- Home

- Why And How States Should Strengthen The...

Why and How States Should Strengthen Their Rainy Day Funds

Recession Highlighted Importance of Funds and Need for Improvements

Summary

The roller-coaster economy of the last decade has highlighted the importance of state “rainy day funds” — budget reserves designed to respond to unexpected revenue declines or spending increases caused by recessions or other events. Between 2001 and 2004 and again starting in 2007, states struggled to close large deficits, and the first place many of them turned was their rainy day funds and other budget reserves. In the aftermath of the recent recession, over 70 percent of states reported using their rainy day funds to address budget gaps, according to surveys by the National Association of State Budget Officers. These budgetary “cushions” reduced the need for large, immediate spending cuts or tax increases, giving many states time to consider ways to maintain needed services despite depressed revenues.

But the downturns also revealed serious flaws in the design of many states’ rainy day funds. Some states have acted quickly to address these flaws. Last fall, five states considered ballot initiatives to improve their rainy day funds and all passed. The lessons of the downturns for state policymakers include the following:

- Having a rainy day fund is critical. States with rainy day funds were able to avert over $20 billion in cuts to services and/or tax increases in the recession of the early 2000s and again in this most recent recession. By contrast, five states — Arkansas, Colorado, Illinois, Kansas, and Montana — do not have designated rainy day funds. The budgets of all of these states except Montana were hit hard by the recent economic downturn, and the lack of a rainy day fund left them more vulnerable to the recession’s effects. States that do not have a rainy day fund should consider enacting one.

- Caps on the size of rainy day funds can prevent states from building them up to adequate levels. Rainy day funds would have been even more effective if they had been larger; part of the reason they weren’t larger is that thirty-three states and the District of Columbia cap them at inadequate levels [1]. If rainy day funds are capped at an inadequate level, such as 10 percent of the budget or less, states will have difficulty accumulating sufficient reserves. States with overly restrictive caps could either remove the cap or increase it to a more adequate level, such as 15 percent of the budget.

- Some rainy day fund rules make it difficult for states to make deposits in good times. Most states place a low priority on replenishing their funds, depositing only whatever surpluses are left over at the end of the year. States could develop a process to integrate rainy day fund transfers into the budget as part of an overall reserve policy that places a high priority on saving. For example, Massachusetts dedicates a portion of revenues to the rainy day fund in addition to transferring a share of any surplus funds.

- Onerous replenishment rules make it difficult for states to use these reserves as intended. Twelve states[2] and the District of Columbia require rainy day funds to be replenished quickly after they are used, even if economic conditions have not improved. Such rules have proven to create a disincentive to use the fund and place the rainy day fund in competition with other programs for scarce resources during an economic downturn. For example, if the District of Columbia had used half of its available rainy day fund in 2009, it could have covered nearly half of its revenue shortfall for FY2009 and FY2010, rather than rely on service cuts. The rigid replenishment rule deterred lawmakers from accessing the fund. States with these replenishment rules could eliminate them.

- Limits on legitimate use reduce the funds’ effectiveness. Ten states have reduced the effectiveness of rainy day funds in addressing budget deficits by requiring a supermajority of legislators to release the fund or by placing an arbitrary limit on how much of the fund can be released at any one time [3]. In some states, such as Louisiana and Missouri, this has inhibited use of the funds, leading to greater spending cuts and tax increases than otherwise would have been necessary. Oftentimes limits such as a supermajority requirement have a chilling effect by discouraging legislators from even introducing measures to access these funds because of the difficulty in rounding up the necessary votes. States with these restrictions could repeal them.

This report examines the important role that rainy day funds have played in the last two recessions and discusses the ways in which states can improve them.

What Is a Rainy Day Fund?

For many years, states have relied on reserves and unobligated general-fund balances to help smooth out the impact of the ups and downs of the business cycle on state budgets. Often, they do this is on an ad hoc basis: when revenues come in above estimates during times of economic growth, states end the year with a positive balance or “surplus,” which they then use as a cushion in the next fiscal year to help address any unanticipated budget shortfalls. But because there often are no restrictions on states’ uses of these surpluses, states can easily spend the funds on programs or tax cuts, which means they are no longer available when they are needed most.

| TABLE 1: FY2006 Rainy Day Fund and General Fund Balances | |||||

| State | Rainy Day Fund Balance (millions) | Rainy Day Fund Balance as a % of Spending | Total Reserves (millions) | Total Reserves as a % of Spending | |

| Alabama | 419 | 6.0% | 1,368 | 19.6% | |

| Alaska | 2,267 | 69.8% | 2,267 | 69.8% | |

| Arizona | 650 | 7.4% | 1,697 | 19.4% | |

| Arkansas | 0 | 0.0% | 0 | 0.0% | |

| California* | 10,816 | 11.8% | 10,816 | 11.8% | |

| Colorado | 0 | 0.0% | 909 | 14.1% | |

| Connecticut | 1,113 | 7.6% | 1,560 | 10.7% | |

| Delaware* | 161 | 5.1% | 691 | 21.7% | |

| Florida | 1,069 | 4.1% | 6,059 | 23.3% | |

| Georgia* | 793 | 4.5% | 2,017 | 11.3% | |

| Hawaii | 54 | 1.2% | 786 | 16.8% | |

| Idaho | 109 | 4.9% | 411 | 18.5% | |

| Illinois | 0 | 0.0% | 866 | 3.6% | |

| Indiana | 328 | 2.7% | 739 | 6.2% | |

| Iowa | 392 | 7.8% | 541 | 10.8% | |

| Kansas | 0 | 0.0% | 734 | 14.3% | |

| Kentucky | 119 | 1.4% | 800 | 9.5% | |

| Louisiana | 681 | 8.8% | 1,508 | 19.5% | |

| Maine | 80 | 2.8% | 94 | 3.3% | |

| Maryland | 759 | 6.1% | 2,121 | 17.2% | |

| Massachusetts* | 2,155 | 8.4% | 3,208 | 12.5% | |

| Michigan | 2 | 0.0% | 5 | 0.1% | |

| Minnesota* | 1,113 | 7.2% | 1,813 | 11.7% | |

| Mississippi | 73 | 1.7% | 108 | 2.5% | |

| Missouri** | 247 | 3.5% | 942 | 13.2% | |

| Montana | 0 | 0.0% | 422 | 26.9% | |

| Nebraska | 274 | 9.4% | 840 | 28.8% | |

| Nevada | 184 | 6.3% | 535 | 18.2% | |

| New Hampshire | 69 | 5.2% | 95 | 7.1% | |

| New Jersey* | 560 | 2.0% | 1,779 | 6.3% | |

| New Mexico* | 798 | 14.7% | 798 | 14.7% | |

| New York* | 944 | 2.0% | 3,257 | 7.0% | |

| North Carolina | 629 | 3.7% | 1,378 | 8.1% | |

| North Dakota | 100 | 10.4% | 296 | 30.6% | |

| Ohio | 1,011 | 4.1% | 1,643 | 6.6% | |

| Oklahoma | 496 | 9.0% | 630 | 11.4% | |

| Oregon** | 622 | 10.2% | 627 | 10.3% | |

| Pennsylvania | 512 | 2.1% | 1,026 | 4.2% | |

| Rhode Island | 95 | 3.1% | 133 | 4.3% | |

| South Carolina* | 154 | 2.7% | 988 | 17.5% | |

| South Dakota | 137 | 13.0% | 137 | 13.0% | |

| Tennessee | 325 | 3.6% | 1,069 | 11.8% | |

| Texas | 7 | 0.0% | 7,070 | 10.5% | |

| Utah | 255 | 5.6% | 255 | 5.6% | |

| Vermont | 52 | 4.7% | 52 | 4.7% | |

| Virginia | 1,065 | 7.0% | 2,442 | 16.0% | |

| Washington | 4 | 0.0% | 703 | 5.2% | |

| West Virginia | 359 | 10.1% | 828 | 23.2% | |

| Wisconsin | 0 | 0.0% | 49 | 0.4% | |

| Wyoming | 446 | 35.9% | 456 | 36.7% | |

| Total | 32,498 | 5.4% | 69,568 | 11.6% | |

| Excluding AK & TX | 30,224 | 5.4% | 60,231 | 10.7% | |

| Notes: *Total reserves include both the ending balance and balances in budget stabilization funds. **FY 2008 figures from the December 2009 NASBO report are used for Oregon in lieu of FY 2006, because this is when their Rainy Day Fund came into being. Amount shown for Missouri is the portion of Budget Reserve Fund that the state considers its Rainy Day Fund due to constitutional prohibitions on using more than half the fund any year. Source: National Association of State Budget Officers, updated by CBPP | |||||

As a result, increasingly over the last 30 years, states have established and maintained reserve funds — often called rainy day funds or budget stabilization funds — for use only when revenues decline or expenditures increase unexpectedly because of economic downturns, natural disasters, or other events. These funds, which may be separate from a state’s general fund or may be a restriction on a portion of the general fund, typically have specific rules that govern their size and uses and that determine when money must be deposited or can be withdrawn. When properly designed, these rules promote the accumulation of reserve funds in good times and their use in bad times.

