A substantial revision of this paper has been issued. The new version is available here.

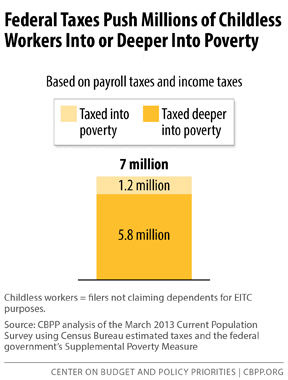

Policymakers have made substantial progress in recent years in “making work pay” for low-income families with children by strengthening the Earned Income Tax Credit (EITC) and Child Tax Credit. (See the box at the end of this paper.) But low-income childless workers — that is, adults without children and non-custodial parents — receive little or nothing from the EITC. For example, a childless adult working full time at the minimum wage receives virtually no EITC because the very limited credit for workers not raising minor children has almost completely phased out for workers at that income level. As a result, childless workers are the sole group that the federal tax system taxes deeper into poverty. In 2012, federal income and payroll taxes pushed 1.2 million childless workers into poverty and another 5.8 million deeper into poverty.[2]

All childless workers under age 25 are ineligible for the EITC, so low-income young people just starting out — who have disturbingly low labor-force participation rates — receive none of the EITC’s proven benefits, such as promoting work,[3] alleviating poverty, and supplementing low wages.

The President’s Fiscal Year 2016 budget and five recent congressional proposals (introduced by Senators Sherrod Brown and Richard Durbin, by Rep. Richard Neal, by Rep. Charles Rangel, by Rep. Danny Davis, and by Senators Patty Murray, Jack Reed, and Sherrod Brown) would substantially strengthen the EITC for childless workers.[4] Most recently, House Ways and Means Committee Chairman Paul Ryan has proposed an expansion that is almost identical to President Obama’s. Nearly all of the proposals would lower the eligibility age to 21, and all would raise the maximum credit — the Obama and Ryan proposals to about $1,000 and the other proposals to somewhat higher amounts. All of the proposals would also phase in the credit more rapidly as a worker’s income rises.

By making more childless workers eligible for the EITC — including those working full time at the minimum wage — and boosting the credit for workers currently eligible, these measures hold strong promise of increasing employment and reducing poverty. The Treasury Department estimates that the President’s proposal would lift about half a million people out of poverty and reduce the depth of poverty for another 10.1 million.[5] (These estimates use the Census Bureau’s Supplemental Poverty Measure, which includes the cash value of tax credits and benefit programs such as SNAP.) The congressional proposals are larger, so they would likely have even larger anti-poverty effects.

While some policymakers have raised concerns about expanding the EITC for childless workers because of the EITC’s “improper payment” rate, these concerns often reflect misunderstandings about the rate. For example, the improper payment rate includes EITC overpayments but excludes significant areas of likely underpayments, so if a non-custodial father mistakenly claims a child for the EITC, the father’s EITC counts as an overpayment, but the forgone amount the mother was eligible to claim is not taken into account. In addition, as IRS Commissioner John Koskinen has pointed out, many EITC errors are due to the credit’s complicated rules for claiming children, which do not affect the EITC for childless workers.[6] There are many sound proposals that Congress should adopt to reduce the error rate, such as allowing the IRS to regulate paid preparers, but policymakers’ failure to adopt these proposals should not prevent them from expanding the EITC for childless workers.[7]

The EITC misses many low-income childless workers entirely and provides only minimal help to many others. Childless workers under age 25 are ineligible for the credit and the average credit for eligible workers between ages 25 and 64 is only about $270, or less than one-tenth the average $2,970 credit for tax filers with children.[8] In addition, the childless workers’ EITC begins phasing out when earnings exceed $8,200, or just roughly 55 percent of full-time, minimum-wage earnings.

