Some policymakers have suggested capping itemized deductions for taxpayers with incomes over $250,000 (for couples) and $200,000 (for singles) as an alternative to letting President Bush’s tax cuts for these taxpayers expire on schedule. To raise the same amount of revenue, however, would require tax changes that pose serious problems from a policy standpoint and would likely prove politically unacceptable. Thus, such an approach would likely raise substantially less revenue than letting the high-income tax cuts expire.

To even come close to replacing the revenues from letting the high-end tax cuts expire with a cap on itemized deductions that targets high-income taxpayers and does not affect middle-class families, policymakers would have to virtually eliminate all itemized deductions for households with incomes over $250,000. Moreover, to avoid a massive increase in effective tax rates, policymakers would have to phase the cap in over an extended income range above the $250,000 level, reducing the revenue it would generate.

A cap on all itemized deductions would eliminate incentives for affluent individuals to make charitable donations once they had reached their limit on deductible expenses for items such as mortgage interest and state and local taxes. Besides, policymakers may well be hesitant to apply a tight cap on deductible expenses for financial transactions such as existinghome mortgages. Given the effect that such a cap would have on charitable contributions and certain other activities — and the protests that would ensue — there is serious question as to whether policymakers would really enact a robust deductions cap and, if they did so, whether it would endure for long and actually be allowed to take effect or would subsequently be scaled back or repealed.

By contrast, letting the high-income tax cuts expire on schedule would be sound policy. It would generate nearly $1 trillion in higher revenue over ten years, helping to boost long-term growth by reducing deficits and debt and thereby preventing greater erosion of national saving. Its progressivity would modestly offset the trend of rising inequality, and it would contribute to a balanced deficit-reduction package. The near-term economic impact would be minimal: the Congressional Budget Office (CBO) estimates that letting the upper-income tax cuts expire would reduce the size of the economy next year (relative to what it would be if policymakers extend all of the 2001 and 2003 tax cuts) by a negligible 0.1 percent.[1]

Itemized deductions allow some taxpayers to reduce their income for tax purposes by the amount of certain expenses. The largest itemized deductions are for home mortgage interest; state and local income, sales, and real estate taxes; and charitable contributions. Itemized deductions also are allowed for medical and dental expenses that are high in relation to a taxpayer’s income, certain personal property and other taxes, casualty and theft losses, certain job-related expenses, and other miscellaneous items. About one-third of federal income tax returns claimed itemized deductions in 2010, the latest year for which IRS data are available. (The other two-thirds took the standard deduction.) The percentage of taxpayers claiming itemized deductions rises as income rises.

Furthermore, letting the high-income tax cuts expire is an important early step toward long-term deficit reduction. The Bowles-Simpson commission assumed that the high-income tax cuts would expire and proposed tax changes that would raise $1.6 trillion in additional revenues over the 2013-2022 period, for a total of $2.6 trillion in additional revenues against a current-policy baseline.[2] President Obama has called for roughly $600 billion in additional revenue from changes in tax expenditures.

Policymakers should reform the wide array of tax deductions, credits, and other preferences, known collectively as “tax expenditures,” to raise the additional revenue needed as part of a balanced approach to major deficit reduction. The President has proposed a tax expenditure limitation, for example, that would limit the tax benefits for itemized deductions and certain other deductions and exclusions to 28 cents per dollar (rather than the 35 cents on the dollar that those in the top tax bracket now receive). Tax expenditure reform should complement, rather than replace, letting the high-income tax cuts expire.

Finally, if policymakers impose a cap on high-income taxpayers’ deductions as a substitute for letting the high-income tax cuts expire — and they make the Bush tax rates permanent at the same time — they would be locking in low tax rates, and they might consider the tax-reform contribution to deficit reduction as complete. That would generate an inadequate revenue contribution to deficit reduction, even as some of the largest tax subsidies for high-income taxpayers — such as the preferential tax rate for capital gains and dividends — were effectively eliminated from future consideration.