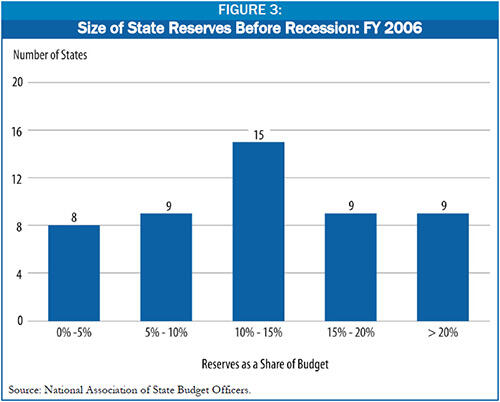

Dedicated rainy day funds generally make up about half of the total funds that states have on hand as general fund balances and reserves. For example, in 2006 — the peak year for reserves in the past decade — reserves in all states except Texas and Alaska totaled 10.7 percent of budgets on average[4], while states’ average rainy day funds equaled just over 5 percent of their budgets. The size of rainy day funds and other reserves differed significantly by state, however (see Table 1). Some states had very small amounts set aside; for example, states like Wisconsin and Michigan had reserves of less than 1 percent. At the other end of the spectrum, mineral-rich states such as Wyoming and North Dakota had reserves of more than 30 percent.

Rainy Day Funds Have Played an Important Role in Closing Recent Budget Shortfalls

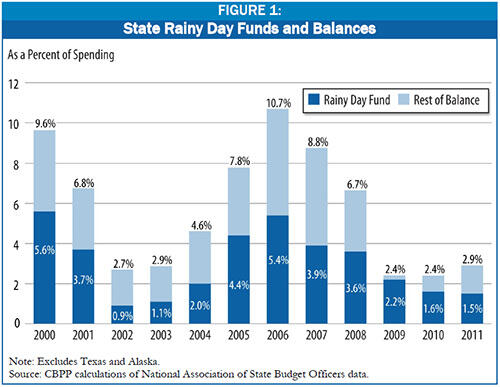

Unrestricted general fund balances and designated rainy day funds serve as a state’s first line of defense against the budget pressures caused by declining revenues and the rising need for public services during a downturn. Figure 1 shows state general fund balances (including rainy day fund balances) at the close of each fiscal year since 2000.

These balances have played an important role in helping states cope with the last two recessions, those of 2001 and 2007. Before both recessions, states accumulated reserve funds equal to some 10 percent of state budgets. In the years following the 2001 recession (2001-2004), states faced shortfalls totaling some $240 billion, and they used reserves to close some 10 percent of those shortfalls. If the funds had not been available, states would have had to make even deeper cuts in health care, education, and other important services or raise additional revenues.

Having funds available in a reserve — and using those funds when needed during a downturn — reduces the toll that spending cuts or revenue increases can take on a state’s economy in a downturn.

Spending cuts are problematic during a downturn because they reduce overall demand, which can make the downturn deeper. When states cut spending, they lay off employees, cancel contracts with vendors, eliminate or lower payments to businesses and nonprofit organizations that provide direct services, and cut benefit payments to individuals. In all of these circumstances, the companies and organizations that would have received government payments have less money to spend on salaries and supplies, and individuals who would have received salaries or benefits have less money for consumption. This directly removes demand from the economy. So do many tax increases. [5]

Research and Recent History Show Need for Larger Reserves

Now that states are beginning to emerge from the fiscal crisis and are developing fiscal policies to deal with the next downturn, the focal question is: how much saving is enough?

A 1999 Center analysis suggested that states would need reserves equal to 18 percent of spending, on average, to weather a simulated recession without substantially cutting spending or raising taxes. At the time, many policymakers used a much lower benchmark of 5 percent for an adequate reserve level, but, given the severity of the recent downturns, that 5 percent estimate now appears inadequate. [6] The Government Finance Officers Association (GFOA) has also questioned the 5 percent benchmark, stating in 2002:

GFOA recommends, at a minimum, that general-purpose governments, regardless of size, maintain unreserved fund balance in their general fund of no less than five to 15 percent of regular general fund operating revenues, or of no less than one to two months [that is, 8 to 16 percent] of regular general fund operating expenditures. A government’s particular situation may require levels of unreserved fund balance in the general fund significantly in excess of these recommended minimum levels. [7]

Use of Rainy Day Funds Won’t Hurt a State’s Bond Rating

A few state officials appear to believe that using rainy day funds even during an economic downturn would cause bond rating agencies to downgrade the state’s bond rating. This does not appear to be the case. For example, a Standard and Poor’s report published after the last recession indicated that prudent use of reserves would not affect a state’s credit rating. According to the report:

It is important to keep in mind that use of budget stabilization reserves is not a credit weakness in and of itself. The reserves are clearly in place in order to be used.a

The experience of states in the recession of the early 2000s confirms this. According to a 2007 University of Tennessee study, seven of the ten states with the highest bond rating (AAA) as of March 2007 had used one-third or more of their rainy day funds in 2002. Three of these states — Minnesota, North Carolina, and South Carolina — had used their entire rainy day funds in 2002.b

a Robin Prunty, and Karl Jacob, “Top 10 Management Characteristics of Highly Rated Credits in U.S. Public Finance,” Standard and Poor’s, January 11, 2006 (emphasis added).

b University of Tennessee Center for Business and Economic Research, “Rainy Day Funds, Analysis and Recommendations for Tennessee”, May 2007.

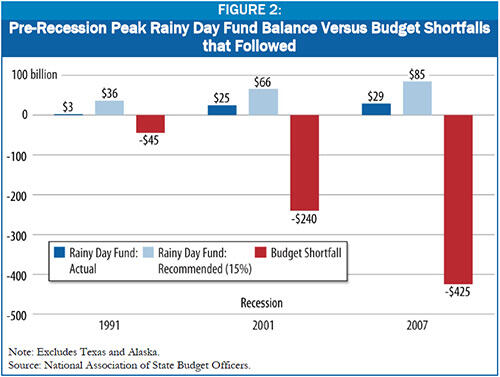

The experience of the last several years indicates that states should target the upper bound of GFOA’s recommendation — reserves of 15 percent or more of operating expenditures. Figure 2 compares states’ actual reserves and a reserve equal to 15 percent of state spending to the budget gaps that states faced in the last three recessions. While a 15 percent reserve would only be enough to fully cover the shortfalls resulting from a relatively short and mild recession such as that of the early 1990s, it would go considerably further toward preserving needed programs than the reserves that most states have typically accrued under current practices.

At the end of 2000, for example, state rainy day fund balances stood at $25 billion. This was considerably more than the reserves prior to the recession of the early 1990s, but it represented only about one-tenth of the cumulative deficits that states faced between 2001 and 2004. In addition, many states faced restrictions on the use of these funds. In the end, reserves (both rainy day funds and other general fund balances) closed only 10 percent of the total budget shortfalls over the period.