As a result:

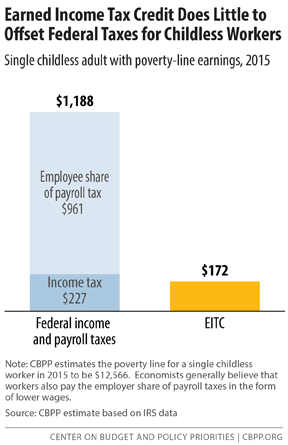

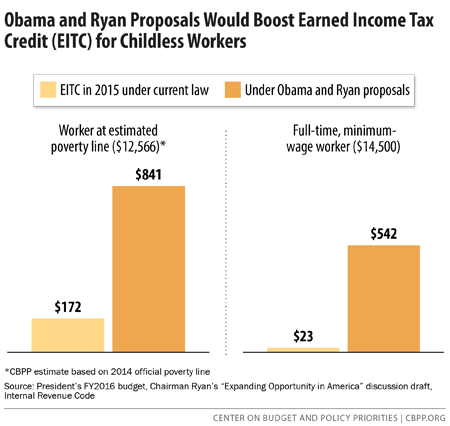

- A childless adult with wages equal to the Census Bureau’s poverty line (projected at $12,566 in 2015) will face a federal tax burden in 2015 of $1,016, after receiving an EITC of just $172. (See Figure 1.) (The employer owes another $961 in payroll taxes, the burden of which, most economists agree, falls on workers in the form of lower wages.)

- A childless adult working full time at the minimum wage (and earning $14,500) will have a federal income and payroll tax burden of $1,506 in 2015 — a substantial tax burden for someone with income this low — after receiving an EITC of just $23.

Because childless workers face tax burdens that exceed their small credits, they are the lone group that the federal tax system taxes into, or deeper into, poverty. In 2012, federal income and payroll taxes pushed 1.2 million childless workers into poverty and another 5.8 million deeper into poverty (see Figure 2).[9]

Providing a more adequate EITC to low-income childless workers and lowering the eligibility age would have several important benefits beyond raising these workers’ incomes and helping offset their federal taxes. Some leading experts believe that an expanded credit would help address some of the challenges that less-educated young people (particularly young African American men) face, including low and falling labor-force participation rates, low marriage rates, and high incarceration rates.

For example, John Karl Scholz, an economist and former Treasury official who is one of the nation’s foremost authorities on the EITC, strongly recommends a more ample EITC for childless workers as a way to raise their employment rate, explaining: “increasing the return to work for childless workers will lower unemployment rates and achieve the dual social benefits of reducing incarceration rates and increasing marriage rates.”[10]

Likewise, Ron Haskins, co-director of the Brookings Institution’s Center on Children and Families and one of the key architects of the 1996 welfare law, argues that an expanded EITC for childless workers would:

provide the very thing that most analysts agree is most needed — namely, work incentive … [and] the young man’s prospects in the marriage market would receive a nice boost. Studies show clearly that married young males are healthier, happier, less likely to commit crimes and less likely to abuse drugs than single males. Thus, to the extent that additional income increases marriage rates, the new EITC would produce fringe benefits beyond mere economic outcomes.[11]

By raising low-income workers’ after-tax incomes, the EITC increases the rewards of low-wage work. Although there is little empirical literature on the impact of the childless workers’ EITC on employment rates, careful econometric studies have demonstrated that the expansions in the EITC for families with children during the 1990s raised employment rates markedly among low-skilled single mothers. University of Chicago economist Jeffrey Grogger found that the EITC expansions during this period were at least as important as the 1996 welfare reforms in increasing employment among single mothers. In addition, women eligible to benefit the most from the EITC expansions experienced higher wage growth in subsequent years than other, similar women.[12] Numerous researchers believe these results are robust enough to conclude that substantially expanding the childless workers’ credit would increase labor force participation among low-skilled childless workers.[13]

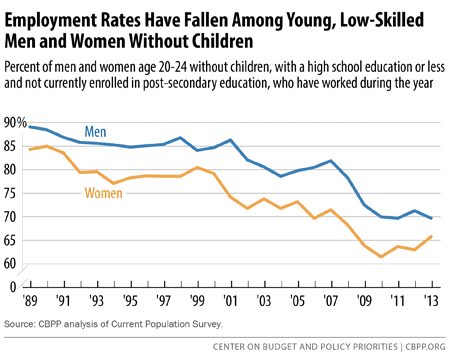

Young men and women’s employment rates (measured by the percentage working or actively looking for work) has been declining for over two decades, particularly for low-skilled men and women with no education after high school. Between 1989 and 2013, the employment rate of childless men aged 20 to 24 with a high school education or less fell from 89 percent to 70 percent. The employment rates for the women in this group also fell sharply, from 84 percent to 66 percent (see Figure 3).

