- Home

- Governors Are Proposing Further Deep Cut...

Governors are Proposing Further Deep Cuts in Services, Likely Harming Their Economies

Less-Harmful Alternatives Include Revenue Increases and Rainy Day Funds

All of the 48 states releasing initial budget proposals for fiscal year 2012 (which begins July 1 in most states) have done so, and for the fourth year in a row, these budgets propose deep cuts in education, health care, and other important public services — in many cases, deeper than previous cuts. [1] These cuts will delay the nation’s economic recovery and undermine efforts to create jobs.

While nearly every state has cut spending in the past few years, some additional cuts are inevitable for 2012: because of the lingering effects of the long and deep recession, tax collections in most states remain well below pre-recession levels and lag far behind the growing cost of maintaining existing services. But the cutbacks in services that many governors have proposed appear to be greater than necessary. Many of the governors proposing very deep cuts are failing to utilize other important tools in their budget-balancing toolkit, such as utilizing reserves or raising new revenue to replace some of the revenue lost to the recession. Some governors are even adding to the cutbacks needed by reducing corporate taxes or other taxes – an ineffective strategy for improving economic growth that likely will do more harm than good.

Increased federal aid, which played an important role in limiting the depth of cuts in services like education and health care in recent years, does not appear to be available this year. Congressional leaders have indicated that they are unwilling to extend the temporary funding for states first enacted in early 2009 and partially extended in 2010. That leaves states with fewer options, one of which is deeper spending cuts.

A total of 48 states have released initial budgets for the coming 2012 fiscal year. That is all the states that will release budgets this year. The two remaining states — Kentucky and Wyoming — operate on a two-year budget cycle that does not require the release of a full budget this year. A review of the initial budget proposals released in the 48 states shows that:

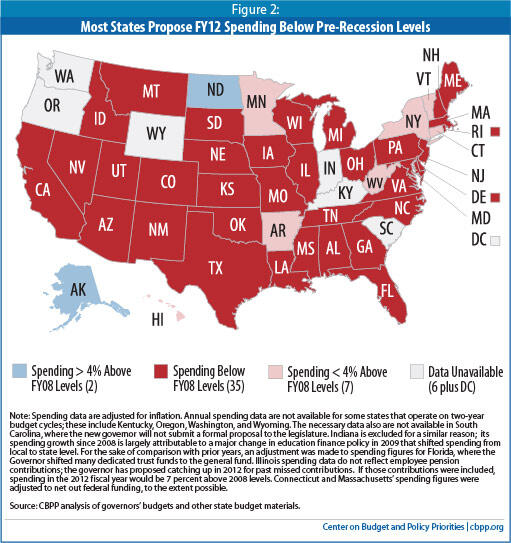

- Nearly all states are proposing to spend less money than they spent in 2008 (after inflation), even though the cost of providing services will be higher. Most state spending goes toward education and health care, and in the 2012 budget year, there will be more children in public schools, more students enrolled in public colleges and universities, and more Medicaid enrollees in 2012 than there were in 2008. But among 44 states which have released the necessary data, 35 states plan to spend less in 2012, after inflation, than they did in 2008, and only two — Alaska and North Dakota — expect to spend significantly more. Total proposed spending would be 9.4 percent below 2008 inflation-adjusted levels. [2]

- The majority of states — at least 39 of 48 — are proposing major cuts in core public services. [3]

- At least 21 states have proposed identifiable, deep cuts in pre-kindergarten and/or K-12 spending. The governor of Mississippi proposes education spending that fails for the fourth year in a row to meet statutory requirements enacted to ensure adequate funding in all school districts. (The three previous years of underfunding have cost over 2,000 school employees their jobs.) The Texas budget proposal would e liminate pre-K funding for nearly 100,000 mostly at-risk children — over 40 percent of the state’s pre-kindergarten students.

- At least 25 states have proposed identifiable, deep cuts in health care. In Arizona, the governor’s budget would eliminate health care for 100,000 poor individuals. Washington’s governor proposes eliminating affordable health care for more than 60,000 low-income residents. Wisconsin’s governor proposes canceling health insurance coverage for about 70,000 people. [4]

- At least 20 states have proposed major, identifiable cuts in higher education. Pennsylvania’s governor proposes to cut funding for the state’s system of higher education by more than 50 percent, resulting in less state funding for the higher education system than it received in 1983, the year in which the state established consolidated funding. Arizona would cut state support for public universities by one-fifth; when combined with previous cuts, this would reduce per-student state funding 46 percent below pre-recession levels. California’s governor proposes to reduce funding for the state’s two university systems by $1 billion. For one of those two systems, the University of California system, the cuts would bring nominal spending down to the fiscal year 1999 level — when the system had 31 percent fewer students than it does today.

- At least 15 states have proposed layoffs or identifiable cuts in pay and/or benefits for public workers.

- Seven governors are balancing deep spending cuts with significant revenue-raising measures. These measures include extending expiring tax surcharges, repealing tax credits or deductions, broadening the base of some taxes, and raising rates. For example:

- Connecticut’s governor proposes increasing income tax rates for many filers, expanding the sales tax base to include more services, increasing the sales tax rate, eliminating a property tax credit, and instituting a rule that would make it harder for corporations to avoid income taxes, among other revenue measures.

- California’s governor calls for extending previously enacted tax increases, including increases in income taxes, sales taxes, and vehicle license fees, in addition to major new spending reductions.

- Minnesota’s governor proposes a new top income tax bracket, an additional property tax charge for homes valued over $1 million, and the closing of some corporate income tax loopholes.

- At the same time, seven governors facing shortfalls are proposing large tax cuts, mostly for corporations; the loss of revenue from these tax cuts in 2012 means that those states would have to enact even deeper spending cuts to balance their budgets. For example:

- Florida’s governor proposes to cut the corporate income tax to 3 percent from 5.5 percent in the coming fiscal year -- costing the state an estimated $459 million in fiscal year 2012 -- and eliminate it by 2018. On the spending side, the governor proposes very large cuts in education, health care and other areas, as described below.

- New Jersey’s governor proposes a variety of tax cuts to begin in 2012, including reducing by 25 percent the corporate minimum tax paid by 93 percent of the state’s corporations and increasing to $1 million from $675,000 the amount that can be bequeathed to heirs tax-free. Taken together, these tax cuts will cost $200 million in fiscal year 2012; by 2016, the cost will have more than tripled to $700 million. At the same time, the governor has proposed substantial pay decreases for state employees, applied for a waiver from federal Medicaid rules that likely would reduce significantly the number of people with access to the program, and other state spending cuts.

- Eight states with budget shortfalls still have large reserves that they could use to reduce the need for deep spending cuts. In one of these states, Nebraska, the governor proposes (in addition to large spending cuts) to spend about 40 percent of the state’s remaining “rainy day” fund in fiscal year 2012 and an identical amount in fiscal year 2013, the second year of the state’s upcoming two-year budget cycle. By saving the state’s education system and human services from even deeper cuts, this prudent use of reserves will both support the economic recovery in the near-term, and help protect the state’s future economic potential. The other six states with large reserves and budget shortfalls could similarly help their economies by following Nebraska’s lead.