As intended, rainy day funds played their most important role in the early stages of the fiscal crisis sparked by the 2001 downturn, giving states time to develop plans to respond. In 2002, the fiscal year that most states first felt the impact of the downturn on revenues, states faced shortfalls totaling $40 billion and closed 44 percent of them using reserves. [8]

When revenues began to decline again in 2008 as a result of the most recent recession, states were somewhat better prepared than they had been at the start of the previous recession. Due to the robust revenue growth of the mid-2000s, states had total balances (including rainy day funds as well as general fund balances) equal to 11.6 percent of annual expenditures at the end of fiscal year 2006. This is higher than states’ total reserve balances of 10.4 percent of expenditures in 2000. [9] (Note: Excluding Texas and Alaska, total balances for all states were 10.7 percent of expenditures in 2006 and 9.6 percent in 2000.)

Unfortunately, even these larger reserves fell short as the budget gaps states faced were also dramatically larger. States have closed shortfalls totaling over $425 billion since the start of the recession and will continue to face large shortfalls in fiscal year 2012 and beyond. As Table 2 shows, state reserves have shrunk dramatically from peak pre-recession levels as states have drawn on their reserves to help compensate for the sharp drop in revenues. In 2006, some 41 states had rainy day funds and reserves that totaled at least 5 percent of their budget; by 2010, only 22 states did. But because state shortfalls have been so much larger in the recent recession, reserves have played a more limited role this time around, closing less than 5 percent of state budget gaps, on average.

If states had maintained larger rainy day funds equal to 15 percent of spending they would have had $85 billion, or just over one-half of 1 percent of GDP on hand prior to the last recession. Assuming that economic activity declines by one dollar for every dollar that states cut spending or raise taxes, and based on a rule of thumb that a one percentage-point loss of GDP costs the economy 1 million jobs, use of rainy day funds of this size could have saved the economy over 200,000 jobs.

Policies to Improve Adequacy of Reserves

States’ recent experience shows that there is room for improvement in the size and use of reserve funds. The rest of this report will focus on designated rainy day funds rather than total general fund balances because, in any period other than one of extremely rapid economic growth, it is difficult for a state to build up its balances without setting money aside in a rainy day fund.

| TABLE 2: Size of Balances | ||

| Fund balances (including Rainy Day Funds) | ||

| Size | FY2006 | FY2010 |

| 20%+ | 8 | 6 |

| 15% - 20% | 9 | 2 |

| 10% - 15% | 15 | 1 |

| 5% - 10% | 9 | 13 |

| 0% - 5% | 9 | 22 |

| < 0% | 0 | 6 |

Building a rainy day fund of 15 percent of spending or more requires both strong reserve policies and sufficient time. If a state were to set aside between 1.5 and 2.5 percent of revenue a year in a rainy day fund, it would take six to ten years to build a fund that equals 15 percent of spending. If states wait too long after revenues recover to begin saving, they likely will not build adequate reserves before the next economic downturn begins. Given the depth of the current state fiscal crisis and the expected slow return to normal revenue levels, it is not yet time for many states to make deposits to these funds. Changing the fund’s design, on the other hand, does not require immediate funding and will leave a state better prepared to improve its reserves when revenues return to normal.

The current environment likely offers the best political opportunity that policymakers will have for years to come to enact critical policy changes to their reserve funds. The experience of the fiscal crisis is fresh in people’s minds. This has led taxpayers to critically examine what went wrong with their state budgets and what could have been done to mitigate the situation. For example, in the November 2010 election, five states (Hawaii, North Dakota, Oklahoma, South Carolina, and Virginia) had measures on the ballot to either increase the caps on their rainy day funds or enhance the state’s ability to make deposits into their rainy day funds; all five measures passed.

States can change the rules governing rainy day funds without affecting their bottom line in the near term. If policymakers wait until revenues begin to rebound to implement changes, they may find that the political window for these much-needed changes has closed, with voters increasingly pushing to receive surplus revenues in the form of tax breaks or use them for new programs. Failure to implement reforms now could mean passing up a chance to prepare their states to weather the next fiscal crisis.

Establish and Maintain a Rainy Day Fund

The most important element of an effective reserve policy is to create a separate rainy day fund to accumulate funds during good economic times that can be used to address budget deficits during an economic downturn. Five states — Arkansas, Colorado, Illinois, Kansas, and Montana — lack rainy day funds. Among those five states:

- Arkansas has a history of inadequate savings. In 2000, prior to the recession of 2001 when most states had built up reserve balances, Arkansas had no reserves. Recently, Arkansas created one-time “set-asides” in its capital project funds, but these sorts of appropriations do not offer the kind of fiscal flexibility that true rainy day funds provide.

- Colorado does not have a separate rainy day fund but does have a 4 percent annual budget reserve requirement that functions in a manner similar to a rainy day fund. Colorado’s situation is complicated by a series of restrictive revenue and spending limits embedded in the constitution and known collectively as TABOR (Taxpayers Bill of Rights), which make the development of a rainy day fund difficult because all revenue in excess of the limits is returned to taxpayers through rebates, tax credits, and other mechanisms. Until recently, Colorado was operating under a five-year freeze on some of these constitutional fiscal policy constraints. Now that TABOR is back in full effect, it will be statutorily impossible to maintain a sufficient level of reserves.

- Illinois has a budget stabilization fund that does not serve as a rainy day fund because the entire fund must be paid back before the end of the fiscal year.

- Kansas has a 7.5 percent general fund balance requirement but no separate rainy day fund. Whereas rainy day funds are specifically intended to address budget shortfalls, a simple general fund balance might be used for purposes other than closing budget gaps. In addition, if this requirement remains in place during economic downturns, it can have the same adverse effects as a replenishment rule. Legislation proposed in 2010 to establish a rainy day fund failed to pass.

- Montana has accumulated significant general fund reserves in the past, but does not have a separate rainy day fund.

Each of these states would benefit from a creating a rainy day fund.

Raise or Eliminate Caps on Fund Size

Some states’ rainy day funds include caps that limit how large the fund can grow, typically measured as a percent of the budget. If the cap is too low, such as 10 percent of the budget or less, the state is going to have difficulty accumulating adequate reserve balances. Unfortunately, 30 states and the District of Columbia have capped their rainy day funds at 10 percent of spending or less and 13 states have capped their funds at 5 percent or less. These states are virtually guaranteed to find their rainy day funds inadequate. (See Table 3.)

Rainy day fund caps clearly restrict the growth of rainy day funds during economic expansions. The rainy day funds in states with caps of 5 percent or less (excluding California[10]) grew from an average of 1.4 percent of expenditures at the end of 2002 to only 2.8 percent of expenditures at the end of 2006. Over this same period, the rainy day funds in states without caps or with caps of 10 percent or greater (excluding Alaska and Texas[11] ) grew from an average of 3.2 percent of expenditures to 5.9 percent of expenditures. The same pattern was evident in the 1990s. [12]

| TABLE 3: Summary of Rainy Day Fund Features to be Reformed | ||||||||

| State | No RDF | Cap of less than 15% | Cap % | Deposit Rule | Replenishment Rule | Limit on Use | Super-Majority Requirement | Type |

| Alabama* | X | 10.0 | Required Budget Allocation/Year-End Surplus | X | Both | |||

| Alaska | no cap | See Deposit Rules | X | X | Both | |||

| Arizona | X | 7.0 | Personal Income Growth Formula | X | Statute | |||

| Arkansas | X | |||||||

| California* | X | 5.0 | Required Budget Allocation | Constitutional | ||||

| Colorado | X | |||||||

| Connecticut | X | 10.0 | Year-End Surplus | Statute | ||||

| Delaware | X | 5.0 | Year-End Surplus | X | Constitutional | |||

| District of Columbia* | X | 6.0 | Required Budget Allocation | X | X | Statute | ||

