House Republicans plan to amend House rules this week to require the Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT) to use “dynamic scoring” for official cost estimates of tax reform and other major legislation.[1] Under dynamic scoring, the official cost estimates would incorporate estimates of how legislation would affect the size of the U. S. economy and, in turn, federal revenues and spending. Incoming Ways and Means Committee Chairman Paul Ryan has said this change is designed simply to generate more information on the impact of proposed policies.[2] In reality, however, the House would be asking CBO and JCT for less information, not more, and the new rule could facilitate congressional passage of tax cuts that are revenue-neutral only on paper.

CBO and JCT already provide macroeconomic analyses of some proposed bills as a supplement to the official cost estimates they produce. These analyses typically present a range of estimates of the legislation’s impact on the economy.

The new House rule, in contrast, asks for an official cost estimate that only reflects a single estimate of the bill’s supposed impact on the economy and the resulting revenue impact. By incorporating additional revenue in the official cost estimate (as a result of an estimate of economic growth), this would enable lawmakers to write bills with deeper tax-rate cuts, or smaller offsetting curbs on tax breaks, than they otherwise could do.

The economic impact of even a well-designed tax reform plan is likely to be modest relative to the size of the U.S. economy. But the estimates of revenue gains from the plan’s estimated dynamic effects could be large in the context of current fiscal debates. Those estimates could also be highly dubious, depending on the models and assumptions used. For example, JCT estimated that the tax reform plan that former Ways and Means Chairman Dave Camp produced last year could generate between $50 billion and $700 billion of additional revenue over the decade through faster economic growth, with the $700 billion estimate reflecting a series of very rosy assumptions — including the assumption that a future Congress will stabilize the debt as a share of gross domestic product (GDP) by approving large spending cuts that aren’t part of the Camp bill. If highly optimistic economic and fiscal assumptions like these are included in official cost estimates but then fail to materialize, the result will be higher deficits and debt. And as CBO, JCT, and other analysts have warned, tax cuts that ultimately expand deficits can slow economic growth, rather than increase it, because the higher deficits can create a drag on saving and investment.

Lawmakers already have access to CBO and JCT analyses that provide the best available information on the economic effects of tax legislation. Current House rules require JCT to produce a macroeconomic impact analysis — including estimates of possible changes in economic output, employment, capital stock, and tax revenues — of legislation to amend the tax code.[3] Congress can also request such analyses. CBO and JCT have produced them for a wide range of proposals.[4]

Because of the very large uncertainty involved in estimating how a piece of legislation will affect the economy, JCT and CBO have typically presented estimates from a number of different economic forecasting models, using a range of assumptions.[5] These JCT and CBO analyses also carefully explain the many reasons why the estimates, which aren’t factored into the legislation’s official cost estimate due to their high degree of uncertainty, might be too high or too low.

The new House rule will no longer explicitly require JCT to provide analyses that set out its estimates of a tax bill’s effect on economic output, employment, and the capital stock. Nor will the rule require CBO and JCT to provide a range of economic and cost estimates that reflect different models and assumptions. Instead, it will require CBO and JCT to incorporate into the official cost estimate for a piece of legislation — the estimate that would then be used to determine whether the bill complies with budget targets and limits — a single estimate of the bill’s impact on economic output and revenues, chosen from the extensive range of uncertain effects the bill might have on economic output and budgetary costs.

Chairman Ryan has proposed large cuts in tax rates — including cutting both the top individual tax rate and the corporate tax rate to 25 percent — without offering specific ways to pay for them.[6] The Camp tax reform plan, by contrast, included specific financing proposals, but it was not well received by other Republican lawmakers, who viewed its rate cuts as too modest and balked at various of its proposals to scale back or eliminate numerous tax breaks to help pay for the rate reductions.

Dynamic scoring could facilitate congressional passage of large rate cuts in tax reform by making the rate cuts appear — on paper — less expensive than under a traditional cost estimate. That’s because some of the models of the economy and related assumptions used to produce a dynamic cost estimate might show some tax reform packages boosting economic growth and thereby generating additional revenue. This effect wouldn’t be large enough to pay entirely for the package’s tax cuts (except under the most extreme and unrealistic models), but it might offset a significant part of the cost. By lowering the package’s official cost, dynamic scoring could create budgetary room for even deeper rate cuts or lessen the need for measures to offset the rate cuts’ cost. If tax legislation were enacted using a dynamic scoring estimate based on optimistic assumptions but the assumed “dynamic” revenues then failed to materialize, the legislation would add to deficits and aggravate the nation’s long-run fiscal challenges.

This contrasts sharply with current estimating practices, in which the potential revenue gains from economic growth aren’t included in a bill’s official cost estimate and thus can’t be used to make the legislation appear less expensive. Under the current rules, if a boost to the economy results from enacted legislation and produces lower deficits than estimated, the nation’s fiscal outlook improves, while if no economic boost occurs, deficits do not widen because extra revenue wasn’t assumed. The current rules are much safer and more prudent for the nation’s fiscal health, especially given that we already face long-term fiscal problems.

