Press Release: Income Inequality Grew Across The Country Over The Past Two Decades: Early Signs Suggest Inequality Now Growing Again After Brief Interruption

In most states, the gap between the highest-income families and poor and middle-income families grew significantly between the early 1980s and the early 2000s, according to a new study by the Center on Budget and Policy Priorities and the Economic Policy Institute. The study is one of the few to examine income inequality at the state as well as national level.

The incomes of the country’s richest families have climbed substantially over the past two decades, while middle- and lower-income families have seen only modest increases. This trend is in marked contrast to the broadly shared increases in prosperity between World War II and the 1970s.

In addition, while income inequality declined following the bursting of the stock and high-tech bubbles in 2000 — both of which were quite costly to the highest-income families — early national-level data suggest that inequality began growing again in 2003. Incomes at the top have rebounded strongly from the stock market correction, while the negative effects of the recent recession on low- and moderate-income families have lasted longer than usual. Thus, it appears that the two-decade-long trend of worsening income inequality has resumed.

The study is based on Census income data that have been adjusted to account for inflation, the impact of federal taxes, and the cash value of food stamps, subsidized school lunches, and housing vouchers. Income from capital gains is also included. The study compares combined data from 2001-2003 with data from the early 1980s and early 1990s, time periods chosen because they stand as comparable low points of their respective business cycles. Its findings include:

In 38 states, the incomes of the bottom fifth of families grew more slowly than the incomes of the top fifth of families between the early 1980s and the early 2000s. In these 38 states, the incomes of the richest grew by an average of $45,800 (62 percent), while the incomes of the poorest grew by only $3,000 (21 percent) In other words, the poorest families — who saw an increase in purchasing power of only $143 per year — have not fared nearly as well as the richest families during this period. In only one state — Alaska — did the incomes of the low-income families grow faster than the incomes of the top fifth.

In 39 states, the incomes of the middle fifth of families grew more slowly than the incomes of the top fifth of families between the early 1980s and the early 2000s. In no state did the income gap (degree of income inequality) between middle- and high-income families narrow during this period.

Within the top fifth of families, the wealthiest families enjoyed the highest income growth over the past two decades. In the 11 states that are large enough to permit this calculation, the incomes of the top 5 percent of families rose between 66 percent and 132 percent during this period. This is faster than the income growth among the top fifth of families as a whole in these states— and much faster than the income growth among the bottom fifth of families in these states, which ranged from 11 percent to 24 percent.

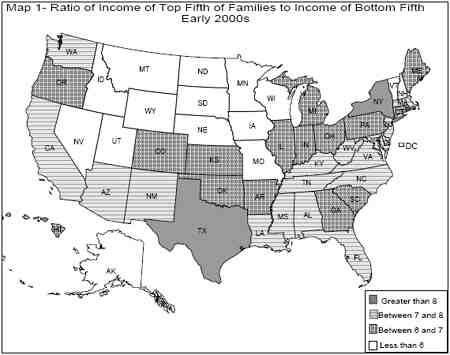

The five states with the largest income gap between the top and bottom fifths of families are New York, Texas, Tennessee, Arizona, and Florida. Generally, income gaps are larger in the Southeast and Southwest and smaller in the Midwest, Great Plains, and Mountain states. Income gaps tend to be larger in states where incomes in the bottom fifth are below the national average, and to be smaller in states where incomes in the bottom fifth are above the national average.

The five states with the largest income gaps between the top and middle fifths of families are Texas, Kentucky, Florida, Arizona, and Tennessee.

Income inequality increased rapidly during the 1980s. During the 1990s exceptionally low unemployment produced relatively broad-based wage growth during the latter part of the decade. This broad-based growth ended with the 2001 economic downturn. Growth in real wages for low- and moderate-income families began to slow and by 2003 wages began to decline. Thus far, the recovery from the downturn has not been strong enough to generate the kind of income gains among low- and middle-income families seen in the late 1990s.

Growing Inequality Has Costly Consequences

“Growing income inequality harms this nation in a number of ways,” stated Jared Bernstein, Senior Economist, Economic Policy Institute and co-author of the report. “When income growth is concentrated at the top of the income scale, the people at the bottom have a much harder time lifting themselves out of poverty and giving their children a decent start in life.”

“A fundamental principle of our economic system is that the benefits of economic growth will flow to those responsible for their creation. When how fast your income grows depends on your position in the income scale, this principle is violated. In that sense, today’s unprecedented gap between the growth of the typical family’s income and productivity is our most pressing economic problem.”

States Can Partially Offset Trend Toward Larger Income Gaps

The biggest cause of rising income inequality over the past two decades has been the erosion of wages for the 70 percent of workers with less than a college education. That erosion, in turn, reflects long periods of higher-than-average unemployment, globalization, the shift from manufacturing jobs to low-wage service jobs, immigration, the weakening of unions, and the decline in the minimum wage. More recently, even college-educated workers have experienced real declines in wages, in part because of offshore competition.

