The Special Supplemental Nutrition Program for Women, Infants, and Children, popularly known as WIC, provides nutritious foods, counseling on healthy eating, breastfeeding support, and health care referrals to nearly 8 million low-income women, infants, and children at nutritional risk. Extensive research has documented that WIC is extremely effective: participating in WIC improves low-income families’ nutrition and health, leading to healthier babies, more nutritious diets and better health care for children, and higher academic achievement for students.[2] WIC is also cost-effective, and its competitive bidding process for purchasing infant formula is essential to its efficiency.[3]

Infant formula manufacturers provide substantial discounts, in the form of rebates, to state WIC programs in return for the exclusive right to provide their products to the state’s WIC participants. These rebates mean that WIC obtains infant formula at a large discount, generating $1.3 billion to $2 billion a year in savings that allows WIC to serve 2 million more participants each year with its federal funding. In the absence of the savings from competitive bidding, WIC either would need a substantially larger appropriation or would serve substantially fewer women, infants, and young children at nutritional risk.

Infants and very young children can face lifelong cognitive and health consequences if they don’t get adequate nourishment. WIC aims to ensure that pregnant women get the foods they need to deliver healthy babies and that those babies are well nourished as they grow into toddlers. Since 1997, Congress — on a bipartisan basis — has provided sufficient funding each year for WIC to serve all eligible applicants. The program receives approximately $6 billion in annual appropriations.

Understanding the history and structure of WIC’s competitive bidding process for infant formula — as well as the resulting federal savings — can help policymakers ensure that this critical component of WIC’s design remains strong.

