The new congressional committee on deficit reduction (the so-called "supercommittee") not only can consider revenue increases, but must consider them — as well as spending cuts — if it's going to produce a balanced plan. [1]

There are five main reasons why.

- Spending cuts alone can't do the job. The key fiscal policy goal is to reduce deficits sufficiently to stabilize the debt relative to the size of the economy. The only way to accomplish this without severe cuts that would hit low- and middle-income Americans hard — in areas ranging from Medicare, Medicaid, and possibly Social Security to basic assistance for the poor — and weaken core government functions like education, scientific research, and ensuring safe food and water, is through revenue increases.

- The 2001-2003 tax cuts are a significant contributor to projected deficits. Letting some or all of those tax cuts expire would make a significant contribution to reducing the deficit.

- Higher-income people can and should share in the sacrifices needed to reduce long-term deficits. Low- and moderate-income households shouldn't be forced to bear a disproportionate share of the burden through cuts in Medicare, Medicaid, Social Security, and programs targeted on people who are poor or near-poor.

- Taxes are low both in historical terms and in comparison with other countries. By either standard, the United States has significant room for increasing tax revenues.

- Higher taxes are not an inherent barrier to economic growth. In fact, the Congressional Budget Office (CBO) has said that tax increases used to reduce budget deficits can improve long-term economic growth and job creation. The experience of the 1990s shows that claims that reasonable revenue increases will sink the economy largely reflect politics and ideology, not solid analysis.

The recent debt ceiling legislation (the Budget Control Act) calls for the Joint Select Committee on Deficit Reduction to propose, by November 23, steps to reduce the deficit by $1.2 to $1.5 trillion or more over the next ten years, in addition to the approximately $1 trillion in savings from reducing discretionary spending that has already been agreed to. Achieving this amount of deficit reduction solely by reducing spending would result in deep cuts in Medicare, Medicaid, and other federal programs, including programs targeted on the poorest Americans.

As a first step, the Budget Control Act has placed binding limits or "caps" on annual appropriations (which cover "discretionary" — or non-entitlement — programs such as defense, education, low-income housing assistance, national parks, the FBI, the EPA, medical research, and many others) that reduce projected funding for these programs by somewhat less than $1 trillion through 2021. Under these caps, CBO estimates, discretionary spending will shrink from about 9 percent of gross domestic product (GDP) in 2011 to 6.2 percent in 2021, "well below the 8.7 percent average over the past 40 years."[2]

Meeting those caps will pose a great challenge.[3] The federal government's responsibilities have grown in recent years, with developments at home and abroad pushing spending above the average for earlier decades. These responsibilities include medical care for veterans of the Iraq and Afghanistan wars, homeland security (in the aftermath of September 11, 2001), and education (with the federal government providing more resources to improve educational quality and outcomes). Additional discretionary funding is also needed to implement recent bipartisan Wall Street reform and food safety legislation and to provide adequate administrative funding to serve the growing numbers of Social Security and Medicare applicants as the population ages.

If the joint committee recommends less than $1.2 trillion in additional deficit-reduction measures, across-the-board reductions in spending would be automatically triggered to make up the shortfall. In 2013, about 85 percent of these automatic cuts would fall on discretionary programs, which would be cut by about 9 percent (if the committee achieves no savings) below the already-low levels mandated by the Budget Control Act caps. [4]

If the joint committee chose to reach its $1.2 trillion goal entirely through cuts in mandatory programs (such as Medicare and Medicaid), the cuts there would have to be harsh, as well. The deal that President Obama and Speaker Boehner were negotiating in July would have raised Medicare's eligibility age,[5] increased Medicare cost-sharing charges, shifted significant Medicaid costs to states,[6] lowered inflation adjustments in Social Security (and the tax code), and instituted a wide array of other entitlement savings, alongside revenue increases. Those cuts in entitlement programs would have saved $650 to $700 billion over ten years. To meet its target solely through entitlement cuts, the joint committee would have to produce cuts twice as deep as these — and roughly twice as deep as those in the plan of the "Gang of Six" senators and in the proposal by Fiscal Commission co-chairs Erskine Bowles and Alan Simpson.[7]

While policymakers will need to take additional steps over the long term to slow the growth of health care costs in the private and public sectors alike, the Affordable Care Act includes most of the good ideas we know now for slowing the growth of Medicare spending. Achieving large additional savings over the near term will therefore be difficult. Studies have shown that proposals such as replacing Medicare with vouchers that don't keep pace with health costs or raising Medicare's eligibility age would generally shift costs to beneficiaries, states, and employers — and in many cases, would increase total health care spending and thus add to the burden that high health care costs place on the economy.