President Obama has called for letting the Bush tax cuts expire for the top 2 percent of taxpayers — couples making over $250,000 and singles making over $200,000 — and restoring the estate tax to its 2009 parameters, under which the tax would apply only to the estates of the wealthiest 3 out of every 1,000 people who die (the top 0.3 percent).[3] The Administration’s proposal would raise $968 billion in revenue over ten years relative to a policy of extending all of these tax cuts, and it would reduce deficits by $1.1 trillion when the resulting savings in interest payments are taken into account.[4] Some, however, have suggested limiting the itemized deductions of this high-income group as an alternative way to raise the same revenue while letting the tax-rate reductions for high-income households continue.[5]

To be sure, many itemized deductions and other tax expenditures are costly and inefficient and should be reformed.[6] And the benefits of itemized deductions are skewed to high-income filers: 26.5 percent of the benefits go to people with incomes over $1 million, while only 3 percent go to people with incomes below $50,000.[7]

Yet it would be exceedingly difficult to limit itemized deductions in a way that is politically feasible, is as progressive as allowing the high-income tax cuts to expire, and raises an equivalent amount of revenue. Any concrete proposal would run into significant problems, the first of which is that merely limiting these deductions would not be sufficient. To pay for the $968 billion ten-year cost of extending the tax cuts for incomes above $250,000 without requiring taxpayers with incomes under $250,000 to pick up the tab, policymakers would have to eliminate high-income people’s itemized deductions and do so immediately.

The Urban Institute-Brookings Institution Tax Policy Center (TPC) estimates that eliminating all itemized deductions for all taxpayers would raise about $2.2 trillion over the 2013-2022 period, if the current top tax rates (the Bush rates) remain in effect.[8] We estimate that approximately 57 percent of this $2.2 trillion would come from households with adjusted gross income below $250,000 for married couples filing jointly and $200,000 for single filers.[9] Exempting those households would reduce the revenue available from repeal of itemized deductions to about $950 billion. To secure that $950 billion would require wiping out all deductions for couples with incomes of more than $250,000 (more than $200,000 for singles), with no phase-in.

Eliminating itemized deductions for high-income people would raise several problems. Solving each problem would erode the revenue such a proposal could raise.

1. Eliminating itemized deductions for high-income taxpayers would create massive increases in effective tax rates. As noted, raising the needed revenue would require eliminating all itemized deductions for couples making more than $250,000 and singles making over $200,000. People below these thresholds would keep all of the benefits of their itemized deduction, while someone just over the threshold would keep none of them.

Policymakers could mitigate this “cliff” by phasing in the limit on households’ itemized deductions over an income range above $250,000 for a married couple and $200,000 for single filers. With a phase-in, a couple making just over $250,000 would keep most of its itemized deductions. But as its income rises above $250,000, the portion of its deductions that a couple could retain would gradually shrink to zero.

Such an approach, however, would raise significantly less revenue than simply eliminating itemized deductions for everyone over $250,000. If the revenue loss amounted to only about 15 percent (a more realistic phase-in would likely lose more), this would reduce the potential revenues from eliminating itemized deductions by roughly $140 billion over ten years.

It is also worth noting that phasing in a limit on itemized deductions over some income range above the $200,000/$250,000 threshold would raise marginal tax rates over the phase-out range. Depending on the phase-out range, some taxpayers could face a larger increase in marginal tax rates than they would face from an expiration of the high-income tax cuts. This would undermine the goal of avoiding marginal tax rate increases, which has drawn many supporters to the deductions-cap option in the first place.[10]

2. Social and economic goals (and political pressures) would likely lead policymakers to retain some itemized deductions for high-income taxpayers. Policymakers may be open to eliminating some tax expenditures for high-income households, including some itemized deductions, if they determine those tax preferences serve no worthwhile economic or social goal or are ineffective (and can’t be restructured to be more effective). But policymakers may want to retain various other tax expenditures.

For example, policymakers likely will not want to eliminate the tax incentive for some or all high-income people to donate to charities, which would occur if they capped total itemized deductions or eliminated itemized deductions for people in high-income brackets. But exempting the charitable deduction partially or fully from a restriction on itemized deductions would further erode the revenue savings.