Cutting state services not only harms vulnerable residents but also slows the economy’s recovery from recession by reducing overall economic activity. When states cut spending, they lay off employees, cancel contracts with vendors, reduce payments to businesses and nonprofits that provide services, and cut benefit payments to individuals. All of these steps remove demand from the economy.

State and local governments have eliminated 450,000 jobs since August 2008, federal data show, and state budget cuts have cost additional jobs in the private sector. These job losses shrink the purchasing power of workers’ families, which in turn affects local businesses and slows recovery.

Moreover, many of the services being cut are important to states’ long-term economic strength. Research shows that in order to prosper, businesses require a well-educated, healthy workforce. Many of the state budget cuts described here will weaken that workforce in the future by diminishing the quality of elementary and high schools, making college less affordable, and reducing residents’ access to health care. In the long term, the savings from today’s cuts may cost states much more in diminished economic growth.

Why States Face Shortfalls Next Year

States are facing record shortfalls next year because the recession continues to hamper state tax collections, the cost of providing services is rising, and emergency federal aid will largely be depleted.

- Revenues remain depressed. The severe recession caused state revenues to decline sharply, and revenues will remain depressed next year, making it difficult for states to maintain public services. Of the 46 states that have released budget proposals with the necessary data, 39 project that they will have less state revenue in 2012 (after adjusting for inflation) than they did in fiscal year 2008, when the recession began. These states on average are projecting revenues next year that are 8.1 percent lower than before the recession, after adjusting for inflation. [5] While state revenues are starting to improve across the country, the rate of growth is generally slow.

- Costs are rising. The cost of meeting people’s needs has increased since the recession began, due both to demographic changes and to the recession. In the 2011-12 school year there are projected to be about 260,000 more public school students and another 960,000 more public college and university students than in 2007-08, for example.[6] Some 4 million more people are projected to receive subsidized health insurance through Medicaid in 2012 than were enrolled in 2008, as employers have cancelled their coverage and people have lost jobs and wages. [7]

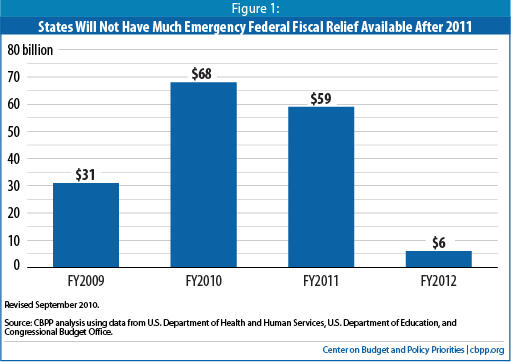

- Federal aid is ending. States have used emergency fiscal relief from the federal government to cover about one-third of their budget shortfalls through the current (2011) fiscal year. But only about $6 billion in fiscal relief will be left for fiscal year 2012, a year in which shortfalls will total at least $125 billion (see Figure 1). That is, the remaining fiscal relief will cover less than 5 percent of state budget shortfalls next year. Image

Not only is emergency federal aid ending, but federal policymakers are considering budget cuts that would significantly reduce the amount of ongoing federal funding to states. About one-third of the category of the federal budget known as “non-security discretionary” spending flows through state governments in the form of funding for education, health care, human services, law enforcement, infrastructure, and other areas. House leaders have proposed cutting that category of spending by $66 billion, or 14 percent below funding levels budgeted for the current federal fiscal year, which ends in September.[8] This would reduce federal support for services provided through state and local governments, forcing states to make still-deeper cuts in their budgets for next year.

States Will Close Their Shortfalls with Program Cuts, New Taxes, or Reserves

To meet their balanced budget requirements, states must close their budget shortfalls, as they have in the last three years and in previous recessions. The question for states is how to accomplish this while doing the least damage to the economy, vulnerable residents, and necessary public services. States’ main choices are to draw on reserves, raise taxes, cut spending, or use a combination of these approaches.

- Most governors are proposing major spending cuts. In the three years since the recession began, states already have imposed cuts in all major areas of state services, including health care, services to the elderly and disabled, and K-12 and higher education. [9]

At least 39 of the 48 states that have released initial 2012 budgets are proposing major cuts in services next year, on top of cuts already implemented in all those states since the recession began. In nearly four-fifths of the 44 states for which the necessary data are available, governors are proposing to spend less next year than their states spent before the recession hit, after adjusting for inflation (see Figure 1). On average, those 44 states plan to spend 9.4 percent less than their states spent before the recession, adjusted for inflation. (These cuts are detailed starting on p. 8 below.)

-

A few states still have large “rainy day” funds to draw on. States entered the recession with the highest reserves on record, including rainy day funds and other general fund balances. Over the last three years, most states have drained their rainy day funds in order to limit the recession’s damage. However, a handful of states retain substantial funds they could draw on next year. Specifically, eight states facing shortfalls for next year have rainy day funds that equal at least 5 percent of current year expenditures (see Table 1).TABLE 1:

Eight States with Shortfalls Next Year Have Large “Rainy Day” Funds AvailableState 2012 Shortfall as Percent of FY11 Budget 2011 Rainy Day Funds as a Percent of FY11 Budget Delaware 6.3% 5.6% Iowa 5.6% 8.2% Louisiana 22.0% 8.3% Nebraska 9.2% 9.5% South Carolina 17.4% 5.5% South Dakota 10.9% 9.2% Texas 31.5% 10.2%* Vermont 13.9% 5.0% Source: CBPP for shortfalls, NASBO for rainy day funds. Excludes Alaska, New Hampshire, North Dakota, West Virginia, and Wyoming which also have substantial reserves but do not project a shortfall for 2012.

* A bill to use over $3 billion of these reserves to help cover a shortfall in the current fiscal year budget is advancing through the Texas legislature and has the governor’s support. Once the bill is enacted, this figure will drop to 6.3 percent. This does not include the additional $1.2 billion expected to flow into the rainy day fund in the upcoming two-year budget cycle.

Only one of those eight states — Nebraska — has proposed using some of its rainy day funds to help close the state’s shortfall next year. [10] Nebraska has gradually drawn down these funds over the past few years; Governor Heineman proposes spending about 40 percent of the state’s remaining rainy day fund in fiscal year 2012 and an identical amount in fiscal year 2013, the second year of the two-year budget cycle. This would leave $62 million in the fund at the end of fiscal year 2013.

In contrast, Texas is facing a shortfall of $27 billion for the coming two-year budget period, yet the state’s initial budget proposal ignores $8.2 billion in reserves, instead imposing very deep cuts to preschools, K-12 schools, universities, health care, and other services, some of which are described below.[11]Image

- Some governors are proposing raising new revenues. Since the recession began, more than 30 states have enacted revenue measures — in some cases significant ones — to replace some of the revenue lost due to the recession. (All of those have also cut services, often sharply.) For next year, of the 48 states that have issued budget proposals, six states include significant new revenue measures as well as spending cuts, and a seventh — Illinois — enacted new revenue measures just prior to its governor’s budget release. Their revenue proposals include:

- Governor Brown in California calls for extending increases in the state’s income tax, sales tax, and vehicle license fees.

