- Home

- Income Security

- Temporary Assistance For Needy Families

Policy Basics: Temporary Assistance for Needy Families

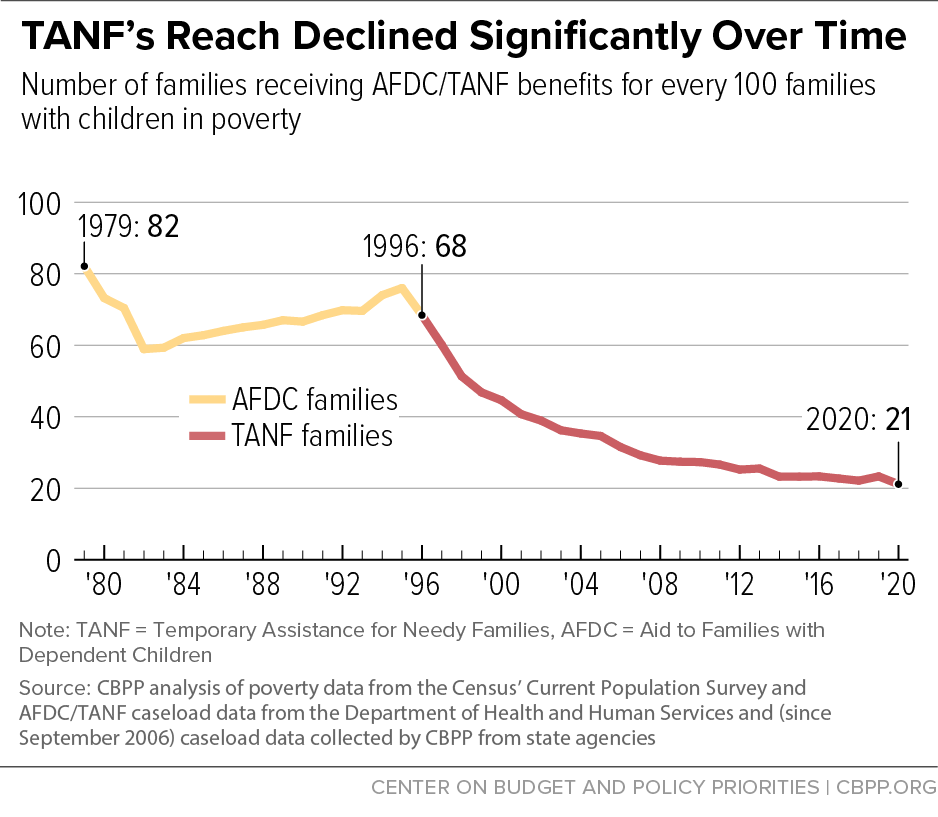

Temporary Assistance for Needy Families (TANF), enacted in 1996, replaced Aid to Families with Dependent Children (AFDC), which provided cash assistance to families with children experiencing poverty. TANF cash assistance can play a critical role in supporting families during times of need. However, TANF reaches far fewer families and provides less cash assistance to families than AFDC, leaving more families in deep poverty. States have shifted the funds that previously went directly to families to fund other programs.

What Is TANF?

Congress created the TANF block grant through the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996, as part of a federal effort to “end welfare as we know it.” TANF replaced AFDC, which had provided income support in the form of cash assistance to families with children in poverty since 1935. Income supports help families in poverty maintain stability and promote children’s healthy development, a large and growing body of research finds.

Under TANF, the federal government provides a fixed block grant to states, which use these funds to operate their own programs. The programs go by different names in states, for example, CalWORKS in California. In order to receive federal funds and avoid a fiscal penalty, states must also spend some of their own dollars, known as “maintenance of effort” (MOE) spending. TANF’s funding structure differs greatly from AFDC, where the federal government contributed at least $1 in matching funds for every dollar that states spent.

States can use federal TANF and state MOE dollars to meet any of the four purposes set out in the 1996 law: (1) assisting families in need so children can be cared for in their own homes or the homes of relatives; (2) reducing the dependency of parents in need by promoting job preparation, work, and marriage; (3) preventing pregnancies among unmarried persons; and (4) encouraging the formation and maintenance of two-parent families. States define what constitutes a “needy” family for the first and second purposes and do not have to limit assistance to needy families for the third and fourth purposes.

