Incomes at the Top Rebounded in First Full Year of Recovery, New Analysis of Tax Data Shows

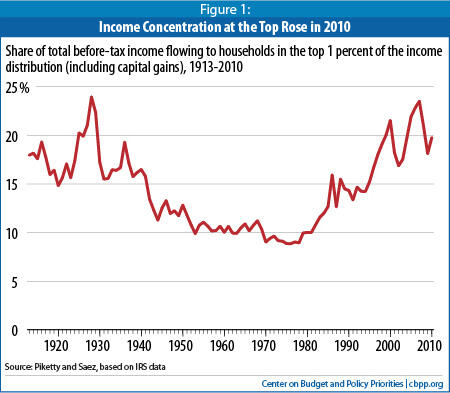

Top 1 Percent’s Share of Income Starting to Rise Again

End Notes

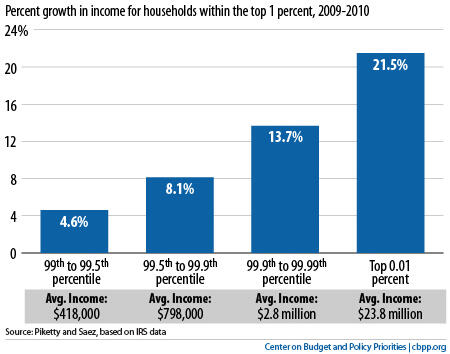

[1] Emmanuel Saez, “Striking It Richer: The Evolution of Top Incomes in the United States (updated with 2009 and 2010 estimates),” March 2, 2012. Available at http://elsa.berkeley.edu/~saez/saez-UStopincomes-2010.pdf.

[2] Piketty and Saez rely on detailed Internal Revenue Service micro-files for available years, extending the full series to 1913 using aggregate data and statistical techniques. Their March 2012 revision incorporates the detailed micro-files for 2009 and 2010. For details on their methods, see Thomas Piketty and Emmanuel Saez, “Income Inequality in the United States: 1913-1998,” Quarterly Journal of Economics, February 2003. Their most recent data are available at http://elsa.berkeley.edu/~saez/TabFig2010.xls.

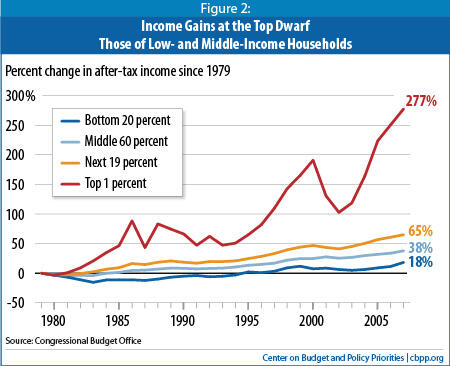

[3] One of the most important limitations of the IRS data used by Piketty and Saez is that they do not include people who do not file income tax returns. Rich data on this population are available through the Census Bureau, but the Census data have incomplete information about incomes at the very top of the distribution. Also, neither Piketty-Saez nor Census adjusts incomes for family size, which can distort trends when average family size changes over time. CBO publishes an analysis combining the Piketty-Saez and Census data to estimate average federal tax rates paid by households in various income categories, as well as before- and after-tax household incomes adjusted for family size; this provides the most comprehensive analysis of income distribution but is not as timely as the Piketty-Saez analysis. The most recent CBO report uses 2007 data and provides historical data only back to 1979; see http://www.cbo.gov/publications/collections/collections.cfm?collect=13.

For a more detailed description of these and other sources of income inequality data, please see Chad Stone, Hannah Shaw, Danilo Trisi, and Arloc Sherman, “A Guide to Statistics on Historical Trends in Income Inequality,” Center on Budget and Policy Priorities, March 5, 2012, https://www.cbpp.org/files/11-28-11pov.pdf.

[4] The adjustment for population growth is made to account for the fact that with a growing population, income must increase to keep average household income constant. Additional growth is necessary to raise average living standards. The shares of growth reported in the text are the shares of the income available to raise living standards that go to different income groups.

[5] The last economic expansion began in November 2001 and ended in December 2007. However, the real income of the top 1 percent of households did not reach a trough until 2002 and that of the bottom 90 percent until 2003. For the purposes of this paper, we measure income growth between 2002 and 2007. If we had chosen 2001 as the base year, the share of income gains accruing to the top 1 percent and bottom 90 percent of households would have been 76 percent and 2 percent, respectively. If we had chosen 2003, those respective shares would have been 59 percent and 20 percent. As footnote 2 explains, the CBO data might show somewhat different differential growth between the top 1 percent and the bottom 90 percent, but a large disparity would still exist.

[6] CBO data are more comprehensive than Piketty-Saez — especially for the bottom 90 percent of households — because they are not based exclusively on tax return data. CBO combines tax data with Census data to offer a richer account of incomes lower down the income distribution. The CBO data cited here account for such things as government cash transfers, public and private non-cash benefits (such as government health and nutrition assistance benefits and employer-paid health insurance benefits), and federal taxes. For more on the differences between the data analyzed by Piketty and Saez and CBO, please see Stone et al., 2011.