- Governor Malloy of Connecticut proposes to increase the number of income tax brackets, expand the base of the sales tax to include more services, increase the sales tax rate, eliminate a property tax credit, and institute a rule that would make it harder for corporations to avoid income taxes, among other revenue measures.

- Governor Abercrombie of Hawaii proposes eliminating an income tax deduction for state taxes paid, taxing sugary sodas, increasing the tax on alcohol, and taxing the pension income of some retirees.

- Minnesota Governor Dayton proposes a new top income tax bracket and an additional property tax charge for homes valued over $1 million. Dayton would also close corporate tax loopholes, and put in place health care surcharges that allow the state to capitalize on additional federal funding for health care.

- North Carolina Governor Perdue proposes extending three-quarters of a temporary 1 percentage point increase in the state sales tax. (She also proposes a major business tax cut; see below.)

- Rhode Island’s Governor Chafee proposes to tax many previously untaxed goods (excluding food, medicine, and gas) and to tax certain services, while lowering the regular sales tax rate to 6 percent from 7 percent. The proposal would raise $165 million in the coming fiscal year. [12]

In addition, Illinois’ Governor Quinn supported a recently enacted personal and corporate income tax increase to help address his state’s budget shortfalls for the current and upcoming year. The tax increase was enacted before Governor Quinn released his formal budget for next year.

All of these governors are also cutting services, some deeply. But by raising new revenue, their proposals reduce the spending cuts needed to close the shortfalls. This balanced approach limits the harmful impact of budget shortfalls on the economy.

- Some governors are proposing tax cuts, forcing even deeper cuts to services. For the first time since the recession caused state revenues to plummet, some governors are proposing large tax cuts – mostly cuts to taxes paid by corporations and other businesses – in a misguided attempt to spur economic activity. Seven governors in states facing budget shortfalls propose (or have already enacted) major tax cuts that would reduce revenues in the coming fiscal year. [13] (As described later in this paper, each of them also proposes major spending cuts.)

- Arizona’s Governor Brewer proposed a tax package that included reducing the corporate income tax rate to 5 percent from 6.98 percent and reducing commercial property taxes by 25 percent. The package was signed into law on February 17 and will cost the state $38 million in fiscal year 2012, or 4 percent of the state’s 2012 budget shortfall. By fiscal year 2018, the cost of the tax cuts will balloon to $538 million, half of which will result from the corporate tax rate cut.

- Florida’s Governor Scott proposes to cut the corporate income tax to 3 percent from 5.5 percent in the coming fiscal year – costing the state $459 million in fiscal year 2012 – and fully eliminating the tax by 2018. He also would reduce motor vehicle fees by $236 million. Together, these cuts equal 19 percent of the state’s projected 2012 shortfall. Scott would also significantly ratchet down Florida’s existing cap on local property taxes, without providing additional state aid to compensate local school districts for their revenue loss.

- Maine’s Governor LePage proposes eliminating in 2012 the state’s alternative minimum income tax. In 2013, he would also lower the top income tax rate, for income above about $50,000, to 7.95 percent from 8.5 percent. And in 2014 he would double from $1 million to $2 million the income exempted from the state’s estate tax. These cuts would cost the state $203 million in the coming two-year budget cycle and would widen the two-year budget gap by 25 percent.

- Michigan’s Governor Snyder would eliminate the state’s current major business tax, replacing it with a flat 6 percent corporate income tax. Snyder proposes to offset the revenue lost from reduced business taxes by increasing personal income taxes, for example by eliminating of the state’s Earned Income Tax Credit for low-income working families and taxing pension income. In the 2012 fiscal year, these personal income tax increases would not fully offset the business tax cuts, leaving Michigan with an additional $254 million hole to fill in 2012. In 2013 and after, the proposed tax increases would offset the cuts, but provide no additional revenue to help fill the state’s budget gap.

- New Jersey’s Governor Christie proposes a variety of tax cuts to begin in 2012, including reducing by 25 percent the corporate minimum tax paid by 93 percent of the state’s corporations and increasing to $1 million from $675,000 the amount that can be bequeathed to heirs tax-free. Taken together, his proposed tax cuts would add $200 million to the $10.5 billion budget gap for fiscal year 2012; by 2016, the cost will have more than tripled – to $700 million.

- In North Carolina, Governor Perdue proposes cutting the state’s corporate income tax rate to 4.9 percent from 6.9 percent, beginning in calendar year 2012. This tax cut for corporations would cost the state more than $400 million over the upcoming two-year budget cycle, and eat up 25 percent of the revenue protected by her proposed extension of the state’s current sales tax rate described above. The tax cut is equal to about 10 percent of the state’s projected two-year shortfall.

- In Wisconsin, Governor Walker proposes $82 million in new corporate tax cuts. For instance, he proposes allowing corporations to claim as a tax deduction a greater share of the losses they have incurred in past years. Together with other tax cuts enacted with the governor’s support earlier this year, the total revenue loss to the state is about $200 million over the next two year budget cycle, increasing the shortfall that the state will need to close. Walker proposes to cover $41 million of this shortfall by scaling back the state’s Earned Income Tax Credit for low-income working families. A single working parent with two kids and earnings of $25,000 would see his or her annual income tax bill more than double, from $193 to $394.

In addition, a governor from one of the few states not facing a shortfall for the coming fiscal year is also proposing a tax cut that would begin next year:

- North Dakota’s Governor Dalrymple’s proposes to reduce every tax bracket by .21 percentage points at a cost of $50 million for the coming two-year budget cycle. He also proposes to continue $100 million worth of income tax rate reductions from the previous biennium, and to lower property taxes by $400 million over the next four years by increasing the state’s share of K-12 education funding.

And one more governor has proposed tax cuts that would take effect starting in 2013:

- When he presented his budget for 2012 to state legislators, Idaho’s Governor Otter expressed his support for lowering individual and corporate income taxes over 10 years, beginning in 2013, until there is a flat tax rate for both individual and corporate taxes of 4.9 percent. Otter did not propose a strategy for offsetting the loss of revenue.

Because states must balance their budgets, these tax cuts must be offset by increases in other taxes or additional service cuts. At best, the economy will lose as much as it gains. In practice, cutting corporate taxes likely will reduce in-state economic activity. That’s because some of the corporations’ tax savings would likely go to their out-of-state shareholders in the form of higher dividends – good for the shareholders but of no value to the state that cut the taxes. Plus, if spending cuts reduce the quality of the state’s human capital and physical infrastructure – its schools, universities, transportation systems, and courts, for example – businesses will be less likely to invest in the state in the future.

Spending Cuts Would Weaken Schools, Reduce Access to Medical Care, and Cost Jobs

Since states spend more of their budgets on education and health care than anything else, governors imposing large spending cuts are hard-pressed to avoid cutting back on these basic public services. [14] Some governors also plan to lay off state employees or cut their pay. These actions, coming on top of deep cuts that states have already made over the last three years, would place a drag on the nation’s economic recovery.[15]

Elementary and Secondary Education

At least 21 states have proposed identifiable cuts in support for public schools. In many cases, these cuts undermine school finance systems that are intended to reduce disparities between high-wealth and low-wealth school districts, so the largest impacts may be felt in communities that are least able to compensate for the loss of funds from their own resources. (These cuts are in addition to education cuts already implemented in at least 34 states since the recession began.)

