BEYOND THE NUMBERS

Buried in the new rules that the House Republican majority plans to adopt for the 114th Congress is a provision that could threaten Disability Insurance (DI) beneficiaries — a group of severely impaired and vulnerable Americans — with a sudden, one-fifth cut in their benefits by late 2016. The provision bars the House from replenishing the DI trust fund simply by shifting some payroll tax revenues from Social Security’s retirement trust fund.

Its drafters state that the rule “would protect the Old-Age and Survivors Insurance (OASI) Trust Fund from diversion of its funds to finance a broken Disability Insurance system.” But DI — a vital part of Social Security — isn’t broken. Its recent growth stems primarily from well-understood demographic and program factors, chiefly the aging of the baby boom into their 50s and 60s, the growth of women’s role in the labor market and hence their eligibility for DI, and the rise in Social Security’s full retirement age. And the Social Security trustees have long anticipated the need to replenish the fund in 2016.

Reallocating some taxes between the retirement and disability trust funds is a historically noncontroversial measure that Congress has taken 11 times, in both directions depending on which trust fund was running short. Another reallocation to replenish the DI trust fund wouldn’t threaten seniors, contrary to the rule’s implicit attempt to pit retirement and disability beneficiaries against each other.

More specifically, here’s what people need to know:

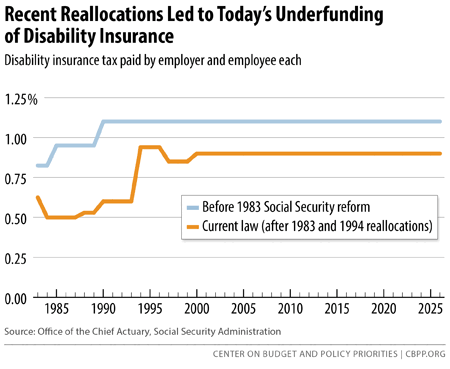

- The last two reallocations have shortchanged DI, underfunding it compared with the retirement program. Congress redirected a big chunk of payroll taxes from DI to OASI in 1983 and only partly offset that in a 1994 law. (See graph.) If DI’s tax rate had remained at its pre-1983 level, we wouldn’t need to replenish the fund today. Yet nobody claims that the 1983 reallocation, which helped stave off OASI’s imminent depletion, “robbed” DI … nor could they reasonably claim that reallocating in the other direction would “rob” OASI.

- A reallocation would have only a tiny effect on the retirement program’s solvency. Reallocating taxes to put the two trust funds on an even footing would prolong the DI trust fund by 17 years (from 2016 to 2033), while advancing the OASI fund’s depletion by just one year (from 2034 to 2033). The reason is simple: OASI is much bigger than DI, so a modest reallocation barely dents OASI. And before then, policymakers will almost surely address Social Security solvency in a comprehensive fashion.

Image

- Most DI recipients are older people, so helping DI helps seniors. The risk of disability rises with age, and most DI beneficiaries are older. Seventy percent of disabled workers are age 50 or older, 30 percent are 60 or older, and 20 percent are 62 or older and would actually qualify as early retirees under Social Security.

Neutral experts like the American Bar Association and the National Academy of Social Insurance, as well as retiree advocates like AARP and the National Association to Preserve Social Security and Medicare, agree that reallocating payroll taxes is necessary and reasonable.

By barring the House from approving a “clean” reallocation in 2016, the rule will strengthen the hand of lawmakers who seek to attach harsh conditions (such as sharp cuts in eligibility or benefit amounts) to such a measure. Instead, policymakers should enact a clean and sensible reallocation to avert an unacceptable cut in DI benefits while working on the main goal: ensuring solvency for all of Social Security.