Real incomes have also fallen for less educated men and women. Between 1991 and 2013, median earnings for a high-school dropout working full-time fell by nearly 10 percent, from $30,402 to $27,985 (in 2013 dollars).[14]

Raising the rewards of work for childless workers may also increase their marriage rates, several analysts have noted.[15] Marriage rates have fallen almost 30 percentage points for the lowest-income men since the 1970s.[16] In 1987, William Julius Wilson noted the correlation between falling real wages and declining marriage rates in low-income communities,[17] arguing that low employment rates and falling wages reduced the “marriageability” of these young men, resulting in an increase in the number of female-headed households. More recently, a 2009 study found that three-quarters of low-income, unwed survey respondents cited financial concerns as an obstacle to marriage.[18]

Marriage can benefit both children and their parents in several ways. Two-parent households have lower poverty rates than single-parent households, in part because they can pool their incomes and resources. Marriage can also promote stability, thereby improving health and lowering stress among parents and children. A number of studies find that children living with two parents (excluding high-conflict marriages) tend to fare better than other children on educational, social, and health outcomes, even after controlling for parental characteristics such as age, income, and education.[19] By rewarding employment among childless individuals (particularly young workers), a more ample childless EITC can lead more of them to work or to work more, thereby boosting not only their current wages but also their employment experience and hence their long-term earning potential. Greater earnings and higher employment can, in turn, improve the marriage prospects of young, low-income men.[20]

The decline in employment among young men is even greater than the employment figures cited above suggest, since those figures omit people who are incarcerated. Young men have disproportionately high incarceration rates, and taking incarceration into account significantly reduces the employment rate for young adults — particularly men of color. One study found that roughly one-quarter of black men ages 22 to 30 were unemployed in 2000, but that the share grows to one-third when one includes incarcerated black men.[21] Some 18 percent of men between ages 20 and 24 were arrested in 2009, according to a recent Justice Department report. (Although not everyone who is arrested is imprisoned, incarceration rates are still high: one in 31 adults will be incarcerated at some point in his or her life.)[22] Upon release, these individuals typically face inhospitable labor markets.[23]

Some evidence suggests that by boosting the incomes of low-wage workers, an expanded EITC could help reduce crime rates. Although the relationship between wage rates and crime is difficult to disentangle (due to the many factors that affect crime rates), researchers have found that lower wages for less-educated people are associated with higher crime rates.[24] Based on this relationship, several leading analysts such as Harry Holzer of the Urban Institute and Georgetown University and John Karl Scholz have argued that an expanded childless EITC, by increasing the wages of low-skilled individuals, would also likely reduce crime rates among young, disadvantaged men.[25]

Expanding EITC for Childless Workers Would Also Help Children

Expanding the EITC for childless adults would help not only the adults who receive the credits, but children and their communities, for at least three reasons:

- Many childless workers are non-custodial parents with financial and parenting obligations to their children. The President’s proposal would benefit about 1.5 million noncustodial parents, Treasury estimates.a By helping them succeed in the labor market, a larger EITC can also help them meet these other responsibilities, including serving as a role model to their children. Children do better when their parents work and are a positive force in their lives.

- Many childless workers are future parents. The Obama, Ryan, and other recent proposals extend the EITC to younger workers (those ages 21-25), many of them future parents. The better a foothold young workers gain in the labor market, the more likely they will succeed over time and provide for their children when they start families.

- Childless workers are part of the community. Children’s success also depends on their extended families and communities. A stronger EITC for childless adults can support children’s siblings, uncles, aunts, and grandparents, who may be considered “childless” for tax purposes even if they live in the same home as their younger relatives. A stronger EITC for young childless workers could increase their labor force participation, improve their marriage prospects, and reduce crime, all of which strengthen children’s communities.

a Executive Office of the President and U.S. Treasury Department, “The President’s Proposal to Expand the Earned Income Tax Credit,” March 3, 2014, http://www.whitehouse.gov/sites/default/files/docs/eitc_report.pdf.

To strengthen the EITC for childless workers, policymakers should lower the eligibility age and expand the maximum credit and the credit’s phase-in rate.