- Governor Bentley of Alabama proposes cutting the state’s K-12 Foundation Program (which provides the vast majority of state K-12 education funding) by 6.4 percent. The state’s Superintendent of Education has argued that meeting these funding levels would require the elimination of 1,251 teaching positions in Alabama schools and the imposition of two furlough days for remaining teachers.

- Colorado Governor Hickenlooper’s budget proposal would cut state spending on K-12 education by $497 per pupil.

- Florida ’s Governor Scott would impose a $700 per pupil, or 10 percent, reduction in state and local spending on K-12 education. This cut results from a small reduction in the state’s share of education funding, a large reduction in the property taxes local school districts are required to levy to receive state education aid, and the disappearance of most federal fiscal relief. [16]

- Governor Deal of Georgia proposes to cut state and lottery funds for pre-kindergarten by 5.6 percent. This would require eliminating 4,500 pre-K slots, reducing payments to providers by nearly $230 per child, or a mix of cutting slots and reducing payments. [17]

- Governor Branstad of Iowa eliminates the state’s voluntary preschool program, replacing it with a means-tested voucher program, and halves other state funds that help children access preschool. As a result, state support for preschool will decline by 41 percent.

- Kansas Governor Brownback proposes a $232 per-pupil cut in K-12 base student funding, bringing base funding nearly 6 percent below fiscal year 2011 levels.

- Louisiana Governor Jindal’s proposal would reduce funding for the state’s K-12 education finance program, which ensures adequate funding for at-risk and special needs students, by 2.4 percent, an $82 million cut.

- Michigan ’s Governor Snyder proposes a $470 per pupil cut to K-12 education spending.

- In Mississippi, Governor Barbour’s budget would fail — for the fourth year in a row — to meet the state’s statutory obligation to support K-12 schools, underfunding school districts by 11 percent or $231 million. The statutory school funding formula is designed to ensure adequate funding for lower-income and underperforming schools. According to the Mississippi Department of Education, the state’s failure to meet that requirement over the past three years has resulted in 2,060 school employee layoffs (704 teachers, 792 teacher assistants, 163 administrators, counselors, and librarians, and 401 bus drivers, custodians, and clerical personnel). [18]

- Governor Nixon of Missouri proposes freezing funding for K-12 education at 2011 levels. This would mean that for the second year in a row, the state has failed to meet the statutory funding formula established to ensure equitable distribution of state dollars to school districts.

- Nebraska’s Governor Heineman also proposes to freeze K-12 funding. Funding would fall $200 million short of the state’s statutory funding formula.

- Governor Sandoval of Nevada calls for reducing K-12 funding by $270 per student, cutting teacher pay by 5 percent, and freezing merit and longevity pay for teachers (and other public employees).

- Governor Martinez of New Mexico proposes reducing K-12 funding by $30 million (1.5 percent) and sparing “classroom spending” from cuts, which would mean greater proportional cut to other areas of K-12 education, like school libraries and guidance counseling. She also proposes a 20 percent cut in the general fund operating budget of the Public Education Department.

- New York ’s Governor Cuomo proposes a $1.5 billion, or 7.3 percent, cut to state education aid. This cut would delay, for the third year in a row, implementation of a court order to provide additional education funding to under-resourced school districts. It would also come on top of a substantial education aid reduction in the current fiscal year.

- North Carolina ’s Governor Perdue proposes a 5 percent cut in state spending on pre-kindergarten for at-risk four-year-olds and a 5 percent cut to the state’s early childhood development network that works to improve the quality of early learning and child outcomes. Her budget would also shift responsibility for future school bus replacements to local governments and eliminate high school dropout prevention grants to local school agencies and organizations.

- Governor Kasich of Ohio proposes to cut funding for K-12 education by 10 percent, a cut of $489 per student and equivalent to more than 16,500 full-time teachers’ salaries.

- Governor Corbett in Pennsylvania proposes to cut K-12 education aid by $550 million, or 10 percent, reducing funding to the lowest level since fiscal year 2009. The budget also cuts over $500 million in additional funding that the state provides to school districts to implement effective educational practices (such as high quality pre-kindergarten programs), train teachers, and maintain tutoring programs, among other purposes.

- South Dakota Governor Daugaard is calling for a 10 percent cut in K-12 funding. The cut is so large that the state’s largest school district says it would be unable to satisfy it even if it were to eliminate all school buses and remove all athletic and fine arts programs. [19]

- Texas’s initial budget, produced by state’s Legislative Budget Board (the Governor is not required to produce an initial budget in Texas), would e liminate funding for pre-K programs that serve almost 100,000 mostly at-risk children — over 40 percent of the state’s pre-kindergarten students. The budget also would reduce K-12 funding to 23 percent below the minimum amount required by the state’s education finance law. Texas already has below-average K-12 education funding compared to other states, and this cut would depress that low level even further at a time when the state’s school enrollment is growing. This would likely force school districts to lay off large numbers of teachers, increase class sizes, eliminate sports programs and other extracurricular activities, and take other measures that undermine the quality of education.

- Washington’s Governor Gregoire would take nearly $1 billion from education funds designed to reduce class size, extend learning time, and provide professional development for teachers. Gregoire also would eliminate early education for 1,300 three-year-olds.

- Wisconsin ’s Governor Walker proposes to reduce state aid designed to equalize funding across school districts by $749 million over the coming two-year budget cycle, a cut of 8 percent.

Higher Education

At least 20 states have proposed large, identifiable cuts in support for state colleges and universities with direct impacts on students. (These cuts are in addition to higher education cuts already implemented in at least 43 states since the recession began.)

- Governor Brewer of Arizona proposes cutting funding for public universities by one-fifth, or $170 million. This would add to deep previous cuts: from 2008 through 2011, state support for universities fell by $230 million, resulting in the elimination of more than 2,100 positions (an 11 percent reduction in the workforce). Universities have raised tuition significantly, closed eight extended campuses, and merged, consolidated, or disestablished 182 colleges, schools, programs, and departments. Combined with those previous cuts, Brewer’s proposal would bring per-student state funding down to 46 percent below pre-recession levels. [20]

Governor Brewer also proposes to cut community college funding for operating expenses by about $73 million. The cut amounts to 6.2 percent of total community college operating revenues and half of all state support for community colleges. - California’s Governor Brown proposes significant cuts to higher education. He would increase fees at community colleges by 38 percent; for the average student, this would mean an annual fee increase of $300. He also proposes to reduce funding for the University of California (UC) and the California State University (CSU) systems by $1 billion ($500 million each). Both the UC and CSI systems already have been cut deeply since the recession struck; the governor’s proposal would reduce UC funding to levels last seen in the 1998-1999 fiscal year, when the system had 73,600 (31 percent) fewer students than it does today, and would reduce CSU funding to levels last seen in the 1999-2000 fiscal year, when the system had almost 70,000 (16 percent) fewer students than it does today.

