BEYOND THE NUMBERS

No state that enacted large personal income tax cuts in the past five years in hopes of spurring growth has seen its economy surge, new data on state gross domestic product (GDP) show. That adds to the already strong evidence that the tax cuts haven’t produced the immediate boost some proponents claimed.

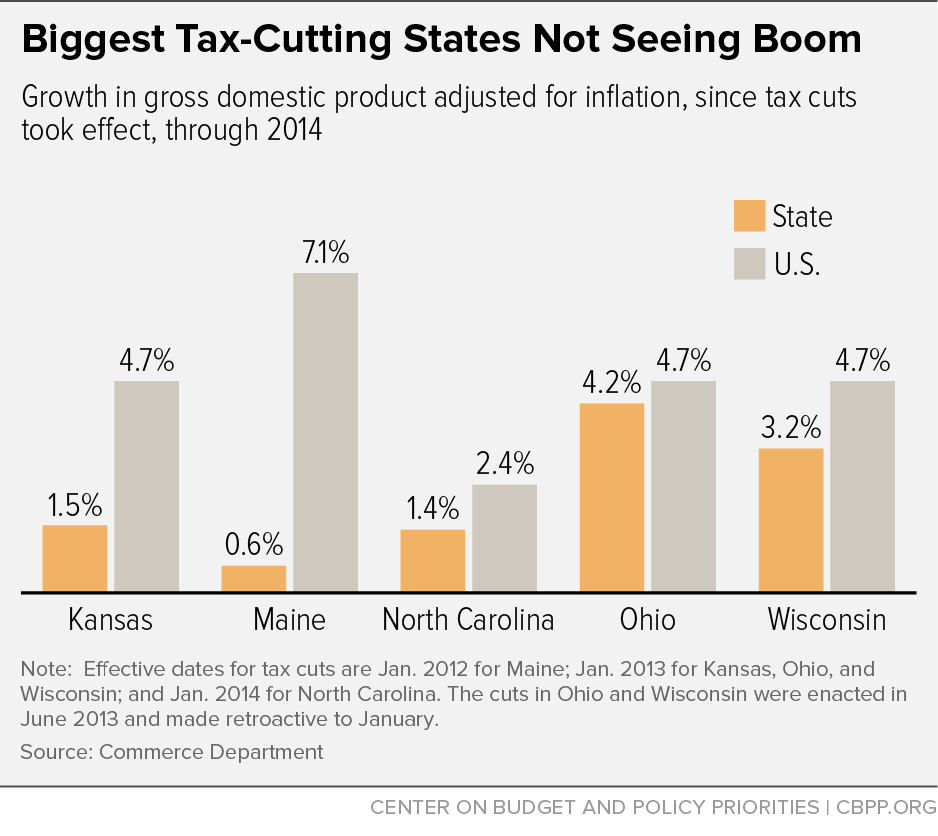

In all five states — Kansas, Maine, North Carolina, Ohio, and Wisconsin — GDP growth has been slower than national GDP growth since the tax cuts took effect. (See chart.) While most of these states were doing relatively poorly before the tax cuts (only North Carolina grew faster than the nation at large in the year before cutting taxes), none have seen a clear improvement in growth relative to the nation since the cuts took effect.

That’s not what tax-cut proponents said would happen. Consultants Art Laffer and Stephen Moore, who helped design Kansas’ tax cuts, claimed in 2012 that cutting income tax rates provides “the most effective immediate and lasting boost” to state economies.

But the results should come as no surprise. State after state that has experimented with large tax cuts has failed to see the promised economic benefits. States should focus instead on investing in the basic building blocks of long-term growth, like a well-educated and healthy workforce and modern infrastructure.