Cash assistance policy in the U.S. is steeped in a legacy of racist ideas and policies. More than a century of false and harmful narratives — such as Black women are unfit mothers — and paternalistic policies that sought to control Black women’s reproductive behavior and compel their labor have led to many aspects of TANF’s current design. These policies have created a weak cash safety net that disproportionately leaves Black families without cash assistance. However, these policies do not exclusively harm Black families: all families facing a crisis or struggling to pay for their basic needs are harmed when they cannot access the support they need.

TANF Funding and Spending

The federal TANF block grant and state MOE contributions are the primary sources of funding for state TANF programs. Federal funding for the TANF block grant has been set at $16.5 billion each year since 1996; as a result, its real value has fallen by 40 percent due to inflation. State allotments were determined in 1996 based on historical spending and have not changed to account for demographic changes or population growth.

As noted above, states must spend state funds on programs that achieve one of TANF’s four purposes in order to receive their full federal TANF block grant allocation. The amount states must spend is set at 80 percent of their 1994 contribution to AFDC-related programs. (This requirement is reduced to 75 percent for states that meet the Work Participation Rate, which most states do; see below for details.) In 2020, states spent roughly $15 billion in MOE funds. After adjusting for inflation, the amount states are required to spend (at the 80 percent level) in 2020 is about half of the amount they spent on AFDC-related programs in 1994.

Because TANF’s four purposes are so broad, states have been able to shift funds that were previously used to provide basic cash assistance toward many other uses. Some of these funds have been used to fund programs and services, such as child care, that encourage and support employment among low-income families, while a significant portion (and in some states the majority) of funds are used neither to meet families’ ongoing basic needs nor to support work. Also, states have often diverted TANF funding from providing basic assistance to families with the lowest incomes to providing services to families with incomes well above the poverty line. In 2020, 15 states spent 10 percent or less of their TANF funds on basic assistance.

| TABLE 1 | |||

|---|---|---|---|

| Total TANF Spending by Category, Fiscal Year 2020 | |||

| Category | Amount Spent (billions of dollars) | Share of Total Spending | |

| Basic Assistance | $7.1 | 22% | |

| Work, Education, and Training Activities | $3.0 | 10% | |

| Work Supports and Supportive Services | $0.8 | 2% | |

| Child Care | $5.2 | 17% | |

| Refundable Tax Credits | $2.8 | 9% | |

| Pre-Kindergarten/Head Start | $2.7 | 9% | |

| Child Welfare | $2.6 | 8% | |

| Program Management | $3.2 | 10% | |

| Other | $4.1 | 13% | |

| Total | $31.5 | 100% | |

Note: TANF = Temporary Assistance for Needy Families.

Source: CBPP analysis of Department of Health and Human Services 2020 TANF financial data

TANF Cash Assistance Eligibility and Benefits

States have broad discretion to determine eligibility for their TANF cash assistance programs. Federal law requires that TANF cash assistance be provided only to “needy” families with children. (Federal law also allows states to extend eligibility to pregnant persons with no other children; two-thirds of state do so.) There is no federal definition of “needy” and each state makes its own policy choices about determining financial need for its TANF program. Most states have set income eligibility thresholds that are far below the federal poverty line. And nearly all states limit the amount of assets families can have while remaining eligible for assistance.