- Governor Hickenlooper of Colorado would cut state university spending by $878 per student over the prior year, which will result in tuition and fees increases.

- Georgia Governor Deal’s budget would cut funding for a popular merit-based college scholarship program by about one-third, cut university funding by 10 percent, and cut funding for technical colleges by 6 percent.

- Governor Branstad of Iowa proposes state support for public universities that is 6 percent below FY11 levels, which the state Board of Regents say may result in higher tuition, larger classes, and more teaching assistants and adjunct faculty teaching undergraduate courses.

- Michigan Governor Snyder’s budget would cut by 15 percent state support for public universities, only partially offsetting this cut with an incentive fund to keep tuition increases below a 5-year system-wide average.

- Minnesota Governor Dayton proposes reducing by one-third state support for the state’s work-study program. Approximately 2,600 fewer students would have a work study opportunity in as a result of the cut. Dayton’s budget also would phase out state funding for a college savings program that helps low-income families save for college expenses. About 2,500 families will no longer receive a state match on their savings.

- Missouri Governor Nixon proposes cutting state support for higher education by 7 percent, which has led the state’s university system to propose tuition hikes for next school year ranging from 4.7 percent to 6.6 percent. The proposed cuts would continue a trend of declining state support for Missouri’s universities; over the last decade, state support has fallen 28 percent.

- Nevada Governor Sandoval would reduce the state funding for higher education by 18 percent and give the Board of Regents full discretion over raising tuition to make up for the loss in funds.

- Governor Lynch of New Hampshire would cut state funding for public universities by 23 percent, or about $750 per student. The governor also proposes a 21 percent cut in state funding for community colleges, a reduction of roughly $400 per student.

- New Mexico ’s Governor Martinez proposes a 5 percent cut in funding for public universities.

- Governor Cuomo of New York proposes cutting state support for the State University of New York (SUNY) system by 9.1 percent and reducing state support for the City University of New York (CUNY) system by 5.2 percent. These reductions would come on top of substantial cuts in previous years, which have resulted in (among other consequences) a 14 percent SUNY tuition increase.

- North Carolina Governor Perdue proposes University of North Carolina campus operating budgets by 9.5 percent and asks campuses to meet this reduction by reducing the number of senior and middle management positions, eliminating low-performing or redundant programs, faculty workload adjustments, among other things. She estimates that the cut might reduce the number of University positions by 1,900. Her proposal would allow for tuition increases to restore funding equivalent to 450 positions.

Perdue also proposes to cut financial aid to students attending private colleges by 6.5 percent and raises tuition rates for community college students enrolled in curriculum courses. The increase will mean $176 more per year for full-time students, bringing resident students' tuition to $1,984 annually. - Ohio’s Governor Kasich would decrease funding of higher education by 11 percent, a cut of $510 per student.

- Governor Kitzhaber of Oregon proposes cutting state funding for community colleges per full-time student by 11 percent, to $1,559 from $1,744. The governor also proposes cutting state support for the Oregon University System by 4.9 percent from FY 2009-2011 levels, and recommends giving university graduate and professional programs more flexibility in raising tuition.

- Governor Corbett in Pennsylvania proposes to cut funding for the state’s system of higher education by $271 million or more than 50 percent, resulting in the lowest level of state funding for public colleges and universities since the state established consolidated funding in 1983. He also proposes to cut funding for the state’s four “state related” universities (Penn State, the University of Pittsburgh, Temple, and Lincoln University) by over 50 percent and to reduce funding for the state’s community colleges by 10 percent. The University of Pittsburgh’s chancellor has warned that the governor’s proposed funding cut would lead to large tuition increases. Penn State’s president has said that the cut would lead to both tuition increases and significant program cuts, including potential layoffs.

- Tennessee ’s Governor Haslam proposes to cut state spending for higher education by 2 percent. In November 2010, when a smaller cut of 1.2 percent was expected, the Tennessee Higher Education Commission recommended minimum tuition increases of 7 percent at universities and 5 percent at community colleges. This continues a trend over the last several years of increasing tuition as state support declines. Assuming a 7 percent tuition increase for universities next year, tuition and mandatory fees at the University of Tennessee–Knoxville will be 48 percent higher than in the 2005-06 school year.

- Texas’s budget would cut public college and university funding by 16 percent, likely forcing tuition increases, reductions in course offerings, and layoffs. The budget would also cancel funding for four community colleges, and it would eliminate financial aid awards for new students under the Texas Grant program, which combines state and institutional money to cover tuition and fees at public schools for 87,000 students with financial need and good academic records.

- Washington ’s Governor Gregoire proposes cutting state funding for colleges and universities by $345 million and allowing them to make up for most of this loss through tuition increases. She also proposes reducing by 2,800 the number of students receiving state work-study funds.

- Wisconsin ’s Governor Walker proposes reducing funding for state universities by $250 million and provides for tuition increases. The cuts would require a 25 percent reduction in funding for administering the university system, as well as other cuts for university operations.

Health Care

At least 25 states have proposed deep, identifiable cuts in health care that will reduce access to care for low-income children, seniors, families and people with disabilities. (These cuts are in addition to health cuts already implemented in 31 states since the recession began.)

- Governor Brewer of Arizona original budget proposal eliminated Medicaid coverage for 280,000 people, more than 4 percent of the state’s population. The cut would have resulted in the loss of $1.1 billion in federal matching funds next fiscal year. With newly received permission from the U.S. Department of Health and Human Services to reduce Medicaid enrollment, Governor Brewer has proposed grandfathering coverage for currently enrolled adults without dependent children (approximately 100,000 people), but eliminating the program for future enrollees. The governor’s new proposal mandates that childless adults and parents re-qualify for coverage every six months (rather than annually) and continues to call for a 5 percent cut in Medicaid provider rates that would take effect in April 2011.

- California’s Governor Brown proposes reducing funding for the Medi-Cal (Medicaid) program by $1.7 billion through a range of cuts. His budget would limit the use of Medicaid services by setting an annual dollar limit on the amount the state will pay for certain services (for example, limiting access to hearing aids and durable medical equipment, limiting prescriptions (except for life-saving drugs) to six per year, and limiting doctor visits to ten per year). The governor also would eliminate a program that helps elderly residents at risk of being placed in a nursing home remain in their communities, and would cut long-term care provider payments by 10 percent.

Brown also proposes scaling back the state's Healthy Families (CHIP) program by eliminating vision benefits, increasing premiums for families with incomes between 150 and 250 percent of poverty, and increasing co-payments, among other cuts. - Colorado Governor Hickenlooper’s budget cuts more than $13 million from state Medicaid services, largely by reducing payments to medical care providers.

- Governor Malloy of Connecticut cuts Medicaid expenses, in part by limiting adult dental exams, cleanings and x-rays to once per year for healthy adults.

- Georgia ’s Governor Deal proposes cuts to several areas of Medicaid and children's health, including eliminating funding for adult vision, dental, and podiatry services; reducing provider reimbursements to physicians, dentists and pharmacies by 1 percent; and increasing and expanding co-pays. Adult co-pays would increase by about 15 percent for outpatient services and more than 400 percent for inpatient hospital services, while many children’s services would be subject to co-pays for the first time.

