Some members of Congress, including House Budget Committee Chairman Paul Ryan, as well as various outside groups are calling for “dynamic scoring” to estimate the budgetary effects of major legislation, notably tax reform proposals.[1] Congress, however, should resist the temptation to use dynamic scoring, which would include estimates of how changes in tax and budget policy would affect the economy’s size and how that, in turn, would affect the level of federal revenues.

In proposing dynamic scoring, Chairman Ryan repeated a widespread and mistaken belief that the standard estimates of tax and spending proposals that the Congressional Budget Office (CBO) and other federal agencies prepare are “static,” saying, “Our rules in Congress require that we don’t take into consideration behavioral changes or economic effects as a result of tax reform.” In reality, estimates by CBO, the Joint Committee on Taxation (JCT), and the Treasury Department do incorporate many specific changes in individual and business behavior that occur in response to changes in tax rates and other policies.

Those cost estimates do not, however, include estimates of macroeconomic feedbacks — that is, whether a change in tax or spending policy would affect the overall economy and, if so, by how much. They do not, for instance, include estimates of how a proposal might affect the rate of economic growth and how that, in turn, would affect federal revenues.

CBO, JCT, and the Treasury Department do not use dynamic scoring for very sound reasons:

- Estimates of the macroeconomic effects of policy changes are highly uncertain. Economists differ substantially on the size of macroeconomic feedbacks from reducing marginal income tax rates or other changes in taxes or spending.

- Dynamic scoring would damage the credibility of the budget process. Because estimates of macroeconomic feedbacks are so uncertain — and are highly subject to manipulation — their use in revenue or spending estimates would be very controversial and raise suspicions that they are biased and politically motivated. Indeed, tax reform’s proponents could seek to use dynamic scoring to make tax reform proposals seem less costly than they really are, paving the way for deeper tax rate cuts or enabling proponents to propose fewer limits on such popular tax preferences as the mortgage interest deduction or various corporate tax breaks.

That is, dynamic scoring could ease the path for a tax reform plan that’s revenue-neutral on paper but, in reality, would increase budget deficits. Those deficits, in turn, would reduce long-term economic growth by creating a drag on saving and investment that outweighs any positive effects of the rate cuts. Chairman Ryan and others call for tax reform that drastically cuts top tax rates without boosting the deficit,[2] but, politically, that is very hard to achieve without raising taxes on low- and moderate-income families or relying on timing gimmicks.[3] Facing that reality, policymakers could use dynamic scoring to appear to finance large cuts in tax rates by assuming those cuts would significantly boost economic growth and thereby raise revenues. They could seek to manipulate the assumptions to produce the most favorable results.

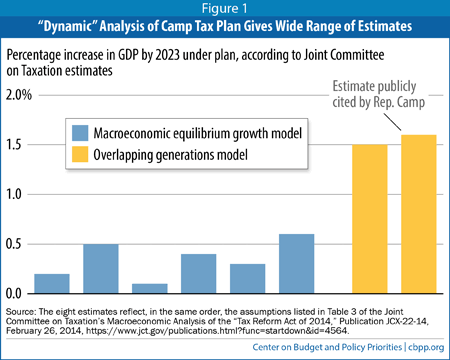

The tax reform proposal from retiring House Ways and Means Committee Chairman Dave Camp offers a cautionary tale. When, as explained below, JCT estimated the revenue effects of the Camp proposal, it used two different economic models and several different assumptions about how tax changes affect personal and business decisions on work, saving, and investment, thus generating eight different estimates of economic effects and a corresponding range of revenue feedback effects. Chairman Camp chose to tout the single most optimistic revenue feedback effect out of the entire range — one that produced revenue effects more than ten times larger than the most modest results and that also assumed that at some future point, Congress would enact spending cuts large enough to prevent the debt from growing as a share of the economy even though the Camp plan itself wouldn’t do any of that. Thus, Chairman Camp cherry-picked the results of JCT’s revenue estimate to put his tax reform proposal in the very best light, claiming the most optimistic impact and assuming (and effectively taking credit for) future congressional actions on taxes and spending that lie wholly outside the scope of his plan and that Congress has shown little inclination to adopt.