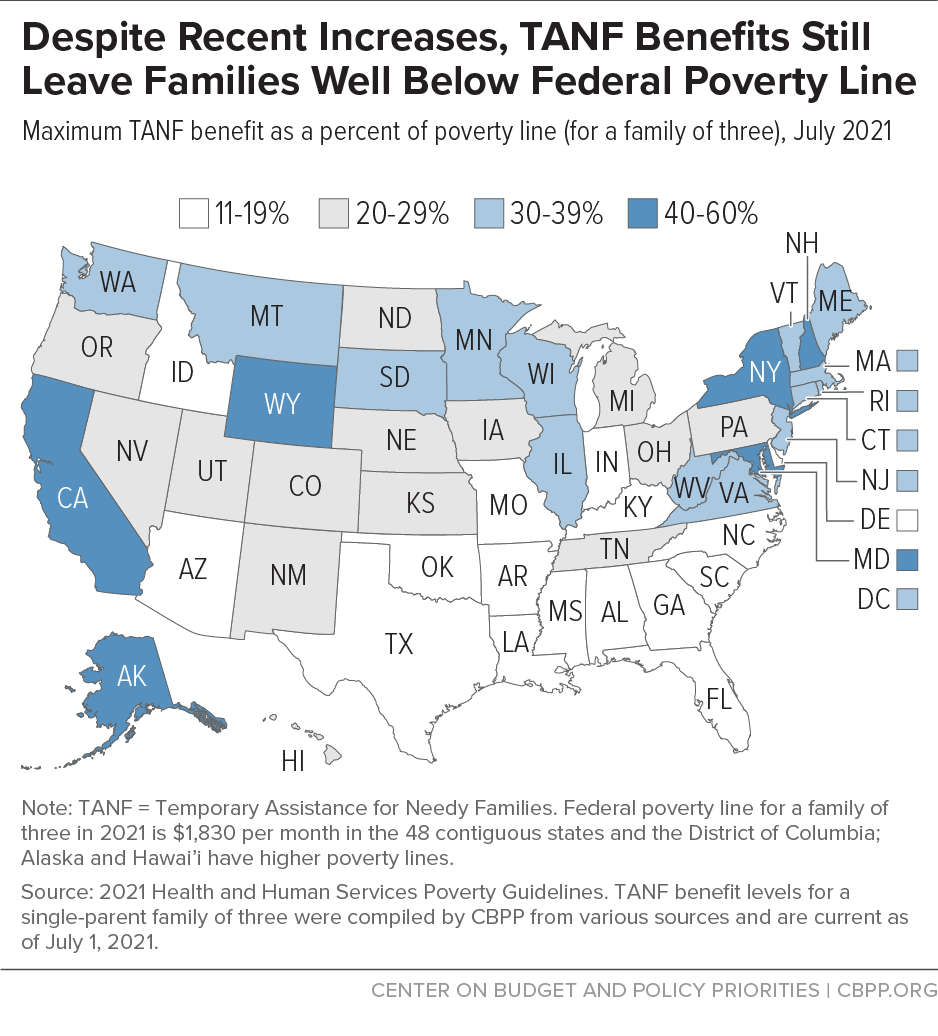

States also have the flexibility to set their own benefit levels (as they did in the AFDC program). TANF benefit levels are low and are not sufficient for families to meet all their basic needs, but the help they do provide is critical for helping families when they have very low or no other income. In July 2021, the maximum TANF benefit that a family of three could receive ranged from $204 in Arkansas (11 percent of the poverty line) to $1,098 in New Hampshire (60 percent of the poverty line), with a median of $498 (27 percent of the poverty line). A majority (52 percent) of Black children live in the 16 states with benefit levels below 20 percent of the poverty line, compared to 41 percent of Latinx children and 37 percent of white children.

Since 2015, more than half of the states have raised their benefit levels at least one time, following a period when most states either cut or did not increase benefits in the aftermath of the Great Recession of 2007-09. However, benefit levels have declined in inflation-adjusted value in all but six states since 1996.

In addition to defining financial need and setting benefit levels, states have broad discretion to set other policies that restrict who can receive cash assistance and in what amount. These policies are often rooted in racist and sexist ideas about parents ─ especially Black mothers with low incomes ─ that have influenced cash assistance programs for over a century. In addition to TANF’s work requirements (discussed in the next section), key policy areas where states have flexibility include:

Time limits on assistance. While states can set their own time limit policies, they cannot provide cash assistance from federal TANF funds for longer than 60 months to a family that includes an adult recipient; however, states can exceed the 60-month limit for up to 20 percent of families based on hardship. Federal law does not impose a time limit on “child-only families” (those with no adult receiving benefits) or on families receiving assistance funded entirely with state MOE funds.

Most states have set lifetime limits of five years on TANF- and MOE-funded assistance, though lifetime limits in 12 states are shorter. Eight states also impose shorter, intermittent time limits after which parents (and often their children as well) are ineligible for a period but can still receive assistance in the future, up to the lifetime limit. States generally provide exceptions and exemptions for some groups of families who meet specific criteria, allowing them to receive assistance beyond the time limit. Washington, D.C. and New York use state funds to provide benefits to families after 60 months.