- Governor Abercrombie of Hawaii proposes cutting $25 million in state funding for Medicaid in FY12 and $50 million in FY13.

- Idaho Governor Otter, according to news reports, seeks $25 million in unspecified cuts to Medicaid. [21]

- Governor Quinn of Illinois would cut Medicaid payment rates for hospitals and nursing homes by 6 percent, which the state’s association for nursing homes says would lead to significant job cuts in their facilities. [22]

- Kansas ’ Governor Brownback proposes eliminating state support for community mental health centers, which provide 24-hour emergency care for 70,000 uninsured and underinsured Kansans experiencing mental health crises. The governor also would eliminate funding for mental health services for 850 families of children with severe emotional disturbances.

- Governor Jindal of Louisiana proposes to reduce by nearly one-fifth state support for the Louisiana State University Hospitals, which provide the majority of care to the state’s uninsured as well as residency and educational opportunities for health professionals in training.

- Maine ’s Governor LePage would reduce the income limit for accessing the state’s subsidized health insurance plan, MaineCare. The proposal would mean that about 14,000 people currently enrolled in MaineCare would not be able to return to the program if they left it, and many others would no longer have access to the program in the future.

- Massachusetts’ Governor Patrick proposes a 3 percent cut to mental health services, including a $16.4 million cut in funding for facilities. This cut would result in the elimination of 160 beds for mental health patients, a reduction of almost 25 percent.

- Mississippi’s Governor Barbour would cut $100 million from Medicaid by slashing provider rates, except those of physicians. Barbour’s budget reduces hospital provider rates by 8 percent and nursing home rates by 4 percent, rolling rates back to FY2010 nominal levels. His budget also cuts funding for mental health by 7 percent, emphasizing the need to move toward home- and community-based care and away from institutional care but without dedicating resources for that purpose. The cut could result in closure of some of the state's mental health facilities.

- Governor Heineman of Nebraska would cut Medicaid provider rates by 5 percent next year, require Medicaid recipients to pay more in co-payments, and bar welfare recipients who do not meet certain work requirements from receiving Medicaid.

- Nevada Governor Brian Sandoval proposes to cut rates for nearly 7,500 providers by between 15 percent and 43 percent, depending on the provider, for a total reduction in funds of $58 million for the coming two-year budget cycle.

- New Jersey ’s Governor Christie would apply to the federal government for a “global waiver” to allow the state to restructure its Medicaid program. The Governor says the restructuring would save New Jersey $300 million in the coming fiscal year. To achieve savings of that magnitude, the waiver likely would significantly reduce services and access to medical care for low-income people.

- New York Governor Cuomo proposes reducing overall Medicaid spending by $982 million, or 1.8 percent. Cuomo’s proposal does not specify how this reduction would be achieved. However, the state has already substantially reduced reimbursement rates for providers of Medicaid services in response to previous cuts. At a time of rising Medicaid enrollment, a cut of this magnitude would be very difficult to implement without reducing access to health services for Medicaid beneficiaries. Cuomo has appointed a “Medicaid Redesign Team” to identify the measures necessary to accomplish the desired level of savings.

- Governor Kasich of Ohio proposes cutting the rates medical care providers receive for a wide range of Medicaid services, including mental health services, outpatient treatment, in-home care, and managed care programs. Combined, these constitute more than $700 million in cuts over the biennium. Other reimbursement reforms bring this figure to well over $1 billion. Kasich also would limit the number of hours of mental health care that patients can receive, reducing services by $135 million over two years.

- Oklahoma 's Governor Fallin proposes cuts to state health care programs that likely will lead to the elimination or sharp reduction of child abuse prevention services that protect about 2,000 children, as well as payment cuts for Medicaid providers and reductions in the medical services covered by Medicaid.[23]

- As part of a major overhaul of the state’s public health care system, Governor Kitzhaber of Oregon proposes to cut payments to Medicaid providers by 16 to 19 percent.

- South Dakota’s Governor Daugaard proposes a 10 percent cut in Medicaid provider rates, which may cause some doctors to stop taking new patients or to drop existing patients.

- Tennessee ’s Governor Haslam proposes to cut Medicaid spending by 2.1 percent, in part by reducing payment rates for some medical care (including cesarean births) and by limiting or barring access to certain medicines, including some hemophilia drugs, detoxification medicines, acne medicine, and some sedatives.

- Texas’ initial budget proposal would cut Medicaid provider rates by 10 percent, making it more difficult for Texas doctors to accept Medicaid patients because of the state’s low reimbursement levels relative to other states, further restricting low-income Texans’ access to health care.

- Washington Governor Gregoire’s budget proposes deep cuts to health and disability services, eliminating the state's Basic Health Plan for more than 60,000 people; eliminating a cash assistance program for most of the 28,000 poor individuals with disabilities currently receiving that assistance; eliminating medical assistance for 21,000 poor individuals with disabilities; eliminating a state food assistance program; eliminating a health program for 27,000 undocumented children; and reducing in-home personal care hours for 45,000 individuals needing personal care assistance.

- Wisconsin ’s Governor Walker proposes to eliminate Medicaid coverage for about 70,000 people, beginning in July of 2012 (and to seek federal approval for even deeper cuts).

Other Services

- Governor Brown in California proposes cutting the CalWorks (TANF) Program by $1.5 billion. He would reduce the lifetime limit on the number of months that a needy family can receive cash benefits from 60 to 48 months. He also proposes a reduction in the size of Cal-Works grants; for instance, his proposal would reduce the maximum monthly Cal-Works grant for a family of three from $694 to $604, a 13 percent cut.

Brown also proposes cutting $750 million from child care programs, in part by reducing subsidies by 35 percent and requiring recipients to have incomes less than 60 percent of the state's median income (down from 75 percent of the median income today). The Governor’s proposal would reduce the number of subsidized childcare slots by about 9,900, or 3 percent. - Delaware’s Governor Markell eliminates a General Assistance program that provides cash assistance to people in deep poverty and who are often homeless.

- Governor Deal in Georgia proposes funding subsidized child care at a level that would reduce the monthly number of children served by as many as 10,000 and create a waiting list of up to 4,000 children.

- Governor Jindal of Louisiana would reduce by 30 percent state support for child and family services. Jindal does not specify the services he proposes to cut, but a 30 percent cut to these services will hurt some of the state’s most vulnerable families. For example, cutting by 30 percent the number of low-income children whose parents receive child care subsidies would eliminate support for the families of more than 10,000 children.

- Maine ’s Governor LePage would eliminate access to state-funded temporary cash assistance and healthcare for legal immigrants in the country less than five years, cutting about 2,500 people from these supports.

- Governor Patrick in Massachusetts proposes a $65 million, or 7 percent cut to non-education aid for local governments, reducing localities’ ability to pay for law enforcement, roads, and other services.

- Governor Snyder of Michigan proposes reducing the lifetime limit on cash assistance for poor families to 48 months from 60 months and to eliminate before- and after-school programs.