| Florida | X | 10.0 | Required Budget Allocation | X | Constitutional | |||

| Georgia | 15.0 | Year-End Surplus | Statute | |||||

| Hawaii | X | 10.0 | Appropriation/Tobacco funds | X | Statute | |||

| Idaho | X | 5.0 | See Deposit Rules | X | Statute | |||

| Illinois | X | |||||||

| Indiana | X | 7.0 | Personal Income Growth Formula | X | Statute | |||

| Iowa* | X | 10.0 | Year-End Surplus/Appropriation | X | Statute | |||

| Kansas | X | |||||||

| Kentucky | X | 5.0 | Year-End Surplus | Statute | ||||

| Louisiana | X | 4.0 | Oil & Gas Revenue | X | X | X | Constitutional | |

| Maine | X | 12.0 | Year-End Surplus | Statute | ||||

| Maryland | X | 7.5 | Required Budget Allocation | X | Statute | |||

| Massachusetts | 15.0 | Year-End Surplus/Required Budget Allocation/Capital Gains Taxes | Statute | |||||

| Michigan | X | 10.0 | Personal Income Growth Formula | X | Statute | |||

| Minnesota | goal (4.0) | Allocation of Projected Surplus | Statute | |||||

| Mississippi | X | 7.5 | Year-End Surplus | Statute | ||||

| Missouri | X | 7.5 | See Deposit Rules | X | X | X | Constitutional | |

| Montana | X | |||||||

| Nebraska | no cap | Year-end Surplus | Statute | |||||

| Nevada | 20.0 | Year-end Surplus | Statute | |||||

| New Hampshire | X | 10.0 | Year-end Surplus | X | Statute | |||

| New Jersey | X | 5.0 | Year-end Surplus | Statute | ||||

| New Mexico | no cap | Year-end Surplus | Statute | |||||

| New York* | X | 5.0 | See Deposit Rules | X | Statute | |||

| North Carolina | goal (8.0) | Year-end Surplus | Statute | |||||

| North Dakota | X | 10.0 | Year-end Surplus | Statute | ||||

| Ohio | X | 5.0 | Year-end Surplus | Statute | ||||

| Oklahoma | 15.0 | Year-end Surplus | X | X | Statute | |||

| Oregon* | X | 12.5 | Required Budget Allocation/Year-end Surplus/Lottery Revenue | X | X | Both | ||

| Pennsylvania | no cap | Year-end Surplus | X | Statute | ||||

| Rhode Island | X | 5.0 | Required Budget Allocation | X | Statute | |||

| South Carolina* | X | 5.0 | Year-end Surplus/Required Budget Allocation | X | Statute | |||

| South Dakota | X | 10.0 | Year-end Surplus | X | Statute | |||

| Tennessee | X | 5.0 | Required Budget Allocation | X | Statute | |||

| Texas | X | 10.0 | Year-end Surplus/Appropriation/Oil & Gas Revenue | X | Constitutional | |||

| Utah* | X | 6.0 | Year-end Surplus | X | Statute | |||

| Vermont | X | 5.0 | Year-end Surplus/Appropriation | Statute | ||||

| Virginia | 15.0 | See Deposit Rules | X | Constitutional | ||||

| Washington | X | 10.0 | Required Budget Allocation/Appropriation | Constitutional | ||||

| West Virginia | X | 10.0 | Year-end Surplus | X | Statute | |||

| Wisconsin | X | 5.0 | Year-end Surplus | Statute | ||||

| Wyoming | no cap | Year-end Surplus | Statute | |||||

| ***Source: NASBO and NGA Fiscal Survey of States (FY 2010) *States with multiple RDFs AK: Alaska has 2 rainy day funds. Neither the constitutional Budget Reserve Fund nor the statutory Budget Reserve Fund are capped. AL: Alabama has 2 rainy day funds. The Education Trust Fund is capped at 6.5% of education expenditures and the General Fund Trust Fund is capped at 10% of general fund expenditures. The ETF account must be repaid within 6 years, and the General Fund account must be repaid within 10 years. CA: California has 2 rainy day funds. The Budget Stabilization Account is capped at 5% and there is no statutory cap for the Special Fund for Economic Uncertainties. There will be a measure on the March 2012 primary ballot that would make significant RDF changes. The RDF has a "soft" cap. Prop 58 required a certain level of GF revenues to be transferred each year to the reserve – unless the transfer is suspended by the governor – until the balance of the reserve reaches the greater of $8 billion or 5% of GF revenues. At that point the transfers would not be required, although the Legislature could deposit additional GF revenues exceeding those levels if it wished to do so. CT: Any surplus funds must now be used to pay down Connecticut's 2009 Economic Recovery Notes through FY2017. DC: DC has 2 rainy day funds. The Emergency Cash Reserve Fund is capped at 2% and the Contingency Cash Reserve Fund is capped at 4%. IA: Iowa has 2 rainy day funds. The Cash Reserve Fund is capped at 7.5% and the Economic Emergency Fund is capped at 2.5%. 60% approval is needed if an appropriation will reduce the Cash Reserve Fund below 3.75% of adjusted revenue estimate. If at close of previous fiscal year, it is determined that general fund is at deficit, up to $50 million from EEF can be used to fill previous year’s deficit, but must be replenished from current fiscal year. LA: Federal money (largely from Hurricane Katrina relief) is pulled out before calculating the cap. Year-end surplusses and oil and gas revenue above a certain amount constitute rainy day fund deposits. The constitution requires replenishment, but the statute does not require replenishment. There is currently a lawsuit going on about the way lawmakers balanced last year’s budget with almost $200 million from the rainy day fund. The lawsuit claims lawmakers violated the constitution by not repaying the money back, but lawmakers are claiming the recent 2009 statutory rule does not require the money to be paid back for years. The ruling still stands with no replenishment for years. MD: Transfers that would reduce the balance below 5.0% must be approved in legislation separate from the budget bill. MI: Personal income growth formula determines amount to be transferred to the rainy day fund, legislature has discretion in determining actual transfer amount. MN: The goal for the budget reserve is $653 million. That works out to be about 4% of the FY 2011 annual budget. It is set in law as a dollar figure rather than a percentage of the budget. ND: has the only state-owned bank in the nation and uses its profits, along with the Rainy Day fund. NH: If the general fund operating budget deficit occurred in the most recently completed fiscal biennium and unrestricted general fund revenues for the most recently completed biennium were less than budget forecast, then a only a simple majority is required to access the RDF. If those two conditions are not met, a supermajority vote is required to stabilize the budget. NY: New York has 2 rainy day funds. The Tax Stabilization Reserve Fund is capped at 5% and the Rainy Day Reserve Fund is capped at 3%. OR: Oregon has 2 rainy day funds. The Rainy Day Fund created is capped at 5% and the Education Stability Fund is capped at 7.5%. SC: South Carolina has 2 rainy day funds. The General Reserve Fund has a floor of 3% and the Capital Reserve Fund has a floor of 2%. UT: Utah has 2 rainy day funds. The General Fund Budget Reserve Account is capped at 6% of general fund expenditures and the Education Budget Reserve Account is capped at 7% of education fund expenditures. Even though the cap is 6%, that 6% limits any year-end transfers done by Finance. There is nothing in the law that would prevent the Legislature to appropriate money to the fund. The 6% does not cap the fund but only the year-end transfer. VA: Virginia's cap is applied to the average of sales and income tax revenues over the previous three fiscal years rather than spending. VT: Vermont has 3 RDFs (general, transportation, and education), all capped at 5% of their respective appropriations. WA: Funds can be withdrawn via a simple majority when the governor declares an emergency or during recessions. Otherwise, withdrawal requires a three-fifths vote. WI: In each fiscal year, if actual general fund tax revenues exceed those projected revenues, 50% of the additional tax revenues are required to be transferred to the budget stabilization fund. Also, net proceeds from the sale of any surplus property are deposited in the budget stabilization fund. WY: recently created and extra legislative stabilization account created in last several years to offset volatile mineral reserve funds. This fund has no statutory role. | ||||||||

The first step that a state with a capped rainy day fund should take to improve it is to either remove the cap or raise it to a more adequate level, such as 15 percent of the budget. Even better, a state could replace its cap with a goal, specifying a desired funding level, as North Carolina and Minnesota do. For example, a state could set a target level for its fund of 15 percent of the budget; once that target is met, policymakers could decide whether to make additional deposits above the 15 percent level. Such a target also increases the likelihood that a state will make the necessary deposits to its fund during periods of economic growth.

