Today’s Washington Post story on the doings of the Washington “influence industry” (as the headline puts it) spotlights the massive lobbying campaign underway to convince Congress to grant large multinational corporations a temporary tax holiday for overseas profits they bring back to this country. This sets up a classic Washington battle of influence versus evidence. Here’s some evidence (more here):

- A similar tax holiday enacted in 2004 proved to be a complete policy failure. Its backers claimed that firms would use the repatriated earnings to invest in U.S. jobs and economic growth. Instead, they mostly used the money for purposes that the tax-holiday legislation had sought to prohibit, such as repurchasing their own stock and paying bigger dividends to their shareholders. Moreover, many firms actually laid off large numbers of U.S. workers even as they reaped multi-billion-dollar benefits from the tax holiday and passed them on to shareholders. To cite just two examples, Pfizer — which repatriated around $37 billion in foreign profits, the most of any firm — eliminated around 10,000 American jobs in 2005, while Merck repatriated $15.9 billion and announced layoffs of 7,000 workers in 2005. (These layoffs cannot be attributed to general economic weakness: they came at a time when the U.S. economy was growing significantly and adding jobs.)

- Repeating the tax holiday would increase incentives to shift income overseas. Many companies responded to the 2004 holiday by shifting even more profits overseas. If Congress enacts a second tax holiday, rational corporate executives will conclude that more tax holidays are likely in the future. That will make them even more inclined to invest abroad and less likely to invest in the United States. That’s why Congress, in enacting the 2004 tax holiday, explicitly warned that it should be a one-time-only event. It’s hard to see how the 14 million Americans who are out of work would benefit from having their government provide another enticement for companies to invest overseas.

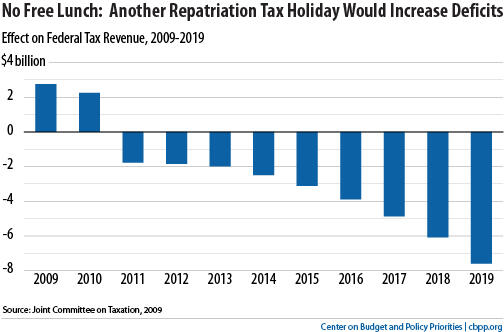

- There’s no free lunch — corporate tax amnesty would add to deficits. One lobbyist in the Post story advances the line that the holiday would “cost taxpayers next to nothing.” In reality, the Joint Tax Committee estimated in 2009 that a similar proposal would cost $29 billion over ten years (see chart) — an expensive lunch even by Washington standards.

Lawmakers should keep all of this evidence in mind as they prepare for the lobbying barrage.