- Nebraska’s Governor Heineman proposes eliminating a state-funded program that provides food assistance to up to 500 low-income legal residents each year who are ineligible for federal food aid because they are not citizens and have not been in the country more than five years.

- Nevada Governor Brian Sandoval proposes shifting the full cost of several joint state-county programs to the counties. He would also eliminate state funding for elder protective services, youth parole services, and a program providing treatment for individuals with mental illness facing minor criminal charges, among others. Counties will either need to find roughly $100 million in additional revenue to cover the decline in state funding over the upcoming two-year budget period, or scale back or eliminate impacted programs.

- New Mexico’s Governor Martinez proposes a range of additional cuts, including a 33 percent cut in funding for the agency handling information technology, a 21 percent cut to funding for the Public Regulatory Commission, and a 21 percent cut to the Department of the Environment.

- Governor Cuomo of New York proposes pushing additional responsibility for funding local services to local governments by cutting local aid for municipalities outside of New York City by two percent (the state currently provides no municipal aid to New York City). At the same time, the governor is proposing placing strict limits on the ability of municipalities and school districts (other than New York City) to raise revenues through local property taxes. The combination of these two factors will likely lead to an erosion in the ability of local governments to provide key services like police and fire protection and road maintenance.

- Governor Perdue of North Carolina recommends reducing the financial eligibility for independent living services for people with disabilities to 100 percent to from 125 percent of the poverty line.

- Governor Kasich of Ohio would cut aid to local governments and libraries by more than $1 billion over the coming two-year budget cycle. He also would reduce the income limit for working parents to be eligible for help paying for child care, to 125 percent of the poverty line from 150 percent. That means that a working mother with one child and income over about $18,400 would not be eligible. Kasich would also cut by 7 percent payment rates for businesses that provide child care to low-income families and deeply cut funding for public defenders and a number of other state services.

- Oklahoma ’s Governor Fallin proposes a three percent cut in state funding for correctional facilities that likely will lead to additional furloughs for correctional workers (beyond the one furlough day per month already in place). With staffing already at its lowest level since 1995, when the state’s corrections system housed 8,000 fewer criminals, additional furloughs would worsen already dangerous conditions in the state’s prisons.

- Wisconsin ’s Governor Walker proposes to cut funding for the state’s child care program by charging working families more for child care, reducing the income limit for accessing financial assistance for child care, and cutting the amount that some child care providers are reimbursed. He would also eliminate a state-funded program providing food assistance to legal immigrants in the country less than five years and reduce the temporary cash assistance that low-income mothers with children can receive when they are between jobs.

Job and Pay Cuts for Public Employees

At least 15 states have proposed layoffs or specific cuts in pay and/or benefits for state workers. (These cuts are in addition to workforce cuts already implemented in 44 states since the recession began. Since August 2008, state and local governments have eliminated more than 400,000 jobs.)

- Colorado Governor Hickenlooper’s budget would raise the state employee salary contribution by 4.5 percent.

- Connecticut Governor Malloy’s budget relies upon $2 billion in personnel related savings over the biennium to be negotiated with the state’s public employee unions. The governor puts forth a number of ideas for achieving those savings including freezing state employee wages, moving state employees to a health plan similar to that provided to federal workers, extending 3 day a year furloughs until the end of the biennium, and raising the retirement age. Malloy warns that failure to reach agreement on how to achieve these savings would result in the dismissal of thousands of state workers, and significant additional program cuts.

- Florida ’s Governor Scott would reduce the state workforce by 8 percent, requiring around 8,100 layoffs and the elimination of about 2,000 vacant positions. Scott would also require $5,000 health insurance premium contributions from state employees.

- Georgia’s Governor Deal proposes to eliminate about 14,000 state government positions, most of which are currently vacant, requiring about 200 layoffs.

- Public employees in Idaho would receive no raises next year, under Governor Otter’s proposed budget.

- Governor Jindal of Louisiana proposes eliminating more than 4,100 positions, nearly half of which are currently filled. He also would extend a suspension of merit-based salary increases for state employees for one additional year and increase the amount certain state workers contribute to the state retirement system.

- Nebraska’s Governor Heineman offers no pay raises for state employees in FY2012. For some state employees this will be the second year in the row with no pay raise.

- In Nevada, Governor Sandoval proposes a 5 percent salary reduction for executive branch public employees, including K-12 and university teachers and staff. He also orders a salary freeze for state employees scheduled for increases.

- Governor Lynch of New Hampshire proposes to eliminate 1,100 positions in state government, requiring 255 layoffs. The governor also would eliminate state contributions to public employee retirement accounts, leaving local governments to either pick up another $50 million in retirement contributions, or cut benefits for public workers.

- Governor Christie of New Jersey would increase the amount some public employees contribute to their retirement; for a portion of these employees, the increase would more than double the required contribution. He also would eliminate cost of living increases for current and future retirees, calculate pension benefits over more years of income, raise the normal age of retirement to 65 from 60, and rescind a 9 percent benefit increase enacted in 2001. The Governor also would change the way public employees contribute towards their health insurance, requiring that they pay 30 percent of the cost of their health policy instead of making a 1.5 percent salary contribution. (The average state health insurance policy costs about $14,000, which means the average public worker would pay $4,200 instead of 1.5 percent of her or his salary.)

- New Mexico’s Governor Martinez’ budget would require K-12 instructors to contribute 1.5 percent of their salaries to their retirement; for all other public employees the contribution would be 3.5 percent of their salaries. Last year, the 1.5 percent salary contribution was imposed upon public employees as a one-time measure. The Governor’s budget would extend the contribution for teachers and more than double it for all other employees.

- Governor Chafee of Rhode Island would require many state employees to pay 11.75 percent of their paycheck for their pensions. Currently, state employees pay 8.75 percent and teachers pay 9.5 percent. Chafee also wants to cut salary costs by an additional 3 percent, in part by negotiating further salary and benefit concessions from workers.

- South Carolina’s former Governor Sanford, who issued a budget for next year before leaving office, proposed a 5 percent salary reduction for all state employees with annual salaries over $35,000, and would require all state employees to choose two holidays without pay. It is unclear whether current Governor Haley will support these cuts.

- According to news accounts, the state’s leading expert on school finance in Texas has estimated that the initial budget’s proposed cuts in state support for public education could force school districts to lay off as many as 100,000 teachers and other education workers. [24] Other cuts in the plan would eliminate almost 10,000 state jobs, such as prison guards and child protective service investigators.

- Wisconsin Governor Walker has proposed sweeping changes to state employee policies and pay. In a current year budget bill, Walker proposes to strip many workers of their collective bargaining rights. Many other workers would have their rights seriously restricted. His bill also would require state workers to make a 6 percent salary contribution to their pensions and to pay nearly 13 percent of the average health premium costs, effectively cutting their pay. Walker’s budget proposal for the upcoming budget cycle extends these compensation cuts over the next two years. He would also freeze state employee salaries for the next two years, and cut over 3,000 positions.