This is why every recent bipartisan proposal, including Bowles-Simpson, the Bipartisan Policy Center panel chaired by Pete Domenici and Alice Rivlin, and the Senate's "Gang of Six," has called for a balanced package that includes both substantial budget cuts and substantial revenue increases. The report of a panel on deficit reduction convened by the National Academy of Sciences and the National Academy of Public Administration also concluded that putting the budget on a sustainable path without increasing revenues is likely to require large cuts in Social Security, very large cuts in Medicare and Medicaid, and cutting all other programs by about 20 percent overall (with deeper cuts in all other areas if one or more of these categories were protected).[8]

The joint committee needs to develop a balanced deficit-reduction package, including significant revenues, to reach its target. Only by proposing substantial increases in revenues can the committee avert automatic cuts in discretionary spending and overly harsh cuts in Medicare, Medicaid, and Social Security.

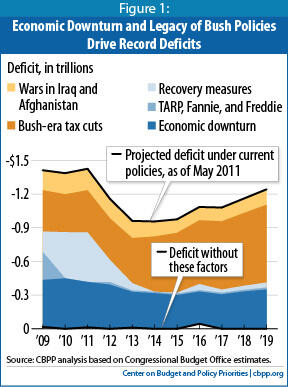

As recently as 2001, the federal government was running large surpluses, and CBO and the Office of Management and Budget were projecting surpluses for years to come. What explains the sharp deterioration in the budgetary outlook? Just two policies dating from the Bush Administration — the 2001-2003 tax cuts and the wars in Iraq and Afghanistan — accounted for over $500 billion of the deficit in 2009 and will account for $7 trillion in deficits in 2009 through 2019, including the associated debt-service costs. By 2019, these two policies will account for almost half — nearly $10 trillion — of the $20 trillion in debt that will be owed under current policies (see Figure 1).[9]

Although the temporary policies adopted to stabilize the economy and financial system during and after the recent recession added to budget deficits in 2009 through 2011, their effects will fade quickly thereafter, and they do not contribute much to the long-run budget shortfall. Nor are the projected deficits caused by a temporary large increase in discretionary spending instituted to respond to the recession. As noted, discretionary spending in 2011 is estimated to total about 9 percent of GDP

— only slightly above its historical average even though some areas of discretionary spending are temporarily elevated now due to the wars and the Recovery Act — and is slated to decline markedly over the next decade.

Letting part or all of the 2001-2003 tax cuts expire would make a significant contribution to reducing projected deficits. Letting all of the tax cuts expire — as former Reagan economic adviser and Harvard professor Martin Feldstein, former OMB director Peter Orszag, and we (among others) have recommended — would save about $3.6 trillion over the next ten years, including the resulting savings in interest payments, and (in conjunction with the savings in the Budget Control Act) stabilize the debt-to-GDP ratio in the years ahead, which most economists consider the key intermediate goal for fiscal policy. Letting only the high-income tax cuts expire would save about $830 billion.

Higher-Income People Can and Should Share in Reducing the Deficit

Low- and moderate-income Americans should not face cuts in Medicare, Social Security, Medicaid, or other essential benefits while the richest households are left largely untouched. Most Medicare and Social Security beneficiaries live on modest incomes. The median income of Medicare beneficiaries in 2006, for example, was $23,000.[10] Medicaid enrollees all have very low incomes, and about half live in poverty.

Over the past several decades, taxes on people at the very top have fallen dramatically, even as their incomes have soared.

Recent IRS data on the nation's top 400 households — whose incomes averaged $270 million in 2008 — show that the average share of income that they paid in federal income taxes

dropped from 26 percent to 18 percent between 1992 and 2008, while their annual incomes shot up by over

700 percent, after inflation.

