- Home

- The Minimum Wage

Policy Basics: The Minimum Wage

Minimum wage laws set the lowest hourly rate an employer can legally pay certain workers. The federal minimum wage is currently $7.25 per hour. Where states and municipalities have enacted their own higher minimum wage laws, employers must pay at least the state or local minimum. As of December 19 2018, 29 states and the District of Columbia have minimum wages above the federal minimum wage.

Who Is Covered by the Federal Minimum Wage?

Most workers employed in the United States are covered by the minimum wage. Employees of any business or enterprise with gross annual sales or business done of at least $500,000 and employees of any business that participates in interstate commerce must be paid the minimum wage. So too must employees of federal, state, and local government agencies, hospitals and schools, and most domestic workers. Certain exceptions apply to young workers, full-time students and student learners, and workers with disabilities. Further, tipped workers have a minimum base wage of $2.13 per hour. If such a worker’s tips in a given pay period plus the base wage do not add up to the regular minimum wage, the employer is required to pay the difference; this requirement, however, can be hard to enforce.

Who Is Paid the Minimum Wage?

In 2017, 1.8 million workers earned wages at or below the federal minimum, according to the Bureau of Labor Statistics (BLS). About half of these workers were over age 25, and over a third worked full time. Women were more likely to hold minimum wage jobs than men, and Black people were more likely to hold minimum wage jobs than people of other races and ethnicities. Almost 70 percent of those who make the minimum wage or below were in the service industry, and about 16 percent were in sales or administrative support.

History of the Minimum Wage

The first U.S. minimum wage was instituted under the Fair Labor Standards Act of 1938. Since then, Congress has raised the minimum wage 22 times and changed who is covered under it.

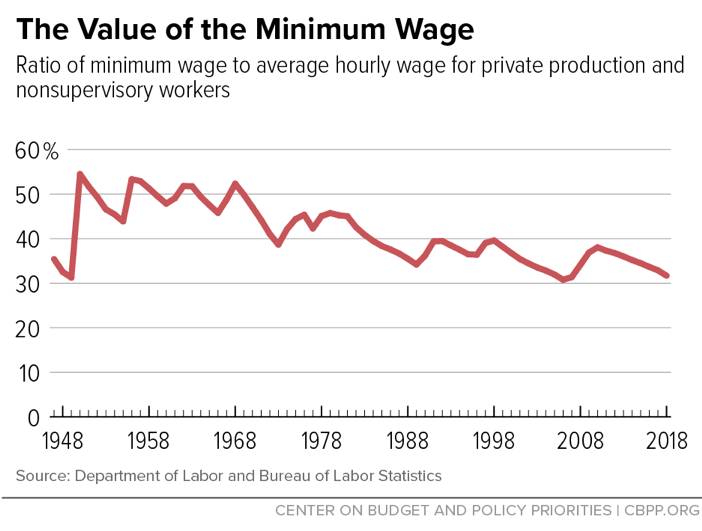

Because the minimum wage is not adjusted automatically for inflation, its real (inflation-adjusted) value tends to fall in the years between enacted increases — as happened during the 1980s when the real value of the wage floor fell by 30 percent, from the mid-1990s until 2007 (20 percent decline), and after 2009 (14 percent and falling). Such declines in the purchasing power of the minimum wage lower minimum-wage workers’ living standards. The minimum wage is roughly 30 percent of the average wage for blue-collar factory workers and non-management service employees ]. In the late 1960s, in contrast, the minimum wage was around half of that typical wage.

Economic Effects of Raising the Minimum Wage

According to simple supply-and-demand theory, employers may respond to a minimum wage increase by:

- hiring fewer workers,

- reducing the number of hours their employees work,

- passing on some of the cost of higher wages to their customers in the form of higher prices, and/or

- absorbing some of the cost of higher wages in the form of lower profits.

Beyond simple supply-and-demand theory, increasing the minimum wage may also spur businesses to operate more efficiently and employees to work harder. Employers may look for ways to increase productivity, such as setting higher performance standards for their employees or investing more in employee training. A higher wage may motivate employees to work harder because they feel they are being paid fairly and have more to lose by getting fired. This combination of efficiency improvements from both employers and employees decreases job turnover, reduces employers’ hiring costs, and can lead to employment gains.

Theory alone does not tell us how large any of these effects are, and is ambiguous about the direction. Indeed, empirical studies suggest that the effects of minimum wage increases on employment have historically been slightly negative, negligible, or sometimes even positive.

The Congressional Budget Office (CBO) estimates that low-wage workers as a group gain more income from the higher wage than they lose from reduced employment. The same can be true for most individuals, as well, if the employment losses are spread broadly over the low-wage population.

Recent Proposals for a Federal Minimum Wage Hike

President Obama proposed a minimum wage increase in 2013 and since then, 18 states and Washington, D.C. have taken action. Congressional Democrats have introduced bills to raise it as well. These proposals would raise the wage in several increments and index it to inflation thereafter.

Most recently, a bill from Senator Bernie Sanders (I-VT) and Representative Bobby Scott (D-VA) would raise the minimum wage in increments over several years but tie it to a measure of typical wages (the median) rather than inflation thereafter. The bill would also increase the minimum wage for individuals with disabilities and gradually eliminate the subminimum wage for tipped workers.

Proposals like these would eliminate the gradual erosion of the minimum wage’s value and the need for periodic, potentially contentious legislative debates to restore it. Such debates have been a feature of the minimum wage since its inception. The Trump Administration does not have an official position on the minimum wage, but Larry Kudlow, the head of President Trump’s National Economic Council, has said that the federal minimum wage is a “terrible idea” and that he personally won’t work with Congressional Democrats to lift it.