Raising Today’s Low Capital Gains Tax Rates Could Promote Economic Efficiency and Fairness, While Helping Reduce Deficits

End Notes

[1] Jane Gravelle, “Limits to Capital Gains Feedback Effects,” Tax Notes 51, April 22, 1991, pp. 363-371

[2] Leonard E. Burman, “Mitt Romney’s Teachable Moment on Capital Gains”, Forbes.com, January 18, 2012, http://www.forbes.com/sites/leonardburman/2012/01/18/mitt-romneys-teachable-moment-on-capital-gains/.

[3] Leonard E. Burman, “Under the Sheltering Lie,” Marketplace Commentary, December 20, 2005, http://www.taxpolicycenter.org/publications/template.cfm?PubID=900918.

[4] Tax Policy Center Table T09-0942.

[5] http://taxprof.typepad.com/files/crs-1.pdf at page 1.

[6] Joel Slemrod, “The Truth About Taxes and Economic Growth” Interview in Challenge, vol. 46, no. 1, January/February 2003, pp. 5–14. http://www.challengemagazine.com/Challenge%20interview%20pdfs/Slemrod.pdf.

[7] Troy Kravitz and Leonard Burman, “Capital Gains Tax Rates, Stock Markets, and Growth,” Tax Policy Center, November 7, 2005. See also Leonard Burman, “Capital Gains Tax Rates and Economic Growth (or not),” Forbes blog, March 15, 2012, http://www.forbes.com/sites/leonardburman/2012/03/15/capital-gains-tax-rates-and-economic-growth-or-not/. Burman also found no statistically significant effect lagged up to five years: Leonard Burman, The Labyrinth of Capital Gains Tax Policy, Washington, D.C., Brookings Institution, 1999, pp. 81.

[8] Thomas L. Hungerford, “Taxes and the Economy: Analysis of the Top Tax Rates Since 1945,” Congressional Research Service, September 14, 2012.

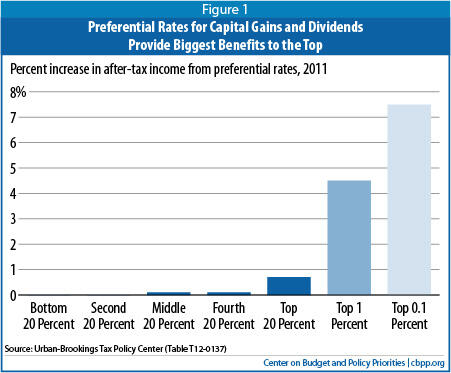

[9] Tax Policy Center Tables T12-0009 and T12-0136.

[10] Treasury Department, “Tax Reform for Fairness, Simplicity, and Economic Growth,” The Treasury Department Report to the President, November 1984.

[11] Debt Reduction Task Force, “Restoring America’s Future,” Bipartisan Policy Center, November 2010, http://bipartisanpolicy.org/library/report/restoring-americas-future.