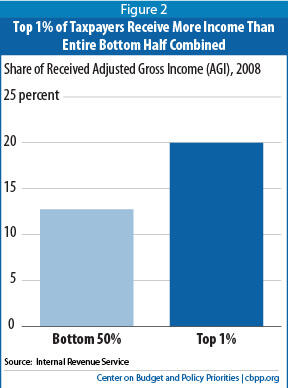

[11]A similar picture emerges if one looks at the top 1 percent of taxpayers — those with adjusted gross income of more than half a million dollars. The top 1 percent had a combined income of $1.7 trillion in 2008, the most recent year for which data are available. This is fully 20 percent of the nation's total adjusted gross income and much more than the entire bottom half of the population had (around 13 percent). (See Figure 2.)

- IRS data show that the top 1 percent of taxpayers paid an average of about 23 percent of their income in federal income taxes in 2008. That's substantially below what they paid prior to the 2001-2003 tax cuts — and about a third less than they paid back in 1980.

- Returning the average effective tax rate on the top 1 percent of taxpayers to its 1996 level of 29 percent would raise about $100 billion a year, or $1 trillion over the next decade.[12]

Tax policy should lean against the rising tide of income inequality, not exacerbate it. During the first three decades after World War II, economic growth was robust and widely shared: economy-wide productivity improvements were accompanied by significant increases in the living standards of most Americans. In recent decades, by contrast, the benefits of economic growth have

not been widely shared. CBO data show that between 1979 and 2007, the average after-tax income of the top 1 percent of Americans grew by 281 percent, after adjusting for inflation, compared to just 25 percent for the middle 20 percent of Americans, and 16 percent for the poorest fifth of the population.

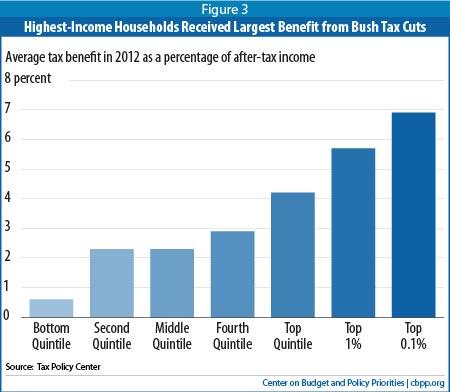

[13]The tax cuts enacted in 2001 and 2003 provided the largest benefit to the highest-income households and widened these yawning income disparities. Under these tax cuts, households with incomes over $1 million stand to receive an average tax cut of $130,000 in 2012, according to the Tax Policy Center, equivalent to an increase of 6.3 percent in their after-tax income. Meanwhile, households in the middle of the income spectrum will receive tax cuts that equal 2.3 percent of their income. Households in the bottom quintile will receive an average increase in income of less than 1 percent. [14] (See Figure 3.)

While taxes have fallen disproportionately for high-income people, they also are at or near historically low levels for middle-class people. That's true whether one counts only federal income taxes or all federal taxes, including payroll and excise taxes. A family of four in the middle of the income spectrum paid only 4.7 percent of its income in federal income taxes in 2010. This is the third-lowest percentage in the past 50 years, after 2008 and 2009. Including payroll and other taxes, middle-income households are paying overall federal taxes at or near their lowest levels in decades, according to the latest data from CBO.[15]