Until now, CBO and JCT have never included the highly uncertain growth effects of tax legislation in their official cost estimates precisely because the effects are so uncertain. Moreover, dynamic scoring is susceptible to manipulation through the selection of the specific model and assumptions to use, which heightens the risks of relying on it. These are compelling reasons why official cost estimates should not rely on the inherently questionable estimates that dynamic scoring produces.[7]

Even a well-designed tax reform proposal won’t likely deliver a large boost to the economy, relative to the economy’s size.[8] But estimates of economic growth — and in particular, the resulting estimates of the “dynamic revenue effects” of tax reform — could be large in the context of current fiscal debates, especially if they are based on rosy assumptions.

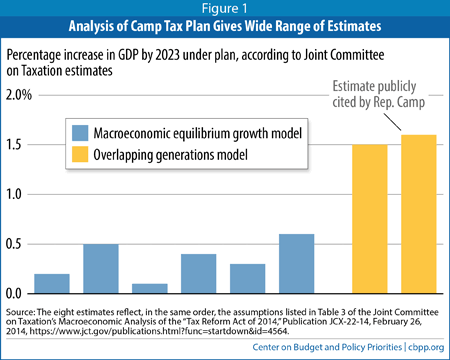

For example, JCT’s analysis of Chairman Camp’s tax plan used two different economic models and an array of differing assumptions, resulting in eight separate estimates of macroeconomic effects. The range of the economic growth estimates was very wide (see Figure 1), as was the corresponding range of revenue estimates — from $50 billion to $700 billion in additional revenue over ten years.

It’s instructive that in presenting and promoting his plan, Chairman Camp chose to highlight the $700 billion estimate, which was based on highly unrealistic assumptions. It came from an “overlapping generations” model that assumed that future Congresses will act to stabilize the debt as a share of the economy and do so entirely through future spending cuts. For this reason, JCT cautioned that only the results of the

other model that it used (the macroeconomic equilibrium growth or MEG model, which chairman Cap did

not highlight) reflected Camp’s “actual proposed law.”

[9]Some observers might view $700 billion over ten years as small if measured as a share of GDP over a decade. But it’s a very substantial amount for budget debates; it is about equal to all of the revenues raised by the 2012 “fiscal cliff” deal. Even the much lower revenue estimates from the MEG model are sizeable in the context of today’s budget debates.

It’s unclear how JCT and CBO would produce a single estimate from their range of models and assumptions; averaging the results could create an estimate that’s driven to a substantial degree by a highly unrealistic model (the “overlapping generations” model) that makes big, questionable assumptions about future congressional action. Whatever the approach, dynamic scoring could have a large impact on budget debates.

The proposed House rule is significant for other reasons as well. For example, it would effectively give House leaders the discretion to use dynamic scoring only when it helps them. While the new House rule would apply dynamic scoring to “major legislation” that has a fiscal impact of more than 0.25 percent of projected GDP, House leaders could easily render this standard meaningless by splitting up bills to avoid the threshold or combining proposals into larger bills to meet it.

Further, the rule would empower the chairs of the Budget and Ways and Means Committees to designate any bill as “major legislation,” regardless of whether it meets the 0.25 percent of GDP threshold. Chairman Ryan has downplayed the impact of the rule change by stating that only three bills in the last Congress would have met the threshold for dynamic scoring.[10] Yet that comment seems misleading; under the proposed rule, dynamic scoring could be applied to many more (or even fewer) bills — essentially, it could be deployed whenever House leaders find it politically useful.

In addition, the rule could lead to misleading mismatches between the cost estimates used for tax proposals and distributional analyses of those proposals that the House might separately request. As noted above, the economic growth and budgetary estimates that Chairman Camp touted of his tax reform plan came from a model that assumes future Congresses will take controversial deficit-reduction actions that policymakers have long resisted. Those estimates assumed not only that Congress will subsequently act to cut future deficits enough to stabilize the debt as a share of the economy, but also that all of this deficit reduction will come from cuts in transfer payments, a category that includes programs such as Social Security, unemployment insurance, and SNAP (formerly known as food stamps). Yet the distributional impacts that Chairman Camp relied on in presenting his bill failed to include any of these cuts in transfer payments, showing only the tax changes. The distributional analysis of his plan would have looked very different — and much less favorable — had it incorporated the cuts in benefit programs that Camp’s favored dynamic scoring estimate assumed.

Congress should not avoid hard budgetary choices by giving itself the ability to use highly uncertain estimates of the potential growth effects of tax legislation in order to hide or minimize the revenue losses that JCT otherwise would show the tax legislation as producing. Current estimating practices exclude these effects precisely because they are so uncertain and subject to manipulation.

Moreover, by requiring CBO and JCT to count these “dynamic” effects in their official cost estimates, the House rule doesn’t ask for more information, as some of its proponents claim — rather, it allows lawmakers to use a single highly uncertain estimate in order to cut tax rates more deeply or curb tax breaks less substantially (or both) than they otherwise could do without facing criticism for adding to deficits and possibly violating key budget rules. For example, congressional budget rules prohibit budget reconciliation bills from increasing deficits in future decades, a requirement that dynamic scoring could be used to help circumvent.

In short, dynamic scoring could make it easier for Congress to fashion a tax reform package that appears revenue neutral, on the basis of questionable and uncertain growth estimates. If those effects then failed to materialize, the increased deficits would worsen the nation’s long-run fiscal problems and, in so doing, could actually create a drag on future economic growth, as CBO and JCT have explained.[11]