Report

Government’s Pandemic Response Turned a Would-Be Poverty Surge Into a Record Poverty Decline

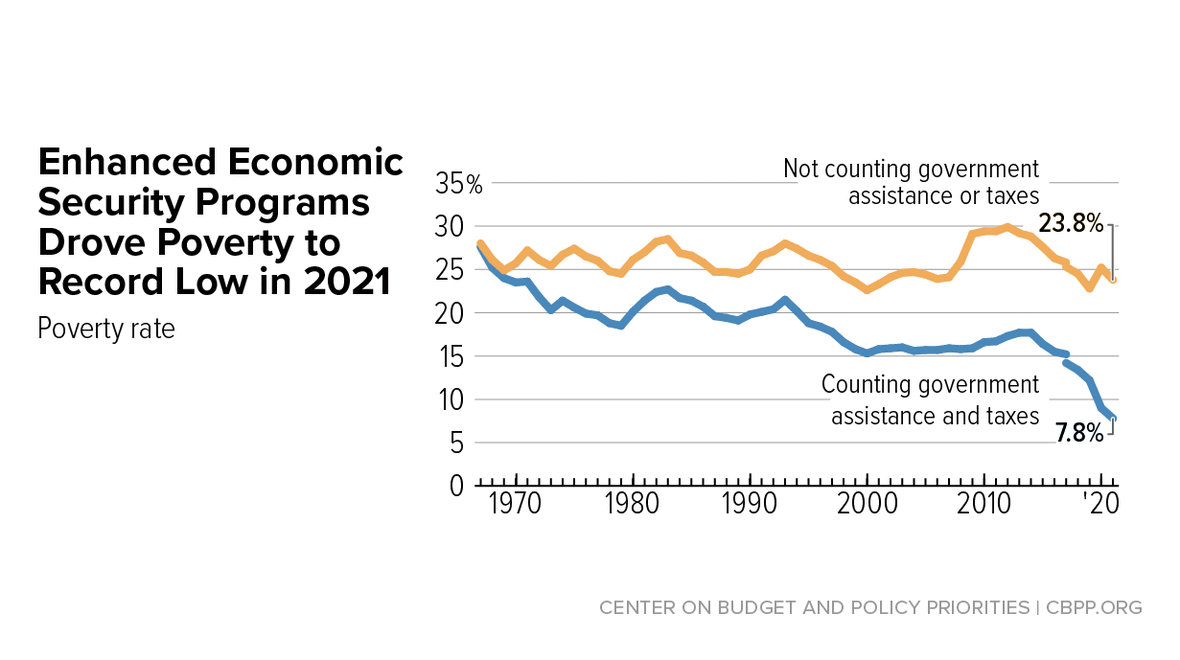

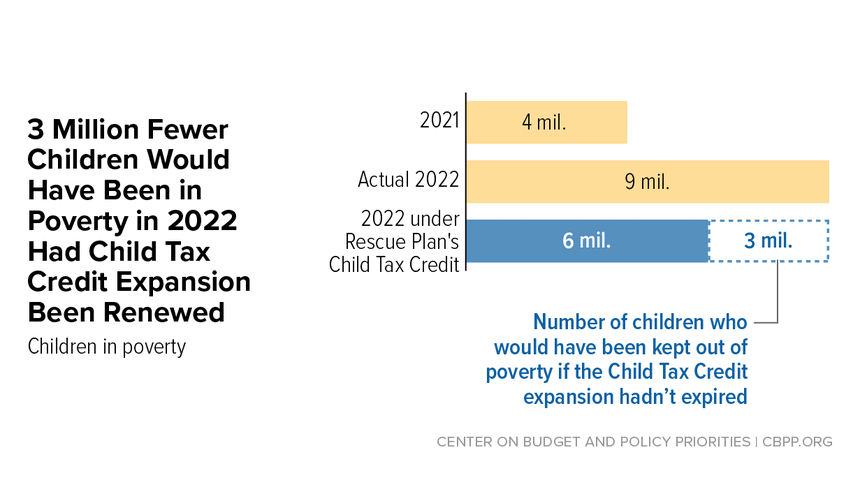

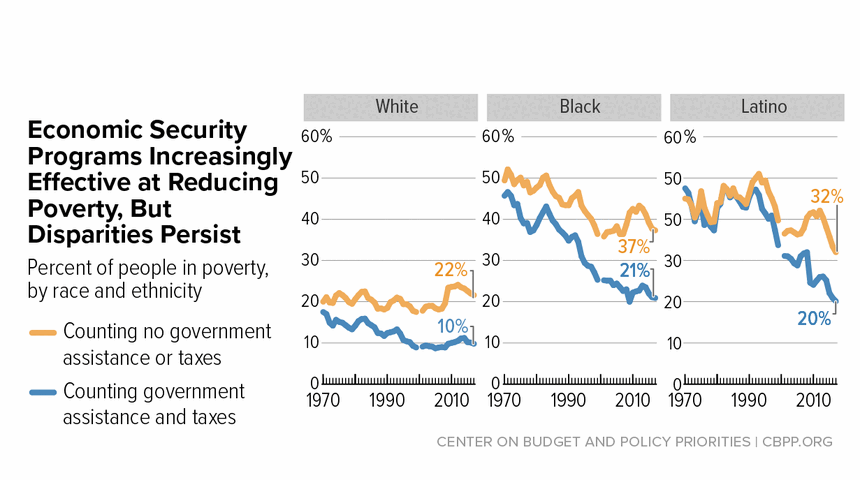

Public programs transformed what, without the programs, would have been a near-record surge in poverty in the COVID-19 recession into a record one-year overall poverty decline in 2020 and a record one-year decline in children's poverty in 2021.