment rate (5.3 percent versus 5.2 percent).

I don’t know which forecast will turn out to be more accurate. As Yogi Berra (or maybe someone else) once said, prediction is hard — especially about the future. But the gap between the two forecasts is very small: 0.3 percent of GDP in 2021. When past administrations and CBO have predicted the size of the economy several years down the road, they’ve sometimes been too optimistic and sometimes too pessimistic, but on average they’ve missed the mark by much more than the difference between these two forecasts.

In short, there are better explanations for the Administration’s economic forecast than Rosy Scenario sightings on Pennsylvania Avenue.