Tax Policy Center estimates indicate that exempting the charitable deduction would lower the savings from repealing itemized deductions for high-income households by about 30 percent.[11] Such an exemption, combined with the revenue loss from phasing in a cap on deductions (as described above), would mean that repealing itemized deductions other than the charitable deduction for high-income households would likely raise in the vicinity of $590 billion over 2013-2022, or less than two-thirds of the revenues from allowing the high-income tax cuts to expire.

3. Concerns about the economic recovery and fairness may lead policymakers to implement deduction limits gradually or “grandfather” certain deductions for many households. For example, we estimate that filers with incomes above $250,000 ($200,000 for singles) claimed roughly $15 billion in mortgage interest deductions in 2011.[12] Given continuing concerns about the housing market’s recovery from the recession, policymakers likely will not want to withdraw a subsidy of roughly this size from the housing market in 2013.

Further, when altering longstanding tax expenditures such as the mortgage interest deduction, some policymakers may argue for exempting deductions relating to existing mortgages (especially if a deductions cap is not limited to higher-income people).

However, phasing in the elimination of some itemized deductions (or grandfathering transactions such as existing mortgages) would further reduce the proposal’s revenue gain, leaving it even further below the revenue gained by allowing the high-income tax cuts to expire.

In light of the above problems, some proponents of substituting reductions in tax expenditures for the expiration of the high-end tax-rate cuts point to other options for limiting tax breaks. These options pose problems of their own, however.

- Limiting a broader range of tax expenditures. One approach to raising more revenue would be to limit more tax expenditures than just itemized deductions. A prime example is the preferential treatment of capital gains income and various savings incentives. These tax expenditures are costly and their benefits are skewed to people with high incomes. But most policymakers who suggest using tax expenditure limits as an alternative to allowing the upper-income Bush tax cuts to expire typically oppose scaling back or eliminating such tax expenditures.[13] They often reject the idea of narrowing or eliminating the differential between capital gains tax rates and ordinary income tax rates or scaling back tax breaks for savings vehicles. (Further, the complexity of certain savings incentives may make their value difficult to estimate on a yearly basis[14] and therefore make it difficult to include them in an across-the-board tax expenditure cap without adding significant complexity to the cap structure.)

Another major tax expenditure, the exclusion from income for employer-sponsored health insurance, reduces revenues by about $128 billion in 2012, according to the Joint Committee on Taxation.[15] But unlike itemized deductions, where 43 percent of the benefits go to those with incomes over $250,000, only about 9 percent of the benefits of the health insurance exclusion flow to those high-income households.[16] Limiting the exclusion for high-income taxpayers thus would not produce substantial savings to offset the revenue loss from continuing the upper-income tax cuts. - Capping rather than eliminating tax expenditures.Some approaches would cap a set of tax expenditures for high-income taxpayers at a set dollar amount or a percentage of a tax filer’s adjusted gross income.[17] These limits might appear to curb tax expenditures less harshly and therefore be less likely to have negative effects such as discouraging charitable giving. But if targeted only on couples with income above $250,000 (and singles with income above $200,000), it would be difficult for these approaches to raise sufficient revenue to offset the cost of continuing the high-income tax cuts.

Further, these capping approaches would themselves eliminate incentives for charitable giving among the many high-income taxpayers who would hit the tax-expenditure cap before making any charitable donations. For these high-income taxpayers, their deductions for mortgage interest and state and local taxes would consume the full amount allowed under the cap, so they would receive no tax benefit from making charitable donations. Furthermore, taxpayers who live in states with relatively high taxes (or who have relatively large mortgages) would have a smaller incentive for charitable giving, an outcome that would be difficult to defend. - Limiting the value of certain tax expenditures. The Administration’s proposal to cap the tax subsidy for itemized deductions and certain other tax expenditures at 28 cents on the dollar — which, as noted, would complement rather than replace an expiration of the high-end tax-rate cuts — is better designed. It is progressive and retains a substantial tax incentive for deductible expenditures such as charitable giving. Wealthy taxpayers would receive a 28-cent tax subsidy per dollar of charitable giving, so the limit should have only modest effects on total donations.[18] The effects on the housing market and the availability of employer-sponsored health insurance would likely be similarly modest, particularly compared to approaches that wipe out most or all of those subsidies for many high-income taxpayers.