Eligibility for immigrants. Federal law bars states from using federal TANF dollars to assist most people with “qualified” immigration status who immigrated after 1996 until they have been in the U.S. for at least five years, with certain exceptions. This restriction applies not only to cash assistance, but also to TANF-funded work supports and services such as child care, transportation, and job training. U.S. citizen children are eligible for TANF benefits and services even if they have non-citizen immigrant parents who do not, or do not yet, qualify. States can use state MOE funds to provide benefits to recent immigrants who are subject to the five-year bar, but fewer than half do so. Neither federal nor state TANF funds can be used for people without a documented immigration status.

Eligibility for people with drug felony convictions. The 1996 law that created TANF included a lifetime ban on benefits for people with drug felony convictions, although states can partially or fully lift the ban by passing legislation. Seven states maintain the full lifetime ban while 18 states and D.C have partially lifted the ban, meaning that some people with drug felony convictions are still ineligible. Twenty-five states have fully lifted the ban.

Child support. Federal law requires TANF participants to assign their rights to child support to the state, meaning that the state can keep the money it collects from the non-custodial parent to reimburse itself and the federal government for the cost of providing cash assistance. Participants are also required to cooperate with child support enforcement or have their benefits reduced or taken away. Most states have “pass throughs” that allow families to keep at least a portion of child support payments ─ usually between $50 and $200 a month ─ and most disregard the full amount passed through so that it does not affect a family’s eligibility. In 2015, Colorado became the first state to pass through and disregard 100 percent of child support payments.

“Family caps.” These policies deny additional assistance to families who have another child while receiving TANF benefits. Family cap policies are based on faulty and racist assumptions that mothers have more children in order to qualify for more public assistance. Research indicates the caps have no effect on birth rates among families who are TANF participants. Close to half of states had family cap policies in TANF at one point; 11 still have them in place.

TANF Work Participation Rate and Work Requirements

Federal TANF law requires states to meet “work participation rate” (WPR) targets or face a penalty. A state’s WPR measures the share of work-eligible participants who are engaged in work activities as defined in federal law. States must meet both an all-families rate and a higher two-parent families rate. For a state to meet its all-families rate, 50 percent of the families receiving TANF cash assistance must be engaged in a work activity for at least 30 hours a week (20 hours a week for single parents with children under age 6). States must also meet the two-parent families rate by having 90 percent of two-parent families engaged in work, generally for 35 hours per week. Both the federal and state WPRs are adjusted if a state’s TANF caseload has fallen since 2005, after accounting for any eligibility changes. Due in part to this “caseload reduction credit,” more than half of states have an adjusted WPR of zero. Therefore, the threat of a penalty is largely nonexistent.

The 1996 law establishes 12 categories of work activities that can count toward the work rates. It limits the extent to which participation in some types of work activities can count for the work rate calculation. For example, participation in some activities, such as job search or job readiness, can only count for a limited time. In addition, participation in education and training activities often cannot count as a full-time activity but instead must be combined with 20 hours of participation in a “core” activity such as employment.

The WPR is a requirement on states, not on individuals. States are expected to engage individuals in work within 24 months of their participation in TANF, but the state determines what constitutes being engaged in work. There is no penalty if the state does not meet this requirement.

Federal law also requires states, under threat of penalty, to reduce or take away benefits (known as a “sanction”) when a family member “refuses” to comply with work requirements as defined by the state without “good cause.” States set their own sanction policies, and nearly all states have chosen to use “full-family” sanctions that take away the entire family’s benefit if a parent fails to meet the work requirements. Five states and D.C. do not use full-family sanctions and reduce benefits by as little as 6 percent as the most severe sanction. States also determine when to impose the penalty and what constitutes “good cause.”

In addition, states can adopt the Family Violence Option (FVO), which requires them to screen TANF participants for domestic violence, refer survivors to services, and provide waivers from work and other program requirements as needed. Although 41 states and D.C. have adopted the FVO, few families are granted waivers despite the widespread prevalence of domestic violence.

How Has TANF Performed?

Some policymakers have pointed to TANF as a model for reforming other programs, but the facts suggest otherwise. TANF is a greatly weakened safety net that does far less than AFDC to alleviate poverty and hardship. States’ broad flexibility to determine eligibility has created wide variation in program access and large racial disparities. Furthermore, TANF’s work programs perpetuate occupational segregation and rarely move parents into jobs that lift their families out of poverty. Many families who leave TANF work in the same low-paying, unstable jobs that led them to need TANF to begin with.