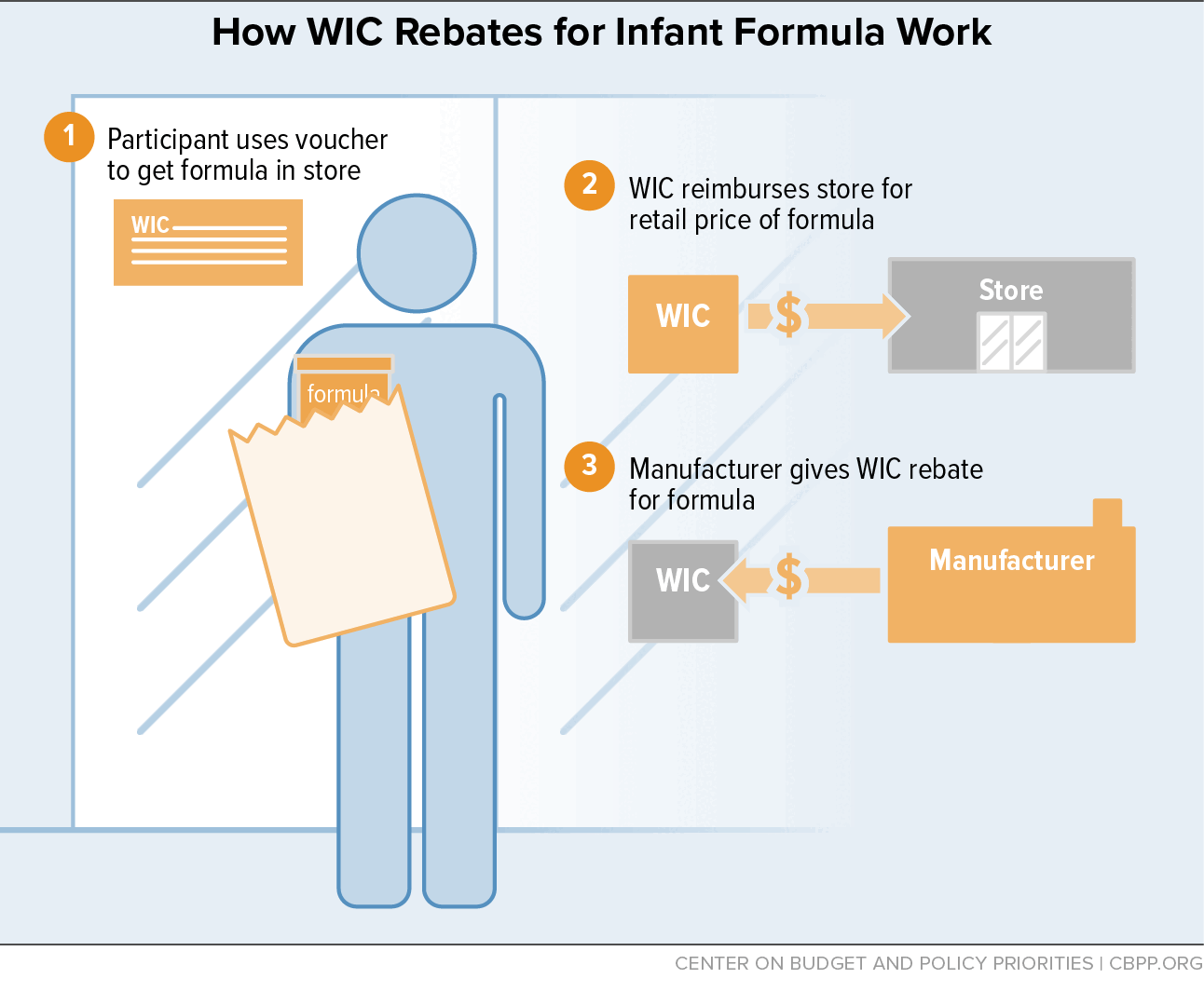

Although WIC recognizes and promotes breastfeeding as the optimal source of nutrition for infants, it provides iron-fortified infant formula for women who do not fully breastfeed. More than 47,000 grocery stores nationwide have been approved to accept WIC food vouchers based on their prices and the variety of foods they offer. Participants select their WIC-approved foods, including infant formula, from the shelves and use WIC vouchers to pay at the register.

The cost of infant formula can be substantial — up to $150 per month — and could easily strain the limited budgets of low-income families if not for the critical assistance WIC provides.[4] Infant formula is the single most expensive item WIC provides and the program spends more on formula than any other food — $927 million in fiscal year 2010.

WIC uses a competitive bidding process under which infant formula manufacturers offer discounts, in the form of rebates, to state WIC programs in order to be selected as the sole formula provider to WIC participants in the state. Winning the WIC contract helps to ensure that a manufacturer’s brand is widely available and receives favorable shelf space in stores. When a manufacturer wins the WIC contract, purchases increase among non-WIC participants as well as WIC participants.

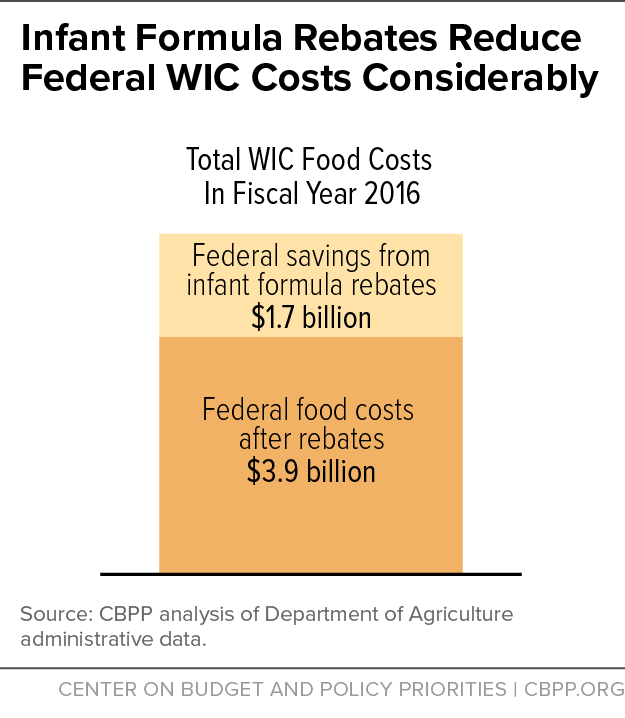

As a result, even though bidding is entirely voluntary, infant formula manufacturers routinely compete aggressively on WIC contracts and offer substantial rebates. Nationwide, the competitive bidding process yields $1.3 billion to $2 billion a year in rebates. As a result of these savings, WIC’s cost to the federal government is much lower than the full retail value of WIC benefits for program participants. (See Figure 1.)