The design of the 28 percent limit means, however, that it raises considerably less revenue than allowing the high-income tax cuts to expire. It would raise about $520 billion over ten years if the high-income Bush tax cuts expired.[19] It would raise considerably less — roughly $300 billion — if the high-income Bush tax cuts were to continue, because this limit would shave tax expenditures by a considerably smaller amount if the top rate remained at 35 percent than if it returned to 39.6 percent.[20] To be sure, the limit could be set below 28 percent to raise more revenue, but that would raise taxes on upper-middle-income filers with incomes in the 28 percent tax bracket (or create a cliff at $250,000 that would require a phase-in).

In short, despite its strong merits, this proposal isn’t an adequate substitute for allowing the high-income tax-rate reductions to expire. Given the dimensions of the nation’s fiscal challenges and projected levels of long-term deficits and debt, the revenues that such a measure can raise should supplement, not substitute for, the revenues from allowing the high-end Bush tax cuts to lapse.

The soundest approach to tax expenditure reform would be to examine each tax expenditure on its merits and to eliminate or restructure expenditures one by one as needed. Policymakers may be attracted to across-the-board limits, however, precisely because they provide a way to avoid making decisions on specific tax expenditures.

The politics of across-the-board approaches to tax expenditure reform may not be as easy as it first may appear, however. Most of today’s major tax expenditures survived the unprecedented 1986 tax reform effort to broaden the tax base.[21] Political pressures to exempt this or that tax expenditure from any limit are likely to be immense. Even a limit that touches only itemized deductions would likely face strong opposition from various constituencies, including the real estate industry, charities, and state and local governments.

The expiration of the Bush high-end tax cuts is sound policy that would save $968 billion in revenues over ten years, make the tax code more progressive, have little effect on the economic recovery, and improve long-run growth by helping shrink the deficit and thereby increasing the pool of national saving available for private investment.[22] Once assured of the deficit reduction from allowing these tax cuts to expire, policymakers can turn to the complementary and necessary, but difficult, task of tax-expenditure reform as part of a balanced approach to fiscal consolidation.

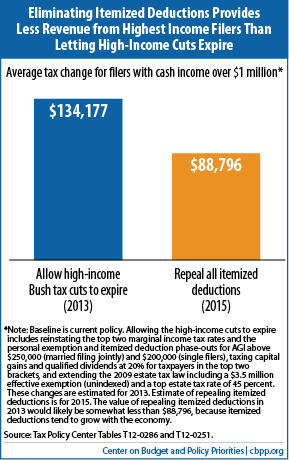

Extremely high-income people — those making more than $1 million a year — would be big winners under a proposal that limited itemized deductions in exchange for continuing the high-income Bush tax cuts; they would gain far more from the tax-cut extension than they would lose from the deductions limit. Analyses by the Tax Policy Center show that extending the high-end tax cuts would provide tax filers with incomes exceeding $1 million with an average tax cut of $134,177 in 2013, while eliminating all itemized deductions would raise taxes on these households by an average of $88,796 in 2015.

This means that if an itemized deduction limit were to raise the same amount of revenue as letting the high-income tax cuts expire, while protecting people below $250,000 from a tax increase, then people between $250,000 and $1 million would need to pay higher taxes to make up the difference.

The net gain for filers over $1 million would be even larger than the above numbers indicate. The $134,177 figure for their tax cut does not include the full value of the 2003 tax law’s cut in the dividends rate. In addition, eliminating itemized deductions would likely cost these households less than $88,796 in 2013 because that estimate is for 2015, and average itemized deductions tend to grow with the economy.