As noted, workers under age 25 are ineligible for the childless workers’ EITC. Congress set the eligibility age at 25 when establishing the EITC for childless workers in 1993 to avoid giving access to the EITC to college and graduate students from middle-income families, who may currently have very low incomes but depend primarily on their parents for support. As a result, however, the EITC misses many low-income workers who do not rely on their parents for support, and it thus cannot influence such individuals’ employment decisions at the start of their careers. (Note: in 1993, the IRS had no way to identify tax filers who were students; today, it does.)[26]

The Obama and Ryan proposals and several of the congressional bills lower this age floor to 21. (President Obama’s proposal would also raise the age at which a worker could receive the EITC, to allow workers aged 65 and 66 to claim it.) There are small differences in the way that the various proposals treat students, but under all proposals, most full-time students would be ineligible for the childless worker EITC. (Under current law and the proposals, most full-time students under age 24 can be claimed on their parents’ tax return as a qualifying child or dependent.)[27]

Raise the Maximum Credit and the Credit’s Phase-in Rate

Historically, policymakers have supported the EITC as a mechanism to offset payroll and income taxes among low-income workers, supplement low wages, and encourage low-wage workers to enter the labor force. Policymakers can and should strengthen the EITC’s ability to accomplish these goals among childless workers.

Under current rules, the EITC for childless workers phases in at a rate of 7.65 percent; in other words, a worker receives an EITC of 7.65 cents for each dollar of earnings until the credit is fully phased in at earnings of about $6,600 in 2015. Payroll taxes, in contrast, equal 15.3 percent of a worker’s income (including the employer share). So, for childless workers earning up to about $6,600, the EITC offsets onlyhalfof the additional payroll taxes they owe if they raise their incomes.

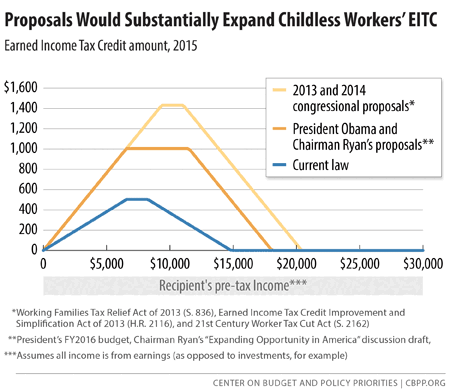

This is why the Obama and Ryan proposals would raise the credit’s phase-in rate to 15.3 percent (see Figure 4). So would three congressional proposals —the Brown-Durbin, Neal, and Murray-Reed-Brown bills — as well as some earlier proposals. This would fully offset payroll taxes for the lowest-income workers and make the credit a more powerful incentive for people to enter the work force; it also would reduce the extent to which single workers are taxed into, or deeper into, poverty.

The Obama and Ryan proposals would fully phase in the credit at earnings of about $6,600; together with the increase in the phase-in rate, this would result in a maximum credit of about $1,000.[28] The Brown-Durbin, Neal, and Murray-Reed-Brown bills would fully phase in the credit at earnings of $9,100 in 2015, expanding the maximum credit to about $1,400.[29]

In addition, the Obama and Ryan proposals raise the income level at which the credit starts to phase out for a single childless worker from about $8,250 to $11,500 in 2015; in the Brown-Durbin, Neal, and Murray-Reed-Brown bills, the credit starts to phase out at $10,750.

Ideally, the credit’s phase-out rate would be set very low to avoid high marginal tax rates. This would be quite expensive, however, and policymakers should focus budget resources on improving the credit’s phase-in rate and maximum value, since these are the features of the credit most likely to affect an individual’s decision on whether to enter the labor force.[30] Under the Obama and Ryan proposals, the credit would phase out at a 15.3 percent rate and phase out entirely for a single childless worker at an income of about $18,050, or about 125 percent of full-time earnings at the minimum wage. Under the Brown-Durbin, Neal, and Murray-Reed-Brown bills, the credit would phase out at a 15.3 percent rate and phase out entirely at an income of $19,850 — 133 percent of full-time earnings at the minimum wage. The current credit, in contrast, ends at $14,800 in 2015, leaving a full-time, minimum-wage childless worker with an EITC of just $23.

As Figure 5 shows, under the Obama and Ryan proposals the credit for a childless adult with wages at the poverty line (projected at $12,566 in 2015) would jump from $172 to $841 in 2015. For a childless adult working full time at the minimum wage (and earning $14,500), the credit would rise from $23 to $542.