The existence of a floor, specifying a minimum level of funding, such as the 3 percent floor in Maryland, can also be problematic if the requirement for contributions into the rainy day fund does not include an exception during economic downturns.

Recently, six states have increased their rainy day fund caps: Georgia (from 10 to 15 percent), Nevada (from 15 to 20 percent), North Dakota (from 5 to 10 percent), Oklahoma (from 10 to 15 percent), South Carolina (from 3 to 5 percent), and Virginia (from 10 to 15 percent.)

Improve Deposit Rules

Most states’ rules for contributions to rainy day funds do not give them much encouragement to save. The most common contribution rule — used in 27 out of 46 states with a rainy day fund — is that a portion of the state’s year-end surplus may be placed in the rainy day fund. [13] This rule has the advantage of ensuring that that the deposited funds are truly surplus and that the state does not need them for some other purpose. The disadvantage is that the rainy day fund is last in line for receiving state resources.

For example, if during the period of budget deliberations a state is projecting a surplus, it may choose to increase expenditures, cut taxes, or both; the rainy day fund would receive funding only if the actual surplus exceeds the projected surplus that was already allocated. This is largely what happened during the 1990s, when states increased spending modestly and cut taxes extensively when they enacted their budgets.

Other types of deposit rules can have the opposite effect, forcing the state to make deposits when it cannot afford to. California, [14] Florida, Hawaii, Maryland, Missouri, and Rhode Island require annual contributions to their rainy day fund without regard to the state’s fiscal conditions, which can lead to deposits being required during an economic downturn when the state is struggling to balance its budget.

Other states have rules intended to assure that rainy day fund contributions will be made only when fiscal conditions are healthy. Six states — Arizona, Idaho, Indiana, Michigan, Tennessee, and Virginia — use formulas based on growth in tax revenues or personal income to determine when rainy day fund contributions are needed.

The rules in these six states have both positive and negative aspects. On the positive side, in four of these six states the deposit is made automatically at some point during the fiscal year; unlike year-end surplus deposit rules, an automatic deposit assures that a deposit will be made. But the rules in some of the six states have other aspects that are less workable. In Idaho and Tennessee, the deposit formulas can require states to make contributions when state finances are not particularly strong. In Tennessee, for example, 10 percent of any revenue increase from one year to the next – in nominal terms – must be placed in the rainy day fund, which means that a deposit would be required even if revenue growth is too low to cover very basic cost increases such as inflation.

In other states, in contrast, the formula appropriately measures whether there is sufficient economic growth to support a rainy day fund deposit by either being triggered by a certain level of personal income growth or by comparing personal income or revenue growth to recent averages.

Drawing on more than two decades of state experience with rainy day funds, one can design a deposit rule that balances the competing needs of building an adequate reserve and ensuring sufficient annual funding for public services. The following suggests how this might be accomplished.

- During the budget development process, the state budget office could compare projected revenue (before considering any possible tax cuts) to projected spending needs for the upcoming budget year. Ideally, the estimate of projected spending needs would utilize a baseline or current services approach that takes into account inflation, caseload increases, workload changes, and statutory requirements. Some states already prepare these types of estimates and include them in the proposed budget document, but many do not. Most states that do not prepare a formal baseline projection should be able to produce an estimate of the required spending needs for the next fiscal year.

- If projected revenues exceed projected expenditure needs, a portion of that surplus (25 percent to 50 percent) could be appropriated as a transfer to the rainy day fund.

- Only the remaining portion of the surplus would be available for other uses. The actual transfer to the rainy day fund would occur at the end of the fiscal year, assuming revenues and spending hold to projections.

- A portion of any additional year-end surplus could also be deposited in the rainy day fund.

- A state could also dedicate a certain percentage of revenues from some volatile revenue stream, such as oil and gas receipts or capital gains taxes, towards its rainy day fund. For example, Massachusetts recently required that capital gains tax revenue that exceeds $1 billion per year be deposited in the rainy day fund. This provides an additional source of funding for rainy day funds during periods of economic growth. It also protects the states from big swings in revenue that could result from some taxes that grow rapidly during good economic times but are more volatile than some others.

Policies to Ensure Access to Rainy Day Funds When Needed

Three types of policies may prevent states from tapping rainy day funds when needed: replenishment rules, supermajority requirements, and limits on use. By reforming these policies, states can make their rainy day funds more effective.

Eliminate Replenishment Rules

Twelve states — Alabama, Alaska, Florida, Iowa, Louisiana, Maryland, Missouri, New York, Rhode Island, South Carolina, Utah, and West Virginia — as well as the District of Columbia require that withdrawals from their rainy day funds be replenished over a specified period of time after a withdrawal. Such rules can be problematic for two reasons. First, in some cases they provide a disincentive to using the fund, since policymakers may fear that funds will not be available to meet the replenishment requirements. Second, when replenishment must occur in the midst of a fiscal crisis or too soon after the drawdown, rainy day deposits may compete for scarce funding with the very programs and services that the rainy day fund was created to help support.

Alabama, Florida, and Utah allow replenishment to occur over five years or more. [15] This lengthy period makes it more likely (though not certain) that most of the replenishment will occur after the fiscal crisis is over. Historically, most state fiscal crises have lasted two to three years.

The replenishment period is three years in Missouri, New York, and South Carolina; two years in the District of Columbia; one year in Iowa, for one of its two rainy day funds. In Rhode Island, the replenishment period is set at two years, but may be altered by statute. The Governor’s proposed budget for FY2011 proposed delaying the payback of the FY2009 amount until FY2012, but the legislature did not approve the change and the amount was paid back in FY2011. West Virginia has one of the most cumbersome restrictions. West Virginia’s rainy day fund requires any funds borrowed to be repaid within 90 days of withdrawal, and in that sense its fund can only be used to address cash-flow shortages within a fiscal year. Alaska, Louisiana, and Maryland do not have set replenishment periods, but have requirements to use future surplus money to replenish the money taken out of their rainy day fund until it is fully repaid, or until, in the case of Maryland, the fund grows to a minimum threshold of 3 percent.

These onerous replenishment rules have prevented states from using these funds for their intended purpose. Despite significant shortfalls throughout the recent fiscal crisis, Missouri has not used its rainy day funds.

In practice, a replenishment rule is simply a problematic form of a deposit rule. States can benefit from deposit requirements without having to refill their rainy day funds while resources are still needed to fund critical programs and services by refraining from replenishment rules altogether and instead implementing effective deposit rules.

Remove Supermajority Requirements

Ten states have supermajority requirements governing the release of rainy day fund resources to address budget deficits. [16] Delaware and Oregon require passage by 60 percent of legislators, while eight other states require at least two-thirds approval. Supermajority rules create an unnecessary political hurdle to accessing the funds. These rules allow a minority of lawmakers to block the sensible use of rainy day funds in times of fiscal crisis. In 2010, a lawsuit was filed in Louisiana challenging the legislature’s use of a statute circumventing the state constitution’s supermajority and repayment provisions of its rainy day fund. As a result, the legislature has been unable to access the $198 million it sought from the rainy day fund and has been forced to rely on other gap-closing measures.

Remove Limits on Use of Funds

Eleven states and the District of Columbia limit the amount of the rainy day fund that a state can use at one time. [17] These limits reduce the flexibility of state policymakers to address budget shortfalls in an effective manner. For example, it may make sense for a state to use a large portion of its rainy day fund in the first year of the fiscal crisis because other budget balancing options, such as revenue increases or targeted budget cuts, may take more time to analyze and implement and are more appropriate for addressing the second or third year of the downturn.

