Despite warning that the nation faces the “perils of debt,” House Budget Committee Chairman Paul Ryan introduced a budget on March 20 whose tax proposals would be extremely costly and would disproportionately favor the nation’s highest-income households and large corporations.[1] His budget would cut the top marginal income tax rate, now 35 percent but scheduled to rise next year to 39.6 percent, to 25 percent. It would cut the corporate income tax rate from 35 percent to 25 percent and eliminate taxes on the foreign profits of U.S.-based multinationals. It would eliminate the Alternative Minimum Tax (AMT), designed to ensure that high-income people pay at least a minimum level of tax. And it would eliminate health reform’s increase in the Medicare tax for high-income individuals.

These tax cuts all would come on top of President Bush’s tax cuts, which also are very expensive and tilted toward the nation’s most affluent people and which Chairman Ryan would make permanent. The Urban-Brookings Tax Policy Center (TPC) estimates that extending the Bush and other expiring tax cuts would cost $5.4 trillion over the next decade and that Chairman Ryan’s additional tax cuts would cost another $4.6 trillion. That means Chairman Ryan is proposing nearly $10 trillion in tax cuts (relative to current law) that heavily favor high-income Americans even while claiming that his budget’s severe cuts in basic low-income programs like Medicaid, food stamps, and Pell Grants are needed to rein in unsustainable deficits.[2]

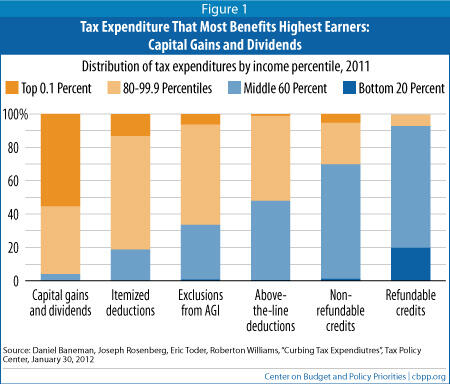

The budget claims to finance its new tax cuts by scaling back unspecified “tax expenditures” (tax credits, deductions, and other preferences) and hints that such restrictions would primarily affect high-income people. But the budget does not contain a single specific proposal to limit any tax expenditure, and it rejects limiting the key tax expenditure that most favors the wealthiest people — the preferential tax rate for capital gains and dividends. As with tax plans that Governor Mitt Romney[3] and Senator Pat Toomey[4] have proposed, placing the low capital-gains rate off limits would make it virtually impossible to enact deep tax-rate cuts like Chairman Ryan proposes without providing a massive net tax cut for the wealthiest Americans.

As noted above, TPC estimates that Chairman Ryan’s new tax cuts would cost $4.6 trillion in lost federal revenue over the next decade. To offset those costs, the Ryan budget documents say the plan would curb tax expenditures. But, the documents offer no details. Tax experts doubt that policymakers could actually pass tax-expenditure savings of anywhere close to this magnitude. As TPC’s Roberton Williams noted with regard to the tax plan that Governor Romney issued last month, which TPC found would cost a similar $4.9 trillion over the coming decade, “Nothing comes to mind to broaden the tax base enough to pay for the lower rates.”[5]

Moreover, the Ryan documents say that his plan would secure the needed revenues to finance his tax cuts not by closing tax expenditures across the board but by “getting rid of special-interest loopholes that mainly benefit the politically well-connected, distort economic growth, and encode unfairness in tax law.” They note that tax expenditures “are disproportionately used by upper-income individuals.” In essence, Chairman Ryan conveys the impression that he would pay for his rather massive tax cuts for high-income individuals by cutting tax expenditures for the same affluent taxpayers.

But, Chairman Ryan himself makes the challenge of doing so all but impossible. As TPC data show (see Figure 1), the tax expenditures that tilt most heavily to high-income households are the preferential rates for capital gains and dividends. And while the Ryan budget does not provide details on the tax expenditures that he would curtail, it makes clear that Chairman Ryan rejects any increase in the capital gains tax rate. The document that he issued on March 20 to support his budget criticizes President Obama for proposing to let the capital gains rate on high-income households return to the 20 percent level at which it stood before the Bush 2003 tax cuts (as compared to today’s 15 percent rate), declaring, “Raising taxes on capital is another idea that purports to affect the wealthy but actually hurts all participants in the economy.”[6]

Indeed, another TPC analysis[7] shows how hard Chairman Ryan would find it to finance his tax cuts. TPC examined the impact of a 46 percent cut on most all major individual tax expenditures except for capital gains and dividend preferences — namely, the tax exclusion for employer-sponsored health insurance and tax deductions for mortgage interest, medical expenses, state and local taxes, and charitable contributions. That 46 percent cut would generate just $2.4 trillion in revenue over the first decade. Moreover, TPC found that this proposal would hit middle-income taxpayers slightly harder than taxpayers in the top 1 percent.

Moreover, the political obstacles to cutting all of the major tax expenditures cited above by nearly half would be daunting, because tens of millions of middle-income Americans rely on them to afford health insurance, buy homes, and so on. The President has proposed a much more modest proposal that would raise $584 billion over ten years; he would cut tax expenditures by less, and his proposal would only affect married filers with incomes above $250,000 and single filers with incomes above $200,000. Specifically, he would limit the benefit of tax expenditures for high-income people to the value that those tax breaks have for people in the 28 percent tax bracket. Reflecting the political challenge of scaling back tax expenditures, Congress has repeatedly rejected that relatively modest proposal.

The numbers related to Chairman Ryan’s corporate tax cuts — cutting the corporate rate to 25 percent and essentially eliminating U.S. tax on the foreign profits of U.S. corporations — also don’t add up. Here, too, Chairman Ryan claims that he would cover the cost by closing tax expenditures, without offering any specific proposal to do so. This ignores a Joint Tax Committee (JCT) analysis[8] of last fall that found that eliminating nearly all of the major corporate tax expenditures — notwithstanding their popularity among powerful corporate lobbies — would only offset the cost of cutting the corporate tax rate to 28 percent. Moreover, the JCT analysis noted that such a change could very well add to long-term budget deficits, because some of the savings from eliminating corporate tax expenditures would not continue beyond the ten-year budget window.