In the mid-1980s, infant formula accounted for nearly 40 percent of total WIC food costs, and the cost of formula was rising much faster than other foods and consumer goods. The very high and rising cost of formula made it harder for state WIC programs to serve eligible women, infants, and children within their WIC funding allotments. Many eligible individuals were placed on waiting lists.

Several state WIC programs, led by Tennessee and Oregon, responded by proposing to use the free-market principle of competition to contain WIC food costs. They proposed to use competitive bidding — long standard for many businesses and government agencies — to secure the most economical price for WIC infant formula.

The two largest infant formula manufacturers, Mead Johnson and Ross Laboratories, resisted. When the first state bids were issued, no company bid. Ultimately, however, a third formula manufacturer with a smaller market share, Wyeth, submitted a bid in Tennessee and won the state contract, with the Tennessee WIC program securing large savings that enabled it to serve more eligible women, infants, and children. Once this occurred, various other states also moved to institute competitive bidding. The most decisive showdown occurred in Texas in 1988, where a conservative Republican administration moved to institute competitive bidding and some of the large manufacturers mounted a major opposition lobbying effort, but the state moved forward with competitive bidding nonetheless.

These developments aroused considerable interest in Washington, D.C. The high and rising cost of infant formula was placing pressure on the annual WIC appropriation. And Congress took notice that the federal government, which funds 100 percent of WIC food costs, was paying much more per infant in states that had not instituted competitive bidding than in states that had done so. Accordingly, Congress and President George H.W. Bush enacted legislation on a bipartisan basis in 1989 requiring all state WIC programs to use competitive bidding for the purchase of infant formula, unless the state could institute an alternative mechanism that would provide comparable savings. (No state has yet taken this approach.)

Conflict over competitive bidding, however, did not end at that point. With the new requirement for all states to institute competitive bidding taking effect, Ross Laboratories lowered the discounts that it offered through competitive bidding, and Mead Johnson — in a highly unusual move —announced publicly the maximum discount per can that it would offer in the sealed bids it would submit under competitive bidding, setting it at about the same level as the shrunken discounts that Ross had begun offering. These practices undercut competitive bidding and sharply reduced the savings it produced. They also caught the attention of the Senate Judiciary’s Subcommittee on Antitrust, Monopolies, and Business Rights, which conducted high-profile hearings, and the Federal Trade Commission (FTC), which launched an investigation into anti-competitive behavior. In addition, 19 state attorneys general sued the infant formula companies.[5]

Ultimately, infant formula companies reached settlements with the FTC and/or various states. Mead Johnson entered a consent agreement with the FTC in January 1992 in which it agreed to end the anti-competitive practices. Mead Johnson, Ross Laboratories, and Wyeth also made multi-million-dollar payments to settle several state lawsuits. The significant media attention stemming from these actions cast the companies in an unfavorable light.

These developments had a strong effect. The apparent coordination of bids among infant formula companies, which undercut competitive bidding, ceased. Companies began to compete vigorously for infant formula contracts, and the savings from competitive bidding rose markedly. These savings have remained strong ever since.

