Statement by Robert Greenstein, President, On House Budget Chairman’s Plan

Note: We have updated our estimate of the proposed SNAP cut to reflect new information.

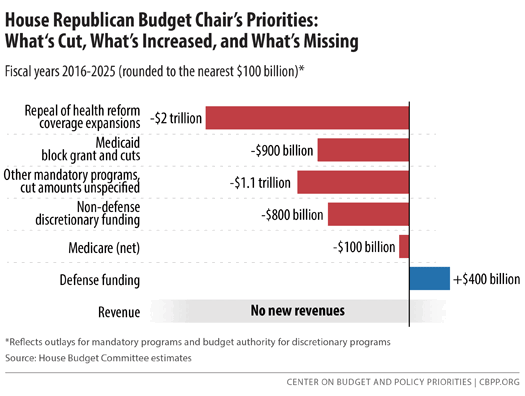

With widespread and growing bipartisan consensus that the country should do more for struggling families of modest income, House Budget Committee Chairman Tom Price offered a budget plan today that does the opposite. Largely a retread of budgets that House Republicans adopted in recent years, it calls for $5 trillion in budget cuts, mostly through steep reductions in programs for low- and moderate-income Americans, as well as deep cuts in investments that strengthen productivity and future economic growth such as education, training, and basic research.

Like the last few House budgets, the new budget packs its priorities into a policy path that would bring the budget to balance within the decade without raising any new revenue. Also like those previous budgets, it doesn’t change Social Security and makes relatively modest cuts to Medicare (though it proposes the dangerous step of converting Medicare into a voucher program for future retirees). In addition, it boosts defense spending, starting in 2016 with a budget gimmick, and in the years thereafter.

The overwhelming bulk of its $5 trillion in cuts come from three areas:

- Health programs for low- and middle-income households. The plan would convert Medicaid and the Children’s Health Insurance Program into a single block grant with drastically reduced funding levels. In addition, it would repeal health reform’s coverage expansions, which have extended coverage to 16.4 million previously uninsured people to date and strengthened coverage for millions of others. These health care cuts total a stunning $3 trillion over ten years.

- Non-defense discretionary programs. The plan would slash these programs by $759 billion below the already damaging sequestration levels. Under sequestration alone, non-defense discretionary funding is slated to tie an all-time record low in 2016, measured as a share of gross domestic product (GDP) in data that go back to 1962, and then to set new record lows in 2017 and every year thereafter. Yet the House budget cuts $759 billion below those levels — with dangerous implications for education, job training, early intervention programs for children, basic scientific and medical research, and transportation, all of which are important for productivity gains and long-term economic growth. By 2025, total funding for non-defense discretionary programs would be 33 percent below the 2010 level adjusted for inflation.

- Unspecified cuts. The plan proposes a whopping $1.1 trillion in essentially unspecified cuts in mandatory (i.e., entitlement) programs outside health care and Social Security, which reflects an exceptional if not unprecedented lack of transparency. Though the plan provides no dollar-cut figures and little programmatic detail, a booklet that House Republicans issued to tout their budget (“A Balanced Budget for a Stronger America”) suggests where a fraction of the cuts will come from.

The book and comments from Chairman Price indicate the plan would cut roughly $125 billion from the Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps), which it also would convert to a block grant. The booklet also makes clear that the plan contains big cuts in Pell Grants, which help children from families with modest incomes afford college. Although Pell Grants already cover a much lower share of college costs than they used to, the plan would freeze the maximum grant level for ten years even as tuition and room and board costs continued to rise, and then cut Pell Grants in other ways as well. Other mandatory programs outside health care and Social Security that would also be candidates for significant cuts under this exceedingly vague part of the budget plan include child nutrition programs, Supplemental Security Income for the elderly and disabled poor, the Earned Income Tax Credit, student loans, veterans’ pensions and disability compensation, federal retirement programs, and farm programs, among others.

The budget clearly gets the lion’s share of its savings from Americans of modest means. While we need more data to do a precise analysis, our preliminary estimate suggests that two-thirds or more of the cuts likely come from programs for people with low or modest incomes, even though such programs comprise less than one-quarter of federal program costs. (Where the plan leaves budget cuts unspecified, we assumed that all programs in an affected program category would face the same percentage cut as that specified for the category as a whole — an approach likely to understate the cuts in means-tested programs.)