JCT and Treasury’s Office of Tax Analysis both produce estimates of how changes in tax laws would affect federal tax receipts, compared to projected receipts under current law. (CBO uses JCT’s estimates of tax-law changes in preparing its cost estimates for Congress.) These estimates are not static; rather, they incorporate a wide range of expected behavioral changes in response to changes in economic incentives. According to JCT, “Such behavioral effects include shifts in the timing of transactions and income recognition, shifts between business sectors and entity forms, shifts in portfolio holdings, shifts in consumption, and tax planning and avoidance strategies.”[4]

For example, the revenue estimate of a bill raising the excise tax on cigarettes or gasoline would take account of the decline in smoking or driving that would stem from the price increase for the taxed product. Similarly, the revenue estimate of a bill changing the capital gains tax rate would take account of the resulting increase or decrease in capital gains realizations, as well as changes in their timing. If the change in the capital gains rate caused a shift away from or towards other forms of income, such as dividends, the estimate would also take account of the revenue impact of the shift.[5]

Revenue and spending estimates traditionally do not, however, include macroeconomic responses, such as how a bill might affect economic growth over either the short term (by altering aggregate demand) or the long term (by altering the supplies of labor, capital, or technology).[6] JCT and CBO sometimes provide supplemental analyses of the estimated macroeconomic effects of major legislation, such as immigration or tax reform proposals, but these analyses are not part of their budget estimates of the bills. (For a discussion of CBO’s estimate of the immigration bill, see box.)

CBO and JCT Did Not Use Dynamic Scoring for Immigration Bill

Some members of Congress have claimed that CBO and JCT used dynamic scoring to estimate the budgetary effects of the 2013 Senate immigration bill and should do the same for tax bills, starting with tax reform. In its official cost estimate of the immigration bill, CBO made an exception to its longstanding policy of assuming that the legislation under consideration does not affect the overall size of the economy. It did not, however, use dynamic scoring.

CBO and JCT confront a unique challenge with immigration bills, which — unlike virtually all other legislation — would substantially expand the U.S. population and labor force and therefore affect the budget independently of any impacts resulting from changes in households’ and businesses’ behavior. CBO’s cost estimate accounted for the direct effects of these population and labor force increases on the size of the economy, revenues, and federal benefit spending.a CBO employed a similar procedure in its cost estimate for the 2006 immigration bill.b

Other than that, CBO sought (in its words) “to remain as consistent as possible with the rules CBO and JCT follow for almost all other legislation” and did not “incorporate the budgetary impact of every economic consequence of the bill.” CBO did not, for instance, include estimates of the immigration bill’s more speculative and uncertain effects on GDP, such as estimates of its effects on business investment and productivity. CBO’s cost estimate of the immigration bill thus did not include the type of “dynamic scoring” that some members of Congress are calling for.

As it sometimes does with major legislation, CBO provided a separate analysis of additional economic effects notin its official cost estimate of the immigration bill, as well as their potential budgetary impact. Reflecting the high degree of uncertainty surrounding these effects, CBO provided a range of estimates rather than the precise estimates required in an official cost estimate. This is the appropriate approach for any legislation with such potential economic effects, including tax reform legislation. But to claim that CBO employed dynamic scoring in its cost estimate for the immigration bill seriously misrepresents CBO’s approach to the unique situation it faces with immigration bills.

a CBO, Letter to the Honorable Patrick J. Leahy, July 3, 2013, http://cbo.gov/publication/44397.

b CBO, Letter to the Honorable Charles E. Grassley, May 16, 2006, http://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/72xx/doc7208/s2611.pdf.

Estimates of the macroeconomic effects of budget and tax changes depend critically on the assumptions and methods employed, including the choice of economic model, the specific parameters assumed for that model, and (in some models) the assumed response of the Federal Reserve to changes in fiscal policy. Different models and assumptions can produce estimates that vary widely, sometimes even in the direction of their effect — for example, in whether a given tax change increases or reduces economic growth.