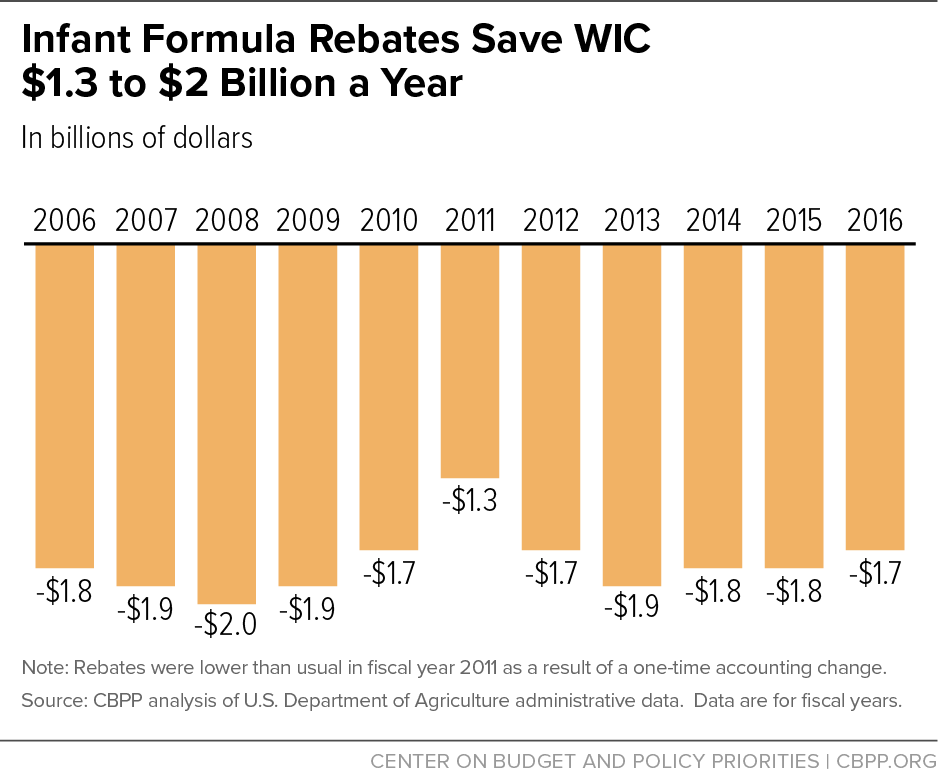

Manufacturers’ rebates are generally large, both in dollar amounts and as a share of the cost of infant formula for WIC participants.[6] The competitive bidding process yields $1.3 billion to $2 billion a year in savings, allowing WIC to serve approximately 2 million more participants annually.

Three firms supply the vast majority of the infant formula available in the United States. Highly concentrated markets such as this, which are dominated by a few large companies, are often associated with higher profit margins, according to Agriculture Department economists.[7] Infant formula manufacturers can price formula at a premium well above their cost of production, which in turn gives them room to offer substantial rebates.

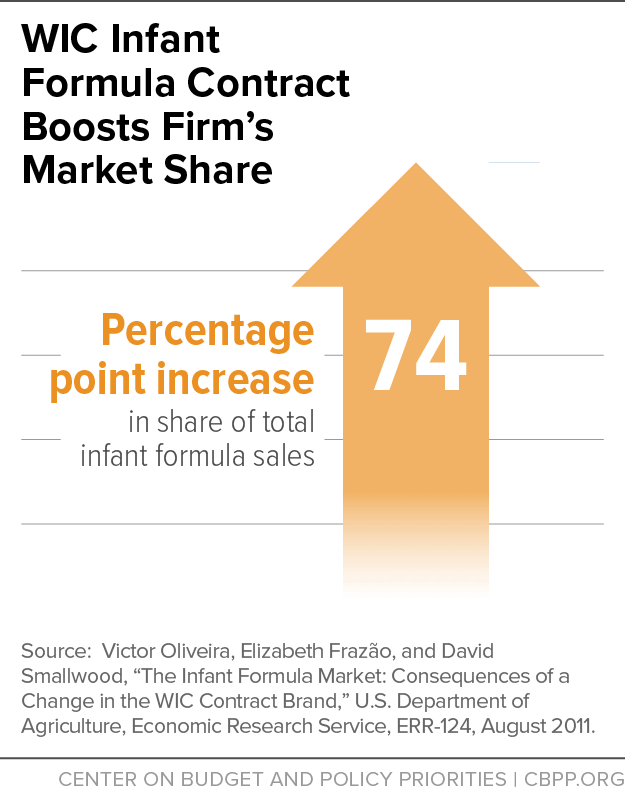

Moreover, there is an immediate benefit for the winning bidder on each infant formula contract. Researchers at the Department of Agriculture’s Economic Research Service have shown that the market share of the winning manufacturer increases by an average of 74 percentage points when a contract changes hands.[8] (See Figure 2.) Most of this increase is a direct effect of WIC participants switching to the new contract brand, but another benefit to manufacturers of winning the WIC contract is that the contract brand typically gets extra shelf space and better product placement. The greater visibility may increase sales among consumers who do not participate in WIC. This effect is important because a manufacturer receives about 20 times as much revenue from each can of formula sold to a non-WIC consumer as from a can purchased through WIC.

It’s worth repeating that infant formula manufacturers are not required to bid. If obtaining a WIC contract were not worthwhile, they wouldn’t bid or would only offer much smaller rebates.