The conclusion is inescapable. The budget would cause tens of millions of people to become uninsured or underinsured, make it harder for low-income students to afford college, shrink nutrition assistance, and squeeze many other such programs. Consequently, it’s sure to significantly increase poverty, hardship, and inequality.

Spending Well Below the Reagan Levels

The documents that describe this plan state that, under it, total federal spending would average 18.8 percent of GDP over the next ten years and fall to 18.3 percent by 2025, even as the baby boomers retire in large numbers and begin drawing Social Security and Medicare. That’s far below the 21.8 percent average in the Reagan years, even though, in those years, no baby boomers had yet retired and the elderly were a much smaller share of the population and thus drawing less from Social Security and Medicare.

When one examines spending outside Social Security and Medicare (and excluding interest payments on the debt), the comparison grows starker. Spending on government programs other than Social Security and Medicare would fall to 7.2 percent of GDP in 2025, — 40 percent below the average of 12.2 percent of GDP over the past 40 years, and far below the previous post-World War II low of 9.4 percent of GDP in the late 1990s. In short, the federal government outside Social Security and Medicare would gradually become a shell of its former self.

The documents try to obscure the pain that the budget would impose by largely omitting specifics of the cuts. For example, they merely state that policymakers would convert programs like Medicaid and SNAP to block grants to states and let the states decide what to do with them. The plan would cut Medicaid by $913 billion over ten years on top of the Medicaid cuts from repealing health reform’s Medicaid expansion. And as noted, the SNAP cuts apparently total about $125 billion (more than three times the size of the harsh and highly controversial SNAP cuts that the House passed in September 2013). This hide-the-details approach prevents analysts and reporters from assessing how these cuts would affect working-poor families, low-income children, and poor seniors, many of whom would see their basic food benefits or health care coverage eliminated or cut back sharply.

Nevertheless, we can discern some tangible consequences. For instance, repealing health reform’s Medicaid expansion means that at least 14 million people would lose their Medicaid coverage or no longer gain such coverage in the future. (That’s the Congressional Budget Office’s estimate of the number who have or are expected to gain coverage under the Medicaid expansion.) Repealing health reform’s subsidies to purchase health insurance would jeopardize coverage for millions more. The severe cut in federal Medicaid and CHIP funding under the block grant would force states to substantially scale back or drop Medicaid and CHIP coverage for many other low-income people who have it. Overall, tens of millions of people would likely become uninsured or underinsured.

The plan thereby violates several core principles that underlay the separate bipartisan plans that Alan Simpson and Erskine Bowles (co-chairs of the National Commission on Fiscal Responsibility and Reform) and the Bipartisan Policy Center’s Rivlin-Domenici Debt Reduction Task Force produced in late 2010. Those plans featured very large deficit reduction, but they included substantial revenue increases as well as program cuts. And they rested on a core principle that deficit reduction should not increase poverty or inequality. The House budget does the opposite.

Defense Increases, With a Gimmick that House Republicans Denounced Last Year

The plan claims to adhere to the sequestration levels for 2016 for both defense and non-defense discretionary programs, but that’s false advertising. It circumvents the sequestration cap for defense in 2016 by pouring additional funding into the Overseas Contingency Operations fund in 2016, which doesn’t count against the defense cap. It adds about $39 billion in 2016 beyond what the Pentagon says it needs for overseas military operations, with the implication that the Pentagon will channel those excess dollars into the regular defense budget. One year ago, the Republican-controlled House Budget Committee denounced this gimmick, calling it “a backdoor loophole that undermines the integrity of the budget process.”

The plan also adds money for defense above the sequestration levels for the years after 2016. Over the decade, it provides nearly $400 billion in additional defense funding even as it slashes funding for non-defense discretionary programs to record lows, as discussed above.

A Final Thought

Sadly, the Chairman’s plan doubles down on the type of extreme and ideological measures that have characterized House budgets in recent years. If its policies were to become law, ours would be a coarser, more mean-spirited nation with higher levels of poverty and inequality, less opportunity, and a future workforce that’s less able to compete with its counterparts overseas.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.