When CBO and JCT produce macroeconomic analyses (as distinguished from cost estimates) of legislation, they use multiple models and assumptions and produce a range of estimates. CBO warns that “no single model can adequately explore the macroeconomic implications of fiscal policy: the best analysts can do is to combine the separate insights that they can glean from different models.”[7] JCT similarly cautions that, even using multiple models, “we cannot account for all the possible effects that [a] proposal might have on the economy.”[8]

JCT’s analysis of Chairman Camp’s tax reform proposal vividly illustrates the uncertainties of these macroeconomic estimates. JCT assessed the effects of the Camp proposal using two different economic models and several different assumptions about how tax changes affect household and business decisions regarding how much to work, save, and invest. The result was eight separate estimates of the macroeconomic effects of the Camp plan and a corresponding range of revenue feedback effects. (See Figure 1.)

The range of estimates is very wide. JCT estimates that, under the Camp plan, the economy would be somewhere between 0.1 percent and 1.6 percent larger in 2023 than it would otherwise be, resulting in somewhere between $50 billion and $700 billion in additional revenue over ten years.[9] The largest estimates are generated by a model (termed an overlapping generations, or OLG, model) that makes highly unrealistic assumptions about how businesses and households behave.[10] The smaller and arguably more realistic estimates come from a pragmatic policy model (a macroeconomic equilibrium growth, or MEG, model) whose results are more consistent with empirical evidence on work, saving, and investment responses to tax changes. CBO also uses the same two types of models for analyzing the effects of changes in fiscal policy on the economy.[11]

Not only do the two models produce very different results, but each model by itself produces different results depending on the assumptions used. The OLG model, for example, requires making assumptions about how and when future governments will stabilize the debt-to-GDP ratio.

“Some approaches to dynamic scoring . . . simply will not work (i.e., the computer algorithms will not function) when the government budget is on an explosive debt trajectory,” former CBO director Douglas Holtz-Eakin has noted. If a tax reform proposal fails to stabilize the long-term fiscal outlook or actually increases future deficits, the model requires introducing an offsetting budget policy at some point in the future.[12] Consequently, the results often reveal more about the effects of the assumed offsetting policy than about the effects of the proposed tax or budget policy.[13] The JCT estimates of the Camp tax reform proposal that use the OLG model assume that all the required deficit reduction would come from cuts to transfer payments (a category that includes programs such as Social Security and SNAP, formerly food stamps). But different assumptions would produce markedly different results.

The results of the MEG model depend critically on the assumed monetary policy. To illustrate the range of outcomes, JCT uses two alternative assumptions. In one scenario, an aggressive Federal Reserve immediately counteracts any increase in demand arising from tax cuts. The growth effects are two to four times as large, however, in the scenario in which the Federal Reserve does not moderate these demand increases. CBO analysts warn that such alternative assumptions “are not meant to be realistic predictions of how the Federal Reserve might actually respond but are included to show the range of implications of alternative assumptions.”[14]

The results of both models are also sensitive to small changes in other critical assumptions, such as the responsiveness of labor supply to changes in tax rates. For example, reducing marginal tax rates on income from work might encourage some taxpayers to work more, by increasing their after-tax compensation and making work more attractive. Others might work less, however, because they could maintain their current level of after-tax income while working fewer hours. Evidence is needed to determine the size of each effect, and academic studies produce mixed results. That’s why JCT and CBO typically provide alternative estimates using different assumptions about the sensitivity of labor supply. In JCT’s analysis of Chairman Camp’s tax plan, the growth impacts in one model are twice as large under an assumption of higher labor elasticity than under an assumption of lower labor elasticity.

Significant gaps in the available models create additional uncertainty in estimating the macroeconomic effects of tax and budget changes. For example, JCT’s models account for the economic benefits of investing in business capital (such as new machinery) but ignore the economic benefits of investing in human capital (such as a college education or worker training). As a result, these models favor tax changes that increase investment in business capital rather than human capital. In another example, the models include no information on important sectors of the economy, such as health care and manufacturing. Thus, they can provide no information about the growth effects of policy changes affecting those sectors, such as changing the tax treatment of employer-sponsored health insurance.