Although governors’ budgets often do not delineate which public employees will lose their jobs, most state and local government workers fall into one of the following categories: schoolteachers and other school employees, university workers, police officers, firefighters, corrections workers, highway and transit workers, public hospital employees, public health workers, public utility employees, and parks and environmental workers.

End Notes

[1] For the most part, these are governors’ proposals, but in one state — Texas — it is a legislative proposal. While the importance of governors’ budgets varies by state, in general these budgets set the baseline from which state legislative debate begins. Over the next few months, state legislatures will debate and enact final state budgets for the FY2011-12 fiscal year.

[2] This figure refers to spending proposed in states’ operating budgets--typically referred to as general fund spending. While there is some variation by state, general fund spending is usually funded with general revenues collected by the state, such as income and sales taxes. Massachusetts is a clear exception: there, the operating budget, includes federal funds and spending of non-general state funds. For the sake of comparison with other states in this paper, we have netted out federal funds from Massachusetts’s spending figures. Also, to be consistent with previous years, California’s general fund spending total for FY2012 includes $5.9 billion associated with the continuation of the state’s 6 percent sales tax rate and 1.5 percent vehicle license fee rate.

[3] Many of the cuts that have already been implemented are described in a separate Center on Budget and Policy Priorities publication, “An Update on State Budget Cuts,” at https://www.cbpp.org/cms/index.cfm?fa=view&id=1214. It is not always possible to identify specific cuts in a governor’s budget proposal, largely because many states do not provide enough information in budget documents to determine whether a cut is being imposed or not. For example, many states do not indicate what the cost would be to maintain the same level of services as the previous year, so it may not be possible to say whether the proposed appropriation is enough to maintain services or whether instead it will require that cuts be made.

[4] The Wisconsin proposal is part of a “budget repair” bill focusing on the current year, and is reiterated in the governor’s budget proposal for next year. These cuts would take place starting in July 2012.

[5] This figure refers to revenues projected to be available for states’ operating budgets -- typically referred to as general fund revenues. While there is some variation by state, general fund revenues are typically revenues collected by the state, such as income and sales taxes. As with the spending figures in this paper, there are a couple of exceptions. In Connecticut and Massachusetts, operating revenues include federal funds and non-general state revenue. For the sake of comparison with other states in this paper, we have netted out federal funds from Massachusetts’s revenue figures and all identifiable federal funds from Connecticut’s revenue figures. Also, to be consistent with previous years, the figure we use here for California’s general fund revenue total for FY2012 includes $5.9 billion associated with the continuation of the state’s 6 percent sales tax rate and 1.5 percent vehicle license fee rate, as the governor has proposed.

[6] U.S. Department of Education, Condition of Education 2010, tables A-2-1 and A-7-1.

[7] CBPP calculations based on data from the Kaiser Commission on Medicaid and the Uninsured and the Congressional Budget Office.

[8] The Senate rejected this proposal on March 9, 2011. James R. Horney, “House GOP Proposal Means Fewer Children in Head Start, Less Help for Students to Attend College, Less Job Training, and Less Funding for Clean Water” Center on Budget and Policy Priorities, updated March 1, 2011, at https://www.cbpp.org/cms/index.cfm?fa=view&id=3405.

[9] Center on Budget and Policy Priorities, “An Update on State Budget Cuts,” at https://www.cbpp.org/cms/index.cfm?fa=view&id=1214.

[10] West Virginia’s governor proposes to use some of the state’s reserves to ensure that the state’s unemployment insurance trust fund remains solvent.

[11] A bill to use over $3 billion of these reserves to help cover a shortfall in the current fiscal year budget is advancing through the Texas legislature and has the support of Governor Rick Perry. The governor has stated forcefully his opposition to using any of the remaining reserves to help close the state’s large shortfall for the coming two-year budget cycle.

[12] Chafee also proposes numerous changes to the state’s corporate income tax, including closing loopholes by requiring companies to include subsidiaries on a single, “combined” return, requiring limited liability companies to pay the minimum corporate income tax, lowering the corporate income tax rate to 7.5 percent from 9 percent over three years, and lowering the minimum corporate income tax. On net, these changes to the corporate income tax are approximately revenue-neutral in the coming fiscal year.

[13] A seventh, Governor Branstad in Iowa, also proposes large tax cuts and large cuts in public services. Under his proposal, however, the tax cuts would be equaled (at least in the short run) by increased casino taxes, according to official revenue estimates. On net, then, it appears his tax changes would neither help solve, nor worsen, the state’s budget shortfall.

[14] Unless otherwise indicated, the cuts listed in this section are relative to nominal spending in the current budget cycle (in most states, the 2011 fiscal year). They are based on CBPP review of state budget documents and, where indicated, analyses by other organizations or news stories.

[15] In some states, legislatures will also need to close new shortfalls that have opened up in the current fiscal year (generally ending June 30), because revenues have continued to sag below expectations. Because governors often lump these current shortfalls in with shortfalls their states face in the next fiscal year, some of the service cuts described in this paper (most notably those in California) may be imposed in the current fiscal year.

[16] Some of the Governor’s cut to schools would be offset by the state’s remaining amount of emergency federal fiscal relief provided by Congress last August’s Education Jobs Fund. Governor Scott claims that his cut to education only amounts to $300 per pupil (4.3 percent) after taking into account the use of the remaining emergency federal fiscal relief and the money school districts would save from a proposed requirement that school district employees contribute to their own pensions.

[17] Cedric D. Johnson, “Governor’s FY 2012 Education Budget Proposals: The Cuts Continue,” Georgia Budget and Policy Institute, http://gbpi.org/documents/FY12%20Education%20Budget%20Overview_%20FINAL.pdf .

[18] Job loss figures from oral testimony given by the state superintendent to the Joint Budget Legislative Committee at a public hearing on September 21, 2010 and communicated to the Center on Budget and Policy Priorities by the Mississippi Economic Policy Center.

[19] Letter to teachers from Sioux Falls Schools Superintendent Pam Homan, January 21, 2011, http://www.sf.k12.sd.us/SFSchoolDistrict/community.aspx?sfsd=WebPointID%3d7%26NewsStoryID%3d328%26__TimeStamp__%3d12/31/9999+11:59:59+PM

[20] Arizona Board of Regents, “ABOR Responds to Governor’s FY12 Budget Recommendations,” January 14, 2011, https://azregents.asu.edu/palac/newsreleases/ABOR%20Responds%20to%20Governor's%20FY12%20Budget%20Recommendations.pdf .

[21] For example, see “No school cuts, $25 million reduction in Medicaid part of Otter's state of the state proposal,” Idaho Press-Tribune, at http://www.idahopress.com/news/article_b76600f0-1ced-11e0-8528-001cc4c002e0.html.

[22] Mike Riopell, “Suburban Hospitals Could Take Hit in Proposed State Budget,” Daily Herald, February 17, 2011.

[23] The 2,000 child figure is cited by the Oklahoma Institute for Child Advocacy, and in a number of local press reports.

[24] Patricia Kilday Hart, “Selling School Finance Cuts,” Burka Blog, Texas Monthly, at http://www.texasmonthly.com/blogs/burkablog/?p=8964.

More from the Authors

Areas of Expertise

Areas of Expertise