Statement by Robert Greenstein, President, on Chairman Ryan’s Budget Plan

Update, April 11: Robert Greenstein has issued a statement on the House passage of the Ryan budget, which includes updated figures.

House Budget Committee Chairman Paul Ryan’s new “Path to Prosperity” is, sadly, anything but that for most Americans. Affluent Americans would do quite well. But for tens of millions of others, the Ryan plan is a path to more adversity.

The budget documents that Chairman Ryan issued today laud his budget for promoting “opportunity,” even as his budget slashes Pell Grants to help low- and moderate-income students afford college by more than $125 billion over ten years and cuts the part of the budget that funds education and job training (non-defense discretionary funding) far below the already low sequestration levels. The budget documents also claim to help the poor, even as the Ryan budget shreds key parts of the safety net; for example, it resurrects the draconian benefit cuts in SNAP (food stamps) that the House passed last fall and adds $125 billion of SNAP cuts on top of them.

The budget also swells the ranks of the uninsured by at least 40 million people. It repeals the Affordable Care Act (ACA), taking coverage away from the millions of people who have just attained it, and cuts Medicaid by $732 billion (by 26 percent by 2024) on top of the cuts from repealing the ACA’s Medicaid expansion. Yet it offers no meaningful alternative to provide health coverage to the tens of millions of uninsured Americans.

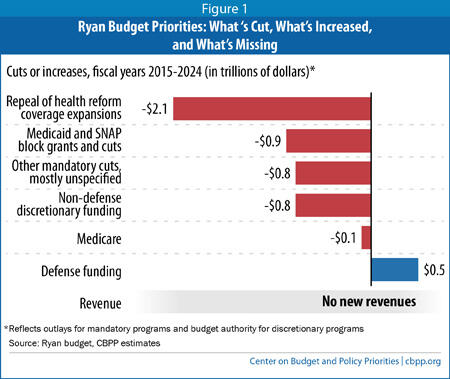

That’s only a partial list of its cuts. The budget cuts non-defense discretionary programs by $791 billion below the sequestration level, shrinking this part of the budget to less than half its share of the economy under President Reagan. These cuts are entirely unspecified, as are more than $500 billion of cuts in entitlement programs.

Meanwhile, the budget aims to cut the top individual tax rate and the corporate income tax rate to 25 percent, eliminate the Alternative Minimum Tax, and repeal the ACA’s revenue-raising provisions. These tax cuts would cost about $5 trillion over ten years, based on past analyses by the Urban-Brookings Tax Policy Center. Yet the Ryan plan doesn’t identify a single tax break to close or narrow to cover the lost $5 trillion, even though his budget assumes no revenue losses overall. And it ignores the hard fact that, in his recent tax reform plan, House Ways and Means Committee Chairman Dave Camp only lowered the top individual tax rate to 35 percent even after identifying scores of politically popular tax breaks to narrow or eliminate.

The Ryan budget is thus an exercise in obfuscation — failing to specify trillions of dollars that it would need in tax savings and budget cuts to make its numbers add up. No one should take seriously its claim to balance the budget in ten years.

Millions More People Without Health Insurance

A day after open enrollment closed in health reform’s new health insurance exchanges and millions more people have insurance due to the ACA, the Ryan budget would move in the opposite direction. Those who signed up for coverage through the exchanges and Medicaid in recent months would lose it, and uninsured people who are expected eventually to enroll in such coverage would remain uninsured.

Under the Ryan plan, at least 40 million low- and moderate-income people — that’s 1 in 8 Americans — would become uninsured by 2024. They include the 25 million otherwise-uninsured people that the Congressional Budget Office (CBO) projects will gain coverage through the ACA by 2024. They also include the 14.3 to 20.5 million people that the Urban Institute estimated would lose Medicaid coverage by the tenth year from a similar Medicaid block grant proposal in a prior Ryan budget.

The Ryan budget uses misleading rhetoric to justify these proposals. The budget documents criticize Medicaid for its low payment rates to doctors and hospitals and argue that some Medicaid beneficiaries can have trouble finding doctors. But slashing federal Medicaid funding by more than one-fourth and turning it over to states in a block grant will inevitably lead states to cut payment rates further, restrict coverage (casting millions into the ranks of the uninsured), limit covered health services (depriving some people of needed treatment), or — most likely — a combination of all of the above. The Urban Institute analysis of the similar Medicaid proposal in a prior Ryan budget projected that states would likely cut reimbursements to health care providers and managed care plans by about 30 percent by the tenth year.