In some cases these limits are designed to minimize the use of the fund during periods of economic growth, which is a reasonable goal. But it is difficult to craft a restriction that applies only to periods of growth and does not also limit flexibility during a downturn. A better mechanism for ensuring that the funds are used for the intended purpose is to restrict the use of the funds to addressing a budget deficit. [18]

Constitutional versus Statutory Rules

A rainy day fund may be codified within the state’s constitution or codified in statute. It is difficult to make a blanket statement regarding the relative effectiveness of the two approaches. The vast majority of rainy day funds are statutory: of the 46 states with rainy day funds, only five are constitutional, while another three have multiple funds that are both statutory and constitutional. A statutory fund would likely be easier to create and reform than a constitutional one. If, however, a state has a statutory rainy day fund that functions very effectively, there may be value in attempting to codify the rules in the constitution in order to make it difficult to weaken them at a later date.

Case Study 1: Massachusetts and Missouri

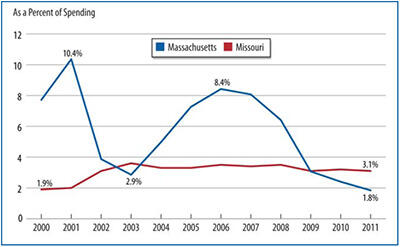

Observing the history of two very distinct rainy day funds, those in Massachusetts and Missouri, gives insight into how well their respective rules have worked.

Massachusetts’ fund grew to a relatively high (though still not entirely sufficient) level of 10.4 percent of expenditures leading up to the 2001 recession. Missouri, in contrast, maintained a very meager fund level of 2.0 percent of expenditures at the outset of the 2001 recession.1

Over the course of the recession, Massachusetts drew down substantially on its rainy day fund to meet budget shortfalls that it otherwise would have found difficult to address. Over that same period, Missouri’s rainy day fund increased, from 2.0 percent of expenditures in 2001 to 3.6 percent in 2003. This increase likely resulted from the overly restrictive rules governing how the fund may be accessed. A rainy day fund is meant to be drawn down during a recession; otherwise it serves no real purpose.

Conversely, during periods of economic growth, a rainy day fund ought to be easily replenished. This was the case in Massachusetts, whose fund increased as a percentage of expenditures from a low of 2.9 percent in 2003 to a high of 8.4 percent in 2006. Over this same time span, Missouri’s fund remained flat.

A summary glance at the two state’s rainy day funds shows how differently they are governed.

- Both states limit the size of their fund, but Massachusetts’ cap is twice the size of Missouri’s — 15 percent compared to 7.5 percent.

- Massachusetts has no replenishment rule, no limits on use, and no supermajority requirement. Missouri has all three.

- Massachusetts employs a combination of different rules to deposit money into the rainy day fund: a budgetary allocation of 0.5 percent of the preceding year’s revenue, any surplus at the end of the fiscal year, and capital gains tax collections in excess of $1 billion. Missouri, on the other hand, relies upon arbitrary, ad hoc transfers from its general fund by the commissioner of administration.

Ultimately, the expansion and contraction of a rainy day fund demonstrates how effective the fund’s rules are. As a percentage of expenditures, the balance in a rainy day fund ought to be counter-cyclical, declining during recessionary periods and increasing during periods of economic growth. A fund like Missouri’s, which remains relatively flat throughout periods of recession and expansion, is in need of reform.

1 The amounts shown for Missouri are the portions of Budget Reserve Fund that the state considers its Rainy Day Fund due to constitutional prohibitions on using more than half the fund any year.

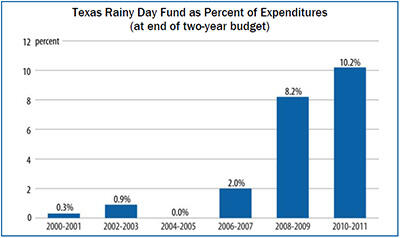

Case Study 2: Texas

Texas’ experience with its rainy day fund during the last recession has been the opposite of most states with rainy day funds. Deposits to the Texas fund depend on oil and gas production in the state. High oil prices and expanding natural gas production shielded the state from the worst effects of the recession at its outset and resulted in large deposits to the fund. While most states were drawing down their reserves to avoid severe budget cuts, the size of Texas’ rainy day fund grew dramatically. At the end of the 2004-05 biennial budget, Texas’ rainy day fund was essentially empty. Now it stands at 10 percent of general revenue spending. The effects of the downturn are now being felt as Texas faces a projected $26.8 billion shortfall in the next biennial budget but the design of the fund is making it difficult to use.

One impediment to Texas’ ability to access its rainy day fund is the state constitution’s requirement that a supermajority of the legislature approve withdrawals from the fund. This creates an unnecessary political barrier to accessing its fund. While it won’t solve the state’s immediate problems, removing this requirement could make it easier to use the fund as intended in the future.

Another reason Texas has not tapped the rainy day fund is a misguided concern that using the fund will hurt the state’s bond rating. A recent report by Standard and Poor’s listed rainy day funds as one of characteristic of governments that are highly rated. But they acknowledged that these funds exist so that they are available in bad times. As the report quite simply states, “reserves are in place to be used.”

The size of the state’s projected shortfall highlights another problem with the fund - the constitutional cap of 10% of the prior biennium expenditure. Once the economy recovers the state will need to rebuild the rainy day fund. The cap will prevent the state from building adequate reserves of 15 percent or more of the budget.