Between 2008 and February 2013, the inflation-adjusted cost of infant formula fell for 20 of the 22 WIC contracts awarded.[9] This means that most of the WIC agencies that awarded new contracts during that period are paying less per unit under their current contract than before.

While the rebate per unit has increased in recent years, the total amount of rebates provided by manufacturers has declined, from $2 billion in 2008 to $1.7 billion in 2016. (See Figure 3.) This trend reflects a reduction in the number of infants participating in WIC, an increase in breastfeeding rates among participants, and a decline in the amount of formula provided in the revised infant food packages introduced in 2009 — all of which reduced formula purchases through WIC as well as manufacturers’ rebate costs.

Rebates are an important source of savings for WIC. WIC is funded annually by congressional appropriations and competes with other programs for funding under the current caps on non-defense discretionary spending.[10] As a result, the number of participants it can serve within its budget depends heavily on the program’s food costs, which in turn are significantly affected by the cost of infant formula. By securing savings through competitive bidding, WIC can serve more people with a given level of federal spending. Without the rebates, WIC would have been able to serve about 2 million fewer participants — a cut of roughly one-fourth — with its federal spending in fiscal year 2016.

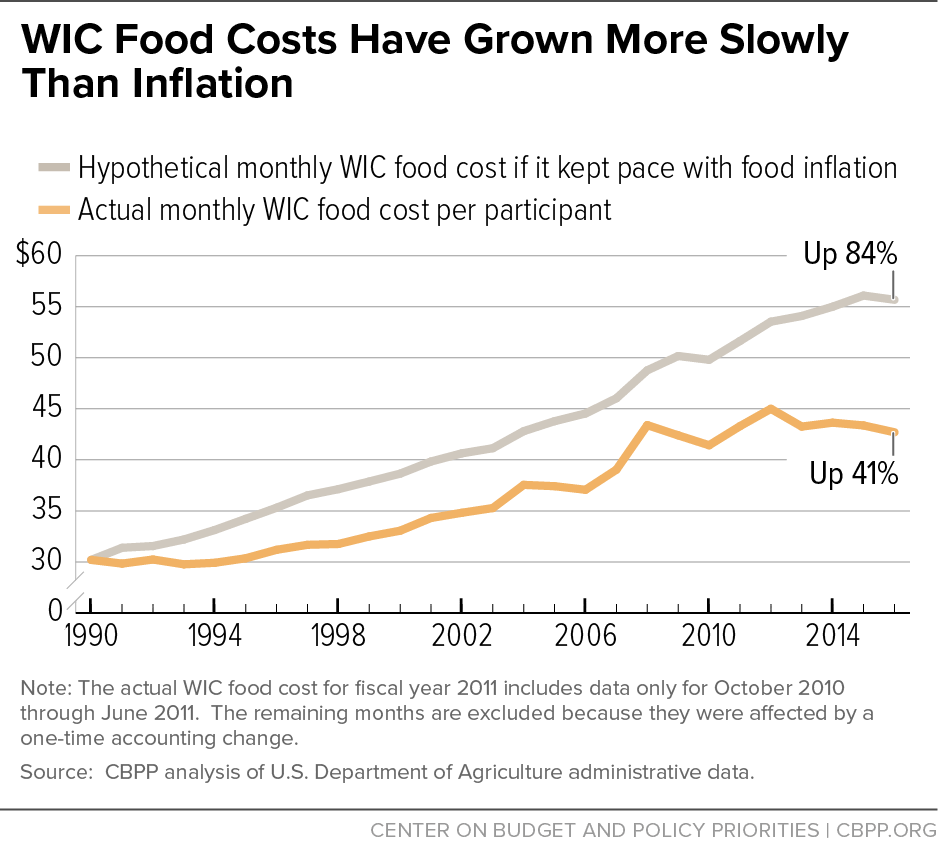

Rebates and other cost containment efforts have also slowed the rise of overall WIC food costs. Between 1990 and 2016, the average cost of food provided to WIC participants — including infant formula — rose slightly less than half as much as the overall cost of food (41 percent versus 84 percent). (See Figure 4.)