More Poverty and Less Opportunity

Chairman Ryan often decries the plight of the poor and the lack of upward mobility in his budget documents, speeches, and hearings. But his budget would:

- Slash basic food aid provided by SNAP by at least $135 billion and convert the program to a block grant. The Ryan budget includes every major benefit cut in the harsh SNAP bill that the House passed in September, which CBO estimated would end benefits to 3.8 million low-income people in 2014. The budget also would block-grant SNAP in 2019, with further steep funding cuts. States would be left to decide whose benefits to cut — poor children, working-poor parents, seniors, people with disabilities, or others struggling to make ends meet. They would have no good choices, as SNAP provides an average of only $1.40 per person per meal.

- Make it harder for low-income students to attend college. Ryan proposes to cut Pell Grants by more than $125 billion over the next decade. He would freeze the maximum grant for ten years, even as college tuition costs continue to rise. The maximum Pell Grant already covers less than a third of college costs, compared to more than half in earlier decades. Yet under the Ryan budget, the grant would fall another 24 percent by 2024 in inflation-adjusted dollars. (Some of that reduction is in the budget baseline, but Ryan would substantially enlarge it.) He also would make some moderate-income students who get modest help from Pell Grants today entirely ineligible.

- Make massive unspecified cuts in a part of the budget in which low-income programs — including the Earned Income Tax Credit (EITC), which Ryan praised in his recent poverty report — make up a substantial share of the expenditures. His budget calls for at least $500 billion in cuts to mandatory programs other than Social Security, Medicare, Medicaid, SNAP, Pell Grants, farm programs, civil service programs, and veterans’ benefits. A substantial share of spending in this category is for low-income programs, including the EITC, the low-income component of the Child Tax Credit, the school lunch and other child nutrition programs, and Supplemental Security Income, which helps very poor people who are elderly or have serious disabilities.

Less Investment in Building Blocks of Economic Growth and Opportunity

The Ryan budget doubles down on sequestration, cutting non-defense discretionary programs by $791 billion over the next ten years below sequestration’s already austere levels. (His funding level is a full $1.1 trillion below the levels under the 2011 Budget Control Act without sequestration.) By 2024, funding for non-defense discretionary programs would be 36 percent below the 2010 funding levels adjusted only for inflation (and 22 percent below the post-sequestration level) and would fall to 1.7 percent of gross domestic product (GDP). By contrast, funding for these programs averaged 3.6 percent of GDP under President Ronald Reagan.

Non-defense discretionary programs include basic building blocks of our economy, including education and basic research, as well as core public services such as law enforcement, border security, food and drug safety, and environmental protection. They also include key supports for low-income families, including Head Start and low-income housing assistance.

Ryan’s Budget Takes This Approach Due to Its Lack of Courage

Chairman Ryan’s plan says it balances the budget in ten years. That requires massive deficit reduction. But the budget plan contains no new revenues, does not touch Social Security, increases defense funding by $483 billion over ten years (relative to the sequestration levels under current law), and contains somewhat smaller Medicare savings over the coming decade than the Obama budget does. This leaves Chairman Ryan to target programs for low-income and vulnerable Americans and non-defense discretionary programs for draconian cuts.

Many congressional Republicans criticized the Obama budget last month for not containing “serious entitlement reform.” But, under the Ryan budget, “entitlement reform” largely means savaging the poor and vulnerable and swelling the ranks of the uninsured by at least 40 million people.

As noted, the budget’s lack of courage is also exemplified by its tax proposals — a goal of shrinking the top individual income tax rate to 25 percent and provisions that would eliminate the Alternative Minimum Tax, cut the top corporate rate to 25 percent, and repeal health reform’s revenue provisions. Based on Tax Policy Center analysis, those tax cuts would likely cost about $5 trillion over ten years, with the benefits flowing heavily to the nation’s most affluent people. Yet the Ryan plan shows these proposals as having zero cost because they supposedly would be offset, even though the plan doesn’t identify a single dollar of the needed $5 trillion in offsets.

House Ways and Means Chairman Dave Camp’s tax reform plan contains scores of provisions that would scale back tax credits, deductions, and other preferences that many other Republicans (and Democrats) don’t like. The Ryan plan includes none. Yet even with his numerous revenue-raising measures, Camp could only lower the top individual income tax rate to 35 percent. The Ryan plan simply ignores that reality.

Budgets are about priorities. Despite Chairman Ryan’s rhetoric on fighting poverty and boosting opportunity, no fair-minded observer can claim that his proposals actually reflect those priorities — or sugarcoat their harsh impact on tens of millions of low- and moderate-income Americans.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.