The Davis and Rangel proposals have higher phase-in rates than the others — 20 percent and 23.15 percent, respectively — and maximum credits of roughly $1,300 and $1,500. The Davis proposal phases out entirely at $25,450, or about 175 percent of full-time, minimum-wage earnings. The Rangel proposal phases out entirely at $23,500, or about 166 percent of full-time, minimum-wage earnings.[31]

The proposed credit expansions, combined with a reduction in the eligibility age, would reduce poverty substantially among low-income childless workers.[32] The Obama and Ryan proposals would lift about half a million people out of poverty and reduce the depth of poverty for another 10.1 million, according to Treasury estimates.[33] The Brown-Durbin, Neal, Murray-Reed-Brown, Davis, and Rangel proposals would likely have an even bigger anti-poverty effect since their expansions are larger than the Obama and Ryan proposals.

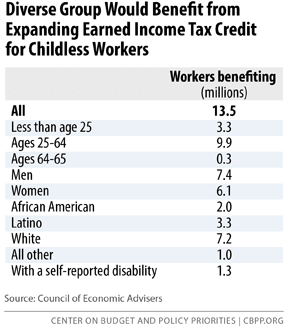

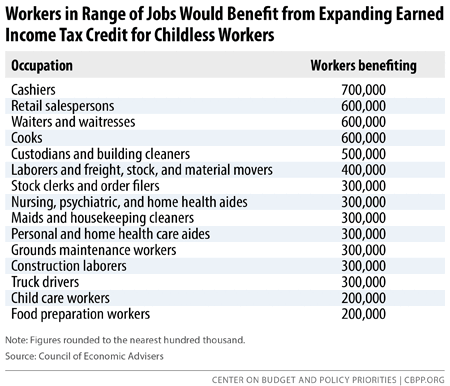

All of the proposals would help a diverse array of people (see Table 1). Of the 13.5 million workers who would benefit from the President’s proposal, we estimate that roughly 35 percent are at least 45 years old, for example, and that 1.5 million or more are non-custodial parents. [34] About 6.1 million are women. Workers in a diverse range of occupations and demographic groups would benefit (see Table 2).

Making Key EITC and Child Tax Credit Provisions Permanent

More than 16 million people in low- and modest-income working families, including 8 million children, would fall into — or deeper into — poverty in 2018 if policymakers fail to make permanent key provisions of the EITC and the Child Tax Credit (CTC). Some 50 million Americans would lose part or all of their EITC or CTC.a The President’s budget, the Brown-Durbin bill, and the Neal bill couple improvements in the childless workers’ credit with measures to make EITC provisions permanent. The Obama and Neal proposals would also make the CTC provisions permanent.

In 2009, policymakers enacted several key CTC and EITC provisions. The provisions lowered the earnings needed to qualify for a partial CTC, thereby expanding the credit for millions of low-income working families and making other families newly eligible for a partial credit. They also raised the income level at which the EITC begins to phase down for married couples to reduce the marriage penalty some two-earner families face in the EITC. And they boosted the EITC for families with more than two children.

Unless policymakers act, these provisions will expire at the end of 2017, causing millions of low-income working families to lose all or part of their CTC and EITC. If they expire:

- None of the $14,500 in earnings of a full-time, minimum-wage worker would count toward the CTC. The earnings needed to qualify for even a tiny CTC would jump from $3,000 to $14,700. The earnings needed to qualify for the full CTC would rise from $16,330 to more than $28,000 for a married couple with two children. A family with two children earning $20,000 would see its CTC cut from $2,000 to $795.

- Many married couples would face higher marriage penalties and cuts to their EITC. Currently, to reduce marriage penalties, the income level at which the EITC begins to phase out is set $5,000 higher for married couples than for single filers. After 2017, it would be $3,000 higher than for single parents, which would shrink the EITC for many low-income married filers and increase the marriage penalty for many two-earner families.

- Larger families would face a cut in their EITC. Currently, families with more than two children receive a larger maximum EITC than families with two children to help them cover their higher living costs. (The poverty rate is 15.3 percent for families with one or two children but 18.7 percent for families with more than two children. This reflects the fact that costs rise with family size but wages do not.) After 2017, the maximum EITC for families with more than two children would fall by over $700, to the level of the maximum EITC for families with two children.

Policymakers should make these provisions permanent while also expanding the EITC for childless workers.

a Chuck Marr, Bryann DaSilva, and Arloc Sherman, “Letting Key Provisions of Working-Family Tax Credits Expire Would Push 16 Million People Into or Deeper Into Poverty,” Center on Budget and Policy Priorities, December 9, 2014, https://www.cbpp.org/cms/index.cfm?fa=view&id=4228.