- Home

- Why Budget And Tax Plans Shouldn’t Use D...

Congress should reject calls to use “dynamic scoring,” which includes estimates of how proposed policies would affect the size of the economy and thus revenues, in official cost estimates for tax reform and other major legislation.[1] Modeling the economy is extraordinarily difficult; even the best analyses leave tremendous uncertainty and are sensitive to the economic models and assumptions used. Estimates of macroeconomic effects of policy changes are thus highly subject to manipulation. Including them in budget estimates would damage the credibility of the budget process.

Current Estimates Aren’t “Static”

Contrary to frequent claims, current budget estimates from the Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT) aren’t “static.” They incorporate many changes in individuals’ and companies’ behavior in response to changes in tax rates and other policies.

For example, JCT estimates incorporate such effects as “shifts in the timing of transactions and income recognition, shifts between business sectors and entity forms, shifts in portfolio holdings, shifts in consumption, and tax planning and avoidance strategies.”[2]

Dynamic Estimates Are Highly Uncertain

Estimates of the macroeconomic effects of budget and tax changes are highly uncertain and depend critically on the assumptions and methods used.

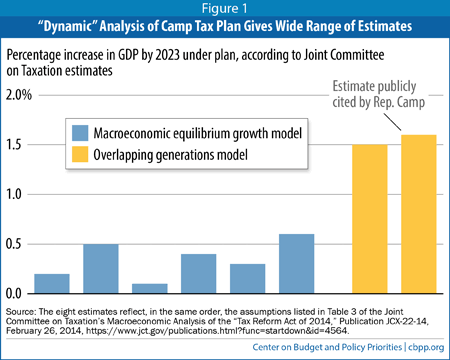

- Different models and assumptions can produce widely varying estimates. JCT’s analysis of retiring House Ways and Means Committee Chairman Dave Camp’s tax reform proposal used two different economic models and many different assumptions, resulting in eight separate estimates of the macroeconomic effects. The range of growth estimates was very wide (see Figure 1). The corresponding range of revenue estimates was also wide, ranging from $50 billion to $700 billion in additional revenue over ten years.

- Some models’ results depend on assumptions about how future Congresses will reduce deficits. The model that showed the largest growth impacts from the Camp plan required JCT to make assumptions about policy changes that future Congresses would make to reduce deficits — changes not in the Camp plan itself.Image

- Significant gaps in the available models create additional uncertainty. JCT’s models account for the economic benefits of investments in business capital (such as new machinery) but not in human capital (such as worker training). Thus, they favor tax changes that increase investment in business capital rather than human capital. Also, these models contain no information on important economic sectors such as health care and manufacturing, so they can provide no information on the growth effects of policy changes affecting those sectors.

Dynamic Estimates Are Prone to Manipulation

Including macroeconomic feedbacks in the cost estimate for a budget or tax reform proposal would impair the credibility of both the proposal and the budget process itself. Congressional leaders could cherry-pick the model and assumptions that give the most favorable estimates.

Chairman Camp, for example, chose to tout the JCT’s most optimistic estimate of the revenue his plan would generate, which was more than ten times larger than the most modest results. He also relied on estimates of the plan’s distributional impacts that omitted the cuts in transfer programs (a category that includes programs such as Social Security and SNAP, formerly food stamps) that were assumed in the dynamic estimates he chose to highlight. The distributional analysis of the plan would have been much less favorable if it included those cuts.

CBO Did Not Use Dynamic Scoring for 2013 Senate Immigration Bill

Unlike almost all other legislation, immigration bills would substantially increase the population and labor force and therefore affect the budget independently of any impacts resulting from changes in households’ and businesses’ behavior. CBO’s cost estimate of the 2013 Senate immigration bill accounted for the direct effects of these increases in population and labor force on the size of the economy, revenues, and federal benefit spending. But it didn’t include the type of dynamic scoring that some members of Congress are calling for, such as estimates of the bill’s more speculative and uncertain effects on business investment and productivity.

End Notes

[1] For more on these issues, see Paul N. Van de Water and Chye-Ching Huang, “Budget and Tax Plans Should Not Rely on ‘Dynamic Scoring,’” Center on Budget and Policy Priorities, updated November 17, 2014, https://www.cbpp.org/cms/index.cfm?fa=view&id=3598.

[2] Thomas A. Barthold, Chief of Staff, Joint Committee on Taxation, Testimony of the Staff of the Joint Committee on Taxation before the House Committee on Ways and Means Regarding Economic Modeling, September 21, 2011.

More from the Authors