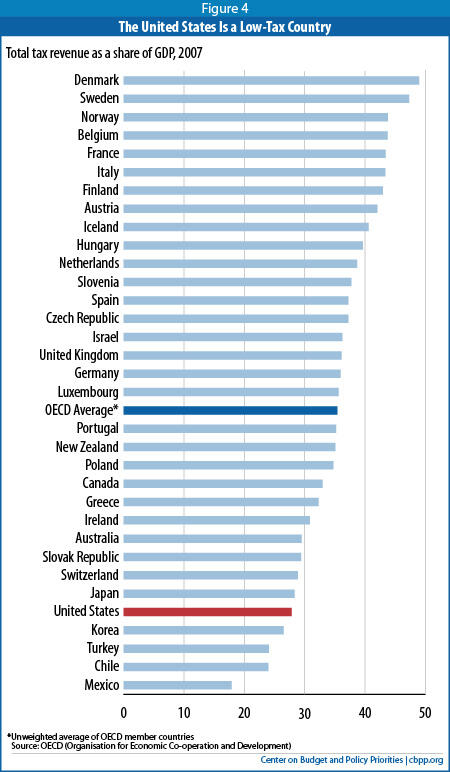

Moreover, the United States collects less in total taxes than nearly any other developed country when measured as a share of the economy. (See Figure 4.) The U.S. share — 27.9 percent of GDP in 2007 (the last pre-recession year) —is less than that in 28 of the 32 other members of the Organisation for Economic Co-operation and Development. It also is far less than the average share in the other wealthy industrialized nations in the G-7 — 36.7 percent.[16] By either standard, the United States has room to raise taxes as part of a balanced deficit-reduction plan.

Many who call for a budget cuts-only approach to deficit reduction argue that tax increases are the wrong prescription during a time of continued economic weakness. But this argument is a rhetorical straw man; advocates of a balanced approach to deficit reduction call for

delaying tax increases until the economy has strengthened. Indeed, it is for this very reason — to avoid creating any fiscal drag that would threaten the recovery — that the Administration has proposed to extend the current payroll tax cut.

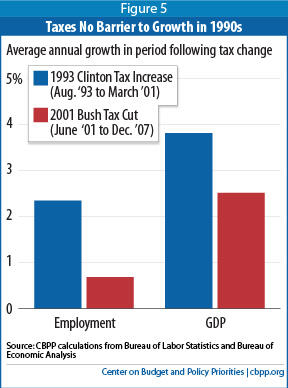

Some assert that raising taxes would damage the economy even under better economic conditions. Similarly, in the early 1990s, some predicted that tax increases on affluent taxpayers would result in a sharp economic slowdown. Instead, as Figure 5 shows, job creation and economic growth were significantly stronger in the recovery following the marginal income tax increases enacted in 1993 than they were following the 2001 tax cuts.

Other critics claim that allowing the high-end tax cuts to expire would kill job growth in the small business sector. This contention, too, is inconsistent with the evidence: a recent Treasury analysis finds that only 2.5 percent of small business owners are in the top two income-tax brackets. [17] Moreover, there is little evidence that tax rates strongly affect growth and job creation by small businesses. Small businesses generated jobs under the Clinton Administration at twice the rate as under the Bush Administration, when marginal tax rates were lower.[18]

In fact, CBO and others have long concluded that tax increases used to reduce budget deficits can

improve long-term economic growth and job creation. The evidence also shows that deficit-financed tax cuts

reduce long-term growth: CBO projects that, over the longer term, extending the 2001 and 2003 tax cuts without paying for them would

reduce economic growth and national income.

[19]Deficit reduction is critical to long-term growth, but reducing deficits too much or too fast in a weak economy is counterproductive. While some have claimed recently that deficit reduction can boost short-term economic growth if it is composed mainly of spending cuts rather than tax increases, [20] economists at the International Monetary Fund (IMF) and elsewhere have refuted those claims. "The idea that fiscal austerity triggers faster growth in the short term finds little support in the data," they concluded. [21] Similarly, the Congressional Research Service has reported that "Fiscal adjustments beginning in a slack economy (such as the current situation in the U.S.) appear to have a low probability of success." [22]

Advocates of a budget-cuts-only approach to deficit reduction argue that even if the approach is not expansionary in the short run, it is more likely to achieve lasting results than one that includes substantial revenues and would do less harm to the economy in the short term. But the international examples they cite in support of their claim have little in common with current U.S. economic and budget conditions. When successful, short and sharp fiscal contractions usually benefit from a rapid decline in interest rates, a moderation of wage growth, and an improvement in the trade balance. In contrast, U.S. interest rates are already very low, wages are growing more slowly than productivity, and it would be difficult for the United States to increase exports substantially when other developed countries are trying to do the same.[23]

Finally, the argument that spending cuts trump revenue increases in deficit reduction is undercut by the blurry line between the two sides of the budget. Most budget experts believe the array of targeted tax provisions known as "tax expenditures" should generally be viewed as a form of government spending. For example, the federal government subsidizes the rental costs of many low-income families through a spending program, but it provides much larger housing subsidies to high-income homeowners through the mortgage-interest deduction in the income tax code. Reform of tax expenditures could both improve economic efficiency and raise much-needed revenue.[24]