TANF’s early years witnessed unprecedented declines in the number of families receiving cash assistance, and those declines have continued throughout most of its history. Since TANF’s creation, the national caseload has declined by 76 percent. Because the program reaches so many fewer families than AFDC did, it provides families substantially less protection against poverty and deep poverty (incomes below half of the poverty line). Despite the precarious economic conditions many families faced during the COVID-19 pandemic, TANF’s reach hit a historic low: nationally, just 21 out of every 100 families in poverty received TANF benefits in 2020 (compared to 68 out of every 100 in 1996) and 14 states reached 10 or fewer families for every 100 in poverty. Black children are also more likely to live in states where TANF reaches the fewest families in poverty.

The share of children living in deep poverty rose after TANF’s creation, and research suggests that the loss of TANF benefits contributed to that increase. While TANF benefits are too low to lift many families above the poverty line, they can help reduce the depth of poverty. Yet TANF has proven far less effective at lifting families out of deep poverty than AFDC, mostly because fewer families receive TANF benefits than received AFDC benefits. (The loss of purchasing power of TANF benefits has also contributed.)

TANF has never lived up to its promise of moving families out of poverty through work. First, states invest little in their work programs. In 2020, states collectively spent only 10 percent of TANF funds on work, education, and training activities meant to connect parents to jobs. (See Table 1 above.) Second, TANF’s primary performance measure, the work participation rate, does not measure parents’ employment outcomes after leaving the program. A recent look at employment outcomes in nine states found that parents often had unstable work after leaving TANF, with annual earnings far below the poverty line.

While some families leave TANF because of employment, many others leave because their benefits were taken away due to time limits or sanctions. Research shows that states often apply sanctions inappropriately to parents facing significant barriers to work, such as people who have physical and behavioral health issues, are fleeing domestic violence, or have low levels of education and limited work experience. TANF parents may also face significant logistical challenges, such as lack of access to (or funds to pay for) child care and transportation.

Nearly every study comparing the race and ethnicity of sanctioned and non-sanctioned TANF participants finds that families of color, especially Black families, are significantly more likely to be sanctioned than their white counterparts. TANF has, for the most part, failed these families — many of whom have become disconnected from both work and cash assistance — by providing them with neither a reliable safety net nor employment assistance that adequately addresses their employment barriers.

Looking Ahead

The American Rescue Plan included $1 billion in Pandemic Emergency Assistance funds, the first new federal TANF funding in over a decade. These funds allow states, U.S. Territories, and tribes to provide additional non-recurrent short-term benefits to families with children through September 2022. These funds can be used to provide additional cash payments for up to four months for TANF participants or SNAP participants with children. These funds can also be used for in-kind assistance such as rental assistance or for emergency assistance that considers applicants’ individual circumstances.

In the long term, improving TANF will require action from the federal government and states. Since states have broad flexibility over TANF, they can improve their programs and reduce racial disparities. States should reinvest TANF funds back into basic assistance and other areas to meet families’ basic needs. They should increase benefits to at least recover the value lost since 1996 and establish a mechanism to annually adjust benefits upward in order to prevent future loss of value. To improve access to the program, states can lift income thresholds and asset limits for applicants, remove barriers to access for those seeking cash assistance, and stop implementing punitive policies such as sanctions and time limits that take away benefits from families even when they continue to need assistance. States also can redesign their work programs to help TANF participants gain the education, skills, and work experience that will allow them to find and maintain quality jobs that can lift their families above the poverty line.

TANF has been due for reauthorization since 2010 but has only been temporarily extended every year since then. When Congress finally reauthorizes TANF, it should redesign the program using the “Black Women Best” framework, which “argues that if Black women — who, since our nation’s founding, have been among the most excluded and exploited by the rules that structure our society — can one day thrive in the economy, then it must finally be working for everyone.” Centering Black women in TANF reauthorization would help to undo the racist policies in TANF and benefit families of all races and ethnicities who need cash assistance. TANF funds should be targeted to families with the lowest incomes and should be used primarily for cash assistance. Congress should also set a federal minimum benefit level, end and bar exclusionary policies rooted in racism, and replace the work participation rate with access measures to ensure that states serve families in need and with performance measures based on employment and earnings outcomes.

This Policy Basics reflects TANF policy in the 50 states and Washington, D.C. Data presented here do not reflect Tribal TANF programs or TANF programs operated by Guam, Puerto Rico, and the U.S. Virgin Islands.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.