| Appendix Table 4: Deposit Rules |

| AK: For the Constitutional Budget Reserve Fund all money received by the state as a result of the termination, through settlement or otherwise, of an administrative proceeding or of litigation in State or federal court involving mineral lease bonuses, rentals, royalties, royalty sale proceeds, federal mineral revenue sharing payments or bonuses, or involving taxes imposed on mineral income, production, or property, shall be deposited in the budget reserve fund. Deposits are made to the statutory reserve fund by appropriation. AL: Beginning on October 1, 2008, and on October 1 of each fiscal year thereafter, there is hereby appropriated into the Education Trust Fund Proration Prevention Account, 75 percent of the ending balance in the Education Trust Fund from the preceding fiscal year that was unanticipated and unappropriated by the Legislature as a beginning balance in the current fiscal year. The Legislature shall set forth the amount of the beginning balance anticipated and appropriated in the Education Trust Fund appropriation act each year beginning in the Education Trust Fund appropriation act for the fiscal year beginning October 1, 1999. The Finance Director shall transfer 75 percent of the unanticipated and unappropriated beginning balance by October 15 of each year. AZ: There is a statutory formula to calculate the amount to be appropriated to (deposit) or transferred out (withdrawal) of the BSF. The EEC determines the annual growth rate of inflation-adjusted total state personal income, the trend growth rate over the past 7 years, and the calculated appropriation to or transfer from the BSF. The EEC calculations, however, do not result in any automatic deposits or withdrawals, as they must be authorized by legislative action. CA: 1 percent (about $850 million) in 2006-07, 2 percent (about $1.8 billion) in 2007-08, and 3 percent (about $2.9 billion) in 2008-09 and thereafter. These transfers would continue until the balance in the account reaches $8 billion or 5 percent of General Fund revenues, whichever is greater. The annual transfer requirement would be in effect whenever the balance falls below the $8 billion or 5 percent target. California also has a Special Fund for Economic Uncertainties, which is funded by appropriation. CT: After the accounts for the General Fund have been closed for each fiscal year and the Comptroller has determined the amount of unappropriated surplus in said fund, after any amounts required by provision of law to be transferred for other purposes have been deducted, the amount of such surplus shall be transferred by the State Treasurer to a special fund to be known as the Budget Reserve Fund. When the amount in said fund equals ten per cent of the net General Fund appropriations for the fiscal year in progress, no further transfers shall be made by the Treasurer to said fund and the amount of such surplus in excess of that transferred to said fund shall be deemed to be appropriated to the State Employees Retirement Fund, in addition to the contributions required pursuant to section 5-156a, but not exceeding five per cent of the unfunded past service liability of the system as set forth in the most recent actuarial valuation certified by the Retirement Commission. DC: Deposit required each year to attain a balance of 2% and 4%, respectively, of the two funds, over two fiscal years. DE: The excess of any unencumbered funds remaining from the said fiscal year shall be paid by the Secretary of Finance into the Budget Reserve Account; provided, however, that no such payment will be made which would increase the total of the Budget Reserve Account to more than five percent of only the estimated General Fund revenues. FL: An amount equal to at least 5% of the last completed fiscal year's net revenue collections for the general revenue fund shall be deposited in the budget stabilization fund. The budget stabilization fund's principal balance shall not exceed an amount equal to 10% of the last completed fiscal year's net revenue collections for the general revenue fund. GA: The amount of all surplus in state funds existing as of the end of each fiscal year shall be reserved and added to the Revenue Shortfall Reserve. HI: The Director of Finance shall deposit moneys received from the tobacco settlement moneys under 328L-2 and appropriations made by the legislature to the fund. IA: By appropriation when there is a year-end GF surplus ID: The state controller shall annually transfer moneys from the general fund to the budget stabilization fund if the state controller certifies that the receipts to the general fund for the fiscal year just ending have exceeded the receipts of the previous fiscal year by more than 4%, then the state controller shall transfer all general fund collections in excess of said 4% increase to the budget stabilization fund, up to a maximum of 1% of the actual general fund collections of the fiscal year just ending. IN: If the annual personal income growth rate for the calendar year preceding the current calendar year exceeds 2%, there is appropriated to the fund from the state general fund, for the state fiscal year beginning in the current calendar year, an amount equal to the product of: (1) the total state general fund revenues for the state fiscal year ending in the current calendar year; multiplied by (2) the remainder of: (A) the annual growth rate for the calendar year preceding the current calendar year; minus (B) 2%. KY: The secretary of the Finance and Administration Cabinet shall cause to be deposited to the budget reserve trust fund account 50% of the general fund surplus. LA: Automatic deposit of revenues exceeding $750M from taxes on the production of, or exploration for, minerals. With some limitations, the $750M base may be increased every 10 years, beginning in the year 2000, by a law enacted by a 2/3 vote. MA: 0.5% of tax revenue from the preceding year; amounts left in budgeted funds at end of fiscal year, capital gains tax collections in excess of $1 billion. MD: If the Account balance is below 3% of the estimated General Fund revenues for that fiscal year, the Governor shall include in the budget bill an appropriation to the Account equal to at least $100M; and if the Account balance is at least 3% but less than 7.5% of the estimated General Fund revenues for that fiscal year, the Governor shall include in the budget bill an appropriation to the Account equal to at least the lesser of $50M or whatever amount is required for the Account balance to exceed 7.5% of the estimated General Fund revenues for that fiscal year. ME: Transfer from the GF unappropriated surplus MI: When the annual growth rate is more than 2%, the percentage excess over 2% shall be multiplied by the total state general fund-general purpose revenue for the fiscal year ending in the current calendar year to determine the amount to be transferred to the fund from the state general fund in the fiscal year beginning in the current calendar year. MN: If on the basis of a forecast of general fund revenues and expenditures, the commissioner of management and budget determines that there will be a positive unrestricted budgetary general fund balance at the close of the biennium, the commissioner of management and budget must allocate money to the following accounts and purposes in priority order: 1) the cash flow account established in subdivision 1 until that account reaches $350,000,000; and 2) the budget reserve account established in subdivision 1a until that account reaches $653,000,000. MO: The commissioner of administration shall transfer from the GF to the budget reserve fund an amount equal to a "cash operating transfer" plus interest, prior to May 16 of the FY in which the transfer was made. A "cash operating transfer" is a transfer made by the commissioner of administration from the budget reserve fund to the GF to meet the cash requirements of the state. . MS: If any unencumbered General Fund cash balance is available for distribution under this section, the distribution of those funds shall be made by the Director of the Department of Finance and Administration to the Working Cash-Stabilization Reserve Fund, fifty percent (50%) of the balance, not to exceed 7.5% of the General Fund appropriations NC: The Controller shall reserve to the Savings Reserve Account one-fourth of any unreserved fund balance, as determined on a cash basis, remaining in the General Fund at the end of each fiscal year. ND: Transfer of GF surplus in excess of $65M at the end of the biennium. NE: In addition to receiving transfers from other funds, the Cash Reserve Fund shall receive federal funds received by the State of Nebraska for undesignated general government purposes, federal revenue sharing, or general fiscal relief of the state. NH: With some limitations, transfer by comptroller of any surplus at the end of each biennium. NJ: 50% of actual revenue collections in excess of governor’s certification of revenues. NM: Transfer from general fund NV: State comptroller must deposit into the Fund to Stabilize Operation of State Government 40% of the unrestricted balance of the state GF which remains after subtracting an amount equal to 10% of all appropriations made from the GF. NY: The Rainy Day Reserve Fund deposits are made by appropriation. The Tax Stabilization Reserve Fund deposits are made by any GF cash surpluses existing at year-end, up to a maximum contribution of 0.2% of total GF disbursements. OH: the director of budget and management shall determine the surplus revenue that existed on the preceding thirtieth day of June and transfer from the general revenue fund, to the extent of the unobligated, unencumbered balance on the preceding thirtieth day of June in excess of one-half of one per cent of the general revenue fund revenues in the preceding fiscal year to the budget stabilization fund, any amount necessary for the balance of the budget stabilization fund to equal 5% of the general revenue fund revenues of the preceding fiscal year |

| TABLE 5: General Fund Balances and Rainy Day Fund balances FY2006 and FY2010 | |||||||||

| Rainy Day Fund Balance | Total General Fund Balance | ||||||||

| State | FY2006 | FY2010 | FY2006 | FY2010 | |||||

| Amount (millions) | % of Spending | 2006 % Rank | Amount (millions) | % of Spending | Amount (millions) | % of Spending | Amount (millions) | % of Spending | |

| Alabama | 419 | 6.0% | 20 | 55 | 0.8% | 1,368 | 19.6% | 55 | 0.8% |

| Alaska | 2,267 | 69.8% | 1 | 10,497 | 227.9% | 2,267 | 69.8% | 11,447 | 248.5% |

| Arizona | 650 | 7.4% | 15 | 0 | 0.0% | 1,697 | 19.4% | -7 | -0.1% |

| Arkansas | 0 | 0.0% | 45 | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% |

| California* | 10,816 | 11.8% | 5 | 0 | 0.0% | 10,816 | 11.8% | -4,804 | -5.6% |