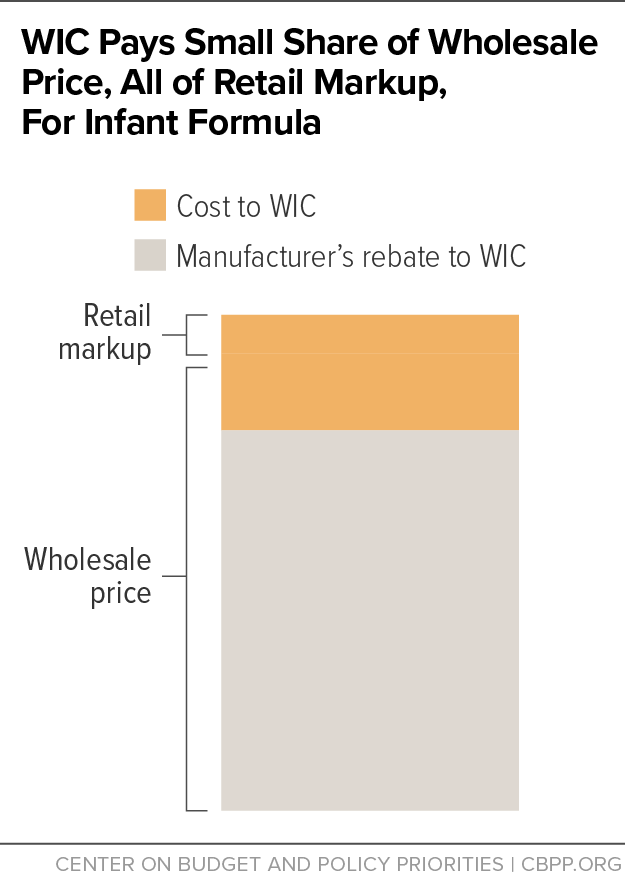

After a WIC participant purchases infant formula at a WIC-authorized grocery store using a WIC food voucher, the state WIC program reimburses the retailer for the retail price of the formula. (See Figure 5.) The state WIC program then bills the manufacturer that won the contract for the discount, or rebate, that the manufacturer offered in its winning bid. As a result, the cost to WIC for each purchase of infant formula is well below the normal retail price. (See Figure 6.)

States typically rebid rebate contracts every three to four years.[11] States can solicit bids on their own or as part of multistate alliances.[12] In exchange for the rebate, states agree to issue only the winning manufacturer’s infant formula to WIC participants. (Exceptions are made for WIC participants who, for medical or religious reasons, require a different infant formula.) Contracts are awarded to the manufacturer that offers the lowest net price (the wholesale price minus the rebate). Since the mid-1990s, three manufacturers have held the various state contracts.

Two factors affect the prices other consumers pay for infant formula: the wholesale price charged by manufacturers and the retail mark-up levied by supermarkets and grocery stores. The impact of WIC infant formula rebates on wholesale and retail prices cannot be measured directly. With the competitive bidding process having been in use throughout the country for more than two decades, we cannot know with any certainty how manufacturers and retailers would have set prices today if rebates did not exist. Nonetheless, economists have used econometric models to estimate what prices might theoretically look like in the absence of WIC infant formula rebates.

Wholesale prices are established by the manufacturers, based in part on their production and marketing costs. David Davis, an economist at South Dakota State University, theorized that WIC would not affect wholesale prices if rebates were adjusted to reflect price changes. While these adjustments are required during the life of each competitively awarded contract under current law, Davis provides empirical evidence that, on average, rebates are also adjusted to reflect price changes when new contracts are awarded. He therefore concludes that WIC has no impact on wholesale

prices.[13] David Betson, an economist at the University of Notre Dame, estimates that WIC’s existence likely raises wholesale prices but by a smaller amount than if WIC existed but did not use competitive bidding.[14]

Retail prices at supermarkets and grocery stores in any given market area depend on a number of economic, demographic, and program factors. The most comprehensive national study of infant formula retail prices, conducted by researchers at USDA’s Economic Research Service (ERS), found no evidence to suggest that rebate levels affect retail markups. ERS found some evidence in 2004 that winning a state’s infant formula contract resulted in modestly higher retail prices for the new contract brand: when the holder of a state’s contract changed, the retail price of the new brand rose by about 1 percent more than the price of the old brand.[15] But evidence of such increases in mark-ups has not been found since. While WIC rebates may have resulted in modest increases in the prices paid by non-WIC consumers for the contract brand, lower-priced brands are available to non-WIC consumers in most parts of the country.