While many of these economic factors are largely outside the control of state policymakers, “there’s a lot that states can do to mitigate the effects of increasing inequality,” Elizabeth McNichol, Senior Fellow, Center on Budget and Policy Priorities and co-author of the report noted. Possible steps include raising the state minimum wage, strengthening supports for low-income working families, and reforming the unemployment insurance system. In addition, states can pursue tax policies that partially offset the growing inequality of pre-tax incomes.

| TABLE A: | |

| Greatest Income | Greatest Incom |

| 1. New York | 1. Texas |

| 2. Texas | 2. Kentucky |

| 3. Tennessee | 3. Florida |

| 4. Arizona | 4. Arizona |

| 5. Florida | 5. Tennessee |

| 6. California | 6. New York |

| 7. Louisiana | 7. Pennsylvania |

| 8. Kentucky | 8. North Carolina |

| 9. New Jersey | 9. New Mexico |

| 10. North Carolina | 10. California |

| Greatest Increase | Greatest Increases |

| 1. Arizona | 1. Kentucky |

| 2. New York | 2. Pennsylvania |

| 3. Massachusetts | 3. West Virginia |

| 4. Tennessee | 4. Indiana |

| 5. New Jersey | 5. Hawaii |

| 6. West Virginia | 6. Texas |

| 7. Connecticut | 7. Tennessee |

| 8. Hawaii | 8. North Carolina |

| 9. Kentucky | 9. Arizona |

| 10. South Carolina | 10. New York |

| Greatest Increases | Greatest Increases |

| 1. Tennessee | 1. Kentucky |

| 2. Connecticut | 2. Pennsylvania |

| 3. Washington | 3. North Carolina |

| 4. North Carolina | 4. Indiana |

| 5. Utah | 5. Tennessee |

| 6. Texas | 6. Texas |

| 7. West Virginia | 7. West Virginia |

| 8. Pennsylvania | 8. Vermont |

| 9. Florida | 9. New Jersey |

| 10. Maine | 10. Connecticut |

| State Contacts | |

| Alabama | Missouri Missouri Budget Project Amy Blouin 314-652-1400 [email protected] |

| Arizona Children's Action Alliance Dana Naimark 602-266-0707 602-882-5755 (cell) [email protected] | New Jersey New Jersey Policy Perspective Jon Shure 609-393-1145 ext. 2 [email protected] |

| Arkansas Arkansas Advocates for Children and Families Kathryn Hazelett 501-371-9678 ext. 105 [email protected] | New Mexico New Mexico Voices for Children Cheryl Gooding 505-401-8709 (cell) |

| California California Budget Project Jean Ross 916-444-0500 [email protected] | New York Fiscal Policy Institute Trudi Renwick 518-786-3156 [email protected] |

| Colorado Fiscal Policy Institute (Colorado Center on Law and Policy) Kathy A. White 303-573-5669 ext. 303 [email protected] | North Carolina North Carolina Budget and Tax Center John Quinterno 919-856-3185 [email protected] |

| Connecticut Connecticut Voices for Children Doug Hall 203-498-4240 [email protected] | North Carolina North Carolina Budget and Tax Center Sorien Schmidt 919-856-2151 [email protected] |

| Connecticut Voices for Children Shelley Geballe 203-498-4240 [email protected] | Ohio Policy Matters Ohio Amy Hanauer 216-931-9922 [email protected] |

| District of Columbia DC Fiscal Policy Institute Ed Lazere 202-408-1080 [email protected] | Oklahoma Community Action Project Heather Hope 918-382-3265 [email protected] |

| Georgia Georgia Budget and Policy Institute Alan Essig 404-420-1324 [email protected] | Oregon Oregon Center for Public Policy Mike Leachman 503-873-1201 [email protected] |

| Idaho United Vision for Idaho Judith Brown 208-882-0492 [email protected] | Pennsylvania Keystone Research Center Stephen Herzenberg 717-255-7181 [email protected] |

| Illinois Center for Tax and Budget Accountability Chrissy Mancini 312-332-1481 [email protected] | Rhode Island Poverty Institute Ellen Frank (401) 456-2752 [email protected] |

| Illinois voices for Illinois Children Maneesha Date 312-516-5568 [email protected] | Tennessee Tennesseans for Fair Taxation Brian Miller 888-671-5188 ext. 14 [email protected] |

| Indiana Indiana Institute for Working Families Charles Warren 317-815-9561 [email protected] | Texas Center for Public Policy Priorities Lynsey Kluever 512-320-0222 ext. 112 [email protected] |

| Iowa Iowa Policy Project Mike Owen 319-338-0773 [email protected] | Utah Voices for Utah Children Karen Crompton 801-364-1182 [email protected] |

| Maine | Vermont Public Assets Institute Paul A. Cillo 802-472-6222 [email protected] |

| Maryland Progressive Maryland Sean Dobson 301-495-7004 [email protected] | Washington Washington State Budget and Policy Center Remy Trupin 206-625-9790 ext. 11 [email protected] |

| Massachusetts Massachusetts Budget and Policy Center Jeff McLynch 617-426-1228 ext. 103 [email protected] | Wisconsin Wisconsin Council on Family and Children Jon Peacock 608-284-0580 ext. 307 [email protected] |

| Michigan Michigan League for Human Services Sharon Parks 517-487-5436 [email protected] | Wisconsin Center on Wisconsin Strategy (COWS) Joel Rogers 608-263-3889 |

| Minnesota Minnesota Council of Nonprofits Minnesota Budget Project Nan Madden 612-709-6948 (cell) [email protected] | |

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.