Taking all of the relevant factors into account, a tax reform that is revenue-neutral based on conventional scoring would not necessarily produce significant positive macroeconomic feedbacks. As a case in point, the Tax Reform Act of 1986 (TRA86) — the last major effort to broaden the tax base and reduce rates — appears to have produced little real impact on economic growth. Summarizing the results of an assessment sponsored by the University of Michigan, one prominent economist wrote, “Most of the papers presented at this conference reinforce the casual observation that TRA86 has had little effect on the broad measures of real economic activity in which most economists are interested.”[15]

Modeling the economy is extraordinarily difficult, and even the best available methods and data leave tremendous uncertainty. Policymakers may glean useful information about the possible effects of tax reform from macroeconomic analyses, but only if they fully recognize the models’ significant limitations and the very wide range of estimates that the models produce. Because of the high degree of uncertainty of the estimates, it is entirely appropriate that official cost estimates for tax and spending legislation exclude macroeconomic feedbacks.

Including macroeconomic feedbacks in the cost estimate for a budget or tax reform proposal would impair the credibility of both the proposal and the budget process itself. Congress could either cherry-pick the model and assumptions that give the most favorable estimate, whether or not the estimate is realistic, or exert pressure on JCT (whose staff report to the chairs of the Senate Finance and House Ways and Means Committees) to use the most favorable assumptions.

The macroeconomic analysis of Chairman Camp’s tax plan highlights the risk of cherry-picking the results. As noted, JCT used two different economic models and a range of assumptions about how the Federal Reserve, businesses, and workers would respond to the plan, giving eight different estimates of its growth effects and a corresponding range of revenue feedback effects. Yet Chairman Camp touted the biggest effects, which were more than ten times larger than the most modest results.[16]

Moreover, the effects that Camp highlighted came from the OLG model, which required JCT to assume that future Congresses would stabilize the debt as a share of GDP through future spending cuts or tax increases. For this reason, JCT cautioned that the results of the other model it used (the MEG model) were the only ones that simulated just the “actual proposed law.”[17] Chairman Camp nonetheless ignored the results that simulated his actual proposal, and presented substantial growth effects as coming from his plan alone when, in fact, they were dependent upon assumptions that future Congresses would take controversial deficit-reduction actions that policymakers have long resisted.

Further, Camp relied on estimates of the distributional impacts of his plan that entirely omitted the cuts to transfer payments that were assumed in the dynamic-scoring estimates he chose to highlight. The distributional analysis of the plan would have looked much less favorable had it incorporated those cuts.[18] As Brookings economist William G. Gale pointed out in 2002:

For purposes of consistency, it seems crucial, if one is going to assume that some sort of financing of tax cuts occurs in the future — i.e., via spending cuts or tax increases — that the revenue and distributional effects of those changes be reported as part of the analysis of the tax cut itself. [19]

For all of the above reasons, including macroeconomic feedbacks in the official revenue estimate for tax reform legislation would appear arbitrary and inconsistent and would smack of budgetary gimmickry. People would inevitably view the revenue estimate as biased and politically motivated, and with good reason.

Some members of Congress, including Chairman Ryan and Chairman Camp, have proposed eliminating various tax preferences and using the resulting revenues to cut marginal tax rates. Such a package might be constructed so that it would lose revenue using standard estimating methods but appear revenue-neutral if certain assumptions (designed to produce that result) were made about its macroeconomic feedbacks. In other words, manipulated and highly uncertain dynamic estimates of revenues would appear to pay for tax-rate cuts. In reality, however, the rate cuts would most likely increase the deficit, and an extensive economic literature shows that unpaid-for tax-rate cuts are likely to hurt economic growth because the increase in deficits creates a drag on national saving and investment that, over time, outweighs any positive incentive effects of lower marginal tax rates.[20]

Instead of focusing on tax-rate cuts, policymakers concerned about growth would be better advised to pursue tax reform that makes the tax code more efficient and raises revenue (and thereby reduces deficits), as scored by traditional methods. When the economy is operating at or near capacity (unlike the situation today), federal budget deficits reduce total saving in the economy, crowd out capital investment, and reduce the economy’s potential rate of growth. Most economists believe that in a healthy economy, the adverse effect of higher deficits outweighs the effect of lower tax rates.[21] By reducing deficits and improving the allocation of resources across the economy by scaling back inefficient tax subsidies, such a tax reform could improve long-term growth.