In sum, it is difficult to assess the impact of WIC on infant formula prices because WIC’s competitive bidding process is such an established aspect of the infant formula market and there have been few attempts to examine this area. The existing evidence suggests that WIC infant formula rebates have a modest effect, if any, on infant formula prices.

Infant formula rebates are an important and highly effective means of reducing WIC’s cost to the federal government, allowing the program to serve more low-income women, infants, and children. While manufacturers have an interest in increasing their profits, competitive bidding for infant formula remains a key cost-containment mechanism. It enables more eligible women and young children to receive WIC, makes the program more efficient and cost-effective, and reduces federal costs. Both WIC participants and general taxpayers benefit as the program improves low-income families’ nutrition and health, leading to healthier babies, more nutritious diets and better health care for children, and higher academic achievement for students.

Competitive Bid: A transparent procurement method in which a state or multistate alliance invites bids from infant formula manufacturers for the exclusive right to provide infant formula to WIC participants. Competitive bidding helps the government obtain the lowest net price for formula by stimulating competition among manufacturers in accordance with free-market principles.

Contract Brand: All infant formulas produced by a manufacturer awarded the infant formula contract for a state (except exempt infant formula; see below).

Cost Containment: A system such as competitive bidding, implemented by a state agency to reduce WIC food costs or limit cost increases.

Exempt Infant Formula: Infant formulas regulated by the Food and Drug Administration for use by infants who have low birth weight, rare genetic disorders in which the body cannot properly turn food into energy, or other unusual medical or dietary problems.

Food Costs: The cost to the government of the supplemental foods provided to WIC participants. In fiscal year 2016, the average monthly cost for each participant — after rebates — was $42.70.

Food Voucher or Food Instrument: A voucher, check, electronic benefits transfer (EBT) card, coupon, or other document used by a WIC participant to obtain WIC foods.

Multistate Alliance: Two or more WIC state agencies that join together to solicit competitive bids for infant formula.

Infant Formula: A manufactured food designed and marketed for feeding to infants under 12 months of age, usually prepared for bottle-feeding from powder (mixed with water) or liquid (with or without additional water). Infant formula typically substitutes for a mother’s breast milk.

Net Price: The government’s wholesale cost of infant formula after rebates. The net price equals the wholesale price minus the rebate; more specifically, it is the difference between an infant formula manufacturer’s lowest national wholesale price per unit for a full truckload of infant formula and the rebate offered by the manufacturer.

Non-Contract Brand: All infant formula, including exempt infant formula, not covered by an infant formula rebate contract awarded by a state agency.

Primary Brand: The specific infant formula for which manufacturers submit a bid to a state agency in response to a competitive bid request and for which a contract is awarded as a result.

Rebate: The money refunded to a state by infant formula manufacturers for formula purchased by WIC participants. Rebate payments are made after participants exchange their food instruments for formula.

Retail Price: The price paid by consumers in grocery stores for infant formula. The retail price equals the wholesale price plus the retailer’s mark-up.

Retail Mark-Up: The difference between the wholesale price that the retailer pays for infant formula and the retail price of formula sold to consumers. The retail mark-up allows retailers to pay for the overhead costs of running a business (such as rent, heating, electricity, and employee wages) and make a profit.

Single Solicitation: States and multistate alliances that serve fewer than 100,000 infants on average have an option to solicit bids for a single iron-fortified, milk-based infant formula that is suitable for most generally healthy, full-term infants. Bidders that do not produce a soy-based infant formula are required to subcontract with another manufacturer to ensure availability of a soy-based option.

Separate Solicitation: Any state or multistate alliance that serves at least 100,000 infants on average must issue separate bid requests for milk-based and soy-based infant formula.

WIC Infant Formula Contract: The contract awarded to the infant formula manufacturer that provides the lowest net price in response to a state’s competitive bid request. In exchange, the manufacturer is given the exclusive right to provide its products to WIC participants in the state.

Wholesale Price: The price established by manufacturers for bulk sales of infant formula for distribution to retail grocery stores. Manufacturers earn a profit by setting wholesale prices above the cost of production.