| Colorado* | 0 | 0.0% | 45 | 0 | 0.0% | 909 | 14.1% | 146 | 2.2% |

| Connecticut | 1,113 | 7.6% | 14 | 103 | 0.6% | 1,560 | 10.7% | 552 | 3.2% |

| Delaware* | 161 | 5.1% | 23 | 186 | 6.0% | 691 | 21.7% | 723 | 23.5% |

| Florida | 1,069 | 4.1% | 27 | 275 | 1.3% | 6,059 | 23.3% | 1,458 | 6.8% |

| Georgia* | 793 | 4.5% | 26 | 193 | 1.2% | 2,017 | 11.3% | 1,331 | 8.3% |

| Hawaii | 54 | 1.2% | 41 | 63 | 1.3% | 786 | 16.8% | 41 | 0.8% |

| Idaho | 109 | 4.9% | 24 | 31 | 1.2% | 411 | 18.5% | 32 | 1.2% |

| Illinois | 0 | 0.0% | 45 | 0 | 0.0% | 866 | 3.6% | 406 | 1.8% |

| Indiana | 328 | 2.7% | 34 | 0 | 0.0% | 739 | 6.2% | 831 | 6.5% |

| Iowa | 392 | 7.8% | 13 | 419 | 7.9% | 541 | 10.8% | 755 | 14.3% |

| Kansas | 0 | 0.0% | 45 | 0 | 0.0% | 734 | 14.3% | -67 | -1.2% |

| Kentucky | 119 | 1.4% | 40 | 0 | 0.0% | 800 | 9.5% | 80 | 0.9% |

| Louisiana | 681 | 8.8% | 11 | 644 | 8.1% | 1,508 | 19.5% | 537 | 6.8% |

| Maine | 80 | 2.8% | 33 | 0 | 0.0% | 94 | 3.3% | 0 | 0.0% |

| Maryland | 759 | 6.1% | 19 | 612 | 4.6% | 2,121 | 17.2% | 956 | 7.1% |

| Massachusetts* | 2,155 | 8.4% | 12 | 657 | 2.1% | 3,208 | 12.5% | 752 | 2.4% |

| Michigan | 2 | 0.0% | 43 | 2 | 0.0% | 5 | 0.1% | 2 | 0.0% |

| Minnesota* | 1,113 | 7.2% | 16 | 0 | 0.0% | 1,813 | 11.7% | 342 | 2.3% |

| Mississippi | 73 | 1.7% | 39 | 250 | 5.1% | 108 | 2.5% | 257 | 5.2% |

| Missouri | 247 | 3.5% | 31 | 252 | 3.4% | 942 | 13.2% | 437 | 5.8% |

| Montana | 0 | 0.0% | 45 | 0 | 0.0% | 422 | 26.9% | 310 | 18.0% |

| Nebraska | 274 | 9.4% | 9 | 467 | 14.1% | 840 | 28.8% | 764 | 13.8% |

| Nevada | 184 | 6.3% | 18 | 0 | 0.0% | 535 | 18.2% | 167 | 5.4% |

| New Hampshire | 69 | 5.2% | 22 | 9 | 0.6% | 95 | 7.1% | 79 | 12.4% |

| New Jersey* | 560 | 2.0% | 38 | 0 | 0.0% | 1,779 | 6.3% | 505 | 1.1% |

| New Mexico* | 798 | 14.7% | 3 | 253 | 4.6% | 798 | 14.7% | 253 | 0.8% |

| New York* | 944 | 2.0% | 37 | 1,206 | 2.2% | 3,257 | 7.0% | 2,302 | 4.2% |

| North Carolina | 629 | 3.7% | 29 | 150 | 0.8% | 1,378 | 8.1% | 387 | 2.1% |

| North Dakota | 100 | 10.4% | 6 | 325 | 24.7% | 296 | 30.6% | 907 | 68.9% |

| Ohio | 1,011 | 4.1% | 28 | 0 | 0.0% | 1,643 | 6.6% | 510 | 2.0% |

| Oklahoma | 496 | 9.0% | 10 | 373 | 7.3% | 630 | 11.4% | 415 | 8.1% |

| Oregon | 622 | 10.2% | 7 | 16 | 0.2% | 627 | 10.3% | -411 | -6.4% |

| Pennsylvania | 512 | 2.1% | 36 | 1 | 0.0% | 1,026 | 4.2% | -293 | -1.2% |

| Rhode Island | 95 | 3.1% | 32 | 112 | 3.9% | 133 | 4.3% | 133 | 4.6% |

| South Carolina* | 154 | 2.7% | 35 | 111 | 2.2% | 988 | 17.5% | 245 | 4.8% |

| South Dakota | 137 | 13.0% | 4 | 107 | 9.5% | 137 | 13.0% | 107 | 9.5% |

| Tennessee | 325 | 3.6% | 30 | 453 | 4.7% | 1,069 | 11.8% | 729 | 7.5% |

| Texas | 7 | 0.0% | 44 | 7,736 | 9.6% | 7,070 | 22.1% | 13,959 | 13.7% |

| Utah | 255 | 5.6% | 21 | 209 | 4.7% | 255 | 5.6% | 209 | 4.7% |

| Vermont | 52 | 4.7% | 25 | 57 | 5.2% | 52 | 4.7% | 57 | 5.2% |

| Virginia | 1,065 | 7.0% | 17 | 295 | 2.0% | 2,442 | 16.0% | 427 | 2.9% |

| Washington | 4 | 0.0% | 42 | 95 | 0.6% | 703 | 5.2% | -447 | -3.0% |

| West Virginia | 359 | 10.1% | 8 | 556 | 15.1% | 828 | 23.2% | 1,108 | 30.1% |

| Wisconsin | 0 | 0.0% | 45 | 0 | 0.0% | 49 | 0.4% | 71 | 0.6% |

| Wyoming | 446 | 35.9% | 2 | 398 | 22.7% | 456 | 36.7% | 398 | 22.7% |

| Total | 32,498 | 5.4% | 27,168 | 4.4% | 69,568 | 11.6% | 39,154 | 6.4% | |

| minus TX/AK | 30,224 | 5.4% | 8,935 | 1.6% | 60,231 | 10.7% | 13,748 | 2.4% | |

| Notes: *Total General Fund Balance includes both the ending balance and balances in budget stabilization funds. Source: National Association of State Budget Officers, updated by CBPP. FY 2008 figures from the December 2009 NASBO report are used for Oregon in lieu of FY 2006, because this is when their rainy day fund came into being. | |||||||||

End Notes

[1] Alabama, Arizona, California, Connecticut, Delaware, Florida, Hawaii, Idaho, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Michigan, Mississippi, Missouri, New Hampshire, New Jersey, New York, North Dakota, Ohio, Oregon, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Washington, West Virginia, and Wisconsin.

[2] Alabama, Alaska, Florida, Iowa, Louisiana, Maryland, Missouri, Nebraska, New York, Rhode Island, South Carolina, and Utah.

[3] Alaska, Delaware, Hawaii, Louisiana, Missouri, Oklahoma, Oregon, Pennsylvania, South Dakota, and Texas.

[4] Figures and tables in this paper often exclude Alaska and Texas because these two states’ reserves are much larger than those of other states — for fiscal year 2010, they made up 65 percent of total balances nationally and including them would obscure the trends in typical states. The purpose of Alaska’s rainy day fund — called the Permanent Fund — is not typical of other states. A portion of oil company proceeds are deposited in the fund and paid out to residents to compensate for the use of the state’s oil reserves. The Texas fund is also a repository for oil- and gas-related revenues. High oil prices and expanded gas production have resulted in large increases in the Texas fund at a time when balances in most state reserves were going down. Tables and figures that exclude Texas and Alaska include a note to that effect.

[5] Tax increases also remove demand from the economy by reducing the amount of money people have to spend. But to the extent that these increases are on upper-income residents, they have a smaller impact on consumption because much of the money comes from savings and so does not diminish economic activity.

[6] Iris Lav and Alan Berube, “When It Rains It Pours,” Center on Budget and Policy Priorities, March 11, 1999, https://www.cbpp.org/3-11-99sfp.htm.

[7] GFOA Best Practices and Advisories, http://www.gfoa.org/services/rp/budget.shtml#10.

[8] The breakdown of budget shortfall measures is derived from a 2004 Center survey of state nonprofit budget and tax policy organizations.

[9] National Association of State Budget Officers, Fiscal Survey of the States, June 2010.

[10] California is excluded from this analysis. California’s reserves declined significantly prior to 2006 – earlier than most states. This decline would have had a disproportionate effect on the results because of the size of California’s budget.

[11] See footnote 4.

[12] The rainy day funds in states with caps of 5 percent or less grew from an average of 1.0 percent of expenditures at the end of 1993 to only 3.7 percent of expenditures at the end of 2000. The rainy day funds in states without caps or with caps of 10 percent or greater grew from an average of 2.3 percent of expenditures at the end of 1993 to 9.0 percent of expenditure at the end of 2000.

[13] The 46 states with a rainy day fund include DC.

[14] California has two funds that act as rainy day funds. A fixed percentage of revenues must be deposited in one of these funds.

[15] Alabama’s constitutional RDF’s have replenishment rules while it statutory RDF’s do not.

[16] Alaska, Delaware, Hawaii, Louisiana, Missouri, Oklahoma, Oregon, Pennsylvania, South Dakota, and Texas.

[17] Arizona, Idaho, Indiana, Louisiana, Michigan, Missouri, New Hampshire, Oklahoma, Oregon, Tennessee, and Virginia.

[18] For example New Mexico’s rainy day fund statute states: “In the event that the general fund revenues, including all transfers to the general fund authorized by law, are projected by the governor to be insufficient either to meet the level of appropriations authorized by law from the general fund for the current year or to meet the level of appropriations recommended in the budget and appropriations bill . . . for the next fiscal year, the balance in the tax stabilization reserve may be appropriated by the legislature up to the amount of the projected insufficiency for either or both fiscal years.”