- Home

- Policies Can Make Health Coverage More A...

Policies Can Make Health Coverage More Affordable, Accessible to Reach the Remaining Uninsured

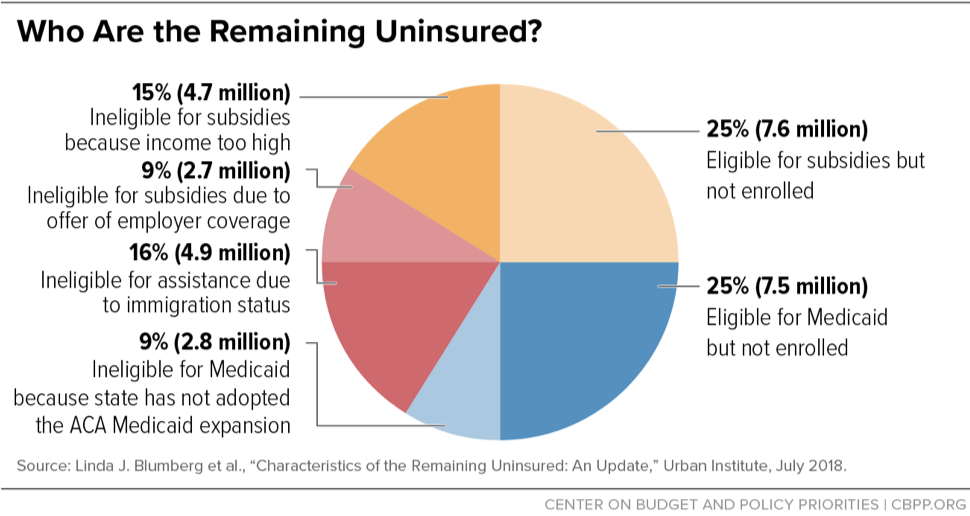

Since the Affordable Care Act (ACA) took effect, more than 20 million people have gained coverage due to Medicaid expansion, subsidies that help people afford private coverage, and private insurance market reforms — dropping the non-elderly uninsured rate from 18.2 percent in 2010 to 10.3 percent in early 2018. Yet, about 30 million people remain uninsured (see chart), and that number will likely rise due to recent Administration actions and the repeal of the ACA’s individual mandate penalty. A range of federal and state policies could make coverage more affordable and accessible for many of these people, sharply reducing the number of uninsured.

Improve the Affordability of Marketplace Coverage

7.6 million uninsured people qualify for subsidized marketplace coverage but aren’t enrolled. Despite usually being eligible for subsidies, people with lower incomes are still much more likely to be uninsured than those at higher incomes, because coverage is often unaffordable for them even with financial assistance. Policies to help include:

- Reduce the cost of coverage: Reduce the share of income people are required to pay for marketplace coverage by increasing subsidies.

- Increase cost-sharing assistance: Increase cost-sharing subsidies and extend them to people at higher incomes to defray high deductibles.

- Address barriers to enrollment: Restore a three-month open enrollment period to give people more time to compare plans and enroll. People with the highest subsidies could be permitted to enroll at any time of year in a Massachusetts-style continuous open enrollment.

4.7 million uninsured people have income too high for subsidies. Policies to help include:

- Protect against excessive premiums: Expand subsidies so that middle-income people would also qualify for help if their premiums exceed about 10 percent of their incomes.

- End substandard plans: Reverse administration actions that have increased the cost of comprehensive coverage by promoting substandard plans that draw healthy people out of the marketplace risk pool.

Expand Access to Medicaid Coverage

2.8 million people are trapped in the coverage gap because their states haven’t expanded Medicaid. Lawmakers in those states could extend coverage to millions, with the federal government covering at least 90 percent of the cost. Federal policymakers could increase the incentive for states to expand by letting newly expanding states access the temporary 100 percent federal match that was available during the first three years of the ACA Medicaid expansion (2014 to 2016).

7.5 million people aren’t enrolled in Medicaid even though they are likely eligible. Some aren’t aware of their eligibility, or they wait until the point of care to enroll or let their enrollment lapse because the enrollment process is challenging.

- Simplify enrollment and improve retention: “Express lane eligibility” uses the data verification and enrollment determinations of other public programs as evidence of meeting most Medicaid eligibility criteria. The federal government could encourage state use of this option and extend it to adults. States can also minimize participant “churn” between programs and save administrative costs by letting people remain enrolled for a full year (“continuous eligibility”).

- Protect retroactive Medicaid: Medicaid-eligible people who aren’t enrolled are still protected from catastrophic costs through retroactive coverage, which covers eligible health costs for up to three months prior to enrollment. But this protection is under threat from state Medicaid waivers approved by the Trump Administration.

Address Challenges for Those Without Access to the Marketplaces or Medicaid

2.7 million people are ineligible for marketplace subsidies because they have an offer of employer coverage that technically qualifies as “affordable,” even though it may be unaffordable in practice. Some of these offers may qualify as “affordable” because premiums are less than about 10 percent of income, but the plans have high deductibles and minimal benefits. Others may qualify as affordable because premiums for employee-only coverage are less than about 10 percent of income, even though family coverage costs much more.

- Strengthen the affordability standard: Raise the standards for an offer to count as affordable by lowering the percentage of income employees can be required to pay in premiums and requiring plans to cover a greater share of total costs.

- Fix the “family glitch:” Base family affordability on the cost of family, rather than employee-only, coverage.

4.9 million people are ineligible to enroll in Medicaid or the marketplaces because they don’t meet immigration-related eligibility requirements. Cities, counties, and states are exploring policies to provide health insurance options for this group, and federal policymakers should also consider immigration and health policies that would increase coverage rates.

Cross-Cutting Policies Can Reduce Cost, Increase Coverage for Multiple Groups

- Enhance outreach. The Trump Administration has dramatically cut funding for outreach and in-person assistance. Outreach helps people who are eligible for Medicaid or subsidized marketplace coverage and don’t know it, while also helping bring down premiums for unsubsidized marketplace consumers by broadening the risk pool.

- Create a public option. A public option could increase choice for all marketplace consumers and put downward pressure on premiums and on hospital and physician charges, especially in markets with limited competition.

- Restore or replace the individual mandate penalty. Congress’ repeal of the ACA’s individual mandate penalty will increase uninsured rates, because some people will forgo enrolling in coverage, including employer coverage, without the additional push to enroll. Some states are responding by creating their own individual mandates. The federal government could restore the mandate penalty or consider more ambitious alternatives, such as automatically enrolling the uninsured in coverage with premiums collected through tax returns.