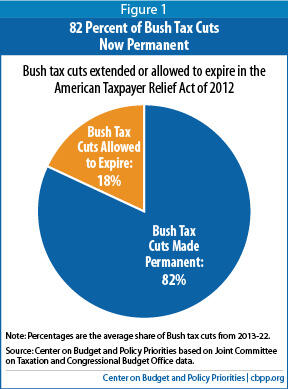

The American Taxpayer Relief Act of 2012 (ATRA)[1] , which President Obama signed into law last night, makes permanent 82 percent of President Bush’s tax cuts.

The Joint Committee on Taxation (JCT) and Congressional Budget Office estimate that making permanent all of the Bush tax cuts would have cost $3.4 trillion over 2013-2022.[2]

That’s the price tag for making permanent:

- all of the income, capital gains, and dividends tax cuts first enacted under President Bush;

- the estate tax at the levels that it was at in 2012; and

- the increase in the cost of “patching” the Alternative Minimum Tax (AMT), caused by the other Bush tax cuts, to ensure that more middle-income taxpayers are not subject to the AMT. The other Bush tax cuts threw more taxpayers onto the AMT. That increased the cost of indexing the AMT parameters for inflation. (Otherwise, the AMT would have cancelled out much of the value of the other Bush tax cuts.[3] The $3.4 trillion does not include the cost of indexing the AMT for inflation that would have existed even without the Bush tax cuts.)

JCT estimates show that ATRA makes all but $624 billion of those $3.4 trillion in tax cuts permanent.

[4] It thus makes permanent 82 percent of the Bush tax cuts, while letting 18 percent expire.

Here’s the 18 percent of the Bush tax cuts allowed to expire:

- $453 billion over ten years comes from the expiration of cuts to the income, capital gains, and dividend tax rates for filers with taxable income above $450,000 for married couples and $400,000 for singles. These filers retain the full Bush tax-rate cuts on their first $450,000 (or $400,000) of taxable income. (Note: the taxable income thresholds of $400,000 and $450,000 translate into significantly higher threshold amounts for adjusted gross income — that is, the income before taxpayers take advantage of the credits, deductions, and other tax preferences to which they’re entitled.)

- $152 billion comes from allowing limits on personal exemptions and itemized deductions (the so-called Pease and PEP provisions) to return for filers with adjusted gross income above $300,000 for married couples and $250,000 for singles.

- $19 billion comes from raising the estate tax rate to 40 percent, from the 35 percent rate in place in 2012. The exemption amount — the value of an estate that is not subject to the estate tax — will be $5.2 million for individuals and $10.4 million for couples in 2013, with the exemption amounts rising with inflation in future years. (By comparison, returning the estate tax to its 2009 parameters of 45 percent, with a $7 million per couple exemption, would have saved $137 billion; thus, relative to the 2009 parameters, $118 billion in revenue was lost.)